California Wage Form

What is the California Wage

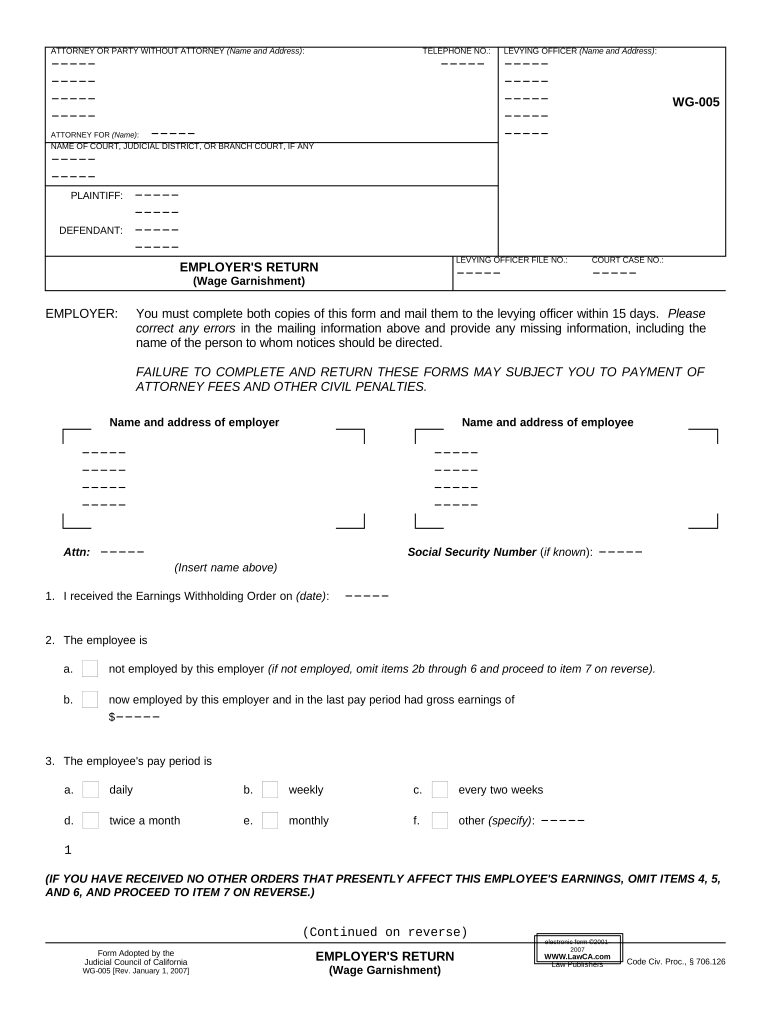

The California wage refers to the minimum amount that employers are legally required to pay their employees for work performed. As of 2023, the minimum wage in California is set at $15.50 per hour for employers with 26 or more employees. For smaller employers, the minimum wage is $15.00 per hour. These wages are subject to change based on state legislation and local ordinances, which may establish higher minimum wage rates.

In addition to the minimum wage, California law also outlines specific guidelines regarding wage garnishments. This process allows creditors to collect debts directly from an employee's wages, but it must comply with legal limits and procedures to ensure fairness and transparency.

How to obtain the California Wage

To obtain proof of wage garnishment from your employer in California, you may need to follow specific steps. First, request a copy of your pay stub or wage statement, which should detail your earnings and any deductions, including garnishments. Employers are required by law to provide this information.

If your employer does not provide the necessary documentation, you can submit a formal request in writing, specifying the details of what you need. It may also be helpful to consult with your HR department or payroll administrator for assistance. Additionally, if you are facing difficulties, consider reaching out to a legal professional who specializes in employment law for guidance.

Steps to complete the California Wage

When completing the California wage garnishment process, it is essential to follow these steps:

- Gather all relevant documentation, including your employment contract, pay stubs, and any court orders related to the garnishment.

- Review your pay stubs to ensure that the garnishment is accurately reflected and that the deductions comply with state law.

- Communicate with your employer to clarify any discrepancies or to request additional documentation if needed.

- If applicable, submit a request for a hearing to contest the garnishment or to seek adjustments based on your financial situation.

Legal use of the California Wage

The legal use of the California wage garnishment process is governed by both federal and state laws. Under California law, an employer can only garnish a portion of an employee's wages, typically up to 25% of disposable earnings or the amount by which weekly earnings exceed 40 times the state minimum wage, whichever is less.

Employers must also provide employees with a written notice of the garnishment, including details about the creditor and the total amount owed. Employees have the right to contest the garnishment in court, and they should be informed of their rights throughout the process.

Required Documents

When dealing with wage garnishment in California, several documents may be required:

- Pay stubs that show your earnings and any deductions for garnishments.

- A court order or notice of garnishment from the creditor.

- Your employment contract, which may outline wage agreements.

- Any correspondence with your employer regarding the garnishment.

Having these documents readily available can help ensure a smoother process when addressing wage garnishment issues.

Who Issues the Form

The form related to wage garnishment in California is typically issued by the court or the creditor seeking the garnishment. Employers are responsible for processing these forms and ensuring compliance with the legal requirements for garnishment.

In some cases, employees may need to fill out forms related to exemptions or to contest the garnishment, which can also be obtained from the court or relevant legal resources.

Quick guide on how to complete california wage 497299615

Complete California Wage effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your paperwork quickly without delays. Handle California Wage on any platform with airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to modify and eSign California Wage with ease

- Locate California Wage and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method for sharing your form, whether by email, SMS, an invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing additional document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you select. Edit and eSign California Wage and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a proof of wage garnishment and why do I need it?

A proof of wage garnishment is a legal document that confirms a portion of an employee's wages is withheld to repay a debt. Understanding how can I get a prof of wage garnishment from employer can help ensure compliance with court orders and protect your rights as an employee.

-

How can I get a prof of wage garnishment from employer if I am currently employed?

To obtain a proof of wage garnishment from your employer, you should first request your payroll department for the necessary documentation. They should have records detailing the garnishment process, answering how can I get a prof of wage garnishment from employer effectively.

-

What features does airSlate SignNow offer for document management?

AirSlate SignNow provides features like electronic signatures, customizable templates, and automated workflows that make document management seamless. These features support the process of obtaining proof of wage garnishment, guiding users in understanding how can I get a prof of wage garnishment from employer.

-

Is there a cost associated with obtaining proof of wage garnishment through airSlate SignNow?

AirSlate SignNow offers competitive pricing plans that are both affordable and offer tremendous value. Depending on your plan, you may be able to streamline how can I get a prof of wage garnishment from employer at no additional cost beyond your subscription.

-

Can I integrate airSlate SignNow with other software systems?

Yes, airSlate SignNow integrates with various applications such as CRM systems and cloud storage services. This integration can play a crucial role in helping you understand how can I get a prof of wage garnishment from employer through organized records.

-

What are the benefits of using airSlate SignNow for wage garnishment documentation?

The benefits of using airSlate SignNow include enhanced security, faster processing times, and easier access to your documents. By leveraging these benefits, you can quickly grasp how can I get a prof of wage garnishment from employer without unnecessary delays.

-

How does electronic signing work for wage garnishment documents?

Electronic signing through airSlate SignNow allows you to securely sign and send documents digitally. This process is straightforward and efficient, helping you understand how can I get a prof of wage garnishment from employer in a modern way.

Get more for California Wage

- Sample letter social security form

- Estate closing form

- Sample letter to withdraw offer on house form

- Bank request to release funds of deceased letter form

- Letter invitation to form

- Letter of renunciation of executorship form

- Payoff request template form

- Probate court statement of creditors claim oconee sc form

Find out other California Wage

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation