Confidential Supplement to Application for Earnings Withholding Order for Taxes California Form

What is the Confidential Supplement To Application For Earnings Withholding Order For Taxes California

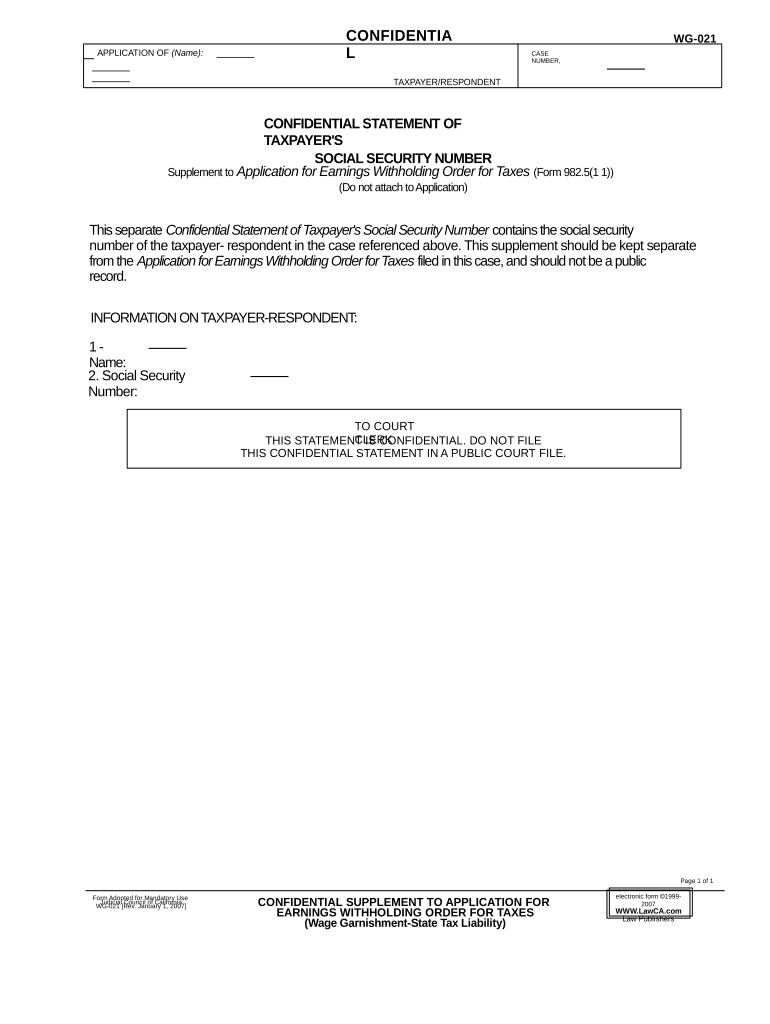

The Confidential Supplement To Application For Earnings Withholding Order For Taxes California is a specialized form used in California to facilitate the withholding of earnings for tax obligations. This document is crucial for ensuring compliance with tax requirements while protecting sensitive information related to the taxpayer's financial situation. It serves as an additional layer of confidentiality, allowing the necessary parties to process withholding orders without exposing personal financial details unnecessarily.

Steps to complete the Confidential Supplement To Application For Earnings Withholding Order For Taxes California

Completing the Confidential Supplement To Application For Earnings Withholding Order For Taxes California involves several key steps:

- Gather necessary personal information, including your Social Security number and details about your income sources.

- Carefully read the instructions provided with the form to understand all requirements.

- Fill out the form accurately, ensuring that all information is complete and correct.

- Review the completed form for any errors or omissions before submission.

- Submit the form through the designated method, whether online, by mail, or in person, as specified in the instructions.

Legal use of the Confidential Supplement To Application For Earnings Withholding Order For Taxes California

The legal use of the Confidential Supplement To Application For Earnings Withholding Order For Taxes California is governed by state tax laws and regulations. This form must be filled out accurately to ensure that any withholding orders are executed in compliance with legal standards. Failure to adhere to these regulations can result in penalties or delays in processing. The confidentiality aspect of the form is particularly important, as it protects sensitive taxpayer information from being disclosed unnecessarily during the withholding process.

State-specific rules for the Confidential Supplement To Application For Earnings Withholding Order For Taxes California

California has specific rules governing the use of the Confidential Supplement To Application For Earnings Withholding Order For Taxes. These rules dictate how the form should be filled out, who is eligible to submit it, and the procedures for processing withholding orders. It is essential for taxpayers to be aware of any state-specific provisions that may affect their situation, including deadlines for submission and requirements for supporting documentation. Compliance with these rules ensures that the withholding process is efficient and legally sound.

How to obtain the Confidential Supplement To Application For Earnings Withholding Order For Taxes California

The Confidential Supplement To Application For Earnings Withholding Order For Taxes California can be obtained through various channels. Taxpayers may access the form online via the California state tax authority's website, where it is typically available for download. Additionally, physical copies may be available at local tax offices or through legal assistance organizations. It is important to ensure that you are using the most current version of the form to avoid any issues during submission.

Key elements of the Confidential Supplement To Application For Earnings Withholding Order For Taxes California

Key elements of the Confidential Supplement To Application For Earnings Withholding Order For Taxes California include:

- Taxpayer identification information, such as name and Social Security number.

- Details regarding the income subject to withholding.

- Signature and date fields to validate the form.

- Instructions for submitting the form and any additional documentation required.

Quick guide on how to complete confidential supplement to application for earnings withholding order for taxes california

Accomplish Confidential Supplement To Application For Earnings Withholding Order For Taxes California effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents quickly without unnecessary delays. Manage Confidential Supplement To Application For Earnings Withholding Order For Taxes California on any device using airSlate SignNow Android or iOS applications and streamline any document-centric process today.

The easiest way to modify and eSign Confidential Supplement To Application For Earnings Withholding Order For Taxes California without hassle

- Find Confidential Supplement To Application For Earnings Withholding Order For Taxes California and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign feature, which takes just seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Decide how you want to send your form—by email, SMS, or share link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Confidential Supplement To Application For Earnings Withholding Order For Taxes California and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Confidential Supplement To Application For Earnings Withholding Order For Taxes California?

The Confidential Supplement To Application For Earnings Withholding Order For Taxes California is a legal document that helps organizations manage the collection of outstanding taxes through earnings withholding. This supplement is essential for ensuring compliance with state tax laws while protecting sensitive information.

-

How does airSlate SignNow facilitate the process of filling out the Confidential Supplement To Application For Earnings Withholding Order For Taxes California?

AirSlate SignNow provides an intuitive platform that allows users to easily fill out and eSign the Confidential Supplement To Application For Earnings Withholding Order For Taxes California. With our user-friendly interface, businesses can quickly complete documents without the hassle of manual paperwork.

-

Is there a cost associated with using airSlate SignNow for the Confidential Supplement To Application For Earnings Withholding Order For Taxes California?

Yes, airSlate SignNow offers various pricing plans tailored to fit the needs of businesses looking to handle their Confidential Supplement To Application For Earnings Withholding Order For Taxes California efficiently. Our plans are designed to provide cost-effective solutions without compromising on features.

-

What features does airSlate SignNow offer for managing the Confidential Supplement To Application For Earnings Withholding Order For Taxes California?

AirSlate SignNow includes features such as document templates, custom branding, and secure cloud storage, which are vital for managing the Confidential Supplement To Application For Earnings Withholding Order For Taxes California. These tools streamline the paperwork process and enhance productivity.

-

Can I integrate airSlate SignNow with other software for the Confidential Supplement To Application For Earnings Withholding Order For Taxes California?

Absolutely! AirSlate SignNow seamlessly integrates with various applications such as CRMs, project management tools, and other productivity software to streamline the handling of the Confidential Supplement To Application For Earnings Withholding Order For Taxes California. This ensures a smooth workflow across your business operations.

-

What are the benefits of using airSlate SignNow for the Confidential Supplement To Application For Earnings Withholding Order For Taxes California?

By utilizing airSlate SignNow for completing the Confidential Supplement To Application For Earnings Withholding Order For Taxes California, businesses can achieve faster turnaround times, reduce the risk of errors, and maintain compliance with legal requirements. Our solution also enhances team collaboration and document security.

-

How secure is airSlate SignNow when dealing with the Confidential Supplement To Application For Earnings Withholding Order For Taxes California?

AirSlate SignNow prioritizes security, offering end-to-end encryption and compliance with data protection regulations for the Confidential Supplement To Application For Earnings Withholding Order For Taxes California. We ensure that your sensitive information is kept safe and only accessible to authorized users.

Get more for Confidential Supplement To Application For Earnings Withholding Order For Taxes California

- Iti fitter resume format pdf download

- Pacific access category 2022 open date form

- Usa drivers license template psd download form

- English file upper intermediate students book answer key form

- Car rental receipt pdf form

- Target publications std 10 question papers pdf form

- Gems newborn registration form 2022

- Request to register saudi arabia saudiembassy form

Find out other Confidential Supplement To Application For Earnings Withholding Order For Taxes California

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple