Ca Withholding Form

What is the CA Withholding

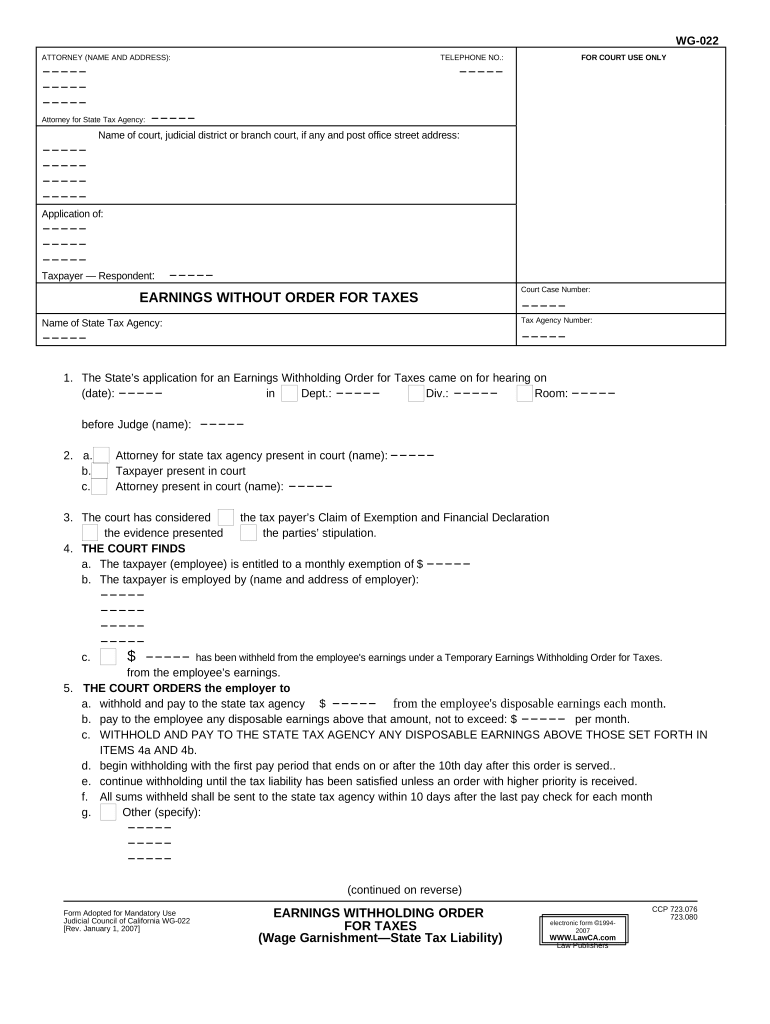

The CA withholding refers to the state income tax that employers in California are required to withhold from employees' wages. This withholding is a prepayment of the employee's state income tax liability, ensuring that taxes are collected throughout the year rather than in a lump sum during tax season. The amount withheld is based on the employee's earnings and the information provided on their California withholding tax form, such as the W-4 form, which includes details on filing status and allowances.

Steps to Complete the CA Withholding

Completing the CA withholding tax form involves several key steps to ensure accuracy and compliance. First, gather necessary information, including your Social Security number, filing status, and the number of allowances you wish to claim. Next, fill out the California withholding tax form accurately, ensuring all details align with your financial situation. After completing the form, review it for any errors before submitting it to your employer. Employers will then use this information to calculate the appropriate amount to withhold from your paychecks.

Legal Use of the CA Withholding

The CA withholding is legally binding and must comply with California state tax laws. Employers are obligated to withhold the correct amount of state income tax from employee wages and remit these funds to the California Department of Tax and Fee Administration (CDTFA). Failure to comply with these regulations can result in penalties for both employers and employees. It is crucial to understand your rights and responsibilities regarding withholding to ensure compliance and avoid any potential legal issues.

Filing Deadlines / Important Dates

Understanding the filing deadlines for CA withholding is essential for both employers and employees. Generally, employers must remit withheld taxes to the state on a quarterly basis. Employees should also be aware of the deadlines for submitting their withholding forms, particularly when starting new employment or making changes to their withholding status. Keeping track of these dates helps avoid late fees and ensures that all tax obligations are met in a timely manner.

Form Submission Methods (Online / Mail / In-Person)

Submitting the CA withholding form can be done through various methods, depending on employer preferences and employee convenience. Many employers offer online submission options, allowing employees to fill out and submit their forms electronically. Alternatively, forms can be mailed directly to the employer or submitted in person at the workplace. It is important to confirm with your employer the preferred method of submission to ensure that your information is processed correctly.

Key Elements of the CA Withholding

Several key elements are critical to understanding the CA withholding process. These include the employee's filing status, the number of allowances claimed, and any additional amount the employee wishes to withhold. Each of these factors influences the total amount of state income tax withheld from an employee's paycheck. Additionally, employers must stay informed about any changes in state tax laws that may affect withholding rates and requirements.

Penalties for Non-Compliance

Non-compliance with CA withholding regulations can lead to significant penalties for both employers and employees. Employers who fail to withhold the correct amount of taxes may face fines and interest charges on unpaid amounts. Employees who do not accurately report their withholding status or fail to submit required forms may also encounter penalties during tax filing. Understanding these potential repercussions underscores the importance of adhering to withholding laws and regulations.

Quick guide on how to complete ca withholding

Complete Ca Withholding effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents quickly without delays. Handle Ca Withholding on any platform using airSlate SignNow's Android or iOS applications and enhance your document-related processes today.

How to modify and eSign Ca Withholding effortlessly

- Obtain Ca Withholding and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark important sections of the documents or obscure confidential information using tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature with the Sign feature, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to preserve your changes.

- Select your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, time-consuming form searches, or errors that require reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign Ca Withholding and ensure clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the process for learning how to submit income tax withholding to ca?

To learn how to submit income tax withholding to ca, you can start by reviewing the state’s guidelines on withholding taxes. It's essential to understand your business type and income levels to determine the right forms and methods involved in the submission process.

-

Are there any fees associated with submitting income tax withholding to ca using airSlate SignNow?

AirSlate SignNow offers affordable pricing plans that allow you to manage your documents efficiently. The costs associated with submitting income tax withholding to ca primarily come from applicable state filing fees rather than the use of our eSigning platform.

-

What features does airSlate SignNow offer for submitting income tax withholding to ca?

AirSlate SignNow provides features such as secure eSigning, document templates, and easy sharing options that simplify the process of submitting income tax withholding to ca. Additionally, our platform enhances organization and tracking of your submissions to ensure compliance.

-

Can airSlate SignNow integrate with payroll software for submitting income tax withholding to ca?

Yes, airSlate SignNow can seamlessly integrate with various payroll software, which simplifies how to submit income tax withholding to ca. This integration ensures that your withholding amounts align with your payroll calculations, streamlining the entire submission workflow.

-

How does airSlate SignNow ensure security when submitting income tax withholding to ca?

When using airSlate SignNow to submit income tax withholding to ca, you benefit from top-notch security features, including encryption and secure access controls. These measures ensure that your sensitive tax information remains confidential and protected throughout the submission process.

-

How can I track the submission of income tax withholding to ca using airSlate SignNow?

AirSlate SignNow allows you to easily track the status of your documents, including income tax withholding submissions to ca. You can receive notifications when the documents are viewed and signed, providing you with assurance that your submissions are being processed timely.

-

What are the benefits of using airSlate SignNow for submitting income tax withholding to ca?

Using airSlate SignNow streamlines the process of how to submit income tax withholding to ca, saving you time and effort. The user-friendly interface, along with robust features, ensures that you can complete your tax submissions accurately and efficiently, allowing you to focus on your business.

Get more for Ca Withholding

Find out other Ca Withholding

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document