Ally Bank Ira Transfer Form 2012-2026

What is the Ally Bank IRA Transfer Form

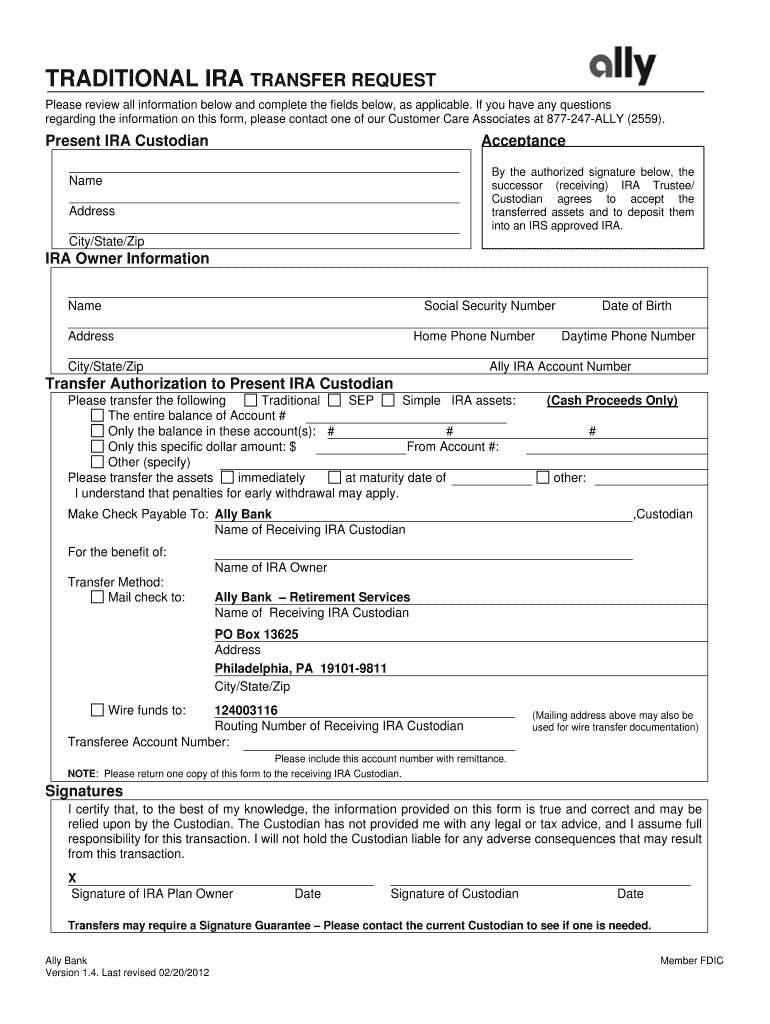

The Ally Bank IRA transfer form is a document used by individuals to transfer funds from one Individual Retirement Account (IRA) to another. This form is essential for those looking to move their retirement savings while maintaining the tax-advantaged status of their accounts. The transfer can occur between different financial institutions or within the same institution, allowing for greater flexibility in managing retirement assets. Proper completion of this form ensures compliance with IRS regulations and helps facilitate a smooth transfer process.

How to use the Ally Bank IRA Transfer Form

Using the Ally Bank IRA transfer form involves several straightforward steps. First, obtain the form either online or through Ally Bank's customer service. Next, fill out the required information, including account details for both the sending and receiving institutions. It is crucial to provide accurate information to avoid delays. After completing the form, submit it to Ally Bank, either electronically or via mail, as per their submission guidelines. Monitoring the transfer status is advisable to ensure the process is completed in a timely manner.

Steps to complete the Ally Bank IRA Transfer Form

Completing the Ally Bank IRA transfer form requires careful attention to detail. Here are the key steps:

- Download the form from the Ally Bank website or request it from customer service.

- Fill in your personal information, including your full name, address, and Social Security number.

- Provide details of the current IRA account, including the institution's name and account number.

- Indicate the type of IRA you are transferring to, such as a traditional or Roth IRA.

- Sign and date the form to authorize the transfer.

- Submit the completed form according to Ally Bank's instructions.

Legal use of the Ally Bank IRA Transfer Form

The Ally Bank IRA transfer form is legally recognized as a valid means to transfer retirement funds. It complies with IRS regulations governing IRA transfers, ensuring that the funds maintain their tax-deferred status. When properly executed, the transfer does not incur tax penalties or early withdrawal fees. It is important to keep a copy of the completed form for your records, as this documentation may be needed for future reference or tax purposes.

Required Documents

To successfully complete the Ally Bank IRA transfer form, you may need to gather several documents. These typically include:

- Your current IRA account statement.

- The new IRA account information, including the account number and institution name.

- Identification documents, such as a driver's license or Social Security card, to verify your identity.

- Any additional forms required by the receiving institution.

Form Submission Methods

The Ally Bank IRA transfer form can be submitted through various methods, depending on your preference and the options provided by Ally Bank. Common submission methods include:

- Online submission via Ally Bank's secure portal.

- Mailing the completed form to the designated address provided by Ally Bank.

- In-person submission at an Ally Bank branch, if available.

Quick guide on how to complete ally bank ira transfer form

The simplest method to obtain and endorse Ally Bank Ira Transfer Form

Across your entire organization, ineffective procedures related to paper approvals can consume a signNow amount of productive time. Executing documents such as Ally Bank Ira Transfer Form is an essential aspect of operations in any enterprise, which is why the effectiveness of each agreement’s lifecycle has a substantial impact on the overall performance of the company. With airSlate SignNow, endorsing your Ally Bank Ira Transfer Form is as straightforward and swift as possible. This platform provides you with the latest version of almost any form. Even better, you can endorse it instantly without the need to install external software on your computer or print anything as physical copies.

How to obtain and endorse your Ally Bank Ira Transfer Form

- Explore our collection by category or utilize the search function to find the form you require.

- Review the form preview by clicking on Learn more to ensure it's the correct one.

- Click Get form to start editing immediately.

- Fill out your form and provide any necessary details using the toolbar.

- Upon completion, click the Sign tool to endorse your Ally Bank Ira Transfer Form.

- Choose the signature method that suits you best: Draw, Create initials, or upload a photo of your handwritten signature.

- Click Done to finalize editing and move on to the document-sharing options if needed.

With airSlate SignNow, you possess everything necessary to handle your documentation efficiently. You can locate, complete, modify, and even transmit your Ally Bank Ira Transfer Form all within one tab without any difficulties. Enhance your procedures by adopting a single, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

I need help filling out this IRA form to withdraw money. How do I fill this out?

I am confused on the highlighted part.

-

How do I fill out Form 30 for ownership transfer?

Form 30 for ownership transfer is a very simple self-explanatory document that can filled out easily. You can download this form from the official website of the Regional Transport Office of a concerned state. Once you have downloaded this, you can take a printout of this form and fill out the request details.Part I: This section can be used by the transferor to declare about the sale of his/her vehicle to another party. This section must have details about the transferor’s name, residential address, and the time and date of the ownership transfer. This section must be signed by the transferor.Part II: This section is for the transferee to acknowledge the receipt of the vehicle on the concerned date and time. A section for hypothecation is also provided alongside in case a financier is involved in this transaction.Official Endorsement: This section will be filled by the RTO acknowledging the transfer of vehicle ownership. The transfer of ownership will be registered at the RTO and copies will be provided to the seller as well as the buyer.Once the vehicle ownership transfer is complete, the seller will be free of any responsibilities with regard to the vehicle.

-

How to decide my bank name city and state if filling out a form, if the bank is a national bank?

Somewhere on that form should be a blank for routing number and account number. Those are available from your check and/or your bank statements. If you can't find them, call the bank and ask or go by their office for help with the form. As long as those numbers are entered correctly, any error you make in spelling, location or naming should not influence the eventual deposit into your proper account.

-

Why do I have to fill RTGS form if I want to transfer money from one bank to another bank?

There are multiple ways to transfer funds from one bank to another. Based on the amount being transferred (minimum amount requirement for few modes) and the time of the day for the transaction (few modes have cutoff time) the mode of transfer will be decided.Now in RTGS (as well as for NEFT and IMPS) there is no mandate for the beneficiary bank to do name validation, which means even if the beneficiary name captured in RTGS message differs from the name of the account maintained in the beneficiary bank, the funds can be credited to the account as far as account number is a valid account number and IFSC code is correct.So to avoid any possible transfer to incorrect account and to avoid later disputes (due to communicate gap/error) application forms are to be filled. Also the beneficiary account has to be captured twice in the application form. Expectation is the person filling the form will refer to the source documents twice for account number while filling the form to avoid oversight (but generally people copy the account number from top while filling the second time, so if the first time account number is wrong, second time also it will be wrong defeating the purpose).However this handled properly in online channels (mobile app & internet banking website), while capturing the account number for the first time it is masked (******) forcing the user to refer the source document for the beneficiary account while entering second time.In nutshell the application form is to avoid transfer to incorrect account and to avoid disputes.Trust i had answered your query.

-

How do I fill out an application form to open a bank account?

I want to believe that most banks nowadays have made the process of opening bank account, which used to be cumbersome, less cumbersome. All you need to do is to approach the bank, collect the form, and fill. However if you have any difficulty in filling it, you can always call on one of the banks rep to help you out.

Create this form in 5 minutes!

How to create an eSignature for the ally bank ira transfer form

How to make an eSignature for your Ally Bank Ira Transfer Form in the online mode

How to generate an eSignature for your Ally Bank Ira Transfer Form in Google Chrome

How to create an eSignature for putting it on the Ally Bank Ira Transfer Form in Gmail

How to create an electronic signature for the Ally Bank Ira Transfer Form right from your smart phone

How to make an electronic signature for the Ally Bank Ira Transfer Form on iOS devices

How to create an eSignature for the Ally Bank Ira Transfer Form on Android

People also ask

-

What is the Ally Bank Ira Transfer Form?

The Ally Bank Ira Transfer Form is a document used to facilitate the transfer of funds from one IRA account to another at Ally Bank. This form ensures that the process is smooth and compliant with IRS regulations, allowing you to manage your retirement savings efficiently.

-

How can I obtain the Ally Bank Ira Transfer Form?

You can easily obtain the Ally Bank Ira Transfer Form directly from the Ally Bank website or by contacting their customer service. Additionally, airSlate SignNow provides a seamless eSigning experience, allowing you to fill out and sign your forms quickly and securely.

-

What are the benefits of using the Ally Bank Ira Transfer Form?

Using the Ally Bank Ira Transfer Form simplifies the process of transferring your IRA funds, making it fast and hassle-free. With the form, you can ensure that your retirement investments remain intact and grow without unnecessary interruptions.

-

Is there a fee associated with the Ally Bank Ira Transfer Form?

Typically, there is no fee for completing the Ally Bank Ira Transfer Form itself; however, it's essential to check with Ally Bank for any applicable fees related to your IRA accounts. airSlate SignNow offers a cost-effective solution for eSigning your forms without additional costs.

-

Can I eSign the Ally Bank Ira Transfer Form?

Yes, you can eSign the Ally Bank Ira Transfer Form using airSlate SignNow, which provides a user-friendly platform for electronic signatures. This feature ensures that your form is signed quickly, securely, and in compliance with legal standards.

-

What features does airSlate SignNow offer for handling the Ally Bank Ira Transfer Form?

airSlate SignNow offers a variety of features for handling the Ally Bank Ira Transfer Form, including secure eSigning, template management, and document tracking. These features streamline the transfer process and enhance your overall experience with document management.

-

How long does it take to process the Ally Bank Ira Transfer Form?

The processing time for the Ally Bank Ira Transfer Form can vary depending on several factors, including the institutions involved and the completeness of the form. Typically, once submitted, you can expect the transfer to be completed within a few business days.

Get more for Ally Bank Ira Transfer Form

- Concerning information furnished to user

- Confidentiality agreement 3par inc and dell inc form

- On information about a prospect

- Confidentiality and non disclosure agreementeason form

- Master joint venture agreement sec form

- Letter confirming nonconfidentiality of proposal form

- C5 84 sample consulting agreement iowa state university form

- Escrow agreement with deposit of earnest money with escrow form

Find out other Ally Bank Ira Transfer Form

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now