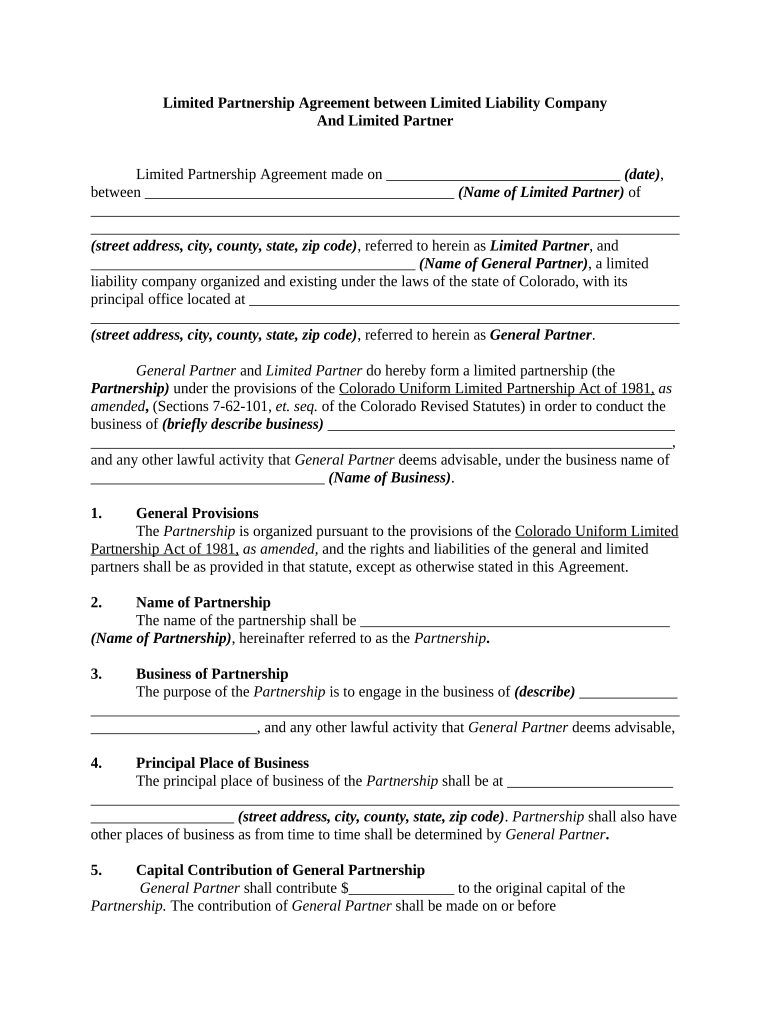

Colorado Limited Company Form

What is the Colorado Limited Company

The Colorado Limited Company, commonly known as an LLC, is a popular business structure that combines the benefits of both a corporation and a partnership. It provides limited liability protection to its owners, known as members, shielding them from personal responsibility for the company's debts and liabilities. This means that personal assets are generally protected in the event of legal issues or financial obligations faced by the business. Additionally, an LLC offers flexibility in management and tax treatment, making it an attractive option for many entrepreneurs in Colorado.

How to obtain the Colorado Limited Company

To establish a Colorado Limited Company, you need to follow a series of steps. First, choose a unique name for your LLC that complies with Colorado naming requirements. Next, designate a registered agent who will receive legal documents on behalf of the company. Afterward, file the Articles of Organization with the Colorado Secretary of State, which can be done online. There is a filing fee associated with this process. Once your LLC is approved, you may also want to create an Operating Agreement, although it is not mandatory in Colorado. This document outlines the management structure and operating procedures of your LLC.

Steps to complete the Colorado Limited Company

Completing the formation of a Colorado Limited Company involves several key steps:

- Choose a name for your LLC that is distinguishable from existing entities in Colorado.

- Appoint a registered agent who will handle legal correspondence.

- File the Articles of Organization with the Colorado Secretary of State online.

- Pay the required filing fee, which is typically around one hundred dollars.

- Consider drafting an Operating Agreement to define the management and operational guidelines of your LLC.

- Obtain any necessary business licenses or permits required for your specific industry.

Legal use of the Colorado Limited Company

The Colorado Limited Company is legally recognized and provides several advantages. It allows for pass-through taxation, meaning that profits and losses can be reported on the members' personal tax returns, avoiding double taxation. Additionally, LLCs in Colorado must adhere to state regulations, including annual reporting requirements and maintaining a registered agent. Compliance with these legal obligations is crucial to ensure the continued protection of personal assets and the legitimacy of the business.

Required Documents

When forming a Colorado Limited Company, several documents are necessary to ensure compliance and proper registration. The primary document is the Articles of Organization, which must be filed with the Colorado Secretary of State. Additionally, having an Operating Agreement is advisable, even though it is not required. This document helps clarify the roles and responsibilities of members and the operational procedures of the LLC. Depending on the nature of the business, other permits or licenses may also be required at the local or state level.

Eligibility Criteria

To form a Colorado Limited Company, certain eligibility criteria must be met. Any individual or entity can be a member of an LLC in Colorado, including foreign entities. There are no restrictions on the number of members, allowing for single-member LLCs or multi-member structures. However, the chosen name for the LLC must comply with state regulations, and it cannot be similar to existing business names registered in Colorado. Additionally, the registered agent must have a physical address in Colorado and be available during regular business hours.

Quick guide on how to complete colorado limited company

Complete Colorado Limited Company effortlessly on any device

Digital document management has become favored by businesses and individuals alike. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage Colorado Limited Company on any platform with airSlate SignNow Android or iOS applications and streamline any document-related process today.

The simplest way to edit and eSign Colorado Limited Company without hassle

- Obtain Colorado Limited Company and click Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that function.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review the details and click on the Done button to save your updates.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document versions. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Colorado Limited Company and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Colorado company LLC and why should I consider forming one?

A Colorado company LLC, or Limited Liability Company, is a flexible business structure that limits personal liability for business debts. By forming a Colorado company LLC, you can protect your personal assets while enjoying tax benefits and operational flexibility. This structure is ideal for many entrepreneurs and small business owners in Colorado.

-

How much does it cost to set up a Colorado company LLC?

Setting up a Colorado company LLC typically involves a filing fee of around $50, plus any additional costs for obtaining an EIN or professional services if needed. It's important to budget for these initial costs to ensure that you fully comply with state regulations. airSlate SignNow provides cost-effective solutions to streamline document signing, which can be useful during your formation process.

-

What are the key benefits of using airSlate SignNow for my Colorado company LLC?

Using airSlate SignNow for your Colorado company LLC allows you to efficiently send and eSign important documents online, reducing the need for paper and in-person meetings. Its user-friendly interface enhances collaboration among team members, saving your business time and resources. Furthermore, the security features ensure your sensitive documents are protected.

-

Can I integrate airSlate SignNow with other tools for my Colorado company LLC?

Yes, airSlate SignNow offers seamless integrations with various business tools like CRM systems, project management apps, and cloud storage services. This flexibility allows your Colorado company LLC to enhance productivity by centralizing document workflows. Such integrations can help streamline your business processes and improve overall efficiency.

-

What features does airSlate SignNow offer for managing documents for my Colorado company LLC?

AirSlate SignNow provides features such as customizable templates, real-time status tracking, and automated reminders, all essential for managing documents for your Colorado company LLC. These tools help ensure that everyone involved in the document process stays informed, facilitating quicker decision-making. Additionally, you can easily organize and access your important files anytime.

-

Is there a free trial available for airSlate SignNow to help my Colorado company LLC?

Yes, airSlate SignNow offers a free trial that allows you to explore its features and capabilities without any commitment. This is a great opportunity for your Colorado company LLC to evaluate how the platform can enhance your document management and eSignature needs. Sign up today to see the benefits firsthand!

-

How does airSlate SignNow ensure the security of documents for my Colorado company LLC?

AirSlate SignNow employs industry-leading security protocols, including data encryption and secure cloud storage, to protect the documents of your Colorado company LLC. These measures ensure that your sensitive information is safe from unauthorized access. With compliance to major security standards, you can trust that your documents are handled with utmost care.

Get more for Colorado Limited Company

Find out other Colorado Limited Company

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast