Continuing Corporation Form

What is the Continuing Corporation

The continuing corporation is a legal entity that allows a business to maintain its existence even after changes in ownership or structure. This form is essential for businesses that wish to ensure continuity in operations, particularly during transitions such as mergers, acquisitions, or changes in management. By filing the continuing corporation form, a company can establish its ongoing status and clarify its legal obligations and rights.

How to use the Continuing Corporation

Using the continuing corporation form involves several steps that ensure compliance with state regulations. First, businesses must gather necessary information about their current structure and any changes being made. This includes details about ownership, management, and any amendments to the corporate bylaws. Once the information is compiled, the form can be completed electronically or on paper, depending on the state’s requirements. After filling out the form, it should be submitted to the appropriate state agency for processing.

Steps to complete the Continuing Corporation

Completing the continuing corporation form requires careful attention to detail. Here are the primary steps involved:

- Gather all relevant business information, including ownership details and corporate structure.

- Access the continuing corporation form, which can typically be found on your state’s business registration website.

- Fill out the form accurately, ensuring that all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the appropriate state agency, either online or by mail.

Legal use of the Continuing Corporation

The legal use of the continuing corporation form is crucial for maintaining a business's legitimacy. When properly executed, this form ensures that the business can continue to operate under the same legal entity, protecting its assets and liabilities. It is essential to comply with state laws governing corporate continuity to avoid potential legal complications, such as loss of business status or penalties.

Key elements of the Continuing Corporation

Several key elements are essential when dealing with the continuing corporation form. These include:

- Business Name: The official name of the corporation must be clearly stated.

- Ownership Information: Details about current and new owners should be included.

- Management Structure: Information about changes in management or board members is necessary.

- Purpose of Continuity: A clear explanation of why the corporation seeks to continue its existence.

State-specific rules for the Continuing Corporation

Each state has its own regulations regarding the continuing corporation form. It is vital for businesses to familiarize themselves with these rules to ensure compliance. This may include specific filing fees, deadlines, and additional documentation that may be required. Consulting with a legal professional or business advisor can provide clarity on state-specific requirements and help navigate the process effectively.

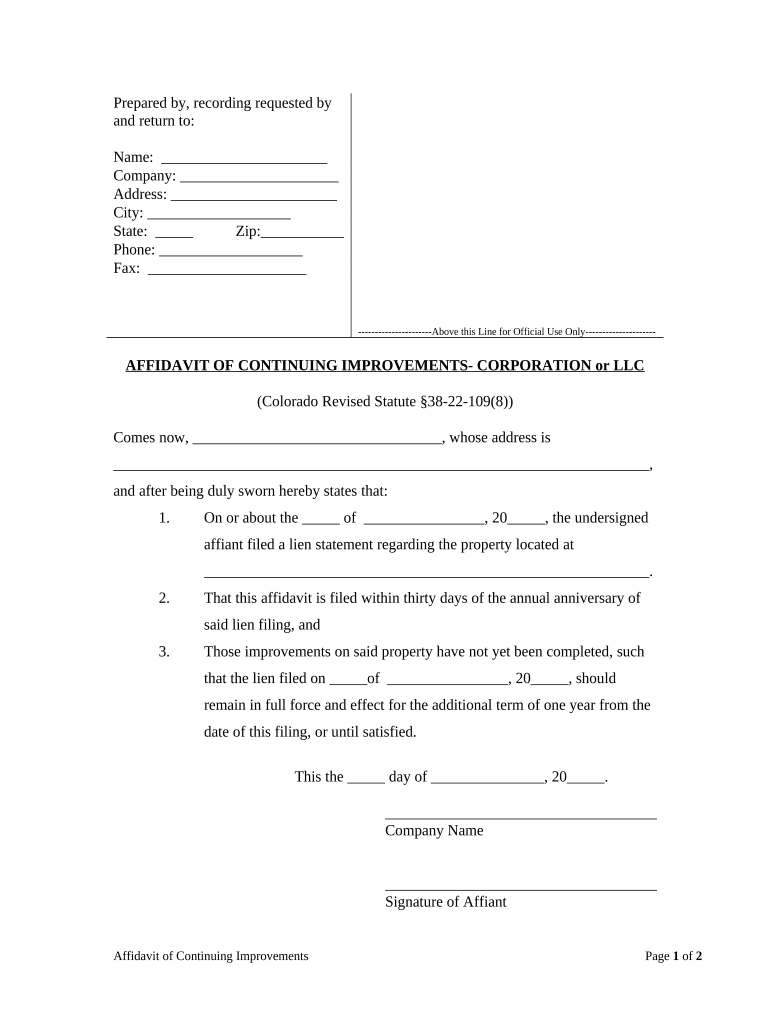

Quick guide on how to complete continuing corporation

Effortlessly Prepare Continuing Corporation on Any Device

Managing documents online has gained immense popularity among organizations and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly without any delays. Handle Continuing Corporation on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to Edit and eSign Continuing Corporation with Ease

- Locate Continuing Corporation and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of the documents or redact sensitive information with specific tools that airSlate SignNow offers for this purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select your preferred method of sharing your form, whether by email, text message (SMS), invitation link, or by downloading it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Continuing Corporation and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a continuing corporation and how does it relate to airSlate SignNow?

A continuing corporation is a business entity that persists after changes in ownership or structure. airSlate SignNow supports continuing corporations by providing robust eSignature solutions, ensuring that document workflows remain efficient and legally binding even during transitions in management or ownership.

-

How can airSlate SignNow benefit a continuing corporation?

airSlate SignNow offers a streamlined document signing process that can signNowly enhance efficiency for continuing corporations. By reducing paperwork and automating workflows, businesses can maintain operational continuity while ensuring compliance with legal requirements.

-

What features does airSlate SignNow offer for continuing corporations?

airSlate SignNow provides features such as customizable templates, secure eSignatures, and real-time tracking, all tailored for the needs of continuing corporations. These functionalities help organizations manage documents more effectively and maintain clarity in their operations.

-

What integrations does airSlate SignNow support for continuing corporations?

airSlate SignNow integrates seamlessly with various business tools such as CRM systems, cloud storage, and project management platforms, benefiting continuing corporations by streamlining their operations. These integrations allow for efficient management of documents across multiple applications, enhancing productivity.

-

Is airSlate SignNow cost-effective for continuing corporations?

Yes, airSlate SignNow is designed to be a cost-effective solution for continuing corporations, helping them save on operational costs related to document management. The pricing model is flexible, catering to businesses of all sizes, ensuring they get maximum value from their investment.

-

Can airSlate SignNow help continuing corporations with compliance?

Absolutely, airSlate SignNow includes robust security measures and complies with legal standards, which is crucial for continuing corporations. By using our platform, businesses can ensure that their eSignatures and document processes meet all necessary regulatory requirements.

-

How secure is airSlate SignNow for a continuing corporation's documents?

airSlate SignNow implements advanced security protocols to protect the documents of continuing corporations. Features like encryption, secure storage, and authentication ensure that sensitive information remains confidential and protected from unauthorized access.

Get more for Continuing Corporation

- Form it 203 gr group return for nonresident partners tax year 2021

- Clear all form

- Form it 6111 ampquotclaim for brownfield redevelopment tax

- Exempt purposes internal revenue code section 501c3 form

- Credit claim forms for corporations current year taxnygov

- 2022 california form 3885 l depreciation and amortization 2022 california form 3885 l depreciation and amortization

- 2023 form 590 p nonresident withholding exemption certificate for previously reported income

- 2022 form 3596 paid preparers due diligence checklist for california earned income tax credit

Find out other Continuing Corporation

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form