Colorado Declaration Form

What is the Colorado Declaration

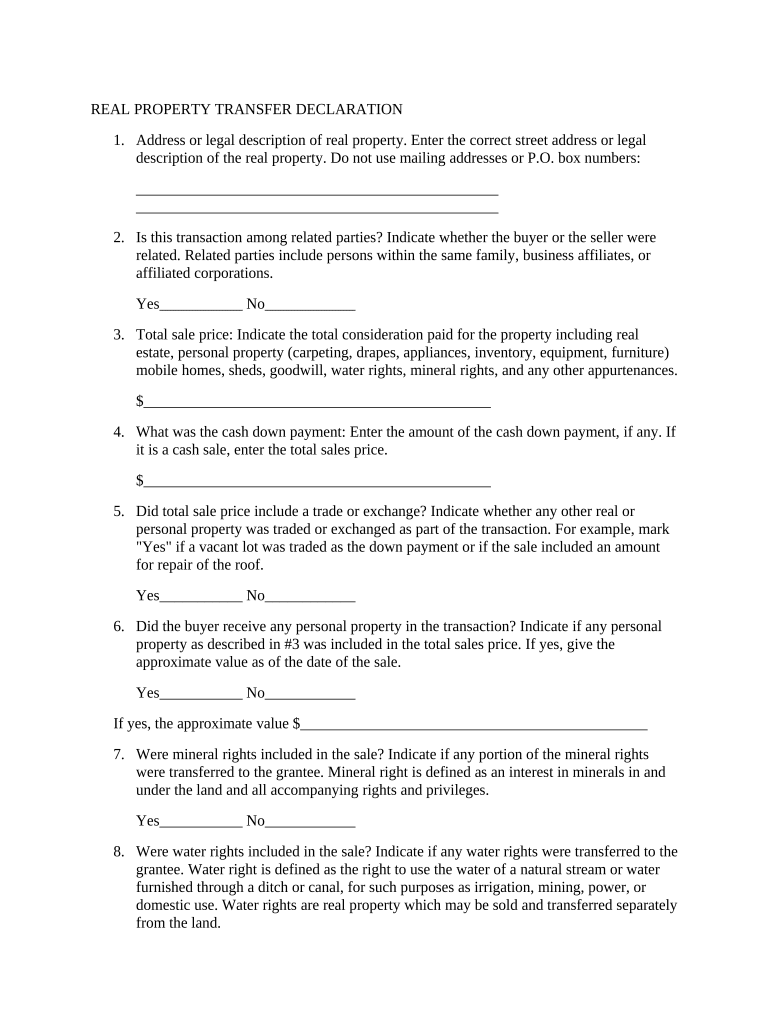

The Colorado Declaration is a legal document used primarily to affirm certain declarations or claims within the state of Colorado. It serves various purposes, including tax-related declarations and compliance with state regulations. The form is essential for individuals and businesses to ensure their statements are recognized legally and can be utilized in various administrative processes.

How to use the Colorado Declaration

Using the Colorado Declaration involves several steps to ensure it is filled out correctly and complies with legal standards. First, identify the specific purpose of the declaration to ensure you are using the correct version of the form. Next, gather all necessary information and documentation to support your claims. Fill out the form accurately, ensuring that all required fields are completed. Finally, submit the form as directed, whether online, by mail, or in person, depending on the requirements.

Steps to complete the Colorado Declaration

Completing the Colorado Declaration requires careful attention to detail. Follow these steps:

- Review the form to understand its requirements.

- Collect all relevant information, including personal details and any supporting documents.

- Fill out the form, ensuring accuracy in all entries.

- Sign the declaration, either digitally or with a handwritten signature, as required.

- Submit the completed form through the appropriate channels.

Legal use of the Colorado Declaration

The Colorado Declaration is legally binding when completed correctly and submitted according to state regulations. To ensure its legal validity, it must comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and other relevant laws. This compliance guarantees that the declaration holds up in legal settings and can be used as evidence if necessary.

Key elements of the Colorado Declaration

Several key elements must be included in the Colorado Declaration for it to be valid:

- Identification of the declarant, including name and address.

- A clear statement of the claims or declarations being made.

- The date of signing.

- Signature of the declarant, which may require additional verification for electronic submissions.

Who Issues the Form

The Colorado Declaration form is typically issued by state agencies or departments relevant to the specific purpose of the declaration. This may include tax authorities or other regulatory bodies. Individuals can often obtain the form directly from these agencies' websites or offices to ensure they are using the most current version.

Quick guide on how to complete colorado declaration

Effortlessly Prepare Colorado Declaration on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly and without delays. Manage Colorado Declaration on any device using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

The Simplest Method to Alter and eSign Colorado Declaration with Ease

- Obtain Colorado Declaration and select Get Form to commence.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Craft your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all information and click the Done button to confirm your modifications.

- Select your preferred method for sharing your form, via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate reprinting new document versions. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choosing. Modify and eSign Colorado Declaration and maintain excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Colorado Declaration, and how can airSlate SignNow help?

A Colorado Declaration is a formal document used in legal and business contexts within the state of Colorado. airSlate SignNow provides a user-friendly platform to create, send, and eSign Colorado Declarations efficiently. With its intuitive tools, businesses can ensure compliance and streamline their document management process.

-

How much does airSlate SignNow cost for managing Colorado Declarations?

Pricing for airSlate SignNow varies based on the plan selected, starting with a budget-friendly option that suits small businesses. Whether you need to process Colorado Declarations or other documents, our plans offer scalable pricing to meet diverse needs. For specific information, visit our pricing page for a detailed breakdown.

-

Can I customize my Colorado Declaration templates with airSlate SignNow?

Yes, airSlate SignNow allows you to customize your Colorado Declaration templates easily. Users can add logos, modify text, and tailor fields to capture necessary information efficiently. This feature ensures that every document meets your branding and legal requirements.

-

Is it easy to integrate airSlate SignNow with other tools for Colorado Declaration processing?

Absolutely! airSlate SignNow offers seamless integration with a variety of third-party applications, enabling smooth processing of Colorado Declarations. Whether you're using CRM systems or cloud storage solutions, the platform can connect effortlessly to enhance your workflow.

-

What are the key benefits of using airSlate SignNow for Colorado Declarations?

The primary benefits of using airSlate SignNow for Colorado Declarations include speed and efficiency in document management, along with enhanced security for sensitive information. The platform also reduces paper usage, helping your business be more environmentally friendly while ensuring compliance with Colorado's legal standards.

-

How do I ensure legal compliance when creating a Colorado Declaration with airSlate SignNow?

airSlate SignNow is designed to comply with Colorado's electronic signature laws, ensuring that your Colorado Declarations are legally binding. You can also access various legal resources and customer support to verify that your documents meet all necessary regulations.

-

Can I track the status of my Colorado Declarations sent via airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for all documents, including Colorado Declarations. You can monitor who has viewed or signed the document, and receive notifications upon completion, allowing for better management of your workflows.

Get more for Colorado Declaration

- Smouldering charcoal summary pdf download form

- Child care director evaluation template form

- Reference form texas aampm university at qatar qatar tamu

- Fill in the blank essay template form

- Affidavit of non compliance form

- Florida quit claim deed form pdf word eforms

- Arkansas quit claim deed pdf form

- Notice of claim against the state of arizona claim form

Find out other Colorado Declaration

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement