Colorado Calculation Form

What is the Colorado Calculation

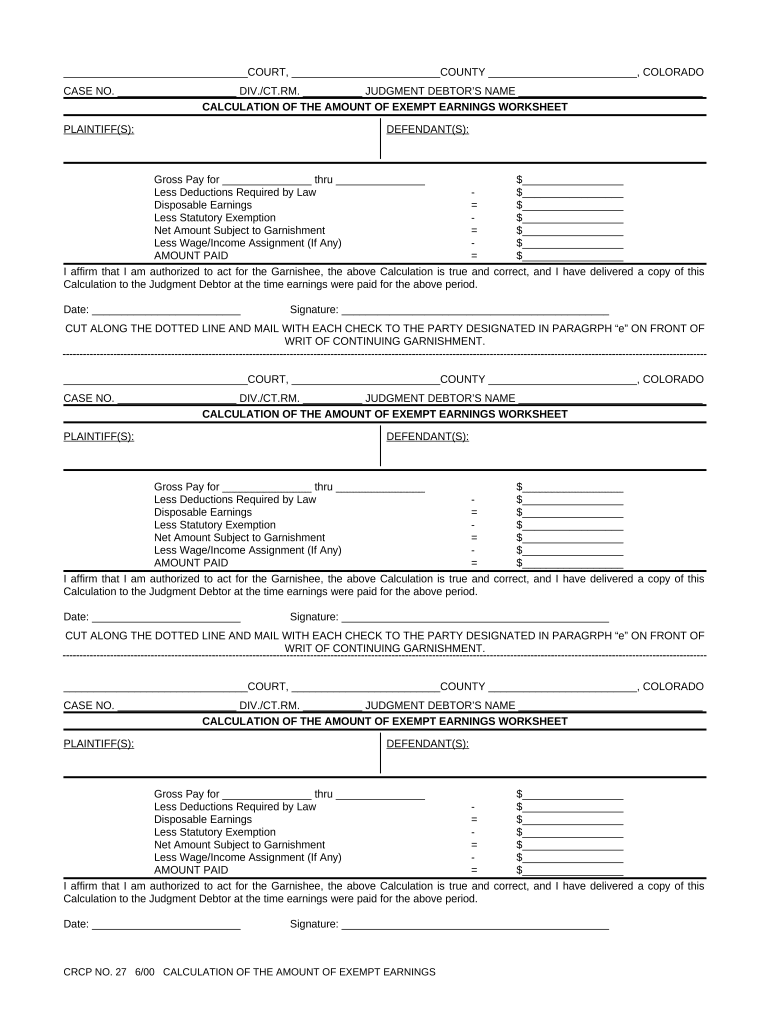

The Colorado calculation refers to a specific process used to determine the amount exempt from earnings in the state of Colorado. This calculation is essential for individuals and businesses to understand their tax obligations accurately. It involves various factors, including income levels, deductions, and applicable state tax laws. The Colorado calculation form is typically used during tax season to ensure compliance with state regulations.

How to use the Colorado Calculation

Using the Colorado calculation involves several steps to ensure accurate completion. First, gather all necessary financial documents, including income statements and previous tax returns. Next, complete the Colorado calculation form by entering your total income and any allowable deductions. It is important to follow the guidelines provided by the state to ensure that all calculations are correct. Once completed, the form can be submitted electronically or via mail, depending on your preference.

Steps to complete the Colorado Calculation

To complete the Colorado calculation, follow these steps:

- Gather all relevant financial documents, including W-2s and 1099s.

- Determine your total income for the tax year.

- Identify any deductions applicable to your situation, such as student loan interest or retirement contributions.

- Fill out the Colorado calculation form accurately, ensuring all figures are correct.

- Review your completed form for any errors or omissions.

- Submit the form electronically through a secure platform or mail it to the appropriate state office.

Legal use of the Colorado Calculation

The Colorado calculation must be completed in accordance with state laws to ensure its legal validity. This includes adhering to the guidelines set forth by the Colorado Department of Revenue. Utilizing a reliable eSignature platform can enhance the legal standing of the document, ensuring compliance with the ESIGN Act and UETA. Proper execution of the form is crucial for it to be recognized by courts and tax authorities.

Key elements of the Colorado Calculation

Several key elements are essential when performing the Colorado calculation:

- Total income: This includes all sources of income, such as wages, dividends, and interest.

- Deductions: Identify all applicable deductions that can reduce taxable income.

- Filing status: Your filing status (single, married, etc.) can impact the calculation.

- Exemptions: Understand the exemptions that may apply to your situation.

Examples of using the Colorado Calculation

Examples of the Colorado calculation can help clarify its application. For instance, if an individual earns $50,000 and has $10,000 in deductions, the taxable income would be $40,000. Another example includes a business that calculates its exempt amount based on its total revenue and allowable expenses. These examples illustrate how the calculation can vary based on individual circumstances and financial situations.

Quick guide on how to complete colorado calculation

Complete Colorado Calculation effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can locate the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage Colorado Calculation on any platform with airSlate SignNow apps for Android or iOS and streamline any document-related operation today.

How to modify and eSign Colorado Calculation with ease

- Find Colorado Calculation and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight relevant sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you want to deliver your form: via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Colorado Calculation and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the colorado calculation feature in airSlate SignNow?

The colorado calculation feature in airSlate SignNow allows users to automate complex calculations within their documents. This tool is particularly beneficial for businesses that require precise data management, as it simplifies the process of generating accurate calculations directly in eSigning workflows.

-

How does airSlate SignNow handle pricing for the colorado calculation feature?

AirSlate SignNow offers competitive pricing models that incorporate the colorado calculation feature. Customers can choose from various subscription plans tailored to their specific needs, ensuring they only pay for the features that enhance their document signing experience, including the precision of colorado calculation.

-

Can I integrate the colorado calculation feature with other applications?

Yes, airSlate SignNow supports integration with numerous applications, allowing the colorado calculation feature to work seamlessly within your existing workflow. This means you can easily connect it with CRM systems, financial software, and other tools to automate data entry and improve efficiency.

-

What are the benefits of using airSlate SignNow's colorado calculation feature?

Using the colorado calculation feature in airSlate SignNow provides signNow advantages, such as accuracy and time savings. Businesses can eliminate manual calculations, reduce errors, and speed up their document processing, leading to enhanced productivity and improved decision-making.

-

Is the colorado calculation feature easy to use for non-technical users?

Absolutely! The colorado calculation feature in airSlate SignNow is designed with user-friendliness in mind. Thanks to its intuitive interface, even non-technical users can easily set up and utilize this feature without extensive training.

-

What types of documents benefit the most from the colorado calculation feature?

The colorado calculation feature is especially beneficial for financial documents, contracts, and forms that require real-time number updates. Whether it's calculating totals, taxes, or discounts, this feature streamlines processes that rely on accurate data calculations to minimize errors.

-

How does airSlate SignNow ensure the security of calculations made with the colorado calculation feature?

AirSlate SignNow prioritizes security by employing advanced encryption protocols to protect all calculations performed through its colorado calculation feature. This ensures that sensitive data remains confidential and secure throughout the entire signing process.

Get more for Colorado Calculation

Find out other Colorado Calculation

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors