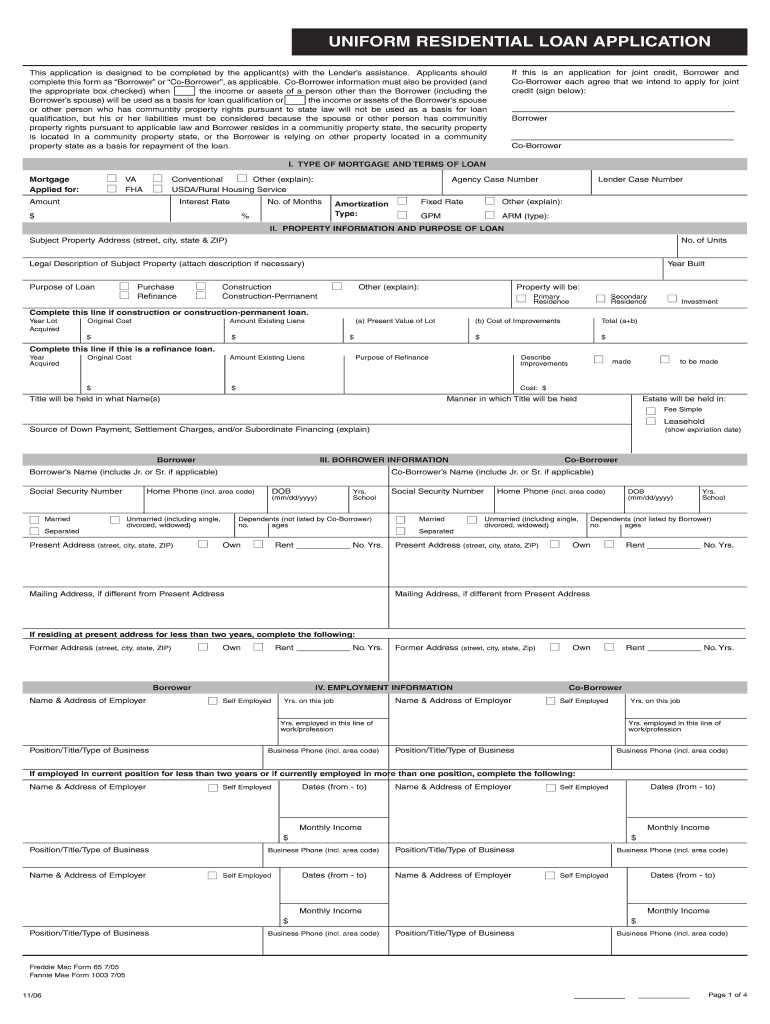

UNIFORM RESIDENTIAL LOAN APPLICATION Independent Bank 2006

What is the UNIFORM RESIDENTIAL LOAN APPLICATION Independent Bank

The Uniform Residential Loan Application (URLA) is a standardized form used by lenders in the United States to evaluate the creditworthiness of borrowers applying for residential mortgages. This application is crucial for independent banks as it gathers essential information about the applicant's financial history, employment status, and the property being financed. The URLA ensures that all necessary details are collected in a uniform manner, facilitating a smoother loan processing experience for both lenders and borrowers.

How to use the UNIFORM RESIDENTIAL LOAN APPLICATION Independent Bank

Using the Uniform Residential Loan Application involves filling out various sections that cover personal information, income details, assets, and liabilities. Borrowers should provide accurate and complete information to avoid delays in the loan approval process. The application can be completed online, allowing for easy access and submission. Independent banks often provide guidance on how to fill out the form correctly, ensuring that applicants understand each section and its significance.

Steps to complete the UNIFORM RESIDENTIAL LOAN APPLICATION Independent Bank

Completing the Uniform Residential Loan Application involves several key steps:

- Gather necessary documentation, such as proof of income, tax returns, and information about existing debts.

- Fill out personal information, including name, address, and Social Security number.

- Provide details about the property being purchased, including its address and estimated value.

- Disclose financial information, including income sources, monthly debts, and assets.

- Review the application for accuracy before submission.

Key elements of the UNIFORM RESIDENTIAL LOAN APPLICATION Independent Bank

The key elements of the Uniform Residential Loan Application include:

- Borrower Information: Personal details about the applicant, including employment history and financial status.

- Property Information: Details about the property being financed, including its type and value.

- Financial Information: A comprehensive overview of the applicant's income, assets, and liabilities.

- Loan Details: Information about the type of loan being applied for, including the loan amount and terms.

Legal use of the UNIFORM RESIDENTIAL LOAN APPLICATION Independent Bank

The Uniform Residential Loan Application is legally recognized under U.S. law, ensuring that electronic signatures and submissions comply with regulations such as the ESIGN Act and UETA. This legal framework supports the validity of the application when submitted electronically, provided that the borrower adheres to the necessary identification and consent requirements. Independent banks often ensure that their processes align with these legal standards to protect both the lender and borrower.

Eligibility Criteria

Eligibility for using the Uniform Residential Loan Application typically depends on several factors:

- Creditworthiness: Lenders assess the applicant's credit score and history.

- Income Stability: Borrowers must demonstrate a reliable income source to support loan repayments.

- Debt-to-Income Ratio: Lenders evaluate the ratio of monthly debt payments to gross monthly income.

- Property Eligibility: The type of property being financed must meet lender guidelines.

Quick guide on how to complete uniform residential loan application independent bank

The simplest method to locate and approve UNIFORM RESIDENTIAL LOAN APPLICATION Independent Bank

Across the breadth of your organization, ineffective workflows related to document authorization can take up a signNow amount of work hours. Signing papers such as UNIFORM RESIDENTIAL LOAN APPLICATION Independent Bank is a fundamental aspect of operations in any sector, which is why the effectiveness of each agreement’s lifecycle signNowly impacts the overall productivity of the business. With airSlate SignNow, endorsing your UNIFORM RESIDENTIAL LOAN APPLICATION Independent Bank can be as straightforward and rapid as it can be. This platform provides you with the most recent version of nearly any document. Even better, you can sign it instantly without the need for any external software on your computer or printing anything as physical copies.

How to obtain and endorse your UNIFORM RESIDENTIAL LOAN APPLICATION Independent Bank

- Explore our collection by category or use the search bar to find the document you require.

- Check the form preview by clicking on Learn more to ensure it’s the correct one.

- Click Get form to begin editing immediately.

- Fill out your form and include any relevant information using the toolbar.

- When finished, click the Sign tool to endorse your UNIFORM RESIDENTIAL LOAN APPLICATION Independent Bank.

- Select the signature method that suits you best: Draw, Create initials, or upload a photo of your handwritten signature.

- Click Done to finalize editing and move on to document-sharing options if needed.

With airSlate SignNow, you have everything necessary to manage your documents effectively. You can locate, complete, modify, and even send your UNIFORM RESIDENTIAL LOAN APPLICATION Independent Bank within a single tab with no inconvenience. Optimize your workflows with a single, intelligent eSignature solution.

Create this form in 5 minutes or less

Find and fill out the correct uniform residential loan application independent bank

FAQs

-

When I fill out a loan application form at a bank, how does the bank know if I am lying about my total assets and liabilities?

Your credit report has more than the score, because part of what makes up you score is the amount of liabilities and how they are handled. Liabilities that will show areCar payments and balanceCredit cardsDepartment store cardsStudent loansChild support/alimony Judgements And many more.For assetsBank statementsBrokerage accounts401k statements etc.If an applicant is sufficiently strong (20% down-payment and a few months mortgage payments reserved) then all assets are usually not verified.But as a mortgage broker I've even used a car and boat title to boost an otherwise shaky application.

-

How do I fill out an application form to open a bank account?

I want to believe that most banks nowadays have made the process of opening bank account, which used to be cumbersome, less cumbersome. All you need to do is to approach the bank, collect the form, and fill. However if you have any difficulty in filling it, you can always call on one of the banks rep to help you out.

-

How do I fill out a SunTrust Bank application?

Go to the website Personal, Mortgage & Small Business Banking.You will find a link to fill out an application.

-

How do I fill out the application form for an educational loan online?

Depending on which country you are in and what kind of lender you are going for. There are bank loans and licensed money lenders. If you are taking a large amount, banks are recommended. If you are working, need a small amount for your tuition and in need of it fast, you can try a licensed moneylender.

-

Why do you have to fill out an application to close a bank account?

Question: WHY DO YOU HAVE TO FILL OUT AN APPLICATION TO CLOSE A BANK ACCOUNT? (Photo credit: warren currier) _______________________________________________________ Answer: "YOU REMAIN RESPONSIBLE FOR THE ACCOUNT AS LONG AS IT REMAINS OPEN, THEREFORE, UNTIL YOU CLOSE A BANK ACCOUNT PROPERLY, YOU OWN IT! CLOSING THE ACCOUNT PROPERLY IS THE ONLY WAY TO ENSURE THE ACCOUNT CAN NOT BE USED IN SOME ILLEGAL WAY IN THE FUTURE. REMEMBER, WHETHER OR NOT YOU'RE INVOLVED OR WHETHER OR NOT YOU HAVE ANY KNOWLEDGE OF ANY ILLEGAL ACTIVITY, IT IS YOUR ACCOUNT AND YOU ARE RESPONSIBLE FOR THE ACCOUNT UNTIL IT HAS BEEN CLOSED ACCORDING TO CURRENT LAWS"____________________________________________________ (see ZERO HEDGE article at bottom of this page)____________________________________________________MONEY LAUNDERING ____________________________________________________Money Laundering: A Banker’s Guide to Avoiding Problems*Office of the Comptroller of the CurrencyWashington, DCDecember 2002. (link below)___________________________________________________ Background: "On February 12, 2002, the U.S. House Financial ServicesSubcommittee on Oversight and Investigations heard testimony regarding terrorist financing and the implementation of the USA PATRIOT Act. The testimony discusses what the Federal Bureauof Investigation (FBI) has learned since the September 11, 2001,terrorist attacks about the patterns of financing associated with terrorist networks. The FBI also described the extent to which U.S. anti-money laundering statutes provide the necessary tools to detect and disrupt these patterns of financing. An interagency Financial Review Group devoted signNow resources toidentifying and following the money trail""The international community has long recognized that the problems of money laundering and terrorism require a coordinated approach. For many years, a number of international organizations have developed standards for combating money laundering, terrorism, and terrorist financing.These standards contain common themes of promoting actionsto deny criminals, terrorists, and those who assist them access to their funds and the world’s financial services industries. Many international agreements and resolutions outline similar standards or build upon each other"http://www.occ.gov/topics/bank-o...____________________________________________________ WHAT ARE BANKS LOOKING FOR? Money Laundering Information for BanksTransactions involving Accounts:Opening accounts when the customer’s address is outside the local service area.Opening accounts in other people’s names.Attempting to open or operating accounts under a false name.Accounts with a large number of small cash deposits and small number of large cash withdrawals.Funds are deposited into several accounts, consolidated into one and transferred outside the country.Customer frequently uses many deposit locations outside of the home branch location.Multiple transactions are carried out on the same day at the same branch but with an apparent attempt to use different tellers.Establishment of multiple accounts, some of which appear to remain dormant for extended periods.Account that was reactivated from inactive or dormant status suddenly sees signNow activity.Reactivated dormant account containing a minimal sum suddenly receives a deposit or series of deposits followed by frequent cash withdrawals until the transferred sum has been removed.Deposit and/or withdrawals of multiple monetary instruments, particularly if the instruments are sequentially numbered.Multiple personal and business accounts are used to collect and then funnel funds to a small number of foreign beneficiaries, particularly when they are in locations of concern, such as countries known or suspected to facilitate money laundering activities.____________________________________________________ "A question of control: Whoever's in charge of the money will ultimately be the one in charge of everything!"(warren currier, april 17, 2016)____________________________________________________ ____________________________________________________ Why is there all of this new interest in governing crypto-currencies?("Whoever's in charge of the money will ultimately be the one in charge of everything!")____________________________________________________ LEARN TO READ BETWEEN THE LINES ____________________________________________________ Excerpt from STRATFOR GLOBAL INTELLIGENCE paragraph seven, below: "Governments have struggled to stop decentralized networks in the past, but with each evolution of government crackdowns on file-sharing programs, the programmers become more sophisticated"____________________________________________________ to wit: STRATFOR Examining the Future of Bitcoin"Editor's Note: This foundational analysis on bitcoin was originally published Feb. 28. 2014. In light of the U.S. Commodity Futures Trading Commission's (CFTC) Sept. 17 decision to change its regulation governing crypto-currencies, we are republishing it. Stratfor asserted that the underlying technology behind bitcoin will have wide-ranging applications in a number of areas, including finance and computer science. The CFTC has decided to consider bitcoin a commodity rather than a currency, which means it will fall under the commission's jurisdiction. While somewhat disruptive in the interim, this ruling does allow for bitcoin to be used as an asset class similar to gold or oil. From now on, companies seeking to operate as trading platforms for cryptocurrency derivatives or futures must register and comply with regulations laid out by the CFTC.Bitcoin is a relatively new and unregulated electronic currency that enables the owner to buy, sell and trade anonymously without incurring high transaction charges. Since its creation in 2009, Bitcoin has become the most prevalent of a number of so-called cryptocurrencies. Some have heralded cryptocurrencies as potential challengers to financial institutions, especially in developing markets and regions where traditional banking infrastructure is underdeveloped. But despite a positive reaction to Bitcoin from the U.S. Federal Reserve Bank, multiple nations have refused to acknowledge the currency. Thailand, Russia, Iceland and Vietnam have all rejected or banned it.Bitcoin experienced a tumultuous February as Mt. Gox, an exchange that converted conventional legal tender into bitcoins and vice versa, on Feb. 7 stopped withdrawals from accounts and ultimately shut down Feb. 24. Finally, on Feb. 28 it was revealed that most of the bitcoins deposited into the exchange — approximately $475 million worth — had disappeared. Electronic currencies such as bitcoin are susceptible to cyberattack, as the Mt. Gox incident shows. Chief among other concerns about electronic currencies is their existence beyond governments' capital controls, making illegal activities such as money laundering relatively straightforward. Financial regulators and many observers say that cryptocurrencies are a speculative bubble waiting to collapse. But no amount of opposition can erase electronic currencies or the technology behind them.AnalysisCentral to the idea of currency is ownership, the fact that money can only belong to (and therefore be spent by) one person or entity at a time. In the digital era, electronic money is no different than any other computer file, which means that unlike physical money, it can be endlessly copied. Bitcoin is not the first attempt at creating an electronic currency, but it is the first digital tender to gain serious interest and backing. This is largely due to the efforts of Satoshi Nakamoto, a fictitious name or group, responsible for the "Bitcoin protocol." Prior to Bitcoin, electronic currencies required a third party, such as PayPal, to determine if one party still owned the money or had previously spent it, thus transferring ownership to someone else. The Bitcoin protocol solved this problem by creating a publicly viewable global ledger, showing the sequential transactions of all accounts using bitcoin.Bitcoins are bought and sold on the Internet at places known as exchanges. Bitcoins are generally stored in a digital wallet and transactions are recorded in a shared public ledger known as the "blockchain." The currency is not controlled by a central bank but is instead managed by an online community. Members with powerful computers are encouraged to maintain the transactional register by "verifying the blockchain" — solving complex mathematical equations and adding another "block" of transactions to the existing chain. The process is known as "mining" because the verifier is rewarded with new bitcoins. The way the system works, new bitcoins will not be created after there are 21 million in circulation, which is projected to happen in the year 2140.Bitcoin has both strengths and weaknesses as a currency. Accounts themselves are anonymous, but determining ownership through regulating exchanges or IP addresses is possible. Bitcoin also enables merchants to escape expensive transaction fees that are often the consequence of fraud protection. This is because bitcoin transactions are not reversible and, from the point of view of the merchant, there is little inherent risk of fraud. But due to skepticism and the fact that this is a relatively new concept entirely, few merchants accept bitcoins. Potential markets are also being shuttered by some countries that are fearful of the unique opportunities that cryptocurrencies offer compared to traditional state-sanctioned money.Decentralized currencies such as Bitcoin remain in their infancy. To achieve mainstream longevity, cryptocurrencies will need to become popular and user friendly or find acceptance with a gigantic corporation such as Amazon. Governments have struggled to stop decentralized networks in the past, but with each evolution of government crackdowns on file-sharing programs, the programmers become more sophisticated. For example, when Napster became popular for file sharing and was taken down, Kazaa, another file-sharing application, was created instead. This has led to peer-to-peer networks that are so decentralized that they are nearly impossible to stop.This will not prevent governments from trying to monitor, disrupt and partially regulate cryptocurrencies — in extreme cases governments could also physically move to shut down exchanges — so the programmers behind cryptocurrencies have to improve the reliability and security of their networks. Hardening exchanges against cyberattacks, or at least limiting their frequency, will be critical in instilling confidence.Bitcoin as a TechnologyBitcoin is far more than a currency; it is a new technological platform. Currency is just one of many potential applications. While bitcoin itself may fail, its technological breakthrough — the Bitcoin protocol — can be used for other applications in computer science. Though observers have pointed to the Mt. Gox shutdown as proof bitcoin will fail, having one exchange shut down is not a big deal, and bitcoins' value on other exchanges has yet to collapse since Mt. Gox's problems began in early February.Over the last year, venture capitalists have been quick to invest money in startup businesses that approach bitcoin with unique ideas. One company envisions "colored coins," essentially a Bitcoin-like cryptocurrency where each individual coin represents another physical commodity. Colored coins would then act as a surrogate to trade anything from stocks to securities, traditional money or anything else. Other companies are attempting to connect Wall Street to digital currencies, planning to trade bitcoins or derivatives based on them. To do so would require oversight from the U.S. Securities and Exchange Commission. There is an ongoing movement to get the Securities and Exchange Commission to approve an exchange-traded fund for bitcoins, which are being looked at not just as a currency, but as an asset class all by themselves. Unlike gold, however, Bitcoin is also a currency in the sense that it is easily divisible as well as relatively fluid.Geopolitically, the use of Bitcoin by financial institutions and venture capitalists is of secondary importance, but they do provide a growing user base. The first five years of Bitcoin saw an exponential growth in value as well as popularity. Like any new, free-floating currency, the worth of bitcoins has remained volatile. In order for Bitcoin — or any other cryptocurrency — to be widely adopted, there will need to be an increase in the number of outlets and potential users, and there must be overall confidence in the value and stability of the tender. All of this can come only with time.Cryptocurrencies in the Developing WorldThe relative ease of moving bitcoins in and out of countries with harsh capital controls was demonstrated during the recent financial crises in Cyprus, Argentina and Russia. Even more recently, Bitcoin addresses have been used on protesters' posters in Ukraine as a way to find financial support from abroad. Banking sectors can impose restrictions and limit the movement of conventional funds, but no such regulatory system exists for digital currencies. For frontier and developing markets, digital currencies provide a way for individuals to gain access to dollars and other more stable currencies. The underlying volatility of national currencies is a driver toward alternative tender.Digital money has already revolutionized local economies in some developing countries, providing a functional way to escape capital controls or bypass technologies. M-Pesa is a mobile money transfer system that has become popular in several African countries. The system debuted in Kenya in 2007, and to date roughly one-third of all Kenyans have an M-Pesa account. As a result, the equivalent value of about one-third of Kenya's gross domestic product is now spent via phone. In July 2013, a technology known as Kipochi was developed to connect M-Pesa accounts with Bitcoin accounts. Currently, anyone in the world can send bitcoins directly to a third of people in Kenya with zero transaction costs. This becomes important when considering the number of workers employed outside their home country. Traditional remittances — when foreign workers send money home — are very expensive, with transaction costs upward of 30 percent. Cryptocurrencies such as Bitcoin provide a signNowly cheaper alternative.Kenya's successful adoption of mobile payment methods is a reminder of the fact that bitcoins can be transferred as easily as sending an SMS message on a phone. Much of the developing world does not have access to financial institutions or traditional bank accounts, but even the poorest countries invest in robust telecommunications network architecture, and almost everyone has a cellphone. The proliferation of cellphones and a digital tender such as Bitcoin could enable societies to skip technological phases, such as the need to construct a massive and intricate network of landlines.On top of the impact on remittances, cryptocurrencies encourage innovative financial markets, for both the developed and the developing world. Cryptocurrencies enable a mechanism for global peer-to-peer lending, a concept made popular through companies like Kickstarter. Digital transactions can be used to finance projects anywhere on the planet. This is especially important for developing countries because it allows access to informal capital markets in the developed world. Securing enough credit through traditional channels to start a small business in Zambia is difficult, but obtaining multiple instances of smaller amounts from the fringes of a developed economy is achievable.Cryptocurrencies in the Developed WorldMost countries that eschew stringent capital controls (such as the United States and Japan) are adopting a wait-and-see approach to Bitcoin, monitoring the currency but not yet taking strong action to regulate it. Other governments with more restricted financial systems are moving to regulate Bitcoin more severely. However, should cryptocurrencies gain prominence in a country's economy to the point that they undermine a central bank's monetary policy, the government of that country would have a problem. Jeopardizing one of the primary methods a nation-state uses to direct its economy — and finance its government — is unacceptable to any authority. By then, assuming a broad citizen investment in the new currency, any attempt to outlaw it or affect the exchanges would be politically difficult, leading to social tension, even unrest.A more likely government strategy to circumvent the impact of digital currencies and preserve the integrity of the treasury would be to employ pre-emptive action at the emergence of cryptocurrency, most likely through regulating the online exchanges. Such regulation would enable government officials to identify online accounts, make connections and thus limit or monitor tax evasion and other illicit activity. Bitcoins are incredibly transparent. Tracking money-flow using the blockchain is just one method agencies may already be using to monitor illegal activities.Bitcoin was initially popularized by libertarians, who saw a digital currency as a way to avoid central banks and state control of the financial sector. As Bitcoin's popularity has grown, so has the interest of venture capitalists, attempting to bring cryptocurrencies into legal and regulated circles. Although Bitcoin may not survive, cryptocurrencies will. While there are enough residual problems to prevent them from going mainstream in the short term, digital currencies are likely to remain popular in specific niche markets"___________________________________________________ THE WAR ON CASH: OFFICIALLY SANCTIONED THEFT By: Tyler Durden, 2015, 06, 15 (complete ARTICLE below)The War On Cash: Officially Sanctioned Theft_______________________________________________________ WHAT DOES IT ALL REALLY MEAN?"It means governments are limiting the use of cash and a variety of official-mouthpiece economists are calling for the outright abolition of cash. Authorities are both restricting the amount of cash that can be withdrawn from banks, and limiting what can be purchased with cash"(tyler durden, june 15, 2015)______________________________________________________ "A question of control: Whoever's in charge of the money will ultimately be the one in charge of everything!"(warren currier, april 17, 2016)______________________________________________________ The War On Cash: Officially Sanctioned Theft ZeroHedge The War On Cash: Officially Sanctioned Theftby Tyler Durden on 06/13/2015 22:15 -0400While the benefits to banks and governments of banning physical cash are self-evident, there are downsides to the real economy and to household resilience.You've probably read that there is a war on cash being waged on various fronts around the world. What exactly does a war on cash mean? It means governments are limiting the use of cash and a variety of official-mouthpiece economists are calling for the outright abolition of cash. Authorities are both restricting the amount of cash that can be withdrawn from banks, and limiting what can be purchased with cash. These limits are broadly called capital controls. The War On Cash: Why Now? Why are governments suddenly acting as if cash money is a bad thing that must be severely limited or eliminated? Before we get to that, let’s distinguish between physical cash—currency and coins in your possession—and digital cash in the bank. The difference is self-evident: cash in hand cannot be confiscated by a “bail-in” (i.e. officially sanctioned theft) in which the government or bank expropriates a percentage of cash deposited in the bank. Cash in hand cannot be chipped away by negative interest rates or fees like cash held in a bank. Cash in the bank cannot be withdrawn in a financial emergency that shutters the banks, i.e. a bank holiday. When pundits suggest cash is “obsolete,” they mean physical paper money and coins, not cash in a bank. Cash in the bank is perfectly fine with the government and its well-paid yes-men (paging Mr. Rogoff and Mr. Buiter) because this cash can be expropriated by either “bail-ins” or by negative interest rates. Mr. Buiter, for example, recently opined that the spot of bother in 2008-09 (the Global Financial Meltdown) could have been avoided if banks had only charged a 6% negative interest rate on cash: in effect, taking 6% of the depositor’s cash to force everyone to spend what cash they might have. Both cash in hand and cash in the bank are subject to one favored method of expropriation, inflation. Inflation—the single most cherished goal of every central bank—steals purchasing power from physical cash and digital cash alike. Inflation punishes holders of cash and benefits those with debt, as debt becomes cheaper to service. The beneficial effect of inflation on debt has been in play for decades, so it can’t be the cause of governments’ recent interest in eliminating physical cash. So now we return to the question: Why are governments suddenly declaring war on physical cash, the oldest officially issued form of money? The first reason: physical cash has the potential to evade both taxes as well as officially sanctioned theft via bail-ins and negative interest rates. In short, physical cash is extremely difficult for governments to steal. Some of you may find the word theft harsh or even offensive. But we must differentiate between taxes—which are levied to pay for the state’s programs that in principle benefit all citizens—and bail-ins, i.e. the taking of depositors’ cash to bail out banks that became insolvent through the actions of the banks’ management, not the actions of depositors. Bail-ins are theft, pure and simple. Since the government enforces the taking, it is officially sanctioned theft, but theft nonetheless. Negative interest rates are another form of officially sanctioned theft. In a world without the financial repression of zero-interest rates (ZIRP—central banks’ most beloved policy), lenders would charge borrowers enough interest to pay depositors for the use of their cash and earn the lender a profit. If borrowers are paying interest, negative interest rates are theft, pure and simple. Why are governments suddenly so keen to ban physical cash? The answer appears to be that the banks and government authorities are anticipating bail-ins, steeply negative interest rates and hefty fees on cash, and they want to close any opening regular depositors might have to escape these forms of officially sanctioned theft. The escape from bail-ins and fees on cash deposits is physical cash, and hence the sudden flurry of calls to eliminate cash as a relic of a bygone age—that is, an age when commoners had some way to safeguard their money from bail-ins and bankers’ control.Forcing Those With Cash To Spend Or Gamble Their CashNegative interest rates (and fees on cash, which are equivalently punitive to savers) raise another question: why are governments suddenly obsessed with forcing owners of cash to either spend it or gamble it in the financial-market casinos? The conventional answer voiced by Mr. Buiter is that recession and credit contraction result from households and enterprises hoarding cash instead of spending it. The solution to recession is thus to force all those stingy cash hoarders to spend their money.There are three enormous flaws in this thinking.One is that households and businesses have cash to hoard. The reality is the bottom 90% of households have less income now than they did 15 years ago, which means their spending has declined not from hoarding but from declining income. While Corporate America has basked in the glory of sharply rising profits, small business has not prospered in the same fashion. Indeed, by some measures, small business has been in a 6-year recession. The bottom 90% has less income and faces higher living expenses, so only the top slice of households has any substantial cash. This top slice may see few safe opportunities to invest their savings, so they choose to keep their savings in cash rather than gamble it in a rigged casino (i.e. the stock market). The second flaw is that hoarding cash is the only rational, prudent response in an era of financial repression and economic insecurity. What central banks are demanding--that we spend every penny of our earnings rather than save some for investments we control or emergencies—is counter to our best interests. This leads to the third flaw: capital -- which begins its life as savings -- is the foundation of capitalism. If you attack savings as a scourge, you are attacking capitalism and upward mobility, for only those who save capital can invest it to build wealth. By attacking cash, the central banks and governments are attacking capital and upward mobility. Those who already own the majority of productive assets are able to borrow essentially unlimited sums at near-zero interest rates, which they can use to buy more productive assets, while everyone else--the bottom 99.5%--is reduced to consumer-serfdom: you are not supposed to accumulate productive capital, you are supposed to spend every penny you earn on interest payments, goods and services. This inversion of capitalism dooms an economy to all the ills we are experiencing in abundance: rising income inequality, reduced opportunities for entrepreneurship, rising debt burdens and a short-term perspective that voids the longer-term planning required to build sustainable productivity and wealth.Physical Cash: Only $1.36 TrillionAccording to the Federal Reserve, total outstanding physical cash amounts to $1.36 trillion.Given that a substantial amount of this cash is held overseas, physical cash is a tiny part of the domestic economy and the nation’s total assets. For context: the U.S. economy is $17.5 trillion, total financial assets of households and nonprofit organizations total $68 trillion, base money is around $4 trillion, and total money (currency in circulation and demand deposits) is over $10 trillion (source). Given the relatively modest quantity of physical cash, claims that eliminating it will boost the economy ring hollow. Following the principle of cui bono—to whose benefit?--let’s ask: What are the benefits of eliminating physical cash to banks and the government? Benefits To Banks And The Government Of Eliminating Physical Cash The benefits to banks and governments by eliminating cash are self-evident:Every financial transaction can be taxedEvery financial transaction can be charged a feeBank runs are eliminatedIn fractional reserve systems such as ours, banks are only required to hold a fraction of their assets in cash. Thus a bank might only have 1% of its assets in cash. If customers fear the bank might be insolvent, they crowd the bank and demand their deposits in physical cash. The bank quickly runs out of physical cash and closes its doors, further fueling a panic.The federal government began insuring deposits after the Great Depression triggered the collapse of hundreds of banks, and that guarantee limited bank runs, as depositors no longer needed to fear a bank closing would mean their money on deposit was lost.But since people could conceivably sense a disturbance in the Financial Force and decide to turn digital cash into physical cash as a precaution, eliminating physical cash also eliminates the possibility of bank runs, as there will be no form of cash that isn’t controlled by banks.While the benefits to banks and governments of banning physical cash are self-evident, there are downsides to the real economy and to household resilience.In Part 2: What To Do With Your Cash Savings, we'll look at the most influential forces in play in this war, and consider strategies for preserving purchasing power, avoiding bail-ins, fees and other threats to cash savings.Click here to read Part 2 of this report (free executive summary, enrollment required for full access)____________________________________________________ end.

-

Is there a way for you to outsource sensitive tasks securely? For instance, calling the bank, or filling out a loan application form that includes your social security number?

You might benefit from compartmentalizing your sensitive information. Realtors often use custom-purpose sticky notes to help people navigate paperwork, like a little yellow arrow that says “signNow” or a blue flag that says “review these options.” Perhaps your assistant could fill out the entire form for you, except where your SSN needs to be provided, and call those lines out to you with a little sticky arrow.When calling the bank, you may have to initiate the call and then allow your assistant to take over. That way, you’d provide the sensitive data to the bank and satisfy their identity verification, then you’d authorize your assistant to speak on your behalf about the account, and let them take it from there.If you have any tasks that require sensitive data to actually conduct the business - say, moving funds between several bank accounts, which would require constant access to account numbers and other info - then you’ll have to give that task to someone you trust with that info. If you’re the only one you trust, you’re the only one who can do the task.

-

Do I need a bank account to fill out the MHT CET application form?

To apply, you need to pay through online mode. This doesn't necessarily need you to have a bank account. You can ask anyone kind-hearted who is having a bank account to pay and handover the hard cash to that person.Hope this helps.

Create this form in 5 minutes!

How to create an eSignature for the uniform residential loan application independent bank

How to generate an electronic signature for the Uniform Residential Loan Application Independent Bank in the online mode

How to generate an eSignature for your Uniform Residential Loan Application Independent Bank in Google Chrome

How to make an electronic signature for signing the Uniform Residential Loan Application Independent Bank in Gmail

How to create an eSignature for the Uniform Residential Loan Application Independent Bank right from your smartphone

How to make an eSignature for the Uniform Residential Loan Application Independent Bank on iOS

How to make an electronic signature for the Uniform Residential Loan Application Independent Bank on Android devices

People also ask

-

What is the UNIFORM RESIDENTIAL LOAN APPLICATION Independent Bank?

The UNIFORM RESIDENTIAL LOAN APPLICATION Independent Bank is a standardized form used by lenders to gather essential information from borrowers seeking a residential mortgage. This application simplifies the loan process by ensuring that all necessary details are collected efficiently, helping both banks and customers.

-

How do I complete the UNIFORM RESIDENTIAL LOAN APPLICATION Independent Bank?

Completing the UNIFORM RESIDENTIAL LOAN APPLICATION Independent Bank can be done easily using airSlate SignNow. Users can fill out the application digitally, ensuring accuracy and convenience while expediting the overall mortgage process.

-

Is there a cost associated with using airSlate SignNow for the UNIFORM RESIDENTIAL LOAN APPLICATION Independent Bank?

Yes, airSlate SignNow offers flexible pricing plans tailored to meet the needs of various businesses. By providing a cost-effective solution for the UNIFORM RESIDENTIAL LOAN APPLICATION Independent Bank, users can streamline their documentation processes without breaking the bank.

-

What features does airSlate SignNow offer for managing the UNIFORM RESIDENTIAL LOAN APPLICATION Independent Bank?

airSlate SignNow provides several features such as customizable templates, e-signature capabilities, and secure document storage specifically for the UNIFORM RESIDENTIAL LOAN APPLICATION Independent Bank. These tools help streamline the application process and enhance collaboration between lenders and borrowers.

-

What are the benefits of using airSlate SignNow for the UNIFORM RESIDENTIAL LOAN APPLICATION Independent Bank?

Using airSlate SignNow for the UNIFORM RESIDENTIAL LOAN APPLICATION Independent Bank comes with numerous benefits including improved efficiency, reduced paperwork, and enhanced security. This platform allows for faster transactions while maintaining compliance with legal standards.

-

Can I integrate airSlate SignNow with other software for processing the UNIFORM RESIDENTIAL LOAN APPLICATION Independent Bank?

Absolutely! airSlate SignNow offers seamless integrations with various software platforms, making it easy to manage the UNIFORM RESIDENTIAL LOAN APPLICATION Independent Bank alongside your existing tools. This integration ensures a smooth workflow and data consistency.

-

How secure is my information when using airSlate SignNow with the UNIFORM RESIDENTIAL LOAN APPLICATION Independent Bank?

The security of your information is a top priority at airSlate SignNow. By employing advanced encryption and compliance with industry standards, your data related to the UNIFORM RESIDENTIAL LOAN APPLICATION Independent Bank is protected throughout the application process.

Get more for UNIFORM RESIDENTIAL LOAN APPLICATION Independent Bank

- Considerations the receipt and sufficiency of which is hereby acknowledged each of the below form

- Workplace injuries and the take up of social security form

- Buyer shall indemnify seller against any claims arising out form

- Please click here to download application form western

- Do i have to sign a medical records release form in my

- Form 1132000doc

- Texas termination of lease notice to vacate lawlandlord form

- 3 day notice of material breach of form

Find out other UNIFORM RESIDENTIAL LOAN APPLICATION Independent Bank

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast