Ct Corporation Business Form

What is the Ct Corporation Business

The Ct Corporation is a legal entity formed under Connecticut state law, designed to conduct business activities. It provides limited liability protection to its owners, meaning personal assets are generally protected from business debts and liabilities. This structure is ideal for entrepreneurs looking to establish a formal business presence while minimizing personal financial risk. The Ct Corporation must adhere to state regulations, including filing annual reports and maintaining proper corporate governance.

How to Obtain the Ct Corporation Business

To obtain a Ct Corporation, you must first choose a unique business name that complies with Connecticut naming regulations. Next, you need to file the Certificate of Incorporation with the Connecticut Secretary of State. This document typically requires information such as the corporation's name, purpose, registered agent, and the number of shares authorized. After submission, you may need to pay a filing fee, and once approved, you will receive a certificate confirming your corporation's existence.

Steps to Complete the Ct Corporation Business

Completing the formation of a Ct Corporation involves several key steps:

- Choose a business name that is distinguishable and complies with state rules.

- Designate a registered agent to receive legal documents.

- File the Certificate of Incorporation with the state, including necessary details.

- Pay the required filing fee.

- Obtain an Employer Identification Number (EIN) from the IRS for tax purposes.

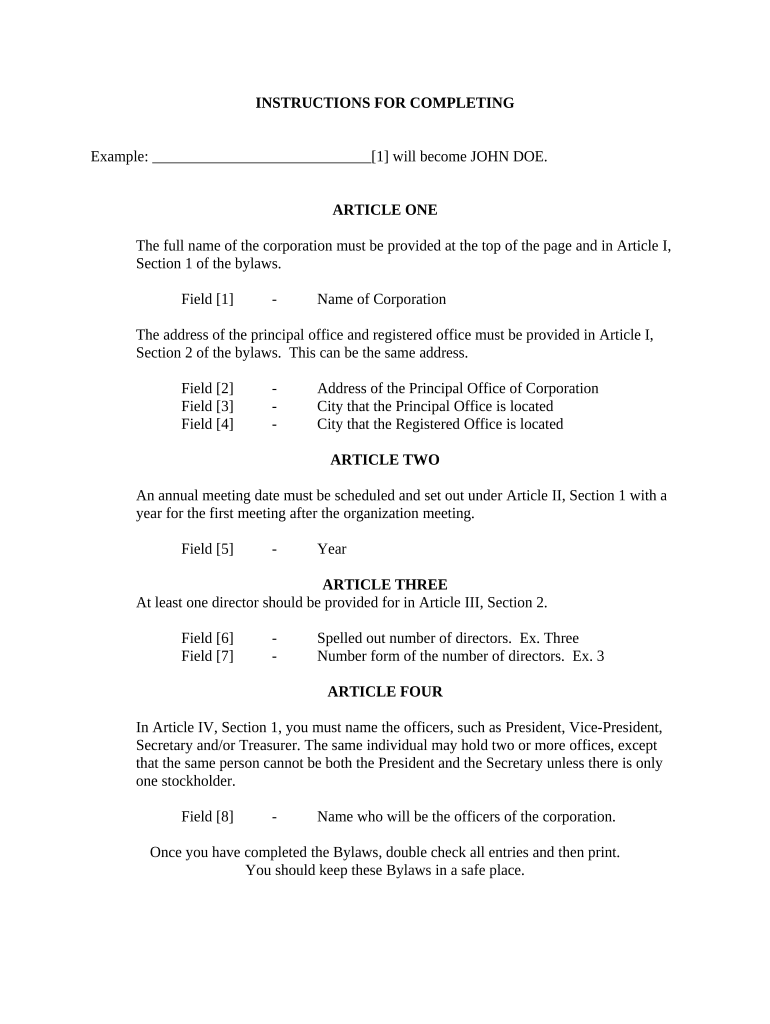

- Draft corporate bylaws to outline governance and operational procedures.

- Hold an organizational meeting to adopt bylaws and appoint officers.

Legal Use of the Ct Corporation Business

The legal use of a Ct Corporation involves adhering to state and federal laws governing corporate operations. This includes maintaining accurate records, holding regular meetings, and filing annual reports. Corporations must also comply with tax obligations, including federal, state, and local taxes. Proper legal use ensures that the corporation retains its limited liability status and avoids potential penalties or legal issues.

Required Documents

To establish a Ct Corporation, several documents are necessary:

- Certificate of Incorporation: This foundational document is filed with the Secretary of State.

- Bylaws: Internal rules governing the corporation's operations.

- Employer Identification Number (EIN): Required for tax purposes.

- Initial reports or statements, if applicable, depending on the corporation's structure.

Filing Deadlines / Important Dates

After forming a Ct Corporation, it is essential to be aware of important deadlines:

- Annual report: Due annually on the last day of the month in which the corporation was formed.

- Tax filings: Federal and state tax returns must be filed according to the respective schedules.

- Renewal of business licenses: Check local regulations for specific renewal dates.

Penalties for Non-Compliance

Failure to comply with the requirements for maintaining a Ct Corporation can lead to serious consequences. These may include:

- Fines for late filing of annual reports.

- Loss of good standing status, which can affect business operations.

- Personal liability for corporate debts if the corporation is not maintained properly.

Quick guide on how to complete ct corporation business

Complete Ct Corporation Business effortlessly on any device

Online document administration has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly without delays. Manage Ct Corporation Business on any platform with airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign Ct Corporation Business with ease

- Locate Ct Corporation Business and click on Get Form to begin.

- Use the tools we offer to fill out your form.

- Highlight pertinent sections of your documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and has the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your preference. Modify and eSign Ct Corporation Business and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is CT Corporation and how does it relate to airSlate SignNow?

CT Corporation specializes in business compliance and registered agent services, which can be enhanced with airSlate SignNow's eSignature capabilities. By integrating airSlate SignNow, CT Corporation users can efficiently manage and sign essential documents electronically, streamlining their compliance processes.

-

How much does airSlate SignNow cost for CT Corporation users?

Pricing for airSlate SignNow varies based on the selected plan, which is designed to accommodate the needs of CT Corporation users. Different tiers offer varying features such as document templates, bulk sending, and advanced authentication, ensuring that businesses can find a cost-effective solution.

-

What features does airSlate SignNow offer for CT Corporation users?

airSlate SignNow provides several features designed for CT Corporation users, including customizable templates, real-time status tracking, and advanced security measures. These tools enable businesses to manage their document workflows efficiently and securely, supporting compliance and regulatory needs.

-

What are the benefits of using airSlate SignNow with CT Corporation?

Using airSlate SignNow alongside CT Corporation allows businesses to expedite their document signing process, reducing turnaround times signNowly. Additionally, the intuitive interface and seamless integration with existing workflows result in enhanced productivity and reduced overhead costs.

-

Can airSlate SignNow integrate with CT Corporation's services?

Yes, airSlate SignNow integrates seamlessly with CT Corporation's services, allowing users to manage their documents from a singular platform. This integration helps companies streamline documentation processes and maintain compliance with state requirements more effectively.

-

Is airSlate SignNow secure for CT Corporation document handling?

Absolutely, airSlate SignNow employs bank-level encryption and multiple layers of security to ensure that all documents handled for CT Corporation are protected. Users can confidently send and eSign their sensitive documents knowing that airSlate SignNow prioritizes their security and compliance.

-

How can I get started with airSlate SignNow as a CT Corporation user?

To get started with airSlate SignNow, CT Corporation users can visit the airSlate SignNow website, choose a plan that fits their needs, and create an account. The platform offers an easy onboarding process with helpful resources to ensure that users can begin using the eSignature capabilities quickly and efficiently.

Get more for Ct Corporation Business

- Petition for certificate releasing connecticut probate fee form

- Coding and billing information with sample cms 1500 and ub

- Faa 0001a application for benefits form

- Report vehicle form

- Dl11cd form

- Request for same day protest hearings form

- Annuity contract prudential financial form

- Alamo heights police department 6116 broadway street form

Find out other Ct Corporation Business

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself