Release Lien Form

What is the Release Lien

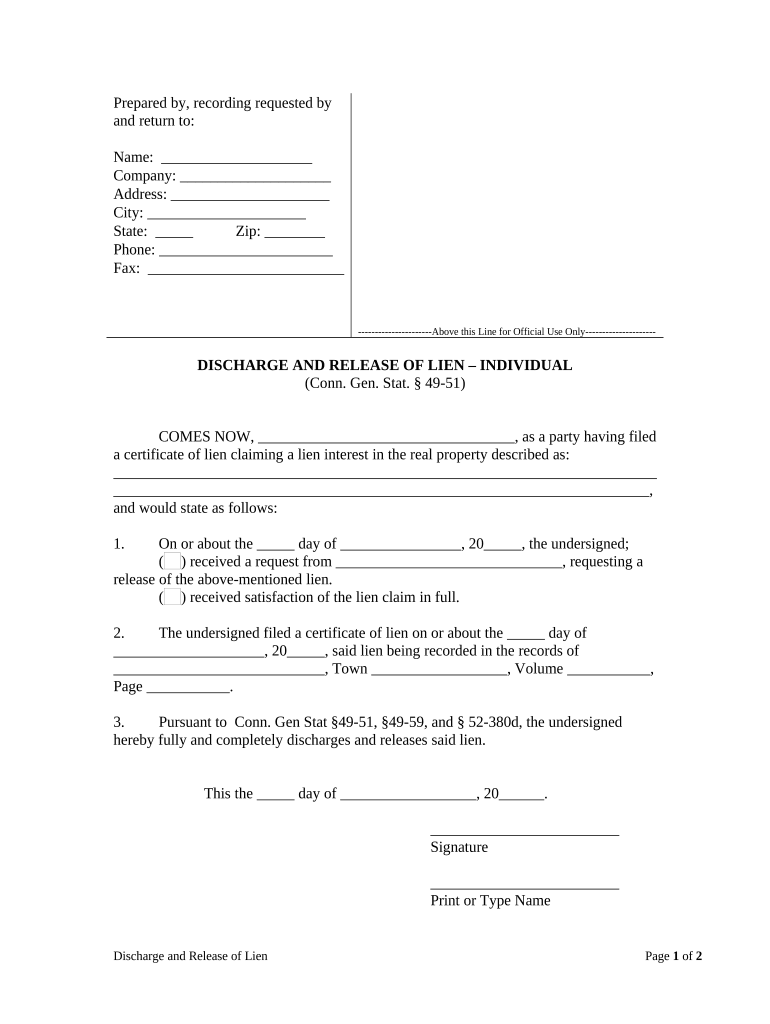

The Release Lien is a legal document that serves to remove a lien from a property. A lien is a claim or legal right against assets that are typically used as collateral to satisfy a debt. In Connecticut, a release lien indicates that the debt associated with the lien has been paid or settled, allowing the property owner to regain full control over their property without encumbrances. This document is essential for individuals or businesses looking to clear their property titles and ensure that no further claims can be made against their assets.

How to Use the Release Lien

To use the Release Lien, individuals must first ensure that the debt associated with the lien has been fully satisfied. Once the debt is cleared, the property owner can complete the release lien form, which typically requires details such as the debtor's name, the lienholder's information, and a description of the property. After filling out the form, it must be signed and dated by the lienholder, confirming that the lien is released. The completed form should then be filed with the appropriate state or local office to update public records.

Steps to Complete the Release Lien

Completing the Release Lien involves several straightforward steps:

- Verify that the debt is paid in full.

- Obtain the official Release Lien form from the relevant state or local authority.

- Fill out the form with accurate information, including the property description and parties involved.

- Have the lienholder sign the document to validate the release.

- Submit the completed form to the appropriate office, either online or in person, depending on local regulations.

Legal Use of the Release Lien

The legal use of the Release Lien is crucial for ensuring that property rights are respected. Once filed, this document serves as proof that the lien has been officially released. It protects property owners from future claims related to the settled debt. Additionally, it is important for maintaining accurate public records, which can affect future transactions involving the property, such as sales or refinancing.

Key Elements of the Release Lien

Key elements of the Release Lien include:

- Property Description: A clear and detailed description of the property involved.

- Debtor Information: The name and contact details of the individual or business that owed the debt.

- Lienholder Information: The name and contact details of the entity that placed the lien.

- Signature of Lienholder: A required signature that confirms the lien has been released.

- Date of Release: The date when the lien is officially released.

State-Specific Rules for the Release Lien

In Connecticut, specific rules govern the use and filing of the Release Lien. It is essential for individuals to be aware of local regulations, including any required forms, filing fees, and deadlines for submission. Failure to comply with these rules may result in delays or complications in clearing the lien from public records. It is advisable to consult with a legal professional or the local office for guidance on the specific requirements in Connecticut.

Quick guide on how to complete release lien 497300993

Easily prepare Release Lien on any device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, since you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the features required to create, modify, and electronically sign your documents swiftly without delays. Manage Release Lien on any device using the airSlate SignNow apps for Android or iOS and simplify your document-related tasks today.

The simplest method to modify and electronically sign Release Lien effortlessly

- Obtain Release Lien and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important parts of the documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature with the Sign tool, which takes a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review all information and click the Done button to save your modifications.

- Choose your preferred method to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Release Lien to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Connecticut lien?

A Connecticut lien is a legal claim against a property often used to secure payment for debts. It can be placed on various types of property, such as real estate or personal assets. Understanding the implications of a Connecticut lien is crucial for property owners and creditors alike.

-

How can airSlate SignNow help with managing Connecticut liens?

airSlate SignNow provides a streamlined platform for eSigning and sending documents related to Connecticut liens. With its easy-to-use interface, you can effectively manage the paperwork associated with lien agreements. This ensures that all legal documents are completed accurately and stored securely online.

-

What are the costs associated with using airSlate SignNow for Connecticut lien documents?

airSlate SignNow offers cost-effective pricing plans suitable for businesses of all sizes looking to handle Connecticut lien documents. The pricing includes features that streamline the eSigning process, making it affordable compared to traditional methods of document handling. You can choose a plan that fits your needs without compromising on quality.

-

Are there any special features for handling Connecticut lien documents?

Yes, airSlate SignNow offers specific features designed for managing Connecticut lien documents. This includes customizable templates and workflows that help ensure compliance with local regulations. Additionally, the platform allows for secure storage and easy retrieval of lien documents, making management hassle-free.

-

Can I integrate airSlate SignNow with other tools for managing Connecticut liens?

Absolutely! airSlate SignNow integrates seamlessly with various tools and applications that assist in managing Connecticut liens. Whether you’re using CRM systems or document management software, airSlate SignNow can streamline your workflow. This integration ensures you can handle all aspects of lien management in one efficient platform.

-

What benefits does airSlate SignNow offer for businesses dealing with Connecticut liens?

Using airSlate SignNow provides numerous benefits for businesses managing Connecticut liens, including speed and efficiency. The intuitive eSigning process saves time, reducing delays in lien processing. Additionally, it enhances security and compliance, reducing the risk of errors in important legal documents.

-

Is eSigning documents related to Connecticut liens legally binding?

Yes, eSigning documents for Connecticut liens through airSlate SignNow is legally binding, provided it meets state regulations. The platform adheres to federal and state laws governing electronic signatures. This allows you to securely and effectively execute lien documents without the need for physical signatures.

Get more for Release Lien

Find out other Release Lien

- Electronic signature Virginia Prenuptial Agreement Template Free

- How Do I Electronic signature Maryland Affidavit of Residence

- Electronic signature Florida Child Support Modification Simple

- Electronic signature North Dakota Child Support Modification Easy

- Electronic signature Oregon Child Support Modification Online

- How Can I Electronic signature Colorado Cohabitation Agreement

- Electronic signature Arkansas Leave of Absence Letter Later

- Electronic signature New Jersey Cohabitation Agreement Fast

- Help Me With Electronic signature Alabama Living Will

- How Do I Electronic signature Louisiana Living Will

- Electronic signature Arizona Moving Checklist Computer

- Electronic signature Tennessee Last Will and Testament Free

- Can I Electronic signature Massachusetts Separation Agreement

- Can I Electronic signature North Carolina Separation Agreement

- How To Electronic signature Wyoming Affidavit of Domicile

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer