Foreign Governments and Certain Other Foreign IRS Gov 2014

What is the Foreign Governments And Certain Other Foreign IRS gov

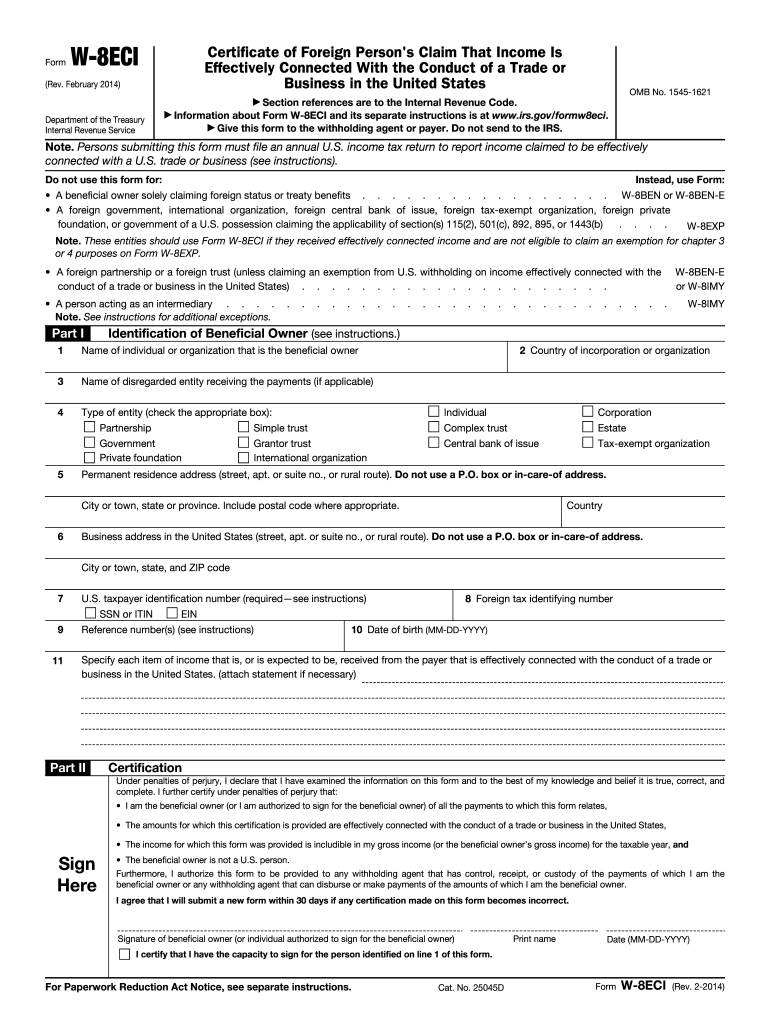

The Foreign Governments And Certain Other Foreign IRS gov form is a specific document used by foreign entities to report income and claim benefits under tax treaties with the United States. This form is crucial for ensuring compliance with U.S. tax laws while allowing foreign governments and certain organizations to avoid double taxation. Understanding the purpose and function of this form is essential for entities engaged in international transactions or investments in the U.S.

Steps to complete the Foreign Governments And Certain Other Foreign IRS gov

Completing the Foreign Governments And Certain Other Foreign IRS gov form involves several key steps:

- Gather necessary information about the foreign entity, including its legal name, address, and taxpayer identification number.

- Review applicable tax treaties between the U.S. and the foreign country to determine eligibility for benefits.

- Fill out the required sections of the form accurately, ensuring all information is current and complete.

- Attach any supporting documentation required, such as proof of residency or tax treaty eligibility.

- Submit the completed form according to IRS guidelines, either electronically or via mail.

Legal use of the Foreign Governments And Certain Other Foreign IRS gov

The legal use of the Foreign Governments And Certain Other Foreign IRS gov form is primarily to facilitate compliance with U.S. tax regulations. This form allows eligible foreign governments and certain organizations to claim exemptions or reductions in withholding tax on income sourced from the U.S. It is essential to ensure that the form is filled out correctly and submitted in a timely manner to avoid penalties and ensure that the benefits of tax treaties are fully realized.

Required Documents

To successfully complete the Foreign Governments And Certain Other Foreign IRS gov form, the following documents are typically required:

- Proof of the foreign entity's status, such as a certificate of incorporation or registration.

- Documentation supporting the claim for tax treaty benefits, including tax residency certificates.

- Any prior correspondence with the IRS regarding similar claims, if applicable.

Filing Deadlines / Important Dates

Filing deadlines for the Foreign Governments And Certain Other Foreign IRS gov form can vary based on the type of income being reported and the specific circumstances of the foreign entity. Generally, it is advisable to submit the form as early as possible to ensure compliance with U.S. tax laws. Entities should also be aware of any specific deadlines related to tax treaty claims to avoid missing out on potential benefits.

IRS Guidelines

The IRS provides comprehensive guidelines for the completion and submission of the Foreign Governments And Certain Other Foreign IRS gov form. These guidelines include detailed instructions on eligibility, required information, and submission methods. It is essential for entities to familiarize themselves with these guidelines to ensure accurate and compliant filings.

Quick guide on how to complete w 8eci 2014 form

Discover the most efficient method to complete and sign your Foreign Governments And Certain Other Foreign IRS gov

Are you still spending time preparing your official documents on paper instead of doing it digitally? airSlate SignNow provides a superior way to fill out and sign your Foreign Governments And Certain Other Foreign IRS gov and related forms for public services. Our intelligent eSignature solution offers everything you need to manage paperwork swiftly and according to official standards - robust PDF editing, managing, securing, signing, and sharing tools are all conveniently available within an intuitive interface.

Only a few steps are required to fill out and sign your Foreign Governments And Certain Other Foreign IRS gov:

- Upload the editable template to the editor using the Get Form button.

- Identify what details you need to include in your Foreign Governments And Certain Other Foreign IRS gov.

- Move between the fields using the Next button to ensure no items are overlooked.

- Utilize Text, Check, and Cross tools to fill in the fields with your details.

- Modify the content with Text boxes or Images from the top toolbar.

- Emphasize what is essential or Obscure areas that are no longer relevant.

- Select Sign to create a legally binding eSignature using any method you prefer.

- Add the Date beside your signature and complete your task with the Done button.

Store your finalized Foreign Governments And Certain Other Foreign IRS gov in the Documents folder of your profile, download it, or export it to your chosen cloud storage. Our platform also allows for flexible file sharing. There’s no need to print out your forms when submitting them to the appropriate public office - use email, fax, or request a USPS “snail mail” delivery from your account. Try it now!

Create this form in 5 minutes or less

Find and fill out the correct w 8eci 2014 form

FAQs

-

When do I have to learn how to fill out a W-2 form?

Form W-2 is an obligatory form to be completed by every employer. Form W-2 doesn’t have to be filled out by the employee. It is given to inform the employee about the amount of his annual income and taxes withheld from it.You can find a lot of information here: http://bit.ly/2NjjlJi

-

How do I fill out a W-4 form?

The main thing you need to put on your W-4 besides your name, address and social security number is whether you are married or single and the number of exemptions you wish to take to lower the amount of money with held for taxes from your paycheck. The number of exemptions refers to how many people you support, i. e. children. Say you are single and have 3 children, you can put down 4 exemptions, 1 for your self and 1 for each child. This means you will have more pay to take home because you aren’t having it with held from your paycheck. If you are single and have no children, you can either take 1 or 0 exemptions. If you make decent money, take 0 deductions, if you are barely making it you could probably take 1 exemption. Just realize that if you take exemptions, and not enough money is taken out of your check to pay your taxes, you will be liable for it come April 15th.If you are married and have no children and you make decent money, take 0 deductions. If you have children, only one spouse should take them as exemptions and it should be the one who makes the most money. For example, say your spouse is the major bread winner and you have 2 children, your spouse could take 4 exemptions (one for each member of the family) and then you would take 0 exemptions.Usually, it’s best to err on the side of caution and take the smaller amount of deductions so that you won’t owe a lot of money come tax time. If you’ve had too much with held it will come back to you as a refund.

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

-

Why did my employer give me a W-9 Form to fill out instead of a W-4 Form?

I wrote about the independent-contractor-vs-employee issue last year, see http://nctaxpro.wordpress.com/20...Broadly speaking, you are an employee when someone else - AKA the employer - has control over when and where you work and the processes by which you perform the work that you do for that individual. A DJ or bartender under some circumstances, I suppose, might qualify as an independent contractor at a restaurant, but the waitstaff, bus help, hosts, kitchen aides, etc. almost certainly would not.There's always risk in confronting an employer when faced with a situation like yours - my experience is that most employers know full well that they are violating the law when they treat employees as independent contractors, and for that reason they don't tolerate questions about that policy very well - so you definitely should tread cautiously if you want to keep this position. Nonetheless, I think you owe it to yourself to ask whether or not the restaurant intends to withhold federal taxes from your checks - if for no other reason than you don't want to get caught short when it comes to filing your own return, even if you don't intend to challenge the policy.

-

Do military members have to pay any fee for leave or fiancee forms?

NOOOOOOO. You are talking to a military romance scammer. I received an email from the US Army that directly answers your question that is pasted below please keep reading.I believe you are the victim of a military Romance Scam whereas the person you are talking to is a foreign national posing as an American Soldier claiming to be stationed overseas on a peacekeeping mission. That's the key to the scam they always claim to be on a peacekeeping mission.Part of their scam is saying that they have no access to their money that their mission is highly dangerous.If your boyfriend girlfriend/future husband/wife is asking you to do the following or has exhibited this behavior, it is a most likely a scam:Moves to private messaging site immediately after meeting you on Facebook or SnapChat or Instagram or some dating or social media site. Often times they delete the site you met them on right after they asked you to move to a more private messaging siteProfesses love to you very quickly & seems to quote poems and song lyrics along with using their own sort of broken language, as they profess their love and devotion quickly. They also showed concern for your health and love for your family.Promises marriage as soon as he/she gets to state for leave that they asked you to pay for.They Requests money (wire transfers) and Amazon, iTune ,Verizon, etc gift cards, for medicine, religious practices, and leaves to come home, internet access, complete job assignments, help sick friend, get him out of trouble, or anything that sounds fishy.The military does provide all the soldier needs including food medical Care and transportation for leave. Trust me, I lived it, you are probably being scammed. I am just trying to show you examples that you are most likely being connned.Below is an email response I received after I sent an inquiry to the US government when I discovered I was scammed. I received this wonderful response back with lots of useful links on how to find and report your scammer. And how to learn more about Romance Scams.Right now you can also copy the picture he gave you and do a google image search and you will hopefully see the pictures of the real person he is impersonating. this doesn't always work and take some digging. if you find the real person you can direct message them and alert them that their image is being used for scamming.Good Luck to you and I'm sorry this may be happening to you. please continue reading the government response I received below it's very informative. You have contacted an email that is monitored by the U.S. Army Criminal Investigation Command. Unfortunately, this is a common concern. We assure you there is never any reason to send money to anyone claiming to be a Soldier online. If you have only spoken with this person online, it is likely they are not a U.S. Soldier at all. If this is a suspected imposter social media profile, we urge you to report it to that platform as soon as possible. Please continue reading for more resources and answers to other frequently asked questions: How to report an imposter Facebook profile: Caution-https://www.facebook.com/help/16... < Caution-https://www.facebook.com/help/16... > Answers to frequently asked questions: - Soldiers and their loved ones are not charged money so that the Soldier can go on leave. - Soldiers are not charged money for secure communications or leave. - Soldiers do not need permission to get married. - Soldiers emails are in this format: john.doe.mil@mail.mil < Caution-mailto: john.doe.mil@mail.mil > anything ending in .us or .com is not an official email account. - Soldiers have medical insurance, which pays for their medical costs when treated at civilian health care facilities worldwide – family and friends do not need to pay their medical expenses. - Military aircraft are not used to transport Privately Owned Vehicles. - Army financial offices are not used to help Soldiers buy or sell items of any kind. - Soldiers deployed to Combat Zones do not need to solicit money from the public to feed or house themselves or their troops. - Deployed Soldiers do not find large unclaimed sums of money and need your help to get that money out of the country. Anyone who tells you one of the above-listed conditions/circumstances is true is likely posing as a Soldier and trying to steal money from you. We would urge you to immediately cease all contact with this individual. For more information on avoiding online scams and to report this crime, please see the following sites and articles: This article may help clarify some of the tricks social media scammers try to use to take advantage of people: Caution-https://www.army.mil/article/61432/< Caution-https://www.army.mil/article/61432/> CID advises vigilance against 'romance scams,' scammers impersonating Soldiers Caution-https://www.army.mil/article/180749 < Caution-https://www.army.mil/article/180749 > FBI Internet Crime Complaint Center: Caution-http://www.ic3.gov/default.aspx< Caution-http://www.ic3.gov/default.aspx> U.S. Army investigators warn public against romance scams: Caution-https://www.army.mil/article/130...< Caution-https://www.army.mil/article/130...> DOD warns troops, families to be cybercrime smart -Caution-http://www.army.mil/article/1450...< Caution-http://www.army.mil/article/1450...> Use caution with social networking Caution-https://www.army.mil/article/146...< Caution-https://www.army.mil/article/146...> Please see our frequently asked questions section under scams and legal issues. Caution-http://www.army.mil/faq/ < Caution-http://www.army.mil/faq/ > or visit Caution-http://www.cid.army.mil/ < Caution-http://www.cid.army.mil/ >. The challenge with most scams is determining if an individual is a legitimate member of the US Army. Based on the Privacy Act of 1974, we cannot provide this information. If concerned about a scam you may contact the Better Business Bureau (if it involves a solicitation for money), or local law enforcement. If you're involved in a Facebook or dating site scam, you are free to contact us direct; (571) 305-4056. If you have a social security number, you can find information about Soldiers online at Caution-https://www.dmdc.osd.mil/appj/sc... < Caution-https://www.dmdc.osd.mil/appj/sc... > . While this is a free search, it does not help you locate a retiree, but it can tell you if the Soldier is active duty or not. If more information is needed such as current duty station or location, you can contact the Commander Soldier's Records Data Center (SRDC) by phone or mail and they will help you locate individuals on active duty only, not retirees. There is a fee of $3.50 for businesses to use this service. The check or money order must be made out to the U.S. Treasury. It is not refundable. The address is: Commander Soldier's Records Data Center (SRDC) 8899 East 56th Street Indianapolis, IN 46249-5301 Phone: 1-866-771-6357 In addition, it is not possible to remove social networking site profiles without legitimate proof of identity theft or a scam. If you suspect fraud on this site, take a screenshot of any advances for money or impersonations and report the account on the social networking platform immediately. Please submit all information you have on this incident to Caution-www.ic3.gov < Caution-http://www.ic3.gov > (FBI website, Internet Criminal Complaint Center), immediately stop contact with the scammer (you are potentially providing them more information which can be used to scam you), and learn how to protect yourself against these scams at Caution-http://www.ftc.gov < Caution-http://www.ftc.gov > (Federal Trade Commission's website)

-

How do you fill out a W-2 form?

In general, the W-2 form is divided into two parts each with numerous fields to be completed carefully by an employer. The section on the left contains both the employer's and employee`s names and contact information as well social security number and identification number.You can find a lot of information here: http://bit.ly/2NjjlJi

-

What are the tips for filling out the IIFT CV FORM for 2014?

CV form is the first impression that you make on the interviewer when it comes to IIFT.Mathematically, resume + about yourself+career goal+ why MBA? + your life story =CV formSo make it genuine and interesting at the same time. Achievements need not be older than your 9th standard, if there aren't many after 9th then go for older ones.The last question "Anything else you want to include" which is an optional question should be answered with something very genuine and don't try to fake it.Keep a photocopy of your CV form and ask your friends to ask you cross questions on your answers and grill you for each one of them.

Create this form in 5 minutes!

How to create an eSignature for the w 8eci 2014 form

How to create an eSignature for your W 8eci 2014 Form online

How to create an electronic signature for the W 8eci 2014 Form in Chrome

How to create an eSignature for signing the W 8eci 2014 Form in Gmail

How to generate an electronic signature for the W 8eci 2014 Form straight from your smartphone

How to generate an eSignature for the W 8eci 2014 Form on iOS

How to generate an electronic signature for the W 8eci 2014 Form on Android OS

People also ask

-

What is airSlate SignNow and how does it relate to Foreign Governments And Certain Other Foreign IRS gov?

airSlate SignNow is a powerful eSignature solution that allows businesses to send and electronically sign documents efficiently. In the context of Foreign Governments And Certain Other Foreign IRS gov, it ensures compliance by providing a secure platform for managing international documents and signatures, facilitating seamless communication with foreign entities.

-

How can airSlate SignNow benefit Foreign Governments And Certain Other Foreign IRS gov compliance?

Using airSlate SignNow can signNowly streamline the compliance process for Foreign Governments And Certain Other Foreign IRS gov. The platform ensures that all documents are securely signed and stored, maintaining the integrity and legality required for international transactions, which is critical for adhering to IRS regulations.

-

What pricing plans does airSlate SignNow offer for businesses dealing with Foreign Governments And Certain Other Foreign IRS gov?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses, including those interacting with Foreign Governments And Certain Other Foreign IRS gov. Whether you are a small business or a large enterprise, you can find a plan that fits your budget while ensuring access to essential features for managing international documentation.

-

What features does airSlate SignNow provide for handling documents related to Foreign Governments And Certain Other Foreign IRS gov?

airSlate SignNow offers an array of features that are beneficial for handling documents pertaining to Foreign Governments And Certain Other Foreign IRS gov. These include customizable templates, secure cloud storage, and advanced tracking capabilities, ensuring that your documents are not only compliant but also efficiently managed throughout their lifecycle.

-

Can airSlate SignNow integrate with other tools I use for Foreign Governments And Certain Other Foreign IRS gov-related tasks?

Yes, airSlate SignNow integrates seamlessly with a variety of tools and platforms you might already be using for Foreign Governments And Certain Other Foreign IRS gov-related tasks. This includes CRM systems, cloud storage services, and project management tools, enhancing your workflow and ensuring all your documents are easily accessible.

-

How does airSlate SignNow ensure the security of documents related to Foreign Governments And Certain Other Foreign IRS gov?

Security is a top priority at airSlate SignNow, especially for documents concerning Foreign Governments And Certain Other Foreign IRS gov. The platform utilizes advanced encryption methods, secure authentication, and compliance with industry standards to protect sensitive information and maintain confidentiality.

-

Is airSlate SignNow suitable for businesses of all sizes working with Foreign Governments And Certain Other Foreign IRS gov?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes that engage with Foreign Governments And Certain Other Foreign IRS gov. Whether you are a startup or an established corporation, the platform's scalability and user-friendly interface make it an ideal solution for managing eSignatures and document workflows.

Get more for Foreign Governments And Certain Other Foreign IRS gov

- Medication destruction log form

- Lic 604a form

- Wage and insurance verification child support services form

- Calpers tax withholding election blank form

- Imperial county health department in el centro ca form

- Sacramento county stage one child care request for reimbursement 2145 form

- Dha child care 2145s saccounty net form

- Cdph 325 form

Find out other Foreign Governments And Certain Other Foreign IRS gov

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template