Quitclaim Deed from Individual to LLC Connecticut Form

What is the Quitclaim Deed From Individual To LLC Connecticut

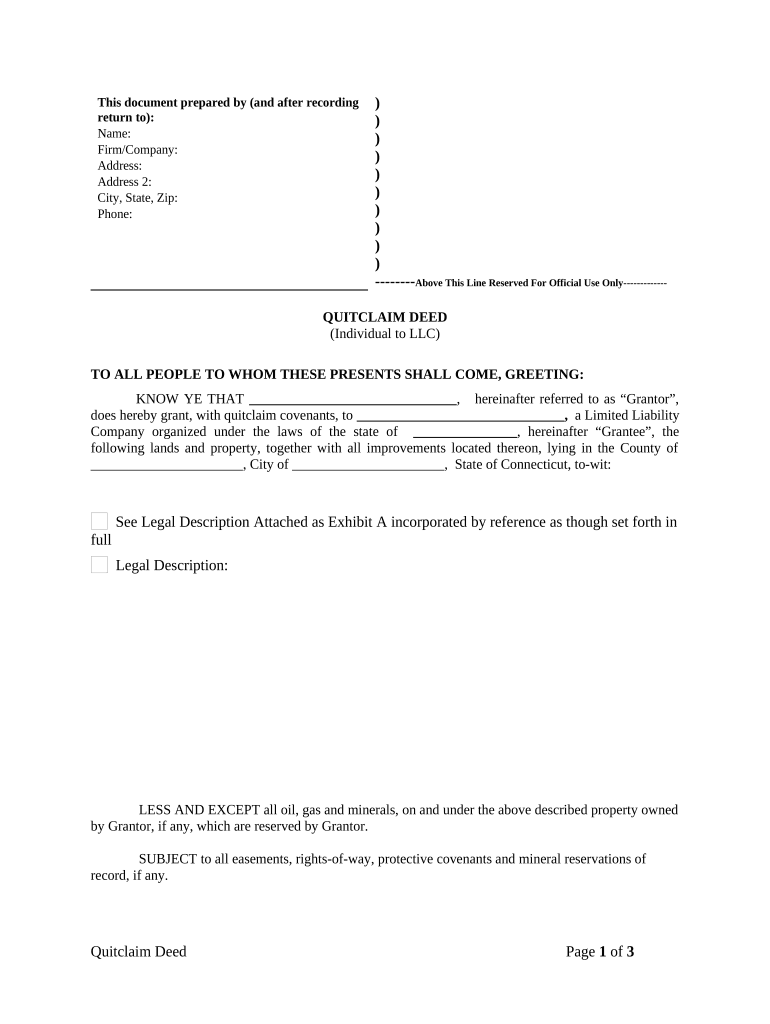

A quitclaim deed from an individual to an LLC in Connecticut is a legal document that transfers ownership of real property from a person to a limited liability company. This type of deed does not guarantee that the title is free of claims or encumbrances; it simply conveys whatever interest the individual has in the property to the LLC. This deed is commonly used in real estate transactions where the owner wants to transfer property to their business entity for purposes such as liability protection or tax benefits.

Steps to Complete the Quitclaim Deed From Individual To LLC Connecticut

Completing a quitclaim deed from an individual to an LLC in Connecticut involves several key steps:

- Gather necessary information, including the legal description of the property, the names of the grantor (individual) and grantee (LLC), and the date of transfer.

- Obtain the appropriate quitclaim deed form, which can typically be found on state or local government websites.

- Fill out the form accurately, ensuring all information is correct and complete.

- Sign the deed in the presence of a notary public to validate the document.

- File the completed deed with the appropriate local land records office to make the transfer official.

Key Elements of the Quitclaim Deed From Individual To LLC Connecticut

Several key elements must be included in a quitclaim deed to ensure its validity:

- Grantor and Grantee Information: Full names and addresses of both the individual transferring the property and the LLC receiving it.

- Legal Description of Property: A precise description of the property being transferred, which may include parcel numbers or boundaries.

- Consideration: The amount of money or value exchanged for the transfer, even if it is nominal.

- Signature and Notarization: The grantor must sign the deed, and it must be notarized to be legally binding.

Legal Use of the Quitclaim Deed From Individual To LLC Connecticut

The quitclaim deed from an individual to an LLC is legally recognized in Connecticut as a valid means of transferring property ownership. It is important to ensure that the deed is executed in compliance with state laws, including proper notarization and filing with the local land records office. This type of deed is often used for estate planning, asset protection, and business structuring, allowing individuals to separate personal and business assets effectively.

Required Documents for the Quitclaim Deed From Individual To LLC Connecticut

To complete the quitclaim deed process, the following documents are typically required:

- Quitclaim Deed Form: The official form to be filled out and signed.

- Identification: A valid form of identification for the grantor to verify identity during notarization.

- Property Deed or Title: Previous deed or title documents that establish ownership and details of the property.

Filing Deadlines / Important Dates for the Quitclaim Deed From Individual To LLC Connecticut

In Connecticut, there are no strict deadlines for filing a quitclaim deed; however, it is advisable to file the deed as soon as possible after it is executed. Delays in filing can lead to complications regarding property ownership and potential disputes. It is also important to consider any local regulations that may impose specific timelines for recording property transfers.

Quick guide on how to complete quitclaim deed from individual to llc connecticut

Complete Quitclaim Deed From Individual To LLC Connecticut effortlessly on any device

The management of online documents has become increasingly favored by organizations and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the correct format and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without any hold-ups. Manage Quitclaim Deed From Individual To LLC Connecticut across all platforms using the airSlate SignNow Android or iOS applications and enhance your document-centric processes today.

How to modify and eSign Quitclaim Deed From Individual To LLC Connecticut with ease

- Find Quitclaim Deed From Individual To LLC Connecticut and click on Get Form to begin.

- Use the tools we provide to fill out your document.

- Highlight pertinent sections of the documents or obscure sensitive details with the tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review all information and click on the Done button to save your modifications.

- Select how you wish to share your form, either by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious searches for forms, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Quitclaim Deed From Individual To LLC Connecticut and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Quitclaim Deed from Individual to LLC in Connecticut?

A Quitclaim Deed from Individual to LLC in Connecticut is a legal document used to transfer ownership of property from an individual to a limited liability company. This type of deed provides no warranty on the title, meaning that the LLC assumes the property without guarantees of any defects. It's commonly used for simplifying business transactions and asset protection in real estate.

-

How do I create a Quitclaim Deed from Individual to LLC in Connecticut?

To create a Quitclaim Deed from Individual to LLC in Connecticut, you can utilize airSlate SignNow's user-friendly templates. Simply fill in the required information, sign the document electronically, and save or print the PDF for filing. The process is efficient and ensures that your deed complies with Connecticut's legal requirements.

-

Are there any fees associated with filing a Quitclaim Deed from Individual to LLC in Connecticut?

Yes, there are fees associated with filing a Quitclaim Deed from Individual to LLC in Connecticut. The state's recording fees vary by town and are generally based on the value of the property. It's advisable to check with your local clerk's office for specific fee schedules and any additional costs related to the eSigning process through airSlate SignNow.

-

What are the benefits of using airSlate SignNow for a Quitclaim Deed from Individual to LLC?

Using airSlate SignNow for a Quitclaim Deed from Individual to LLC offers several benefits, including easy document customization, secure eSigning, and immediate access to completed documents. This platform streamlines the entire process, reducing the time and effort needed compared to traditional methods. Plus, it ensures that you remain compliant with Connecticut’s legal standards.

-

Can multiple parties sign a Quitclaim Deed from Individual to LLC using airSlate SignNow?

Absolutely! airSlate SignNow allows multiple parties to sign a Quitclaim Deed from Individual to LLC effortlessly. You can send the document to all required signers at once, ensuring that the eSigning process is smooth and timely. This feature facilitates faster transactions and enhances collaboration.

-

Is there a mobile app for handling Quitclaim Deeds from Individual to LLC in Connecticut?

Yes, airSlate SignNow offers a mobile app that enables you to handle Quitclaim Deeds from Individual to LLC conveniently. You can create, edit, and eSign your documents directly from your smartphone or tablet. This flexibility helps ensure that you can manage your real estate transactions on the go.

-

What integrations does airSlate SignNow offer for processing Quitclaim Deeds from Individual to LLC?

airSlate SignNow seamlessly integrates with various platforms, including Google Drive, Dropbox, and CRM systems. These integrations enhance your workflow when processing a Quitclaim Deed from Individual to LLC, making it easy to pull necessary documents and store signed copies securely. This connectivity ensures that your documentation process remains organized and efficient.

Get more for Quitclaim Deed From Individual To LLC Connecticut

- Agency disclosure statement ohio form

- Mvt 16 16656516 form

- Printable spanish patient registration form

- Best self mike bayer worksheets form

- Gallery exhibition application form allegany arts council

- Antrag auf teilzeitbeurlaubung fr beamte form

- Klicken sie hier damit die rechnungsnummer und das rechnungsdatum automatisch generiert werden form

- Auslagenrechnung fr nebenkosten bei schulfahrten im rahmen einer form

Find out other Quitclaim Deed From Individual To LLC Connecticut

- How Do I Sign Oklahoma Warranty Deed

- Sign Florida Postnuptial Agreement Template Online

- Sign Colorado Prenuptial Agreement Template Online

- Help Me With Sign Colorado Prenuptial Agreement Template

- Sign Missouri Prenuptial Agreement Template Easy

- Sign New Jersey Postnuptial Agreement Template Online

- Sign North Dakota Postnuptial Agreement Template Simple

- Sign Texas Prenuptial Agreement Template Online

- Sign Utah Prenuptial Agreement Template Mobile

- Sign West Virginia Postnuptial Agreement Template Myself

- How Do I Sign Indiana Divorce Settlement Agreement Template

- Sign Indiana Child Custody Agreement Template Now

- Sign Minnesota Divorce Settlement Agreement Template Easy

- How To Sign Arizona Affidavit of Death

- Sign Nevada Divorce Settlement Agreement Template Free

- Sign Mississippi Child Custody Agreement Template Free

- Sign New Jersey Child Custody Agreement Template Online

- Sign Kansas Affidavit of Heirship Free

- How To Sign Kentucky Affidavit of Heirship

- Can I Sign Louisiana Affidavit of Heirship