Individual Credit Application Connecticut Form

What is the Individual Credit Application Connecticut

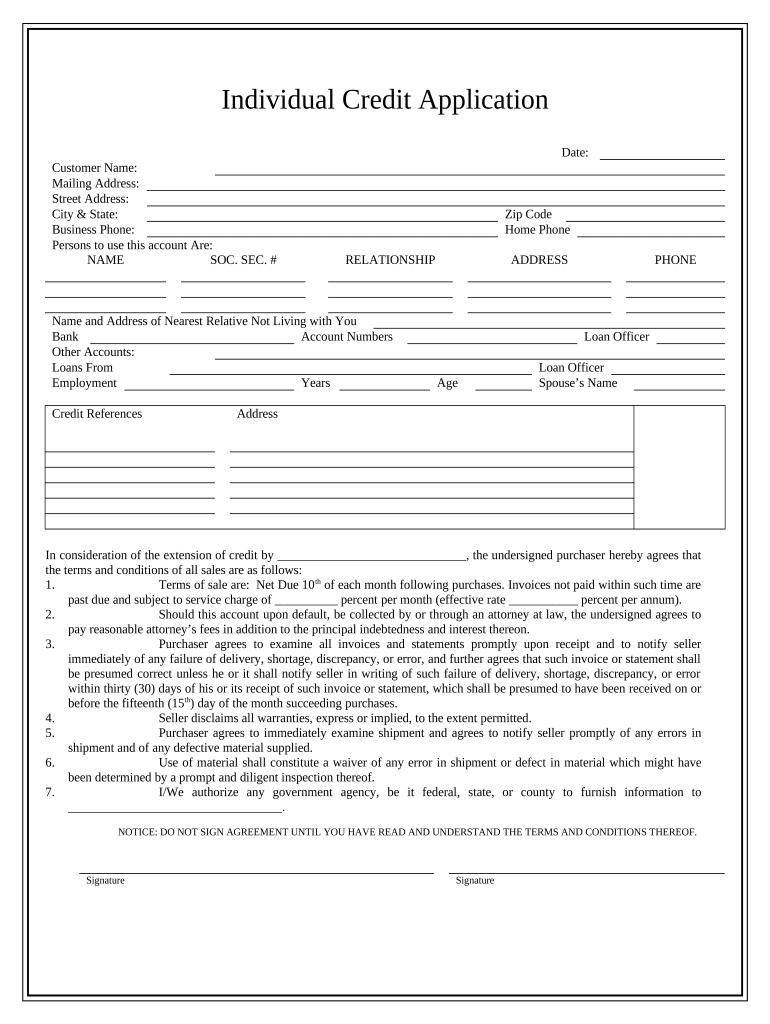

The Individual Credit Application Connecticut is a formal document used by individuals seeking credit from financial institutions or lenders within the state. This application collects essential personal and financial information, allowing lenders to assess the creditworthiness of the applicant. It typically includes details such as the applicant's name, address, Social Security number, employment information, income, and any outstanding debts. Completing this form accurately is crucial for obtaining credit approval.

Steps to complete the Individual Credit Application Connecticut

Completing the Individual Credit Application Connecticut involves several key steps that ensure all necessary information is provided. Begin by gathering personal identification documents, such as a driver's license or Social Security card. Next, fill out the application form with accurate details regarding your employment, income, and financial obligations. It is important to review the form for any errors or omissions before submission. Finally, sign the application electronically or in print, depending on the submission method chosen.

Legal use of the Individual Credit Application Connecticut

The legal use of the Individual Credit Application Connecticut hinges on compliance with state and federal regulations governing credit applications. This includes adherence to the Fair Credit Reporting Act (FCRA), which mandates that lenders must obtain consent before accessing an applicant's credit report. Additionally, the application must be completed truthfully, as providing false information can lead to legal consequences and denial of credit. Utilizing a secure platform for electronic submission can further enhance the legal validity of the application.

Eligibility Criteria

Eligibility criteria for the Individual Credit Application Connecticut may vary by lender but generally include age, residency, and credit history requirements. Applicants must be at least eighteen years old and a resident of Connecticut. Lenders will also consider the applicant's credit score, income level, and debt-to-income ratio to determine eligibility. Meeting these criteria increases the likelihood of a successful credit application.

Required Documents

When completing the Individual Credit Application Connecticut, several documents are typically required to support the information provided. Commonly requested documents include proof of identity, such as a government-issued ID, recent pay stubs or tax returns to verify income, and bank statements to demonstrate financial stability. Having these documents ready can streamline the application process and enhance the chances of approval.

Form Submission Methods

The Individual Credit Application Connecticut can be submitted through various methods, depending on the lender's preferences. Common submission methods include online applications via secure portals, mailing a printed version of the application, or submitting it in person at a local branch. Each method has its advantages, with online submissions often being the fastest and most convenient option.

Key elements of the Individual Credit Application Connecticut

Key elements of the Individual Credit Application Connecticut include personal identification information, employment details, financial history, and consent for credit checks. Each section of the application is designed to provide lenders with a comprehensive view of the applicant's financial situation. Accurate completion of these elements is vital for a thorough evaluation by the lender, influencing the decision on credit approval.

Quick guide on how to complete individual credit application connecticut

Effortlessly prepare Individual Credit Application Connecticut on any device

Online document administration has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the necessary template and securely store it online. airSlate SignNow equips you with all the tools required to create, amend, and electronically sign your documents swiftly without delays. Manage Individual Credit Application Connecticut on any gadget with airSlate SignNow's Android or iOS applications and enhance any document-focused procedure today.

How to modify and electronically sign Individual Credit Application Connecticut effortlessly

- Locate Individual Credit Application Connecticut and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Formulate your electronic signature using the Sign tool, which takes seconds and carries the same legal authority as a conventional wet-ink signature.

- Verify the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your requirements in document management within a few clicks from any device you prefer. Alter and electronically sign Individual Credit Application Connecticut and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Individual Credit Application Connecticut process?

The Individual Credit Application Connecticut process involves submitting a formal request for credit to financial institutions, where applicants provide their personal and financial information. airSlate SignNow simplifies this process by allowing you to create, send, and eSign your Individual Credit Application Connecticut digitally, ensuring a quick and efficient experience.

-

What features does airSlate SignNow offer for Individual Credit Applications in Connecticut?

airSlate SignNow provides a range of features tailored for Individual Credit Applications Connecticut, including customizable templates, real-time tracking, and secure eSignature options. These features help streamline the application process and ensure that all necessary information is collected accurately.

-

How much does airSlate SignNow cost for Individual Credit Application Connecticut users?

Pricing for airSlate SignNow varies based on the plan chosen, but it is designed to be cost-effective for users dealing with Individual Credit Application Connecticut. We offer tiered subscription plans that cater to different business needs, ensuring you find a solution that fits your budget.

-

Can I integrate airSlate SignNow with other tools for Individual Credit Application Connecticut?

Yes, airSlate SignNow seamlessly integrates with a variety of business tools and CRM systems, enhancing the workflow for your Individual Credit Application Connecticut. This means you can easily manage your applications alongside other essential software, maximizing efficiency and productivity.

-

Is airSlate SignNow secure for handling Individual Credit Applications in Connecticut?

Absolutely! airSlate SignNow employs advanced security measures, including data encryption and secure cloud storage, to protect all Individual Credit Application Connecticut submissions. You can have peace of mind knowing that your sensitive information is safe and secure throughout the signing process.

-

What benefits does airSlate SignNow provide for Individual Credit Applications in Connecticut?

Using airSlate SignNow for Individual Credit Applications Connecticut offers numerous benefits, such as reducing paperwork, speeding up the approval process, and providing a hassle-free eSigning experience. These advantages lead to improved customer satisfaction and a more efficient credit application handling process.

-

How does airSlate SignNow support the eSignature process for Individual Credit Applications in Connecticut?

airSlate SignNow offers a user-friendly eSignature platform designed for Individual Credit Application Connecticut, allowing signers to easily review and sign documents from any device. This feature not only enhances user experience but also expedites the signing process, ensuring your applications are processed quickly.

Get more for Individual Credit Application Connecticut

- Fillable online form ct 51 request for additional extension of time to

- Georgia form g 7fill out and use this pdf formspal

- Instructions for form it 201 full year resident income tax return new york statenew york cityyonkersmctmt including

- Instructions for form ct 3 general business corporation franchise

- Corporate income tax province of british columbia govbcca form

- Maryland form for nonresidents employed in

- New york tax appeals tribunal requires bank to apply its nol form

- General excise and use tax forms department of taxation

Find out other Individual Credit Application Connecticut

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors