Living Trust Property Record Connecticut Form

What is the Living Trust Property Record Connecticut

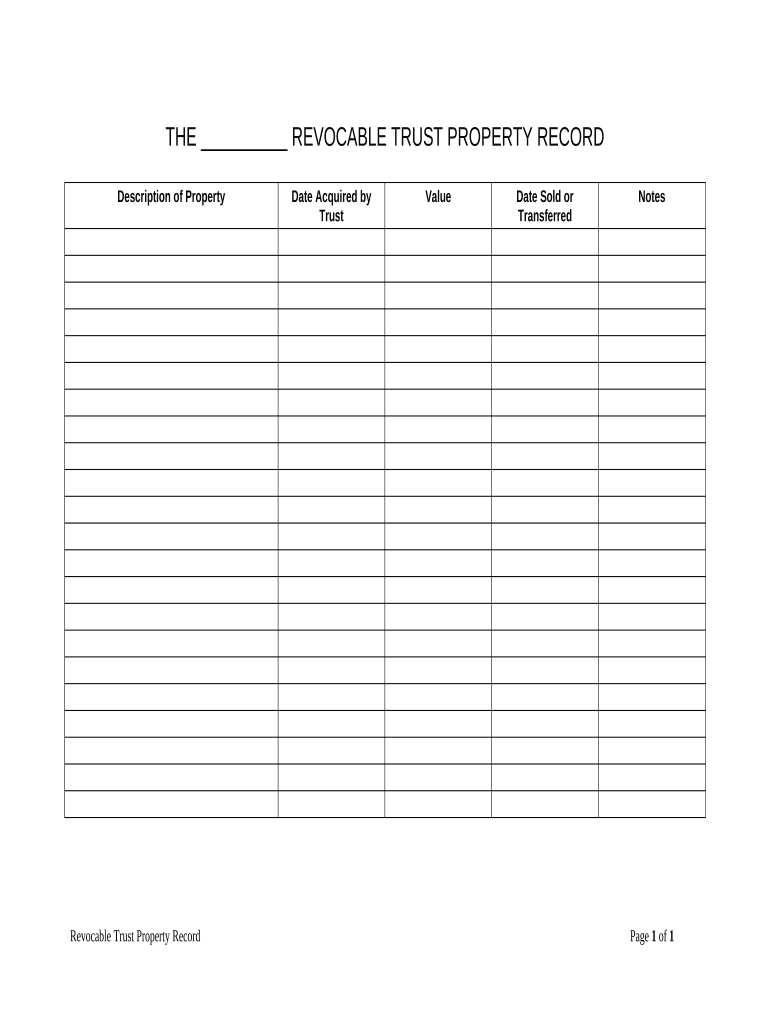

The Living Trust Property Record in Connecticut is a legal document that outlines the assets held within a living trust. This record serves to clarify the ownership and management of property during the lifetime of the trustor and after their passing. It is essential for estate planning, ensuring that assets are distributed according to the trustor's wishes without the need for probate. This document typically includes details such as the names of the trustor, trustee, and beneficiaries, as well as a comprehensive list of the trust's assets.

How to use the Living Trust Property Record Connecticut

Using the Living Trust Property Record involves several key steps. Initially, the trustor must create the living trust, which includes drafting the trust agreement and identifying the assets to be placed within the trust. Once established, the trustor should complete the property record by listing all relevant assets and their corresponding values. This record must be kept updated to reflect any changes in the trust's assets or beneficiaries. It is advisable to consult with a legal professional to ensure that the document complies with state laws and accurately reflects the trustor's intentions.

Steps to complete the Living Trust Property Record Connecticut

Completing the Living Trust Property Record in Connecticut involves a structured approach:

- Gather all relevant information about the trustor, trustee, and beneficiaries.

- Compile a list of all assets to be included in the trust, such as real estate, bank accounts, and investments.

- Determine the value of each asset to ensure accurate representation in the record.

- Draft the property record, ensuring all information is clear and concise.

- Review the completed record for accuracy and completeness.

- Have the document signed and notarized, if required.

- Store the record in a safe place and ensure that all relevant parties have access to it.

Legal use of the Living Trust Property Record Connecticut

The Living Trust Property Record is legally binding and serves as a critical component of estate planning in Connecticut. It ensures that the trustor's assets are managed and distributed according to their wishes. For legal validity, the document must comply with state laws regarding trusts, including proper execution and notarization. Additionally, it is important to keep the record updated to reflect any changes in the trust or its assets, as outdated information may lead to disputes among beneficiaries or complications during asset distribution.

State-specific rules for the Living Trust Property Record Connecticut

Connecticut has specific regulations governing living trusts and their property records. These rules dictate how trusts must be established, maintained, and terminated. For instance, the trustor must be of sound mind and at least eighteen years old to create a valid trust. Additionally, Connecticut law requires that the trust document be in writing and signed by the trustor. It is also essential to comply with any local requirements regarding the recording of real property held in the trust. Understanding these state-specific rules is crucial for ensuring the trust's legal standing.

Required Documents

To complete the Living Trust Property Record in Connecticut, several documents are typically required:

- The trust agreement, which outlines the terms and conditions of the trust.

- Documentation of the assets being transferred into the trust, such as deeds for real property and account statements for financial assets.

- Identification documents for the trustor and trustee, such as driver's licenses or passports.

- Any additional legal documents that may pertain to the assets, such as beneficiary designations or prior wills.

Quick guide on how to complete living trust property record connecticut

Prepare Living Trust Property Record Connecticut easily on any device

Online document management has gained traction among businesses and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Living Trust Property Record Connecticut on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to adjust and eSign Living Trust Property Record Connecticut effortlessly

- Locate Living Trust Property Record Connecticut and press Get Form to begin.

- Utilize the tools we offer to complete your document.

- Select important sections of your files or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Decide how you wish to submit your document: via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Modify and eSign Living Trust Property Record Connecticut to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust Property Record in Connecticut?

A Living Trust Property Record in Connecticut is a legal document that keeps track of assets placed in a living trust. This record outlines the ownership and management of these assets, ensuring a smooth transfer of property upon the trustor's passing. Understanding this record is essential for effective estate planning.

-

How does airSlate SignNow facilitate the management of Living Trust Property Records in Connecticut?

AirSlate SignNow enables users to create, edit, and securely eSign Living Trust Property Records in Connecticut. The platform streamlines the document management process, allowing for quick updates and easy sharing with relevant parties. This efficiency simplifies the overall estate planning process.

-

What are the costs associated with obtaining a Living Trust Property Record in Connecticut?

The costs of obtaining a Living Trust Property Record in Connecticut can vary based on several factors, including legal fees and filing costs. Using airSlate SignNow can help reduce these expenses by providing cost-effective eSigning solutions. By utilizing our service, you can save time and money in your estate planning efforts.

-

Are there any specific features for managing Living Trust Property Records in Connecticut?

Yes, airSlate SignNow offers features specifically designed for managing Living Trust Property Records in Connecticut, such as customizable templates and secure eSigning. Users can also benefit from document tracking and automated reminders, making it easier to stay organized and compliant with state requirements.

-

What are the benefits of using airSlate SignNow for Living Trust Property Records in Connecticut?

The primary benefits of using airSlate SignNow for Living Trust Property Records in Connecticut include enhanced security, ease of use, and swift document processing. Our platform ensures that your sensitive information is protected while providing a user-friendly experience. Efficient management of these records can also lead to peace of mind regarding your estate planning.

-

Can airSlate SignNow integrate with other tools for managing Living Trust Property Records in Connecticut?

Absolutely, airSlate SignNow provides integrations with various popular applications that can assist in managing Living Trust Property Records in Connecticut. This seamless connectivity enhances your workflow, allowing you to leverage existing tools while incorporating our eSigning capabilities. Efficient integrations can streamline the entire estate planning process.

-

Is it legally binding to eSign a Living Trust Property Record in Connecticut?

Yes, eSigning a Living Trust Property Record in Connecticut using airSlate SignNow is legally binding, provided all state requirements are met. Our platform adheres to the regulations governing electronic signatures, ensuring compliance and validity. This means you can confidently manage your records without any legal uncertainties.

Get more for Living Trust Property Record Connecticut

Find out other Living Trust Property Record Connecticut

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile