Ct Trust Form

What is the Ct Trust

The Ct Trust is a legal document that establishes a trust in Connecticut, allowing individuals to manage and protect their assets. This form is essential for those looking to create a trust arrangement that can provide benefits such as asset protection, tax advantages, and the ability to dictate how assets are distributed after death. Understanding the Ct Trust is crucial for anyone considering estate planning or asset management in Connecticut.

How to use the Ct Trust

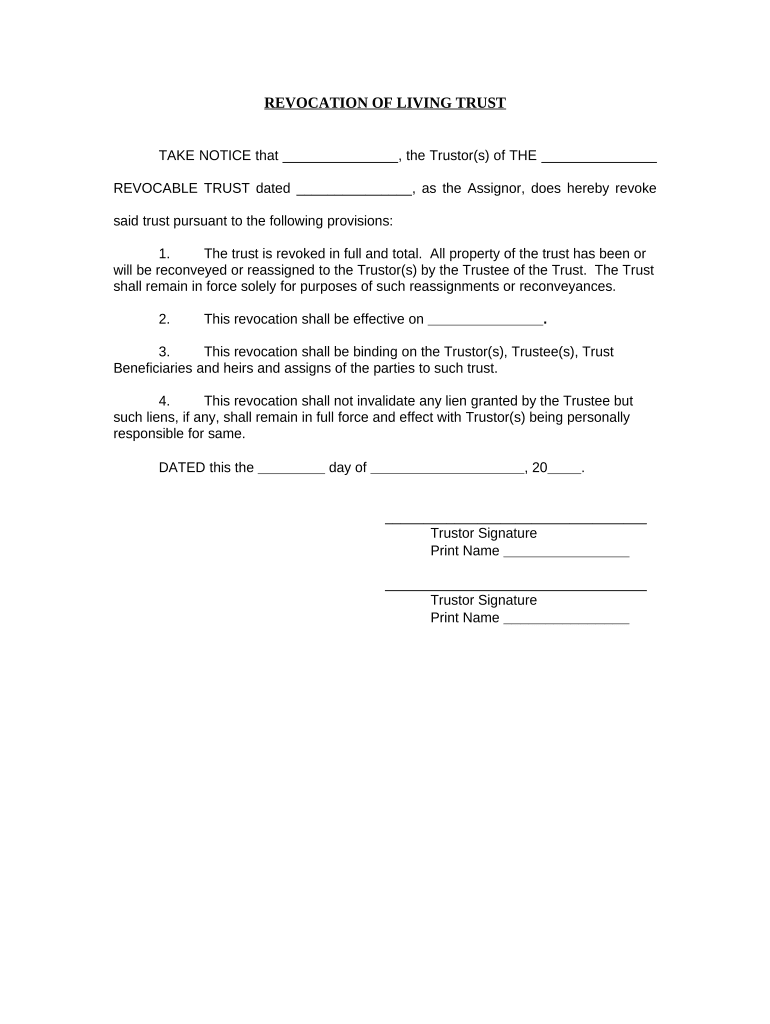

Using the Ct Trust involves several steps to ensure that the trust is set up correctly and functions as intended. First, individuals must determine the type of trust that best suits their needs, whether it's a revocable or irrevocable trust. Next, they should gather all necessary information about the assets to be included in the trust. Once the trust document is drafted, it must be signed and notarized to be legally binding. Finally, it is important to fund the trust by transferring ownership of the specified assets into it.

Steps to complete the Ct Trust

Completing the Ct Trust involves a series of methodical steps:

- Identify the purpose of the trust and the assets to be included.

- Choose the appropriate type of trust (revocable or irrevocable).

- Draft the trust document, ensuring it meets state requirements.

- Have the document signed in the presence of a notary public.

- Transfer ownership of the assets into the trust.

Following these steps helps ensure that the Ct Trust is established properly and serves its intended purpose.

Legal use of the Ct Trust

The legal use of the Ct Trust is governed by Connecticut state law, which outlines the requirements for creating and managing trusts. This includes ensuring that the trust document is properly executed and that the trust is funded with the appropriate assets. The Ct Trust can be used for various purposes, including estate planning, tax minimization, and asset protection. It is important to comply with all legal requirements to ensure the trust is enforceable in court.

Required Documents

To establish a Ct Trust, several documents are typically required:

- Trust agreement or declaration of trust.

- Identification documents for the grantor and trustee.

- List of assets to be included in the trust.

- Any relevant financial statements or appraisals.

Having these documents prepared in advance can streamline the process of creating the trust.

Who Issues the Form

The Ct Trust form is not issued by a specific agency but is typically drafted by an attorney specializing in estate planning or trusts. Legal professionals ensure that the trust document complies with state laws and meets the specific needs of the individual creating the trust. It is advisable to consult with a qualified attorney to ensure that all legal requirements are met and that the trust is set up correctly.

Quick guide on how to complete ct trust 497301219

Easily Prepare Ct Trust on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as a fantastic eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the correct form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and efficiently. Manage Ct Trust on any device with the airSlate SignNow apps available for Android or iOS, and enhance any document-related task today.

How to Alter and eSign Ct Trust with Ease

- Locate Ct Trust and then click Get Form to begin.

- Utilize the available tools to fill out your document.

- Highlight important sections of the documents or redact sensitive information using tools provided by airSlate SignNow specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, laborious form navigation, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Ct Trust and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is ct trust and how does it relate to airSlate SignNow?

CT Trust is a critical aspect of ensuring secure electronic signatures and document handling within airSlate SignNow. Our platform adheres to stringent compliance standards to uphold the integrity and legality of your signed documents, making it a reliable solution for businesses.

-

How does airSlate SignNow ensure document security under ct trust standards?

AirSlate SignNow employs advanced encryption techniques and secure storage protocols to meet ct trust requirements. This ensures that your documents are protected against unauthorized access while maintaining trustworthy electronic transactions.

-

What features does airSlate SignNow offer to support ct trust compliance?

Our platform provides features like audit trails, secure user authentication, and legally binding signatures, all of which align with ct trust compliance. These features help reinforce the credibility and legality of your e-signatures in various business situations.

-

What are the pricing plans available for airSlate SignNow that focus on ct trust?

AirSlate SignNow offers a range of pricing plans to accommodate businesses of all sizes while ensuring compliance with ct trust. Each plan provides access to essential features that promote secure and efficient document signing.

-

Can airSlate SignNow integrate with other tools while maintaining ct trust standards?

Yes, airSlate SignNow seamlessly integrates with various tools and applications, ensuring that all transactions continue to meet ct trust standards. This integration supports enhanced workflows without compromising document security.

-

What benefits does airSlate SignNow offer for businesses focusing on ct trust?

By using airSlate SignNow, businesses benefit from enhanced security, efficiency, and compliance with ct trust regulations. This allows teams to streamline their document processes while ensuring that every signature is secure and legally compliant.

-

How can I get started with airSlate SignNow to fulfill ct trust requirements?

Getting started with airSlate SignNow is easy! Simply sign up for a free trial on our website and explore the features that help you meet ct trust compliance, ensuring your document signing process is secure and efficient from the start.

Get more for Ct Trust

- Room inventory list form

- Observation hours form

- Dog behavior assessment form

- How a bill becomes a law flowchart form

- Smouldering charcoal summary pdf download form

- Child care director evaluation template form

- Reference form texas aampm university at qatar qatar tamu

- Florida quit claim deed form pdf word eforms

Find out other Ct Trust

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now