Contract for Deed Seller's Annual Accounting Statement District of Columbia Form

What is the Contract For Deed Seller's Annual Accounting Statement District Of Columbia

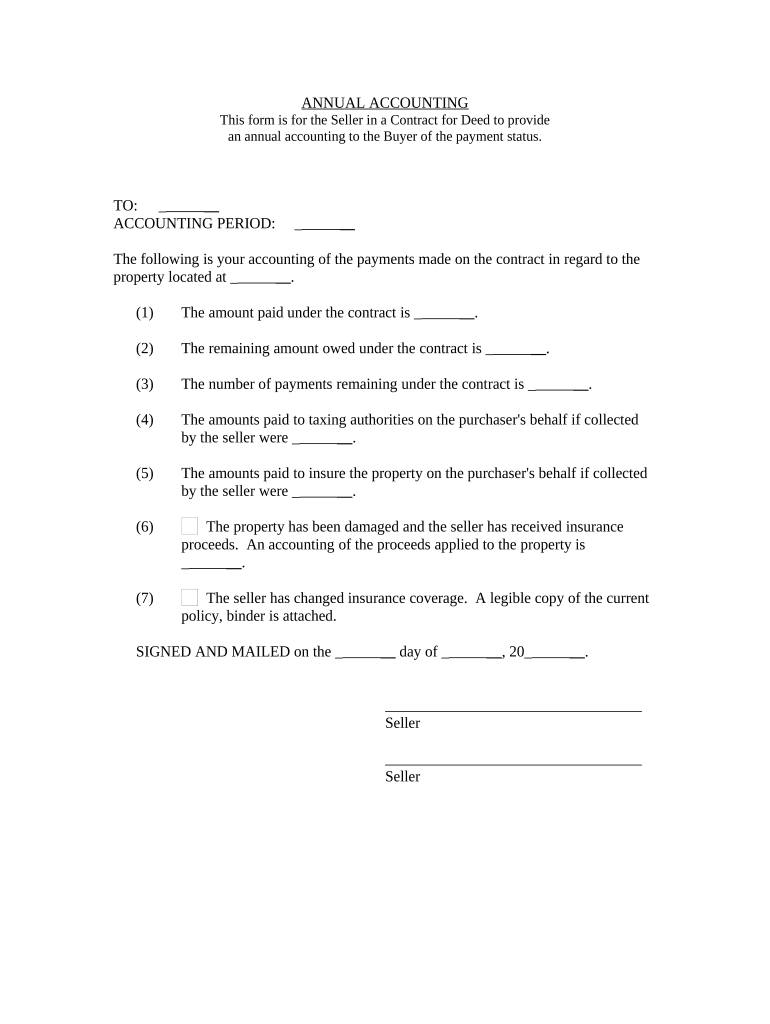

The Contract For Deed Seller's Annual Accounting Statement in the District of Columbia serves as a crucial document for sellers involved in a contract for deed arrangement. This statement outlines the financial transactions between the seller and the buyer over the course of the year. It typically includes details such as the total amount paid, remaining balance, and any applicable interest. This document is essential for both parties to maintain transparency and ensure accurate record-keeping in accordance with local regulations.

How to Use the Contract For Deed Seller's Annual Accounting Statement District Of Columbia

Utilizing the Contract For Deed Seller's Annual Accounting Statement involves several steps. First, the seller must gather all relevant financial information from the year, including payments received and any adjustments made. Once the data is compiled, the seller can fill out the statement form, ensuring that all figures are accurate and complete. After completing the form, it should be provided to the buyer, who may need it for their records or tax purposes. Proper usage of this statement can help prevent disputes and facilitate smooth transactions.

Steps to Complete the Contract For Deed Seller's Annual Accounting Statement District Of Columbia

Completing the Contract For Deed Seller's Annual Accounting Statement involves a systematic approach:

- Gather all payment records from the year, including dates and amounts.

- Calculate the total payments made by the buyer.

- Determine the remaining balance owed on the contract.

- Include any interest accrued during the year.

- Review all information for accuracy before finalizing the document.

- Provide the completed statement to the buyer for their records.

Legal Use of the Contract For Deed Seller's Annual Accounting Statement District Of Columbia

The legal use of the Contract For Deed Seller's Annual Accounting Statement is governed by local laws that dictate how such agreements must be documented and reported. In the District of Columbia, this statement must accurately reflect the financial transactions between the seller and buyer to be considered valid in legal contexts. It is advisable for both parties to retain copies of the statement for their records, as it may be required in case of disputes or for tax reporting purposes.

Key Elements of the Contract For Deed Seller's Annual Accounting Statement District Of Columbia

Key elements of the Contract For Deed Seller's Annual Accounting Statement include:

- Seller Information: Name and contact details of the seller.

- Buyer Information: Name and contact details of the buyer.

- Payment History: Detailed record of payments made throughout the year.

- Remaining Balance: Total amount still owed by the buyer.

- Interest Calculation: Any interest that has accrued on the outstanding balance.

State-Specific Rules for the Contract For Deed Seller's Annual Accounting Statement District Of Columbia

In the District of Columbia, specific rules apply to the Contract For Deed Seller's Annual Accounting Statement. These rules may include requirements for how the statement is formatted, what information must be included, and how it should be delivered to the buyer. It is important for sellers to familiarize themselves with these regulations to ensure compliance and avoid potential legal issues. Consulting with a legal professional can provide clarity on any state-specific requirements that must be met.

Quick guide on how to complete contract for deed sellers annual accounting statement district of columbia

Finish Contract For Deed Seller's Annual Accounting Statement District Of Columbia effortlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It serves as a perfect environmentally friendly alternative to traditional printed and signed documents, as you can obtain the correct form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly and without complications. Handle Contract For Deed Seller's Annual Accounting Statement District Of Columbia on any device using the airSlate SignNow Android or iOS applications and enhance any document-oriented procedure today.

The most efficient way to modify and eSign Contract For Deed Seller's Annual Accounting Statement District Of Columbia without stress

- Find Contract For Deed Seller's Annual Accounting Statement District Of Columbia and click Get Form to start.

- Utilize the features available to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

No more worrying about lost or misplaced files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign Contract For Deed Seller's Annual Accounting Statement District Of Columbia and guarantee effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Contract For Deed Seller's Annual Accounting Statement in the District of Columbia?

A Contract For Deed Seller's Annual Accounting Statement in the District of Columbia is a document that details the financial transactions and balance owed on a seller-financed contract. It provides transparency for both the buyer and seller, ensuring proper accounting of payments made and obligations remaining. Utilizing airSlate SignNow can streamline the creation and delivery of this important statement.

-

How can airSlate SignNow help with managing Contract For Deed Seller's Annual Accounting Statements?

airSlate SignNow simplifies the process of creating, sending, and eSigning your Contract For Deed Seller's Annual Accounting Statement in the District of Columbia. With its user-friendly interface, you can quickly generate documents, track their status, and obtain legally binding signatures without any hassle. This makes your transactions more efficient and secure.

-

What features does airSlate SignNow offer for Contract For Deed management?

The airSlate SignNow platform offers a variety of features beneficial for managing your Contract For Deed Seller's Annual Accounting Statement in the District of Columbia. These include customizable templates, cloud storage, automated reminders, and real-time tracking of document status. With these tools, you can enhance your workflow and ensure timely management of your contracts.

-

Is airSlate SignNow cost-effective for small businesses handling Contracts For Deed?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. With flexible pricing plans, it offers small businesses the ability to efficiently manage their Contract For Deed Seller's Annual Accounting Statement in the District of Columbia without incurring high costs. The return on investment is signNow when considering the time and resources saved.

-

Can airSlate SignNow integrate with other tools used for real estate transactions?

Absolutely! airSlate SignNow features seamless integrations with various tools commonly used in real estate transactions, enhancing the management of your Contract For Deed Seller's Annual Accounting Statement in the District of Columbia. Whether you use CRM systems, document management solutions, or cloud storage services, airSlate SignNow can connect with them to streamline your workflow.

-

How does airSlate SignNow ensure the security of my documents?

Security is a top priority at airSlate SignNow. Your documents, including the Contract For Deed Seller's Annual Accounting Statement in the District of Columbia, are protected with advanced encryption methods and secure cloud storage. Additionally, airSlate SignNow provides audit trails to track access and modifications, ensuring compliance and peace of mind.

-

What benefits do I gain from using airSlate SignNow for my accounting statements?

Using airSlate SignNow for your Contract For Deed Seller's Annual Accounting Statement in the District of Columbia offers numerous benefits, including increased efficiency, reduced paperwork, and easier collaboration. The platform minimizes the time spent on manual tasks, allowing you to focus on your core business activities while ensuring your documents are legally binding and easy to manage.

Get more for Contract For Deed Seller's Annual Accounting Statement District Of Columbia

- Application form for vendor registration in indian coast guard

- Polst form pa

- Mathe all type angle and name hd image form

- Printable visual analog scale form

- Stanbic ibtc account upgrade form

- Declaration re lostmisplaced supporting documentation form

- Sp 41 form fillable

- New york state tax informationsupport

Find out other Contract For Deed Seller's Annual Accounting Statement District Of Columbia

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later