Notice of Intent to Enforce Forfeiture Provisions of Contact for Deed Delaware Form

What is the Notice Of Intent To Enforce Forfeiture Provisions Of Contact For Deed Delaware

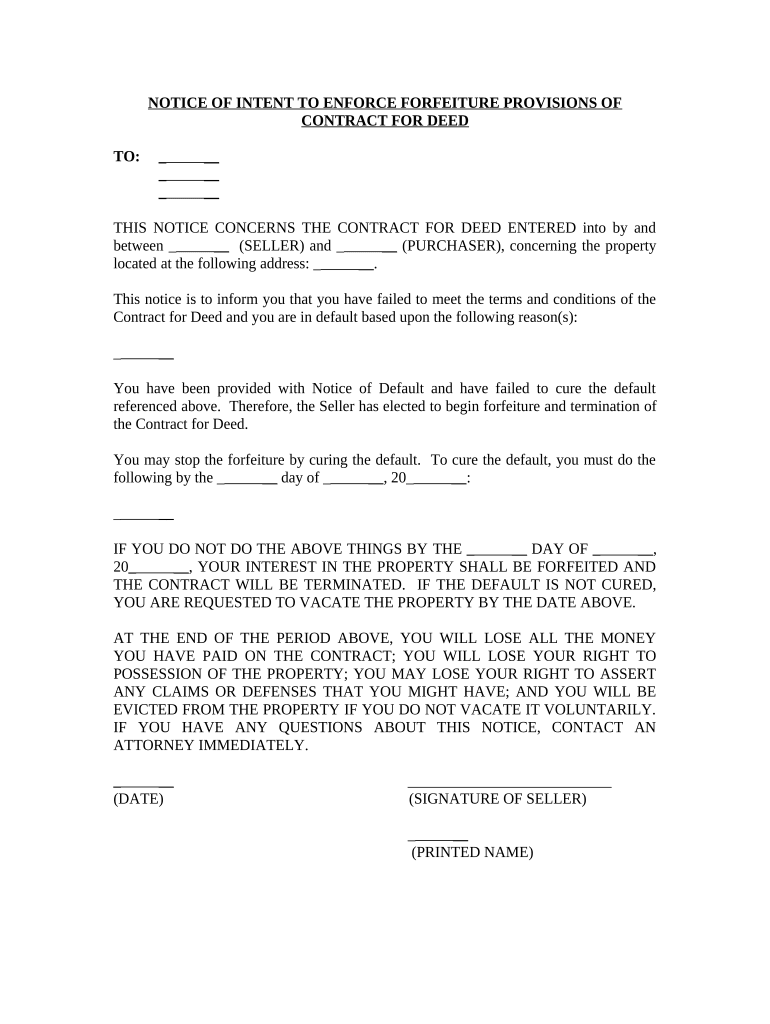

The Notice of Intent to Enforce Forfeiture Provisions of Contract for Deed in Delaware is a legal document used by sellers to inform buyers of their intention to enforce forfeiture provisions outlined in a contract for deed. This notice serves as a formal communication that a buyer is in default of their contractual obligations, which may include failing to make timely payments or violating other terms of the agreement. The document is crucial in initiating the process of forfeiture, allowing sellers to reclaim the property after providing the buyer with notice and an opportunity to remedy the default.

How to Use the Notice Of Intent To Enforce Forfeiture Provisions Of Contact For Deed Delaware

Steps to Complete the Notice Of Intent To Enforce Forfeiture Provisions Of Contact For Deed Delaware

Completing the Notice of Intent to Enforce Forfeiture Provisions involves the following steps:

- Review the contract for deed to identify specific default conditions.

- Draft the notice, including the buyer's information, property details, and reasons for enforcement.

- Include a statement regarding the buyer's right to remedy the default, if applicable.

- Sign and date the notice to validate it.

- Send the notice to the buyer using a traceable delivery method.

Key Elements of the Notice Of Intent To Enforce Forfeiture Provisions Of Contact For Deed Delaware

Essential elements of the Notice of Intent to Enforce Forfeiture Provisions include:

- The date of the notice.

- The names and addresses of both the seller and buyer.

- A clear description of the property involved.

- Specific details outlining the nature of the default.

- Any applicable deadlines for the buyer to respond or remedy the situation.

State-Specific Rules for the Notice Of Intent To Enforce Forfeiture Provisions Of Contact For Deed Delaware

In Delaware, specific rules govern the use of the Notice of Intent to Enforce Forfeiture Provisions. Sellers must adhere to state laws regarding the notice period and delivery methods. Typically, Delaware law requires that the notice be sent a certain number of days before any enforcement actions can be taken. It is essential for sellers to familiarize themselves with these regulations to ensure compliance and avoid potential legal challenges.

Legal Use of the Notice Of Intent To Enforce Forfeiture Provisions Of Contact For Deed Delaware

The legal use of the Notice of Intent to Enforce Forfeiture Provisions is critical for protecting the seller's rights. This notice must be executed in accordance with Delaware law to be enforceable. Failure to follow proper procedures can result in delays or the invalidation of the forfeiture process. Sellers should consider consulting with a legal professional to ensure that all aspects of the notice meet legal standards and that they are fully informed of their rights and obligations.

Quick guide on how to complete notice of intent to enforce forfeiture provisions of contact for deed delaware

Complete Notice Of Intent To Enforce Forfeiture Provisions Of Contact For Deed Delaware smoothly on any device

Online document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle Notice Of Intent To Enforce Forfeiture Provisions Of Contact For Deed Delaware on any platform with airSlate SignNow Android or iOS applications and streamline any document-based process today.

The easiest way to edit and eSign Notice Of Intent To Enforce Forfeiture Provisions Of Contact For Deed Delaware effortlessly

- Obtain Notice Of Intent To Enforce Forfeiture Provisions Of Contact For Deed Delaware and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign Notice Of Intent To Enforce Forfeiture Provisions Of Contact For Deed Delaware and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Notice Of Intent To Enforce Forfeiture Provisions Of Contact For Deed in Delaware?

A Notice Of Intent To Enforce Forfeiture Provisions Of Contact For Deed in Delaware is a legal document that informs parties about the intention to enforce forfeiture clauses in a contact for deed. This notice serves to protect the rights of sellers and buyers by outlining the steps that will be taken in the enforcement process. Understanding this document is essential for both parties in a real estate transaction.

-

How can airSlate SignNow assist with the Notice Of Intent To Enforce Forfeiture Provisions Of Contact For Deed in Delaware?

AirSlate SignNow provides a simple and efficient way to create, manage, and eSign legal documents, including the Notice Of Intent To Enforce Forfeiture Provisions Of Contact For Deed in Delaware. With our platform, you can ensure that all signatures are collected quickly and securely, reducing the risk of errors. This leads to smoother transactions and better legal compliance.

-

What features does airSlate SignNow offer for handling Notices Of Intent To Enforce Forfeiture?

AirSlate SignNow offers features such as customizable templates, secure eSigning, and automated workflow processes that are especially useful for handling Notices Of Intent To Enforce Forfeiture Provisions Of Contact For Deed in Delaware. These features help maintain compliance and streamline your documentation process. Additionally, our audit trails provide a record of all document activity for your peace of mind.

-

What are the pricing options for airSlate SignNow related to legal documents?

AirSlate SignNow offers competitive pricing tailored to meet the needs of businesses looking to manage legal documents like the Notice Of Intent To Enforce Forfeiture Provisions Of Contact For Deed in Delaware. Our subscription plans vary based on features and usage, providing flexibility for both small and large organizations. You can try our service through a free trial to evaluate how it fits your needs.

-

Can airSlate SignNow integrate with other platforms for managing Notices Of Intent?

Yes, airSlate SignNow can easily integrate with a variety of platforms, enhancing your ability to manage documents like the Notice Of Intent To Enforce Forfeiture Provisions Of Contact For Deed in Delaware. Our integrations include CRM systems, cloud storage solutions, and project management tools. This connectivity ensures that your workflow remains seamless and efficient.

-

What are the benefits of using airSlate SignNow for legal documentation?

Using airSlate SignNow for legal documentation such as the Notice Of Intent To Enforce Forfeiture Provisions Of Contact For Deed in Delaware offers numerous benefits, including increased efficiency, cost-effectiveness, and enhanced security. Our platform simplifies the document signing process and allows for faster transaction times. Additionally, you can track the status of documents in real-time, which minimizes delays.

-

Is airSlate SignNow secure for handling sensitive legal documents?

Absolutely! AirSlate SignNow employs advanced security measures to protect your sensitive legal documents, including the Notice Of Intent To Enforce Forfeiture Provisions Of Contact For Deed in Delaware. We adhere to industry standards for data protection, including encryption and secure cloud storage. You can trust that your documents are safe and securely managed across our platform.

Get more for Notice Of Intent To Enforce Forfeiture Provisions Of Contact For Deed Delaware

Find out other Notice Of Intent To Enforce Forfeiture Provisions Of Contact For Deed Delaware

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form