Delaware Certificate of Trust by Corporation Delaware Form

What is the Delaware Certificate Of Trust By Corporation Delaware

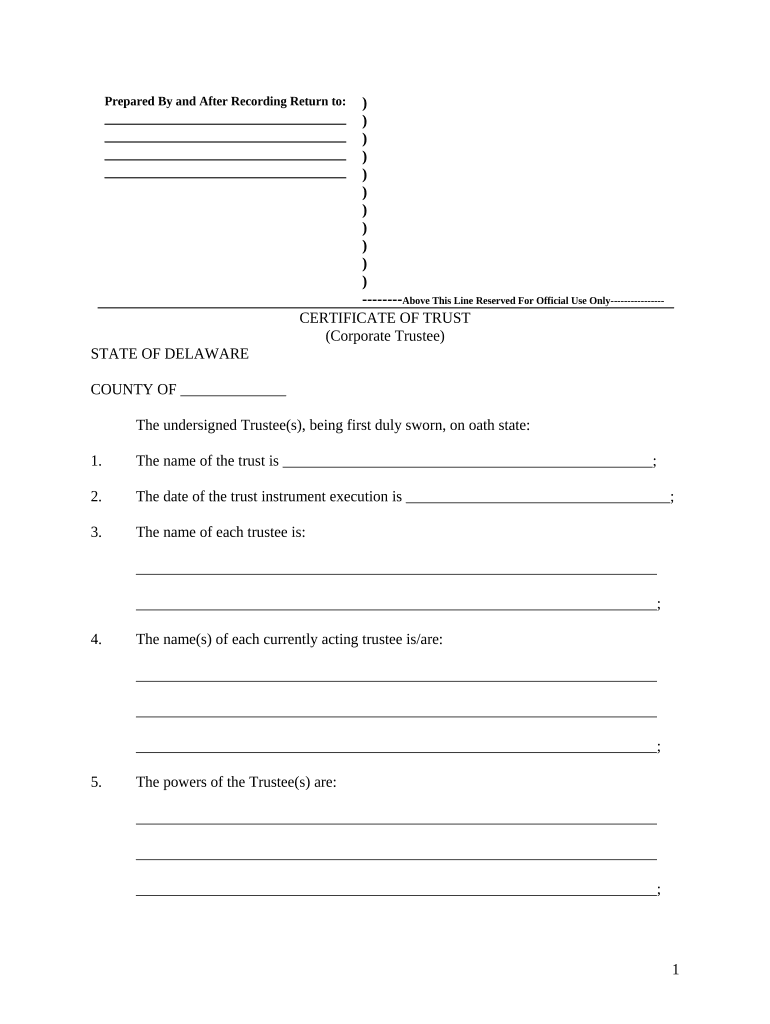

The Delaware Certificate of Trust by Corporation is a legal document that establishes a trust in the state of Delaware. This certificate outlines the terms and conditions of the trust, including the roles and responsibilities of the trustee and beneficiaries. It serves as a formal declaration of the trust's existence and provides essential information about the trust's purpose, assets, and management. This document is particularly useful for corporations looking to manage assets or investments through a trust structure, ensuring compliance with state laws while providing clarity and protection for all parties involved.

How to use the Delaware Certificate Of Trust By Corporation Delaware

Using the Delaware Certificate of Trust by Corporation involves several key steps. First, the corporation must draft the certificate, detailing the trust's terms and the identities of the trustee and beneficiaries. Once the document is prepared, it should be signed by the authorized representatives of the corporation. After signing, the certificate must be filed with the appropriate state authority, typically the Delaware Division of Corporations. This filing formalizes the trust and makes it legally binding. It is essential to keep a copy of the certificate for record-keeping and future reference.

Steps to complete the Delaware Certificate Of Trust By Corporation Delaware

Completing the Delaware Certificate of Trust by Corporation involves the following steps:

- Gather necessary information about the trust, including the names of the trustee and beneficiaries.

- Draft the certificate, ensuring all required details are included, such as the trust's purpose and any specific provisions.

- Review the document for accuracy and compliance with Delaware laws.

- Obtain signatures from the authorized representatives of the corporation.

- File the completed certificate with the Delaware Division of Corporations.

- Retain a copy of the filed certificate for your records.

Key elements of the Delaware Certificate Of Trust By Corporation Delaware

Key elements of the Delaware Certificate of Trust by Corporation include:

- Trust Name: The official name of the trust must be clearly stated.

- Trustee Information: Names and addresses of the trustee or trustees responsible for managing the trust.

- Beneficiary Details: Identification of beneficiaries who will benefit from the trust.

- Trust Purpose: A clear description of the purpose of the trust and the assets it will manage.

- Duration: Information on how long the trust will remain in effect.

Legal use of the Delaware Certificate Of Trust By Corporation Delaware

The legal use of the Delaware Certificate of Trust by Corporation is crucial for ensuring that the trust operates within the framework of Delaware law. This document provides legal recognition of the trust, allowing the trustee to manage assets on behalf of the beneficiaries. It is essential for the corporation to adhere to all relevant legal requirements, including proper filing and maintenance of the trust. Failure to comply with these regulations could lead to legal disputes or challenges regarding the trust's validity and the management of its assets.

State-specific rules for the Delaware Certificate Of Trust By Corporation Delaware

Delaware has specific rules governing the creation and management of trusts, including the Delaware Certificate of Trust by Corporation. These rules include requirements for the content of the certificate, filing procedures, and the responsibilities of trustees. It is important for corporations to familiarize themselves with Delaware's trust laws to ensure compliance. Additionally, any amendments to the trust must be documented and filed appropriately to maintain the trust's legal standing.

Quick guide on how to complete delaware certificate of trust by corporation delaware

Complete Delaware Certificate Of Trust By Corporation Delaware effortlessly on any device

Digital document management has gained signNow traction among companies and individuals. It serves as an optimal eco-friendly substitute for conventional printed and signed papers, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Delaware Certificate Of Trust By Corporation Delaware on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to modify and eSign Delaware Certificate Of Trust By Corporation Delaware with ease

- Obtain Delaware Certificate Of Trust By Corporation Delaware and click on Get Form to begin.

- Use the tools we offer to fill out your document.

- Highlight crucial sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this task.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to deliver your form, via email, text message (SMS), or a shared link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors that require printing new document versions. airSlate SignNow streamlines your document management needs in just a few clicks from any device you prefer. Modify and eSign Delaware Certificate Of Trust By Corporation Delaware and ensure smooth communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Delaware Certificate Of Trust By Corporation Delaware?

A Delaware Certificate Of Trust By Corporation Delaware is a legal document used to establish a trust entity within the state. It outlines the trust's purpose and the beneficiaries involved, providing legal validity to the trust. This document ensures that your trust is recognized by the state of Delaware, allowing for efficient management of assets.

-

How can airSlate SignNow help with creating a Delaware Certificate Of Trust By Corporation Delaware?

AirSlate SignNow offers an easy-to-use platform that allows you to create and eSign your Delaware Certificate Of Trust By Corporation Delaware seamlessly. Our templates guide you through the necessary steps, ensuring that all required information is included. The platform simplifies the entire process, saving you time and reducing complexity.

-

What are the benefits of using a Delaware Certificate Of Trust By Corporation Delaware?

A Delaware Certificate Of Trust By Corporation Delaware provides numerous benefits, including asset protection and privacy for beneficiaries. It allows for more flexible management of property and can help avoid probate. Establishing a trust in Delaware can also offer tax advantages, making it a strategic financial decision.

-

Is there a fee associated with obtaining a Delaware Certificate Of Trust By Corporation Delaware?

Yes, there are fees associated with filing a Delaware Certificate Of Trust By Corporation Delaware. These fees can vary depending on the specific requirements and the services used to create the document. Using airSlate SignNow’s digital platform can help reduce additional costs by streamlining the eSignature and document management process.

-

What features does airSlate SignNow provide for managing a Delaware Certificate Of Trust By Corporation Delaware?

AirSlate SignNow includes features such as secure eSigning, document templates, and automated workflow processes. These tools allow you to efficiently manage your Delaware Certificate Of Trust By Corporation Delaware and ensure compliance with legal requirements. Our user-friendly interface makes tracking progress and managing documents incredibly simple.

-

Can I integrate airSlate SignNow with other tools for managing trust documents?

Yes, airSlate SignNow can be integrated with a variety of other business tools and applications. This allows for a cohesive workflow when managing your Delaware Certificate Of Trust By Corporation Delaware alongside other documents. Integrations with platforms like Google Drive and Dropbox enhance your document management capabilities.

-

How secure is the information when using airSlate SignNow for my Delaware Certificate Of Trust By Corporation Delaware?

Security is a priority at airSlate SignNow. We utilize advanced encryption protocols to ensure that your information, such as your Delaware Certificate Of Trust By Corporation Delaware, is protected. Additionally, our platform complies with industry standards to maintain the confidentiality and integrity of your documents.

Get more for Delaware Certificate Of Trust By Corporation Delaware

Find out other Delaware Certificate Of Trust By Corporation Delaware

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online