Wages Attachment Form

What is the Wages Attachment

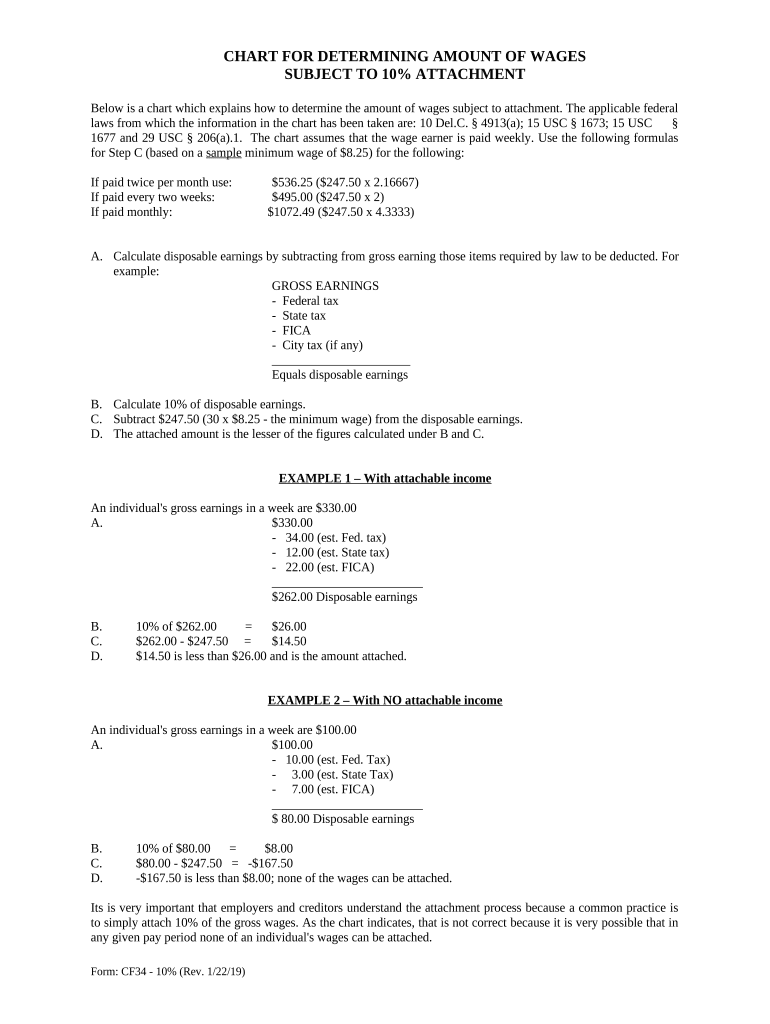

The wages attachment is a legal document used to direct an employer to withhold a portion of an employee's wages to satisfy a debt or obligation. This form is often associated with child support, tax debts, or other financial obligations. It serves as a formal request for the employer to deduct a specified amount from the employee's paycheck and send it to the appropriate agency or creditor. Understanding the purpose and function of the wages attachment is essential for both employees and employers to ensure compliance with legal requirements.

How to Use the Wages Attachment

Using the wages attachment involves several steps to ensure proper execution. First, the creditor or agency must complete the form, specifying the amount to be withheld and the reason for the attachment. Next, the completed form is served to the employer, who is then responsible for implementing the wage deductions. Employers should verify the validity of the attachment and ensure that the deductions do not exceed the limits set by federal and state laws. It is crucial for both parties to maintain clear communication throughout the process to avoid misunderstandings.

Steps to Complete the Wages Attachment

Completing the wages attachment requires careful attention to detail. Here are the key steps involved:

- Obtain the correct form from the relevant agency or creditor.

- Fill in the employee's information, including name, address, and Social Security number.

- Specify the amount to be withheld and the reason for the attachment.

- Sign and date the form to validate it.

- Submit the completed form to the employer, ensuring that it is delivered through an appropriate method.

Following these steps helps ensure that the wages attachment is processed correctly and legally.

Legal Use of the Wages Attachment

The legal use of the wages attachment is governed by various federal and state laws. These laws dictate the circumstances under which a wages attachment can be issued, the maximum amounts that can be withheld, and the rights of the employee. For example, under federal law, the maximum amount that can be garnished from an employee's disposable earnings is 25 percent. Employers must comply with these regulations to avoid legal repercussions. It is advisable for both creditors and employers to consult legal counsel when dealing with wages attachments to ensure compliance.

Key Elements of the Wages Attachment

Understanding the key elements of the wages attachment is crucial for effective use. Important components include:

- Employee Information: Accurate details of the employee, including their name and Social Security number.

- Creditor Information: The name and contact information of the creditor or agency requesting the attachment.

- Amount to Withhold: The specific dollar amount or percentage of wages to be deducted.

- Reason for Attachment: A clear explanation of the debt or obligation that the wages attachment addresses.

These elements ensure that the wages attachment is clear and legally enforceable.

Filing Deadlines / Important Dates

Filing deadlines for the wages attachment can vary based on the type of debt and the jurisdiction. It is essential to be aware of these timelines to ensure compliance and avoid penalties. Generally, once the wages attachment is issued, it should be served to the employer promptly. Additionally, creditors should follow up to confirm that the employer has received and processed the attachment. Keeping track of these important dates helps maintain the integrity of the process and protects the rights of all parties involved.

Quick guide on how to complete wages attachment

Manage Wages Attachment effortlessly on any gadget

Digital document management has gained traction with companies and individuals alike. It serves as an ideal eco-conscious alternative to conventional printed and signed paperwork, allowing you to obtain the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Wages Attachment on any gadget using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and electronically sign Wages Attachment with ease

- Find Wages Attachment and click on Get Form to initiate.

- Utilize the tools we provide to fill out your document.

- Emphasize important parts of the documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes moments and carries the same legal force as a conventional handwritten signature.

- Review all information and click on the Done button to save your modifications.

- Select your preferred method to send your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, laborious form hunting, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Modify and electronically sign Wages Attachment and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an amount attachment in airSlate SignNow?

An amount attachment in airSlate SignNow refers to the ability to include specific financial details within your documents. This feature allows you to clearly specify monetary sums related to transactions or agreements, ensuring both parties understand the financial terms involved. By utilizing amount attachments, businesses can streamline their documentation process effectively.

-

How can amount attachments enhance the signing experience?

By using amount attachments in airSlate SignNow, you provide signers with clear financial information without cluttering the document. This enhances the signing experience as all necessary details are presented concisely. As a result, signers can focus on essential terms related to financial commitments, promoting faster and more accurate completions.

-

Is there an additional cost for using amount attachments with airSlate SignNow?

No, integrating amount attachments in your documents is included in airSlate SignNow's pricing plans. This means you can enjoy the benefits of this feature without incurring extra charges. Our cost-effective solution aims to support your business without compromising on essential features such as amount attachments.

-

Can amount attachments be customized in airSlate SignNow?

Yes, you can customize amount attachments in airSlate SignNow to cater to your specific requirements. This includes adjusting the presentation and formatting of the amounts, ensuring they align with your branding and document aesthetics. Such customization helps maintain consistency across your business documentation.

-

What types of documents can include amount attachments in airSlate SignNow?

You can use amount attachments in various document types, including contracts, proposals, and invoices within airSlate SignNow. This versatility enables businesses to accurately represent financial obligations in a range of critical business documents. Whether it's for internal use or client-facing materials, amount attachments can be effectively utilized.

-

How do amount attachments integrate with other features of airSlate SignNow?

Amount attachments work seamlessly with other features in airSlate SignNow, such as templates and workflows. This integration allows for automatic population of financial information and ensures all parts of your document are consistent. By leveraging amount attachments alongside these features, you can signNowly enhance your document management efficiency.

-

Are amount attachments mobile-friendly in airSlate SignNow?

Yes, amount attachments are fully optimized for mobile devices in airSlate SignNow. This ensures that users can view and interact with financial details on their smartphones and tablets with ease. A mobile-friendly design enhances accessibility, allowing for on-the-go signing and viewing of important financial information.

Get more for Wages Attachment

- Architectural graphic standards 12th edition pdf download form

- Pogil activities for high school biology pdf answer key form

- Bruma finance loan application form pdf

- E verify affidavit georgia form

- Rigging inspection form 240123407

- De 1275a 48586 form

- Dog bite incident report form

- Transferable skills worksheet form

Find out other Wages Attachment

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF