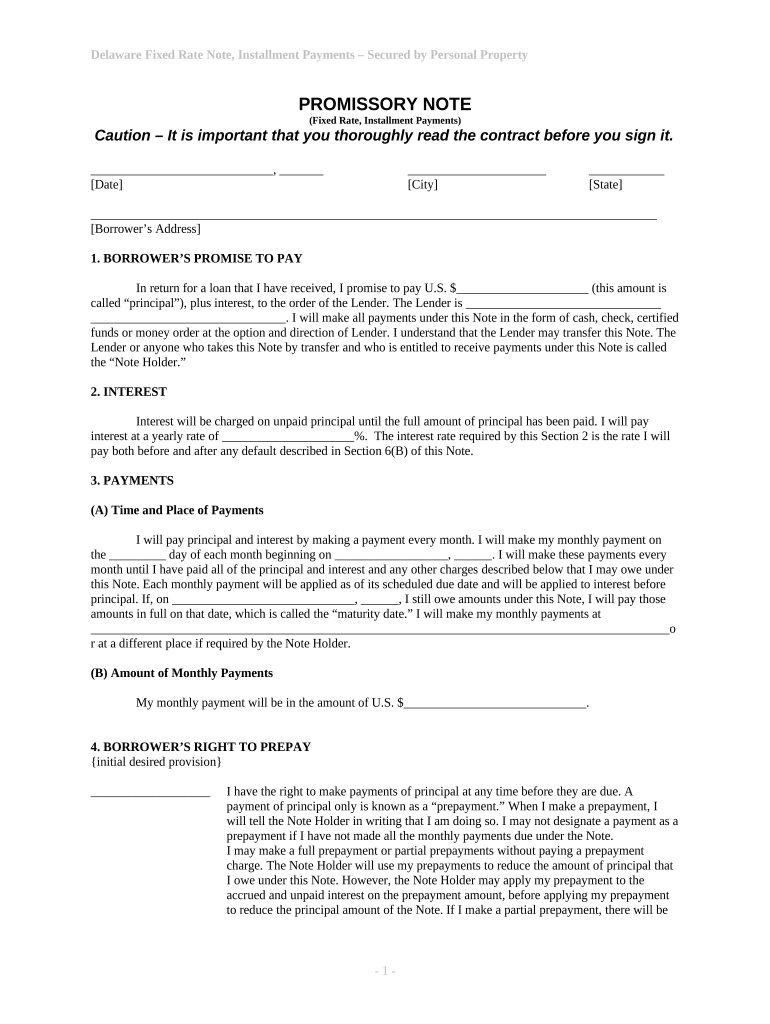

Delaware Rate Form

What is the Delaware Rate

The Delaware rate refers to a specific tax rate applicable to various financial transactions and business activities within the state of Delaware. This rate is crucial for businesses operating in Delaware, as it influences their overall tax liability. Understanding the Delaware rate is essential for compliance with state tax laws and for making informed financial decisions. The rate may vary based on the type of business entity and the nature of the transactions involved.

How to use the Delaware Rate

Using the Delaware rate effectively involves understanding its application to your specific business activities. Businesses must calculate the tax owed based on the applicable rate for their transactions. This includes sales tax, corporate income tax, and other relevant taxes. Accurate record-keeping and timely reporting are vital to ensure compliance and avoid penalties. Utilizing accounting software can simplify this process and help maintain accurate financial records.

Steps to complete the Delaware Rate

Completing the Delaware rate involves several key steps:

- Identify the applicable rate for your business type and transactions.

- Gather necessary financial documentation, including sales records and transaction details.

- Calculate the total tax owed based on the identified rate.

- Prepare and submit the required forms to the Delaware Division of Revenue.

- Ensure timely payment to avoid late fees or penalties.

Legal use of the Delaware Rate

The legal use of the Delaware rate is governed by state tax laws and regulations. Businesses must adhere to these laws to ensure their operations remain compliant. This includes understanding the implications of the Delaware rate on various business activities and ensuring that all tax obligations are met. Failure to comply with these regulations may result in penalties, fines, or other legal consequences.

Key elements of the Delaware Rate

Key elements of the Delaware rate include:

- The specific percentage applicable to different types of transactions.

- Exemptions or deductions that may apply to certain businesses or transactions.

- Filing requirements and deadlines for tax submissions.

- The impact of the Delaware rate on overall business operations and financial planning.

Examples of using the Delaware Rate

Examples of using the Delaware rate can include:

- A retail business calculating sales tax on customer purchases.

- A corporation determining its corporate income tax based on revenue generated in Delaware.

- Service providers assessing their tax obligations for services rendered within the state.

Filing Deadlines / Important Dates

Filing deadlines for the Delaware rate are critical for compliance. Businesses must be aware of the specific dates for submitting tax forms and making payments. These deadlines can vary based on the type of tax and the business entity. Keeping a calendar of important dates can help ensure that all obligations are met in a timely manner, reducing the risk of penalties.

Quick guide on how to complete delaware rate

Complete Delaware Rate seamlessly on any device

Managing documents online has gained traction among companies and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork, as you can access the necessary form and securely store it on the web. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents swiftly without any holdups. Handle Delaware Rate on any platform with the airSlate SignNow Android or iOS applications and enhance your document-focused operations today.

The easiest way to modify and eSign Delaware Rate effortlessly

- Find Delaware Rate and click Get Form to begin.

- Utilize the tools available to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive details with tools that airSlate SignNow provides for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and then click the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Eliminate concerns about lost or misplaced documents, tedious searches for forms, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and eSign Delaware Rate and guarantee exceptional communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Delaware rate for airSlate SignNow?

The Delaware rate for airSlate SignNow offers cost-effective options tailored for businesses in the state. Our pricing is designed to accommodate various business sizes and needs, ensuring you get the best value for your eSignature and document management solutions.

-

How can I compare Delaware rates with other eSignature services?

To compare Delaware rates effectively, consider the features and benefits offered by airSlate SignNow versus other eSignature services. Our platform provides an easy-to-use interface and a range of integrations, making it an ideal choice for businesses looking to optimize their document signing processes.

-

What features are included at the Delaware rate?

At the Delaware rate, airSlate SignNow includes features such as document templates, unlimited eSignatures, and in-app collaboration tools. These features streamline your workflows and enhance productivity, making document management easier and more efficient.

-

Are there any hidden fees associated with the Delaware rate?

No, airSlate SignNow is committed to transparency, so there are no hidden fees associated with the Delaware rate. Our pricing structure is straightforward, and you only pay for the features and services you need, allowing you to manage your budget effectively.

-

Can I integrate airSlate SignNow with other software at the Delaware rate?

Absolutely! The Delaware rate for airSlate SignNow includes seamless integrations with popular software such as Google Drive, Salesforce, and Microsoft 365. This ensures that you can easily incorporate our eSignature solution into your existing workflows and enhance your overall productivity.

-

What are the benefits of using airSlate SignNow at the Delaware rate?

Using airSlate SignNow at the Delaware rate provides multiple benefits, including time savings, cost efficiency, and enhanced security for your documents. Our solution simplifies the signing process, helps reduce paperwork, and ensures your documents are stored securely in the cloud.

-

Is there a free trial available for the Delaware rate?

Yes, airSlate SignNow offers a free trial to allow potential customers in Delaware to experience our capabilities firsthand. This trial gives you an opportunity to explore our features and see how they can fit your business needs before committing to a subscription.

Get more for Delaware Rate

- On job training format

- City of calgary cross connection form

- Plant vocabulary worksheet answers form

- Eas application form

- Practice worksheet factoring quadratics answer key form

- Ficha de investigacion de casos de coqueluche form

- Cvsc parent player contract sport ngin form

- Poboxceservicerequest cmsenergy form

Find out other Delaware Rate

- Sign Nebraska Operating Agreement Now

- Can I Sign Montana IT Project Proposal Template

- Sign Delaware Software Development Agreement Template Now

- How To Sign Delaware Software Development Agreement Template

- How Can I Sign Illinois Software Development Agreement Template

- Sign Arkansas IT Consulting Agreement Computer

- Can I Sign Arkansas IT Consulting Agreement

- Sign Iowa Agile Software Development Contract Template Free

- How To Sign Oregon IT Consulting Agreement

- Sign Arizona Web Hosting Agreement Easy

- How Can I Sign Arizona Web Hosting Agreement

- Help Me With Sign Alaska Web Hosting Agreement

- Sign Alaska Web Hosting Agreement Easy

- Sign Arkansas Web Hosting Agreement Simple

- Sign Indiana Web Hosting Agreement Online

- Sign Indiana Web Hosting Agreement Easy

- How To Sign Louisiana Web Hosting Agreement

- Sign Maryland Web Hosting Agreement Now

- Sign Maryland Web Hosting Agreement Free

- Sign Maryland Web Hosting Agreement Fast