Mortgage Note Form

What is the mortgage note?

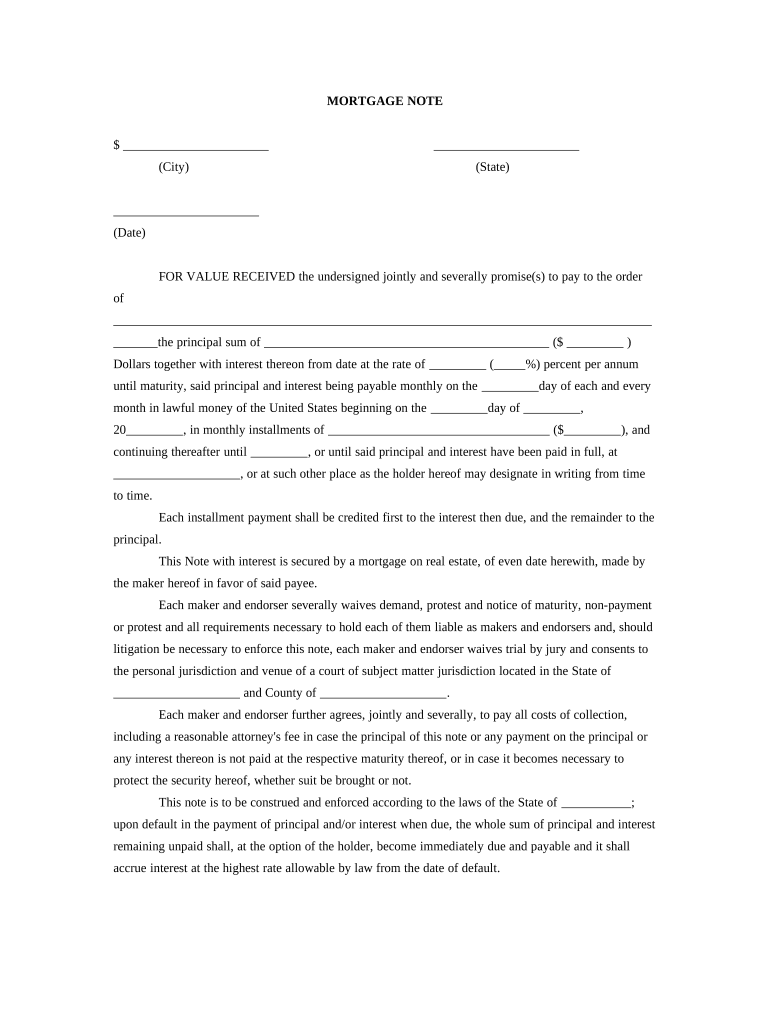

A mortgage note is a legal document that outlines the terms of a loan secured by real estate. It serves as a promise to repay the borrowed amount, detailing the loan amount, interest rate, payment schedule, and consequences of default. This document is essential for both lenders and borrowers, as it establishes the legal obligations of the parties involved in the transaction.

Key elements of the mortgage note

Understanding the key elements of a mortgage note is crucial for both borrowers and lenders. The primary components include:

- Loan amount: The total amount borrowed by the borrower.

- Interest rate: The rate at which interest will accrue on the loan.

- Payment schedule: The timeline for repayments, including due dates and amounts.

- Maturity date: The date by which the loan must be fully repaid.

- Default terms: Conditions under which the lender can take action if the borrower fails to make payments.

Steps to complete the mortgage note

Completing a mortgage note involves several important steps to ensure accuracy and legality:

- Gather necessary information: Collect all relevant details about the loan, property, and parties involved.

- Fill out the document: Accurately input the loan amount, interest rate, payment schedule, and other required information.

- Review the terms: Carefully read through the note to ensure all terms are clear and agreeable.

- Sign the document: Both the borrower and lender must sign the mortgage note to make it legally binding.

- Store the document securely: Keep a copy of the signed mortgage note in a safe place for future reference.

Legal use of the mortgage note

The mortgage note is legally binding once signed by both parties. It is essential to comply with state laws and regulations regarding mortgage documents. This includes ensuring that the note is properly executed, witnessed if required, and recorded with the appropriate government office. Legal compliance protects both the lender's and borrower's rights, ensuring that the terms of the loan are enforceable in court if necessary.

How to obtain the mortgage note

Obtaining a mortgage note typically occurs during the loan application process. Borrowers can request a copy from their lender once the loan is approved and finalized. It is important to ensure that the document is complete and accurately reflects the agreed-upon terms. In some cases, mortgage notes may also be available through public records if they have been recorded with the local government.

Digital vs. paper version of the mortgage note

Both digital and paper versions of the mortgage note are legally valid, provided they meet the necessary requirements. Digital notes offer convenience, allowing for easier storage and sharing. They can be signed electronically, streamlining the process. However, some lenders may still prefer paper documents for their traditional approach. Understanding the preferences of the lender and the legal requirements in your state can help determine the best format for your mortgage note.

Quick guide on how to complete mortgage note 497302748

Effortlessly handle Mortgage Note on any device

Managing documents online has gained tremendous popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, edit, and electronically sign your documents swiftly and without any holdups. Manage Mortgage Note on any platform using airSlate SignNow's Android or iOS applications, and simplify your document-related tasks today.

The easiest way to edit and electronically sign Mortgage Note effortlessly

- Find Mortgage Note and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Generate your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or mistakes that necessitate printing out new copies. airSlate SignNow fulfills all your document management requirements with just a few clicks from any device of your choice. Edit and electronically sign Mortgage Note, ensuring outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a mortgage note?

A mortgage note is a legal document that outlines the terms of a mortgage loan between a borrower and lender. It includes crucial information such as the loan amount, interest rate, and payment schedule, ensuring both parties understand their obligations. Utilizing airSlate SignNow, you can easily create, send, and eSign mortgage notes, streamlining your document management process.

-

How does airSlate SignNow streamline the mortgage note signing process?

airSlate SignNow simplifies the mortgage note signing process by allowing users to send documents for electronic signatures securely and efficiently. The platform provides a user-friendly interface, enabling borrowers and lenders to quickly review and sign mortgage notes from anywhere, reducing turnaround time signNowly. This enhancement to workflow ensures that all parties remain informed and engaged throughout the signing process.

-

What features does airSlate SignNow offer for managing mortgage notes?

airSlate SignNow offers several features that enhance the management of mortgage notes, including customizable templates, automated reminders, and real-time tracking of document status. These features ensure that your mortgage notes are handled with ease and efficiency, reducing the potential for errors. Additionally, the platform's cloud storage capability allows for easy access and retrieval of all signed documents.

-

What are the benefits of using airSlate SignNow for mortgage notes?

Using airSlate SignNow for mortgage notes provides numerous benefits, including increased efficiency and reduced paper usage. The electronic signing process helps save time and resources by eliminating the need for in-person meetings and physical document handling. Moreover, secure storage of mortgage notes guarantees that important paperwork is protected and easily accessible when needed.

-

Is airSlate SignNow cost-effective for managing mortgage notes?

Yes, airSlate SignNow is a cost-effective solution for managing mortgage notes. With various pricing plans tailored to meet different business needs, you can choose an option that fits your budget while accessing powerful features. By reducing administrative costs and speeding up the signing process, the software ultimately saves money in the long term.

-

Which integrations are available with airSlate SignNow for mortgage notes?

airSlate SignNow integrates seamlessly with various applications to help enhance your workflow when managing mortgage notes. Popular integrations include CRM systems, document management software, and cloud storage solutions like Google Drive and Dropbox. These integrations allow you to synchronize data and enhance the overall efficiency of your document processes.

-

Can I customize my mortgage notes in airSlate SignNow?

Absolutely! airSlate SignNow allows users to customize their mortgage notes with ease. You can add your branding, modify templates to fit specific needs, and include necessary clauses or disclosures tailored to your transaction. This level of customization ensures that your mortgage notes accurately represent your business and meet all legal requirements.

Get more for Mortgage Note

- Non creamy layer certificate kerala form

- Resource book for geometry houghton mifflin form

- Buckeye fire extinguisher service manual form

- Strathmore university application form

- Sample psychiatric clearance letter for bariatric surgery form

- Biorad qc workbook form

- Affidavit of circumstances form

- Dependent pass application form

Find out other Mortgage Note

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter