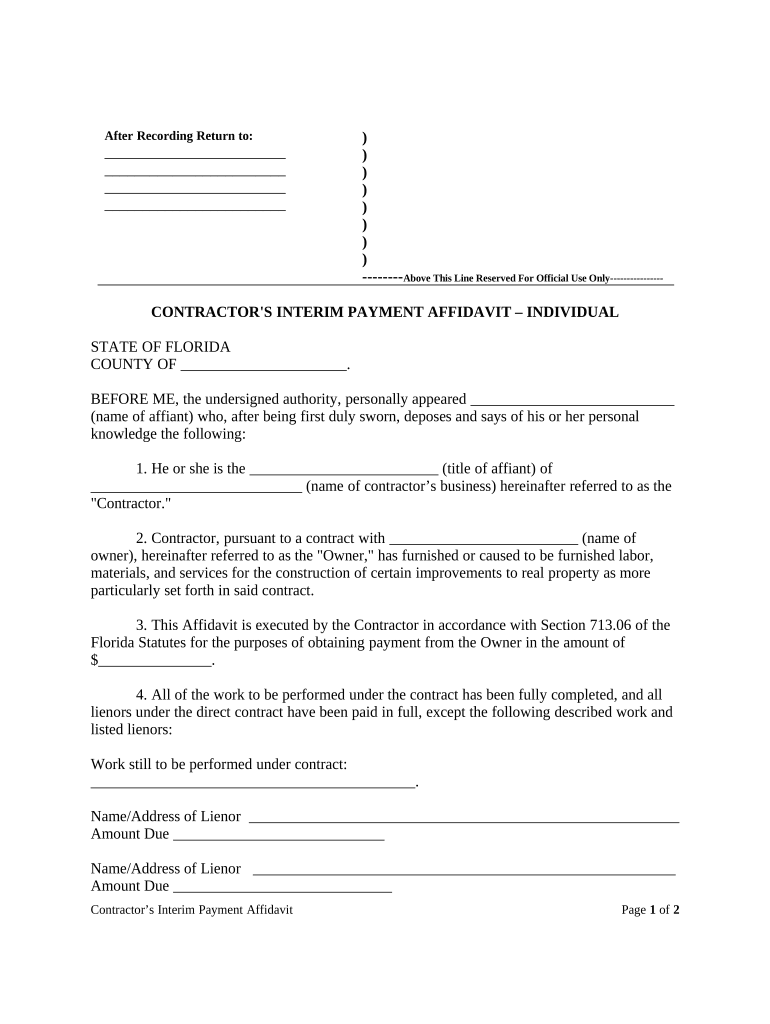

Contractor Individual Form

What is the Contractor Individual

The contractor individual form is a crucial document used by independent contractors in the United States to report income and expenses related to their work. This form helps to ensure that contractors comply with tax regulations and accurately report their earnings to the Internal Revenue Service (IRS). It is essential for self-employed individuals to understand the implications of this form, as it can affect their tax obligations and overall financial standing.

How to use the Contractor Individual

Using the contractor individual form involves several steps to ensure accurate completion. First, gather all necessary information, including your personal details, business name, and financial records related to your contracting work. Next, fill out the form with precise information, detailing your income and any deductible expenses. Finally, submit the form to the appropriate tax authority, ensuring you meet any deadlines to avoid penalties.

Steps to complete the Contractor Individual

Completing the contractor individual form requires careful attention to detail. Start by entering your name and contact information at the top of the form. Then, list all sources of income from your contracting work, including payments received from clients. After that, document any business-related expenses, such as materials, travel, and other costs incurred while performing your services. Review the form for accuracy before submitting it to ensure compliance with IRS guidelines.

Key elements of the Contractor Individual

Several key elements must be included in the contractor individual form to ensure it is complete and accurate. These elements typically include:

- Name and contact information: Your full name, address, and phone number.

- Tax identification number: Your Social Security Number (SSN) or Employer Identification Number (EIN).

- Income details: Comprehensive listing of all income sources related to your contracting work.

- Expense documentation: A record of all deductible expenses associated with your business activities.

Legal use of the Contractor Individual

The contractor individual form must be used in accordance with IRS regulations to ensure its legal standing. This includes accurately reporting income and expenses, adhering to filing deadlines, and maintaining records that support the information provided on the form. Misuse of the form, such as underreporting income or inflating expenses, can lead to significant penalties and legal repercussions.

Required Documents

To complete the contractor individual form successfully, several documents are typically required. These may include:

- Invoices: Copies of invoices issued to clients for services rendered.

- Receipts: Documentation of all business-related expenses.

- Bank statements: Statements that reflect income deposits and business transactions.

IRS Guidelines

It is essential to adhere to IRS guidelines when completing the contractor individual form. The IRS provides specific instructions regarding the reporting of income, allowable deductions, and filing requirements. Familiarizing yourself with these guidelines can help ensure compliance and minimize the risk of errors that could lead to audits or penalties.

Quick guide on how to complete contractor individual

Complete Contractor Individual effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the right format and securely store it online. airSlate SignNow provides all the essential tools you require to create, edit, and eSign your documents quickly without delays. Manage Contractor Individual on any platform with airSlate SignNow Android or iOS applications and streamline your document-centric tasks today.

How to edit and eSign Contractor Individual effortlessly

- Locate Contractor Individual and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides expressly for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Contractor Individual and ensure exceptional communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how can it help a contractor individual?

airSlate SignNow is an eSignature solution designed to streamline document management for a contractor individual. It allows users to send, receive, and eSign documents effortlessly, ensuring that contracts are signed quickly and securely. This helps contractor individuals save time and enhance their efficiency in managing contractual workflows.

-

What features does airSlate SignNow offer for contractor individuals?

For a contractor individual, airSlate SignNow provides essential features such as customizable templates, real-time tracking of document status, and mobile access for signing on the go. These features simplify the signing process and allow contractor individuals to manage agreements anytime, anywhere. Additionally, users can integrate other tools to streamline their operations further.

-

How does airSlate SignNow ensure document security for contractor individuals?

AirSlate SignNow prioritizes security for contractor individuals by offering advanced encryption, two-factor authentication, and audit trails for all documents. This ensures that contracts remain confidential and are only accessible to authorized parties. Contractor individuals can confidently manage sensitive agreements, knowing their data is protected.

-

What are the pricing options for contractor individuals using airSlate SignNow?

airSlate SignNow offers flexible pricing options for contractor individuals, making it easy to find a plan that fits their budget. Users can choose from various subscription tiers, providing access to essential features or advanced capabilities depending on their needs. These options make it a cost-effective solution for contractor individuals managing multiple contracts.

-

Can contractor individuals integrate airSlate SignNow with other tools?

Yes, contractor individuals can easily integrate airSlate SignNow with various tools, such as CRM systems, project management software, and cloud storage services. This integration allows contractor individuals to enhance their workflow by connecting their eSigning process with the applications they already use. Streamlining these processes is crucial for managing contracts effectively.

-

What benefits does airSlate SignNow provide for contractor individuals?

Using airSlate SignNow, contractor individuals experience numerous benefits, including faster contract turnaround times and improved customer satisfaction. The intuitive interface makes it easy for clients to sign documents, which can lead to quicker project initiation. Contractor individuals can focus more on their work and less on paperwork.

-

Is airSlate SignNow user-friendly for contractor individuals?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it accessible for contractor individuals of all tech levels. The straightforward interface allows contractor individuals to easily navigate the platform, send documents for eSignature, and manage their workflow without requiring extensive training or technical skills.

Get more for Contractor Individual

- Scao proof of service form

- Cv 424 form

- Drumcondra tests order form

- Tears of a tiger anticipation guide form

- Blank printable quitclaim deed form

- Njhs service hours log form

- Series seed preferred stock investment agreement form

- Authorization for verbal communication 1280490v dt 08 18 15doc uwhealth form

Find out other Contractor Individual

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy