Business Credit Application Florida Form

What is the Business Credit Application Florida

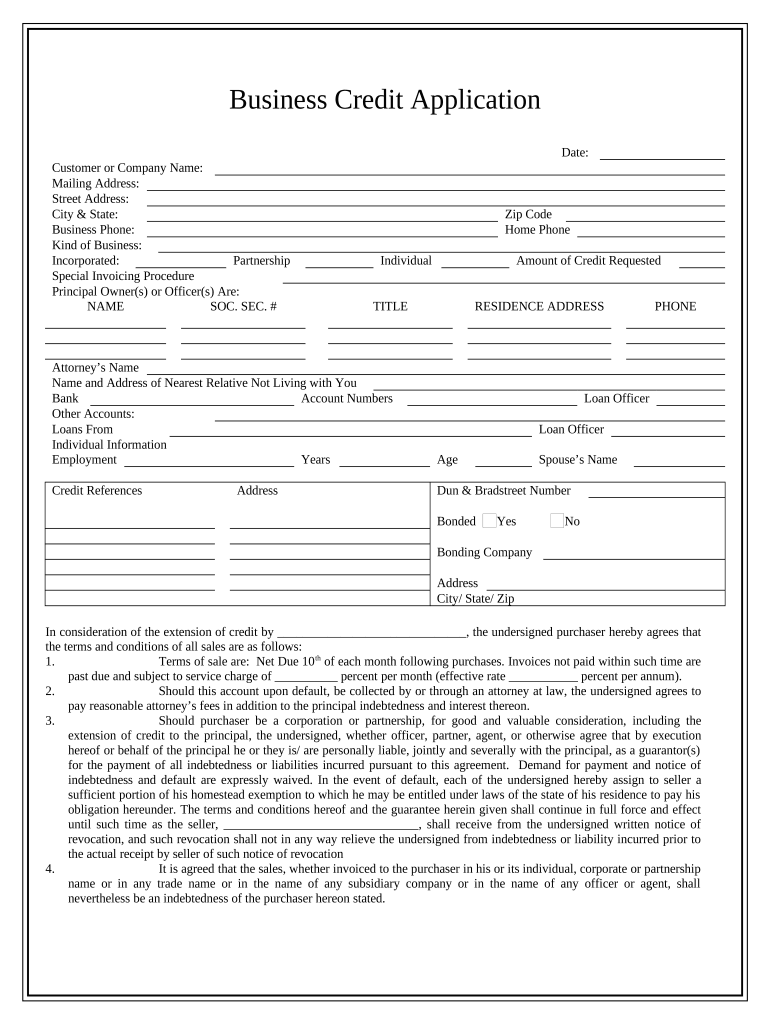

The Business Credit Application Florida is a formal document that businesses in Florida use to apply for credit. This application collects essential information about the business, including its legal structure, financial history, and creditworthiness. It serves as a tool for lenders to assess the risk associated with extending credit to a business. By providing accurate and comprehensive information, businesses can improve their chances of obtaining the necessary funding for growth and operations.

Steps to complete the Business Credit Application Florida

Completing the Business Credit Application Florida involves several key steps that ensure the application is thorough and accurate. First, gather all required documentation, such as financial statements, tax returns, and business licenses. Next, fill out the application form with precise details about the business, including ownership structure and operational history. It is crucial to review the application for any errors or omissions before submission. Finally, submit the application either online or through traditional mail, depending on the lender's requirements.

Key elements of the Business Credit Application Florida

Several key elements are essential to the Business Credit Application Florida. These include:

- Business Information: Name, address, and contact details.

- Ownership Structure: Details about the owners and their percentage of ownership.

- Financial Information: Recent financial statements, including balance sheets and income statements.

- Credit History: Information on existing debts and credit lines.

- Purpose of the Credit: A clear explanation of how the funds will be used.

Providing this information accurately can significantly impact the application’s success.

Legal use of the Business Credit Application Florida

The legal use of the Business Credit Application Florida is governed by various state and federal regulations. To ensure compliance, businesses must provide truthful information and understand the implications of submitting false statements. The application must be signed by authorized individuals, and electronic signatures are legally binding if they meet specific criteria under the ESIGN Act and UETA. Businesses should retain copies of submitted applications for their records and potential future audits.

Eligibility Criteria

Eligibility for the Business Credit Application Florida typically depends on several factors, including:

- Business Type: The application is available for various business entities, such as LLCs, corporations, and partnerships.

- Creditworthiness: Lenders assess the credit history and financial stability of the business.

- Time in Business: Many lenders prefer businesses that have been operational for a minimum period, often two years or more.

Understanding these criteria can help businesses prepare a stronger application.

Form Submission Methods

The Business Credit Application Florida can typically be submitted through various methods, enhancing convenience for applicants. Common submission methods include:

- Online Submission: Many lenders offer digital platforms for submitting applications, allowing for quicker processing.

- Mail: Businesses can print the completed application and send it via postal service.

- In-Person Submission: Some lenders may require or allow businesses to submit applications directly at their offices.

Choosing the right submission method can impact the speed and efficiency of the application process.

Quick guide on how to complete business credit application florida

Complete Business Credit Application Florida effortlessly on any device

Digital document management has gained traction among companies and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed papers, as you can locate the appropriate form and securely keep it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage Business Credit Application Florida on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to edit and eSign Business Credit Application Florida with ease

- Locate Business Credit Application Florida and click on Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize important parts of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, either through email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searching, or errors that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Business Credit Application Florida and maintain excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Business Credit Application in Florida?

A Business Credit Application in Florida is a document that businesses submit to request credit from vendors or financial institutions. This application typically includes details about the business's financial history, ownership, and operational status. By using an effective Business Credit Application in Florida, businesses can enhance their chances of obtaining the credit they need.

-

How can airSlate SignNow help with my Business Credit Application in Florida?

airSlate SignNow provides a user-friendly platform that allows businesses to create, send, and eSign their Business Credit Application in Florida quickly and efficiently. This ensures that applications are completed in a timely manner, reducing delays in credit approval. The digital signing feature also adds a layer of convenience and security.

-

What features does airSlate SignNow offer for Business Credit Applications?

With airSlate SignNow, businesses can benefit from features such as customizable templates for Business Credit Applications in Florida, secure eSigning, and real-time document tracking. Additionally, the platform allows for easy collaboration, enabling multiple stakeholders to review and sign applications seamlessly. These features streamline the application process and enhance productivity.

-

Is there a cost to use airSlate SignNow for Business Credit Applications in Florida?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs for managing Business Credit Applications in Florida. The plans are competitive and provide access to essential features, enabling businesses to choose the right option based on their volume of applications and usage requirements. Contact our sales team for detailed pricing information.

-

What are the benefits of using airSlate SignNow for Business Credit Applications?

Using airSlate SignNow for your Business Credit Application in Florida provides several benefits, including increased efficiency, reduced paperwork, and enhanced compliance with legal standards. The platform’s easy-to-use interface minimizes the complexity often associated with traditional application processes. Additionally, digital storage of documents ensures easy access and retrieval.

-

Can I integrate airSlate SignNow with other software for my Business Credit Application in Florida?

Yes, airSlate SignNow offers integrations with numerous applications and services, making it easy to incorporate it into your existing workflows for Business Credit Applications in Florida. This means you can connect with CRM systems, accounting software, and other tools to streamline your processes further. Check our integration options for more information.

-

How secure is using airSlate SignNow for Business Credit Applications in Florida?

airSlate SignNow takes security seriously, ensuring that all Business Credit Applications in Florida submitted through the platform are encrypted and stored securely. The platform complies with industry standards for data protection, providing businesses with the peace of mind that their sensitive information is safeguarded. Regular updates also enhance system security.

Get more for Business Credit Application Florida

Find out other Business Credit Application Florida

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word

- How Can I eSign Hawaii High Tech Form

- How Do I eSign New Mexico Healthcare / Medical Word