Farm Income and Expense Worksheet Form

What is the Farm Income And Expense Worksheet

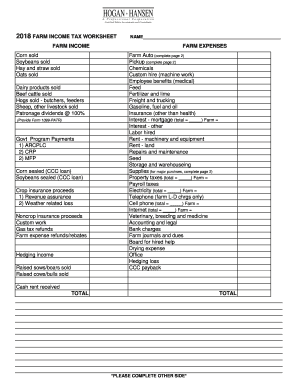

The Farm Income and Expense Worksheet is a crucial tool for farmers and agricultural businesses in the United States. It serves as a comprehensive record for tracking income and expenses related to farming activities. This worksheet is essential for accurate financial reporting and tax preparation, allowing farmers to organize their financial data efficiently. It typically includes sections for various income sources, such as crop sales and livestock sales, as well as detailed expense categories, including equipment costs, labor, and supplies. Properly completing this worksheet can help ensure compliance with IRS guidelines and facilitate smoother tax filing processes.

How to use the Farm Income And Expense Worksheet

Using the Farm Income and Expense Worksheet involves several straightforward steps. First, gather all financial records related to your farming activities, including receipts, invoices, and bank statements. Next, categorize your income and expenses according to the sections provided in the worksheet. For income, list all sources such as sales from crops or livestock. For expenses, include costs like feed, seed, maintenance, and utilities. After filling out the worksheet, review it for accuracy and completeness. This organized approach not only aids in tax preparation but also provides insights into your farm's financial health.

Steps to complete the Farm Income And Expense Worksheet

Completing the Farm Income and Expense Worksheet involves a systematic approach to ensure accuracy. Follow these steps:

- Collect all relevant financial documents, including receipts and invoices.

- Fill in the income section, detailing all sources of revenue from your farming operations.

- Complete the expense section by categorizing all costs associated with the farm.

- Double-check all entries for accuracy, ensuring that totals are correctly calculated.

- Save the completed worksheet in a secure format, such as a PDF, for easy access during tax filing.

Legal use of the Farm Income And Expense Worksheet

The Farm Income and Expense Worksheet is legally recognized as a valid document for tax purposes when filled out correctly. It is essential to comply with IRS regulations, which stipulate that accurate records of income and expenses must be maintained for tax reporting. Utilizing a reliable electronic signature tool, such as signNow, can enhance the legal standing of your completed worksheet. This ensures that the document is securely signed and stored, providing an additional layer of protection against disputes or audits.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the Farm Income and Expense Worksheet. Farmers must adhere to these guidelines to ensure compliance and avoid penalties. Key points include maintaining accurate records of all income and expenses, using the worksheet to summarize financial data for tax returns, and retaining copies of the worksheet for at least three years. Understanding these guidelines is vital for effective tax planning and compliance, helping to prevent potential issues during audits.

Form Submission Methods (Online / Mail / In-Person)

The completed Farm Income and Expense Worksheet can be submitted through various methods, depending on your preference and the requirements of the IRS. Common submission methods include:

- Online submission through tax preparation software, which often integrates the worksheet into the filing process.

- Mailing a printed copy of the worksheet along with your tax return to the appropriate IRS address.

- In-person submission at local IRS offices, if needed for specific inquiries or assistance.

Examples of using the Farm Income And Expense Worksheet

Practical examples of using the Farm Income and Expense Worksheet can illustrate its importance. For instance, a farmer might use the worksheet to track the profitability of different crops. By categorizing income and expenses by crop type, the farmer can identify which crops yield the highest profits. Additionally, during tax season, having a well-organized worksheet simplifies the process of reporting income and claiming deductions. These examples highlight the worksheet's role in effective farm management and financial planning.

Quick guide on how to complete farm income and expense worksheet

Effortlessly prepare Farm Income And Expense Worksheet on any device

Digital document management has gained popularity among organizations and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed papers, as you can easily access the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage Farm Income And Expense Worksheet on any device with the airSlate SignNow apps for Android or iOS and simplify any document-related operation today.

The optimal way to edit and eSign Farm Income And Expense Worksheet seamlessly

- Locate Farm Income And Expense Worksheet and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Choose how you wish to deliver your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require new document copies to be printed. airSlate SignNow addresses your document management needs in a few clicks from any device of your preference. Edit and eSign Farm Income And Expense Worksheet and ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the farm income and expense worksheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a farm income and expense worksheet PDF?

A farm income and expense worksheet PDF is a financial document designed to help farmers track their income and expenses effectively. This worksheet allows users to input various financial data, ensuring accurate record-keeping and financial management. By utilizing our farm income and expense worksheet PDF, farmers can gain clearer insights into their fiscal performance.

-

How can I create a farm income and expense worksheet PDF using airSlate SignNow?

To create a farm income and expense worksheet PDF with airSlate SignNow, simply access our user-friendly platform and select the template for the worksheet. You can then customize it to fit your specific needs and fill in the necessary financial information. Once completed, you can download your personalized farm income and expense worksheet PDF for easy access.

-

What are the key features of the farm income and expense worksheet PDF offered by airSlate SignNow?

The farm income and expense worksheet PDF includes sections for categorizing different income streams and expenses, as well as automatic calculations for totals. Additionally, users can integrate other digital tools for seamless document management and eSigning capabilities. This ensures efficient data handling and simplifies the overall process for farmers.

-

Is the farm income and expense worksheet PDF included in my airSlate SignNow subscription?

Yes, the farm income and expense worksheet PDF is included in various airSlate SignNow subscription plans, making it accessible for users. Depending on your chosen plan, you may benefit from additional features that enhance document management and signing. Check your subscription details for specific offerings related to the farm income and expense worksheet PDF.

-

What are the benefits of using a farm income and expense worksheet PDF?

Using a farm income and expense worksheet PDF helps in organizing your financial records and prepares you for tax season. It promotes better financial insight, allowing for more informed decision-making in your farming operations. Moreover, it simplifies the tracking of income and expenses, leading to enhanced profitability.

-

Can I integrate my farm income and expense worksheet PDF with other applications?

Absolutely! AirSlate SignNow allows you to integrate your farm income and expense worksheet PDF with various third-party applications like accounting software. This ensures that your financial data syncs seamlessly across platforms, streamlining your record-keeping process and improving efficiency.

-

How secure is my financial information in the farm income and expense worksheet PDF?

Your financial information within the farm income and expense worksheet PDF is highly secure with airSlate SignNow. Our platform uses advanced encryption and security protocols to protect all sensitive data. You can confidently manage your financials knowing that your information is safe and secure.

Get more for Farm Income And Expense Worksheet

Find out other Farm Income And Expense Worksheet

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors