Individual Credit Application Florida Form

What is the Individual Credit Application Florida

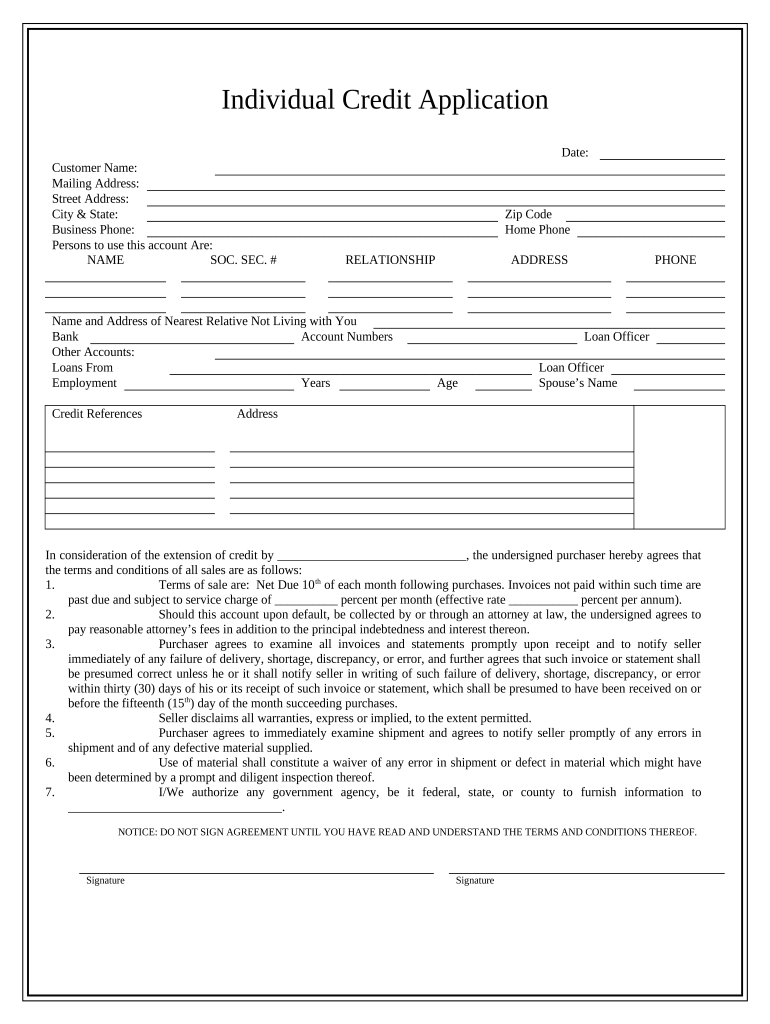

The Individual Credit Application Florida is a formal document used by individuals seeking credit from financial institutions, lenders, or service providers within the state of Florida. This application collects essential personal and financial information to assess the applicant's creditworthiness. It typically requires details such as the applicant's name, address, Social Security number, employment information, income, and any existing debts. Understanding this form is crucial for anyone looking to secure loans, credit cards, or other financial products in Florida.

Steps to Complete the Individual Credit Application Florida

Completing the Individual Credit Application Florida involves several key steps to ensure accuracy and compliance. Here’s a straightforward guide:

- Gather necessary documents: Collect identification, proof of income, and any other relevant financial information.

- Fill out personal information: Enter your full name, address, and Social Security number accurately.

- Provide employment details: Include your current employer's name, address, and your position.

- Disclose financial information: List your income, monthly expenses, and any outstanding debts.

- Review the application: Check for any errors or omissions before submission.

- Submit the application: Follow the specified submission method, whether online, by mail, or in person.

Legal Use of the Individual Credit Application Florida

The Individual Credit Application Florida must comply with various legal standards to be considered valid. It is essential that the application is filled out truthfully, as providing false information can lead to legal consequences, including denial of credit or potential fraud charges. Additionally, the application must adhere to state and federal regulations regarding privacy and data protection. Utilizing a secure platform for submission, such as eSignature services, can help ensure that the application is legally binding and protected under laws like ESIGN and UETA.

Key Elements of the Individual Credit Application Florida

Several key elements are critical to the Individual Credit Application Florida. These components ensure that lenders can adequately assess the applicant's financial situation:

- Personal Identification: This includes the applicant's name, address, and Social Security number.

- Employment Information: Details about the applicant's job and employer.

- Financial History: Information regarding income, existing debts, and credit history.

- Consent for Credit Check: A section where the applicant authorizes the lender to perform a credit check.

State-Specific Rules for the Individual Credit Application Florida

Florida has specific regulations governing the use of Individual Credit Applications. These rules may include requirements for disclosures regarding interest rates, fees, and the rights of the applicant. Lenders must also comply with the Fair Credit Reporting Act, which mandates how credit information is collected, used, and shared. Understanding these state-specific rules is vital for both applicants and lenders to ensure compliance and protect consumer rights.

Application Process & Approval Time

The application process for the Individual Credit Application Florida generally involves several stages. After submission, lenders will review the application, which may take anywhere from a few minutes to several days, depending on the lender's policies and the complexity of the application. During this time, the lender may conduct a credit check and verify the information provided. Once the review is complete, the applicant will receive a decision regarding their credit request, along with any terms and conditions associated with the credit offer.

Quick guide on how to complete individual credit application florida

Complete Individual Credit Application Florida effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can easily find the necessary form and securely save it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly and without interruptions. Manage Individual Credit Application Florida on any device with airSlate SignNow Android or iOS applications and enhance any document-related task today.

The easiest way to edit and electronically sign Individual Credit Application Florida effortlessly

- Find Individual Credit Application Florida and then click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and then click the Done button to save your modifications.

- Select how you wish to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tiring form searches, or errors that require printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Modify and electronically sign Individual Credit Application Florida and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Individual Credit Application Florida?

An Individual Credit Application Florida is a document used for applying for credit or loans in the state of Florida. This form collects personal and financial information to assess the creditworthiness of the applicant. By utilizing airSlate SignNow, users can easily eSign and send their applications securely.

-

How can airSlate SignNow help with the Individual Credit Application Florida?

airSlate SignNow simplifies the process of completing the Individual Credit Application Florida by allowing users to fill out and sign documents online. The platform provides a user-friendly interface for both applicants and lenders, making it easier to manage the application workflow and reduce processing time.

-

What features does airSlate SignNow offer for the Individual Credit Application Florida?

AirSlate SignNow offers features such as eSignature capabilities, document templates, and secure file storage for the Individual Credit Application Florida. Users can also track document status in real-time and automate reminders, ensuring a smooth application process and timely submissions.

-

Is there a cost to use airSlate SignNow for the Individual Credit Application Florida?

Yes, there are subscription plans available for airSlate SignNow that provide various pricing tiers based on your needs. These plans allow for unlimited signing and document management features tailored to the Individual Credit Application Florida. A free trial is often available to help you evaluate the service before committing.

-

Can I integrate airSlate SignNow with other software for processing the Individual Credit Application Florida?

Absolutely! airSlate SignNow offers various integration options with popular CRM and document management software. This allows for seamless processing of the Individual Credit Application Florida with other tools your business may already use, enhancing productivity and data management.

-

What benefits can I expect from using airSlate SignNow for the Individual Credit Application Florida?

Using airSlate SignNow for the Individual Credit Application Florida can signNowly reduce the time taken to process applications. The platform enhances security with encrypted eSignatures, provides convenient access from various devices, and helps businesses streamline operations through efficient document management.

-

Is airSlate SignNow compliant with financial industry regulations for Individual Credit Application Florida?

Yes, airSlate SignNow is designed to comply with various financial industry regulations, ensuring the safe handling of the Individual Credit Application Florida. The platform uses advanced security measures such as encryption and audit trails to protect sensitive applicant information and maintain compliance.

Get more for Individual Credit Application Florida

- Body composition analysis form bwellnessncbbcomb

- Superior grocers employee handbook form

- 6th grade math minutes pdf form

- Daylight trucking form

- Medicare abn form printable

- Dental claim bform electricalb welfare trust fund ewtf

- Uss berkeley ddg 15 association form

- Minor release and waiver of liability and indemnity form

Find out other Individual Credit Application Florida

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free