Non Foreign Affidavit under IRC 1445 Florida Form

What is the Non Foreign Affidavit Under IRC 1445 Florida

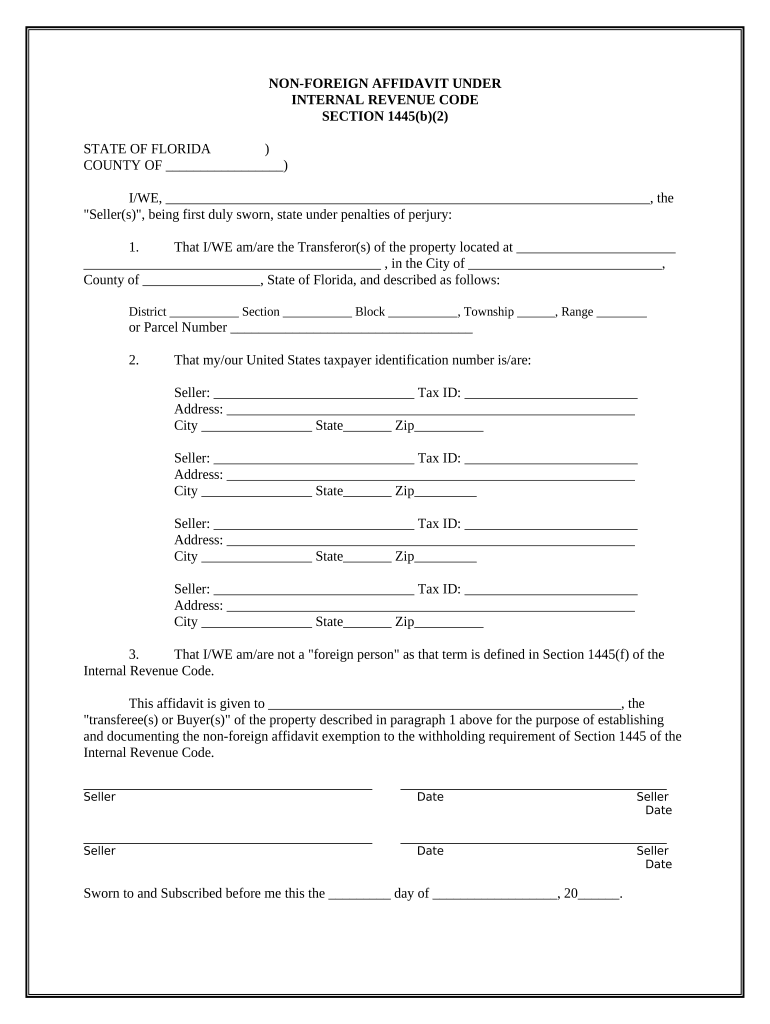

The Non Foreign Affidavit Under IRC 1445 in Florida is a legal document used primarily in real estate transactions. This affidavit certifies that the seller of a property is not a foreign person, which is crucial for compliance with U.S. tax laws. Under the Internal Revenue Code Section 1445, buyers must withhold a portion of the sale price if the seller is a foreign entity. This affidavit helps to confirm the seller's status, thereby protecting the buyer from potential tax liabilities associated with foreign sellers.

How to Use the Non Foreign Affidavit Under IRC 1445 Florida

To utilize the Non Foreign Affidavit Under IRC 1445 in Florida, the seller must complete the form accurately. The seller needs to provide essential information, including their name, address, and tax identification number. Once completed, the affidavit should be signed in front of a notary public to ensure its validity. The buyer will then present this document during the closing process to confirm the seller's non-foreign status, which is essential for avoiding withholding taxes.

Steps to Complete the Non Foreign Affidavit Under IRC 1445 Florida

Completing the Non Foreign Affidavit Under IRC 1445 involves several key steps:

- Obtain the affidavit form from a reliable source or legal advisor.

- Fill in your personal information, including your full name, address, and tax identification number.

- Certify that you are not a foreign person by checking the appropriate box.

- Sign the affidavit in the presence of a notary public to authenticate the document.

- Submit the completed affidavit to the buyer during the property closing.

Key Elements of the Non Foreign Affidavit Under IRC 1445 Florida

Several key elements must be included in the Non Foreign Affidavit Under IRC 1445 to ensure its effectiveness:

- Seller's Information: Full name, address, and tax identification number.

- Certification Statement: A declaration confirming that the seller is not a foreign person.

- Signature: The seller's signature, which must be notarized to validate the affidavit.

- Date: The date on which the affidavit is signed.

Legal Use of the Non Foreign Affidavit Under IRC 1445 Florida

The Non Foreign Affidavit Under IRC 1445 serves a critical legal function in real estate transactions. By providing this affidavit, sellers protect buyers from potential withholding tax obligations. If a buyer fails to withhold the required tax due to an incorrect assumption about the seller's status, they may face significant penalties from the IRS. Thus, the affidavit is not only a formality but a necessary legal safeguard for both parties involved in the transaction.

Filing Deadlines / Important Dates

While there are no specific filing deadlines for the Non Foreign Affidavit itself, it is essential to submit the affidavit during the closing of the property sale. The timing is crucial to ensure compliance with tax withholding requirements. Buyers should be aware of the IRS guidelines regarding withholding taxes, which typically require action at the time of the property transfer. Therefore, it is advisable to prepare the affidavit well in advance of the closing date to avoid any last-minute issues.

Quick guide on how to complete non foreign affidavit under irc 1445 florida

Easily prepare Non Foreign Affidavit Under IRC 1445 Florida on any device

Managing documents online has gained signNow traction among businesses and individuals. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow provides you with all the tools you need to create, edit, and electronically sign your documents quickly and effortlessly. Handle Non Foreign Affidavit Under IRC 1445 Florida on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to edit and electronically sign Non Foreign Affidavit Under IRC 1445 Florida effortlessly

- Obtain Non Foreign Affidavit Under IRC 1445 Florida and click on Get Form to begin.

- Use the tools we offer to complete your form.

- Mark important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and has the same legal validity as a traditional ink signature.

- Verify the information and click on the Done button to save your changes.

- Select your preferred method for sending your form: by email, SMS, invite link, or download it to your computer.

Forget about lost or misfiled documents, tedious searches for forms, or errors that necessitate reprinting new copies. airSlate SignNow meets your document management needs with just a few clicks from any device. Modify and electronically sign Non Foreign Affidavit Under IRC 1445 Florida while ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Non Foreign Affidavit Under IRC 1445 Florida?

A Non Foreign Affidavit Under IRC 1445 Florida is a legal document that certifies a foreign seller's non-resident status for tax purposes. This affidavit is essential for real estate transactions involving foreign sellers to ensure compliance with IRS regulations.

-

Why do I need a Non Foreign Affidavit Under IRC 1445 Florida?

You need a Non Foreign Affidavit Under IRC 1445 Florida to avoid withholding taxes during the sale of property from foreign sellers. It protects both buyers and sellers and ensures that tax liabilities are correctly reported according to U.S. tax laws.

-

How can airSlate SignNow help with the Non Foreign Affidavit Under IRC 1445 Florida?

airSlate SignNow provides an easy-to-use platform for creating, sending, and eSigning the Non Foreign Affidavit Under IRC 1445 Florida. With our integrated templates, you can save time and ensure legal compliance seamlessly.

-

What features are included in airSlate SignNow for handling Non Foreign Affidavits?

airSlate SignNow includes features such as customizable templates, secure eSigning, document tracking, and cloud storage. These features streamline the management of Non Foreign Affidavit Under IRC 1445 Florida, making the process efficient and hassle-free.

-

Is airSlate SignNow cost-effective for processing Non Foreign Affidavits?

Yes, airSlate SignNow offers competitive pricing plans that suit businesses of all sizes. Our cost-effective solution for managing Non Foreign Affidavit Under IRC 1445 Florida allows you to save on both time and resources.

-

Can I integrate airSlate SignNow with other applications for Non Foreign Affidavit processes?

Absolutely! airSlate SignNow integrates seamlessly with various applications, including CRM systems and cloud storage services. This functionality enhances your ability to manage Non Foreign Affidavit Under IRC 1445 Florida efficiently across different platforms.

-

What are the benefits of using airSlate SignNow for Non Foreign Affidavits?

Using airSlate SignNow for Non Foreign Affidavit Under IRC 1445 Florida simplifies the documentation process, reduces errors, and speeds up transaction times. Our platform enhances collaboration and ensures that you remain compliant with IRS guidelines.

Get more for Non Foreign Affidavit Under IRC 1445 Florida

- Nace standard sp0204 stress corrosion cracking scc direct assessment methodology nace form

- Vsa 39 dmv form

- Who moved my cheese worksheet pdf form

- Echs application format

- Counting atoms practice answer key 455977565 form

- Dhs 4159a eng adult mental health rehabilitative services authorization form this form must be attached to authorization form

- St marys feeding program introducing new foods form

- Radiology requisition form

Find out other Non Foreign Affidavit Under IRC 1445 Florida

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement