Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children Florida Form

What is the Living Trust for Individual Who Is Single, Divorced or Widow or Widower With No Children in Florida

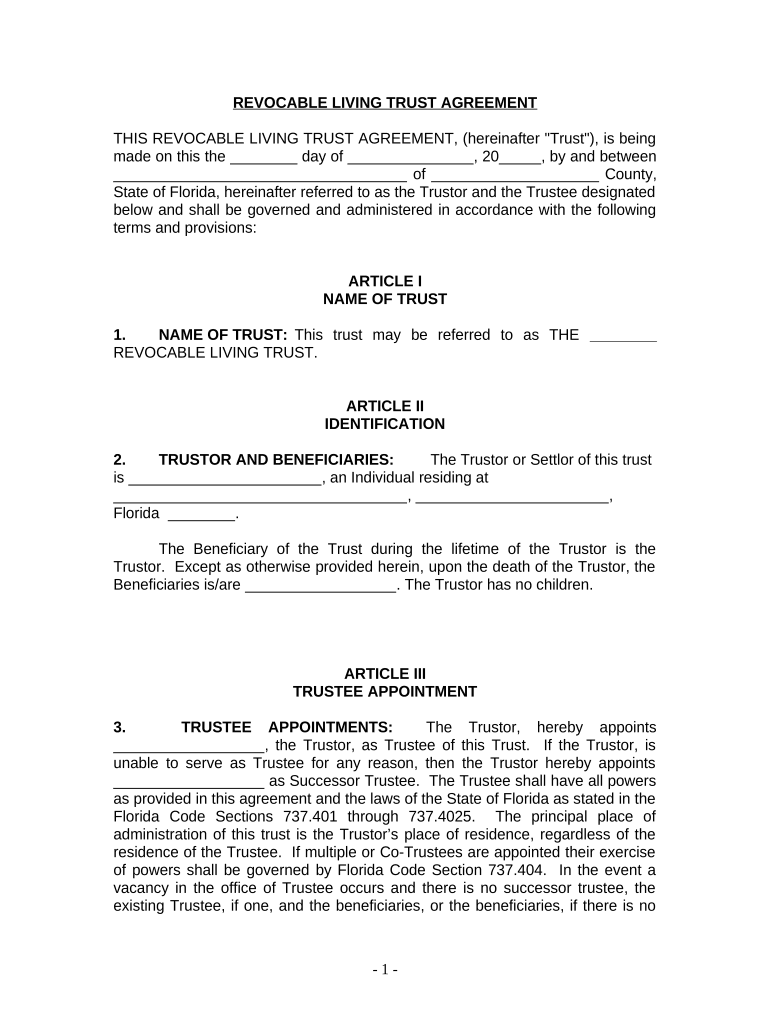

A living trust is a legal document that allows individuals to manage their assets during their lifetime and specify how those assets should be distributed after death. For individuals who are single, divorced, or widowed with no children in Florida, a living trust can serve as an effective estate planning tool. It helps avoid probate, offers privacy, and allows for the seamless transfer of assets to beneficiaries. This type of trust can be tailored to meet specific needs, ensuring that the individual’s wishes are honored regarding asset distribution.

Steps to Complete the Living Trust for Individual Who Is Single, Divorced or Widow or Widower With No Children in Florida

Completing a living trust involves several important steps:

- Identify your assets: List all assets you want to include in the trust, such as real estate, bank accounts, and investments.

- Choose a trustee: Select a reliable individual or institution to manage the trust. As a single individual, you can also choose yourself as the trustee.

- Draft the trust document: Create the trust document, outlining how assets will be managed and distributed. This may require legal assistance to ensure compliance with Florida laws.

- Sign the document: Execute the trust in accordance with Florida law, which may include notarization and witnessing.

- Fund the trust: Transfer ownership of your assets into the trust. This step is crucial for the trust to be effective.

Legal Use of the Living Trust for Individual Who Is Single, Divorced or Widow or Widower With No Children in Florida

The legal use of a living trust in Florida is governed by state laws. It allows individuals to manage their assets without court intervention. This can be particularly beneficial for those with complex financial situations or specific wishes regarding asset distribution. The trust document must comply with Florida statutes to ensure it is enforceable. Additionally, a properly established living trust can provide protection against creditors and may help in qualifying for certain government benefits.

State-Specific Rules for the Living Trust for Individual Who Is Single, Divorced or Widow or Widower With No Children in Florida

Florida has specific regulations regarding living trusts that individuals must adhere to:

- Trustee requirements: The trustee must be a competent adult or a financial institution authorized to act in Florida.

- Revocability: Most living trusts in Florida are revocable, allowing the creator to modify or dissolve the trust at any time before death.

- Asset transfer: Properly transferring assets into the trust is essential for its effectiveness. This includes changing titles and beneficiary designations.

How to Obtain the Living Trust for Individual Who Is Single, Divorced or Widow or Widower With No Children in Florida

Obtaining a living trust involves several options:

- Consulting an attorney: Engaging a legal professional specializing in estate planning can help ensure the trust meets all legal requirements.

- Using online resources: There are various online platforms that offer templates and guidance for creating a living trust, though caution should be exercised to ensure compliance with Florida law.

- Financial institutions: Some banks and financial advisors offer trust services and can assist in establishing a living trust.

Key Elements of the Living Trust for Individual Who Is Single, Divorced or Widow or Widower With No Children in Florida

Key elements of a living trust include:

- Trustee and beneficiaries: Clearly define who will manage the trust and who will benefit from it.

- Asset description: Provide a detailed list of assets included in the trust.

- Distribution instructions: Outline how and when the assets will be distributed to beneficiaries after death.

- Revocation clause: Include provisions that allow the trust to be revoked or amended as needed.

Quick guide on how to complete living trust for individual who is single divorced or widow or widower with no children florida

Complete Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children Florida effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed papers, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents promptly without delay. Manage Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children Florida on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to alter and eSign Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children Florida with minimal effort

- Locate Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children Florida and click on Get Form to begin.

- Use the tools available to complete your document.

- Highlight pertinent sections of your documents or obscure sensitive information with the tools specifically offered by airSlate SignNow for this purpose.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a standard handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to deliver your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children Florida and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children Florida?

A Living Trust for individuals who are single, divorced, or widowed with no children in Florida is a legal document that allows you to manage your assets during your lifetime and details how they will be distributed after your passing. This type of trust can help avoid probate, ensuring that your wishes are fulfilled without lengthy court proceedings.

-

How much does a Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children Florida cost?

The cost of setting up a Living Trust for individuals who are single, divorced, or widowed with no children in Florida can vary depending on the complexity of your assets and the services you choose. Typically, costs can range from a few hundred to a few thousand dollars, but many find it worthwhile for the peace of mind it provides.

-

What are the benefits of a Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children Florida?

A Living Trust provides several benefits for individuals who are single, divorced, or widowed with no children in Florida, including avoiding probate, maintaining privacy, and having control over asset distribution. It simplifies the management of your assets and can expedite the transfer process, providing you and your heirs with a smoother experience.

-

Can I change my Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children Florida after it's created?

Yes, one of the key features of a Living Trust for individuals who are single, divorced, or widowed with no children in Florida is that it is revocable. This means that you can modify the trust, add or remove assets, and change beneficiaries as your situation or intentions change over time.

-

Do I need an attorney to set up a Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children Florida?

While it's possible to create a Living Trust without an attorney, it is highly recommended to consult with one to ensure that your Living Trust for individuals who are single, divorced, or widowed with no children in Florida complies with state laws and accurately reflects your wishes. An attorney can provide valuable guidance and help prevent legal issues in the future.

-

How does a Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children Florida interact with my other estate planning documents?

A Living Trust works in conjunction with other estate planning documents such as wills, powers of attorney, and healthcare directives. It's essential to coordinate these documents to ensure that your wishes are clearly outlined and legally enforceable for your estate after your death.

-

Can I manage my own Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children Florida?

Yes, you can serve as the trustee of your Living Trust for individuals who are single, divorced, or widowed with no children in Florida, allowing you to manage your assets while you are alive. This self-management is one of the primary advantages, giving you full control over your financial affairs.

Get more for Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children Florida

Find out other Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children Florida

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple