Simple Ira Salary Deferral Election Form

What is the Simple IRA Salary Deferral Election Form

The Simple IRA salary deferral election form is a critical document used by employees to indicate their choice regarding contributions to a Simple IRA plan. This form allows employees to decide how much of their salary they wish to defer into their retirement account. It is essential for both employers and employees to understand the implications of this election, as it directly affects retirement savings and tax obligations.

Steps to Complete the Simple IRA Salary Deferral Election Form

Completing the Simple IRA salary deferral election form involves several straightforward steps. First, employees need to gather necessary personal information, including their Social Security number and employment details. Next, they should indicate the percentage or dollar amount they wish to contribute from each paycheck. After filling out the form, employees must sign and date it to validate their election. Finally, the completed form should be submitted to the employer for processing.

Legal Use of the Simple IRA Salary Deferral Election Form

The Simple IRA salary deferral election form must comply with specific legal requirements to be considered valid. This includes ensuring that the form is signed by the employee and submitted within the designated election period. Employers are responsible for maintaining records of these forms to comply with IRS regulations. Additionally, understanding the legal implications of the contributions made can help employees avoid potential penalties associated with improper deferrals.

IRS Guidelines

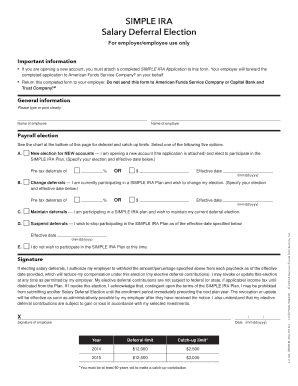

The Internal Revenue Service (IRS) provides guidelines regarding the use of the Simple IRA salary deferral election form. These guidelines outline contribution limits, eligibility criteria, and deadlines for making elections. Employees should familiarize themselves with these regulations to ensure their contributions are compliant and to maximize their retirement savings. For example, the IRS sets annual contribution limits that employees must adhere to when completing their forms.

Filing Deadlines / Important Dates

Filing deadlines for the Simple IRA salary deferral election form are crucial for employees to consider. Typically, employees must submit their elections before the start of the plan year to ensure their contributions are effective for that year. It is important to check with the employer for specific deadlines, as they can vary. Missing these deadlines may result in the inability to defer salary for that year, impacting retirement savings.

Eligibility Criteria

Eligibility to participate in a Simple IRA plan and use the salary deferral election form generally includes employees who have earned at least a specified amount in the previous year and have worked for the employer for a certain period. Employers may also set additional criteria for participation. Understanding these requirements is essential for employees to determine their ability to contribute to a Simple IRA and make informed decisions regarding their retirement planning.

Who Issues the Form

The Simple IRA salary deferral election form is typically issued by the employer sponsoring the Simple IRA plan. Employers are responsible for providing this form to eligible employees and ensuring that they understand how to complete it. Additionally, employers must maintain copies of the submitted forms for compliance and record-keeping purposes, ensuring that all contributions are processed accurately and in accordance with IRS regulations.

Quick guide on how to complete simple ira salary deferral election form

Manage Simple Ira Salary Deferral Election Form easily on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Simple Ira Salary Deferral Election Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to adjust and electronically sign Simple Ira Salary Deferral Election Form effortlessly

- Locate Simple Ira Salary Deferral Election Form and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark signNow sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Verify all the information and click on the Done button to save your alterations.

- Choose how you want to submit your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Adjust and electronically sign Simple Ira Salary Deferral Election Form and ensure seamless communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the simple ira salary deferral election form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a SIMPLE IRA salary deferral election?

A SIMPLE IRA salary deferral election is an arrangement that allows employees to defer a portion of their salary into a SIMPLE IRA account. This election is beneficial for saving for retirement while enjoying potential tax advantages. By making a SIMPLE IRA salary deferral election, employees can take control of their financial future.

-

How does a SIMPLE IRA salary deferral election benefit employees?

The main benefit of a SIMPLE IRA salary deferral election is the ability to invest pre-tax dollars, which can lead to signNow growth over time. This election also helps employees prepare for retirement by building their savings in a tax-advantaged account. Additionally, financial flexibility is enhanced by allowing employees to contribute a certain percentage of their salaries.

-

What is the contribution limit for a SIMPLE IRA salary deferral election?

For 2023, the contribution limit for a SIMPLE IRA salary deferral election is $15,500, with an additional catch-up contribution of $3,500 for those aged 50 and older. These limits allow for a substantial amount to be set aside for retirement each year. It's important to review these limits annually, as they may change.

-

How do employees make a SIMPLE IRA salary deferral election?

Employees can make a SIMPLE IRA salary deferral election by completing the required paperwork as provided by their employer. This process typically involves choosing a percentage of their salary to defer into their SIMPLE IRA. Once elected, the deferral will be automatically deducted from their paychecks.

-

Are there any tax implications with a SIMPLE IRA salary deferral election?

Yes, contributions made through a SIMPLE IRA salary deferral election are made before taxes, which can lower your taxable income. This deferral allows employees to save on taxes now while building retirement savings. However, taxes will apply when the money is withdrawn during retirement.

-

Can employer contributions be made alongside a SIMPLE IRA salary deferral election?

Yes, employers can make contributions in addition to employee salary deferral elections through a SIMPLE IRA. They are required to match employee contributions up to a certain percentage or can opt for a non-elective contribution. This creates an attractive retirement savings option for employees.

-

What features does airSlate SignNow offer for managing SIMPLE IRA salary deferral elections?

airSlate SignNow provides a user-friendly platform to manage and eSign documents related to SIMPLE IRA salary deferral elections. Features include document templates, electronic signatures, and secure storage of important paperwork. This ensures a streamlined process for both employers and employees, making retirement planning simpler.

Get more for Simple Ira Salary Deferral Election Form

- Agreement to enter into a lease form 1114 rev bb ocean wave team

- Genre and subgenre worksheet 4 reading worksheets form

- Clauses at the mall form

- Onomatopoeia worksheet form

- Eib local 25 form

- Darul yatama bursary form

- Cd 322 child care staff health assessment pagov form

- Trespass letter city of santa rosa form

Find out other Simple Ira Salary Deferral Election Form

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple