Living Trust for Individual, Who is Single, Divorced or Widow or Widower with Children Florida Form

What is the Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Florida

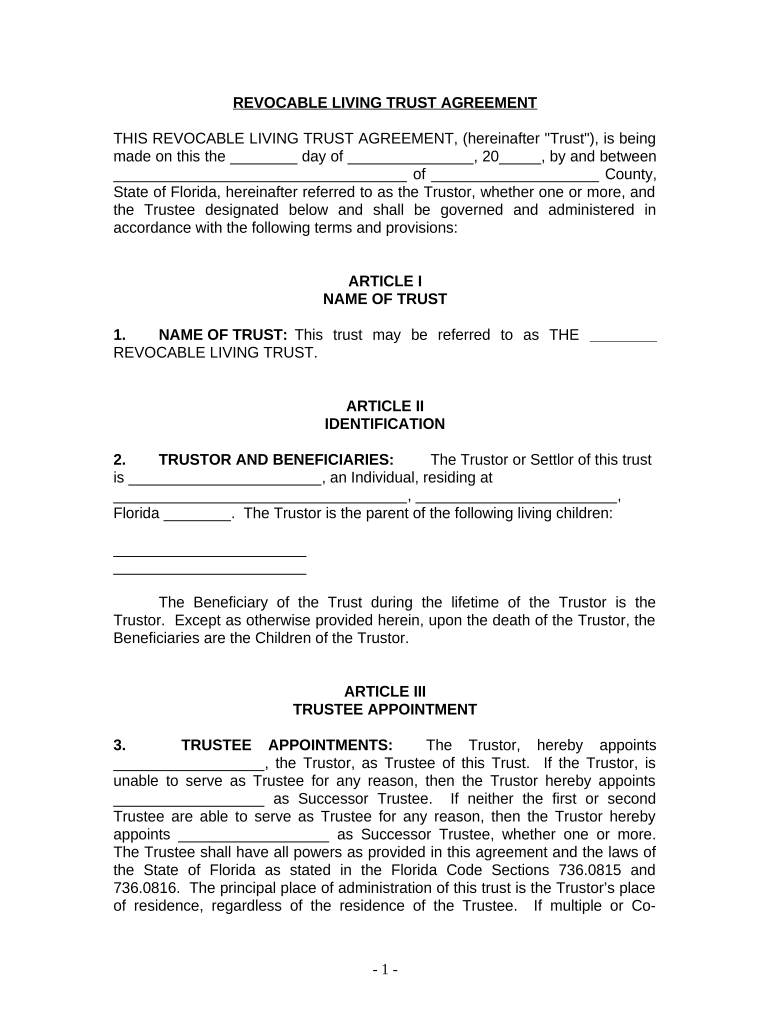

A living trust for individuals who are single, divorced, or widowed with children in Florida is a legal document that allows a person to manage their assets during their lifetime and specify how those assets should be distributed after their death. This type of trust is particularly beneficial for individuals in these circumstances, as it provides a way to ensure that their children are taken care of and that their wishes are honored without the need for probate. The trust can hold various types of assets, including real estate, bank accounts, and investments, making it a flexible estate planning tool.

How to use the Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Florida

Using a living trust involves several key steps. First, the individual must create the trust document, which outlines the terms of the trust, including the trustee's powers and the beneficiaries. Next, assets must be transferred into the trust. This process, known as "funding the trust," involves changing the title of assets from the individual's name to the name of the trust. Once the trust is established and funded, the individual can manage the assets as needed. Upon their passing, the trustee will distribute the assets according to the instructions laid out in the trust document, ensuring a smooth transition for the beneficiaries.

Key elements of the Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Florida

Several key elements define a living trust for individuals in these situations. These include:

- Trustee: The person or entity responsible for managing the trust assets.

- Beneficiaries: The individuals or entities who will receive the trust assets after the grantor's death.

- Revocability: Most living trusts are revocable, meaning the grantor can alter or dissolve the trust at any time during their lifetime.

- Asset management: The trust allows for the management of assets during the grantor's lifetime, providing flexibility and control.

Steps to complete the Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Florida

Completing a living trust involves several important steps:

- Determine your assets: Identify all assets you wish to include in the trust.

- Choose a trustee: Decide who will manage the trust, whether it be yourself, a family member, or a professional.

- Draft the trust document: Create the legal document that outlines the trust's terms and conditions.

- Fund the trust: Transfer ownership of your assets into the trust.

- Review and update: Regularly review the trust to ensure it reflects your current wishes and circumstances.

State-specific rules for the Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Florida

In Florida, specific rules apply to living trusts. These include the requirement that the trust must be in writing and signed by the grantor. Additionally, Florida law allows for both revocable and irrevocable trusts, with revocable trusts being more common for estate planning. It is also essential to ensure that the trust complies with Florida's laws regarding the distribution of assets, particularly concerning minor children and guardianship provisions. Consulting with a legal professional familiar with Florida estate law can help ensure compliance and effectiveness.

Legal use of the Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Florida

The legal use of a living trust in Florida is recognized for its ability to avoid probate, which can be a lengthy and costly process. By establishing a living trust, individuals can streamline the transfer of their assets upon death, providing a clear and legally binding framework for asset distribution. Furthermore, the trust can help maintain privacy, as it does not become a matter of public record like a will does. It is crucial to ensure that the trust is properly funded and maintained to uphold its legal standing and effectiveness in estate planning.

Quick guide on how to complete living trust for individual who is single divorced or widow or widower with children florida

Effortlessly Prepare Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Florida on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly and without delays. Manage Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Florida on any device using airSlate SignNow's Android or iOS applications, and enhance your document-centric processes today.

How to Modify and Electronically Sign Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Florida with Ease

- Locate Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Florida and click on Get Form to begin.

- Make use of our available tools to fill out your document.

- Select pertinent parts of the documents or redact sensitive information using the tools provided by airSlate SignNow specifically for this purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns over missing or lost files, tedious form searches, or errors that necessitate printing new copies of documents. airSlate SignNow meets your document management needs with just a few clicks from your chosen device. Edit and electronically sign Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Florida to guarantee outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Florida?

A Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Florida is a legal arrangement that allows you to manage your assets during your lifetime and specify how they should be distributed after your death. This type of trust can help avoid probate, ensuring your children receive their inheritance promptly and efficiently.

-

How much does creating a Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Florida cost?

The costs for establishing a Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Florida can vary widely based on complexity and legal assistance needed. Typically, you might expect to invest in legal fees ranging from a few hundred to several thousand dollars. It's important to consider this investment for the peace of mind and protection it offers for your children.

-

What are the main benefits of setting up a Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Florida?

A Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Florida provides numerous benefits, such as avoiding the lengthy probate process, maintaining privacy regarding asset distribution, and allowing for greater control over how your assets are managed after your passing. This ensures your children's future is safeguarded and handled according to your wishes.

-

How does a Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Florida integrate with other estate planning tools?

A Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Florida can work in harmony with wills, powers of attorney, and healthcare directives. These tools combined create a comprehensive estate plan, ensuring all aspects of your wishes regarding asset distribution and healthcare decisions are covered, providing firmly for your children.

-

Can I change or revoke my Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Florida?

Yes, one of the great advantages of a Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Florida is that you can alter or revoke it at any time while you are still alive and mentally competent. This provides the flexibility to adapt your estate plan as your life circumstances change, ensuring your children’s needs are always prioritized.

-

What happens to my Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Florida if I move to another state?

If you move to another state, your Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Florida generally remains valid. However, it is wise to consult with an attorney in your new state of residence to ensure compliance with local laws and make any necessary adjustments to your trust effectively.

-

Is my Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Florida protected from creditors?

A Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Florida can offer some protection from creditors, as assets held in a trust are generally not directly accessible to creditors. However, it's essential to seek legal advice to understand the specific implications and protections that might apply in your situation.

Get more for Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Florida

Find out other Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Florida

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile

- eSignature North Carolina Proforma Invoice Template Easy

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy