Living Trust for Husband and Wife with Minor and or Adult Children Florida Form

Understanding the Living Trust for Couples with Children in Florida

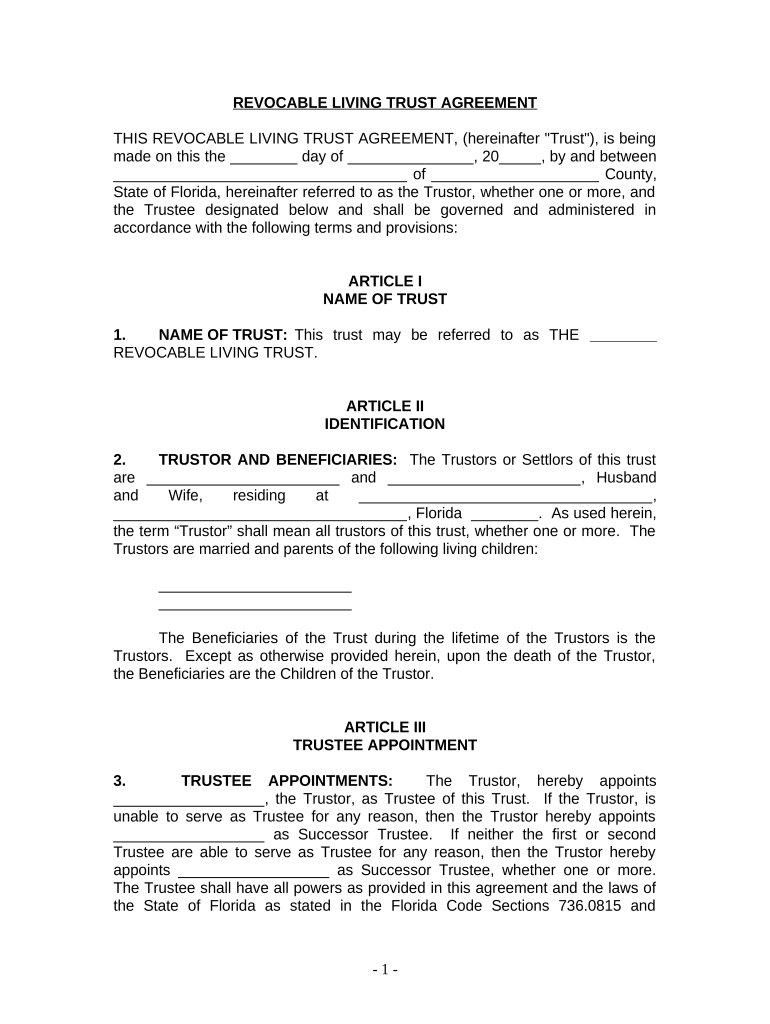

A living trust for husband and wife with minor and/or adult children in Florida is a legal arrangement that allows couples to manage their assets during their lifetime and specify how those assets will be distributed after their passing. This type of trust is revocable, meaning that the creators can alter or dissolve it as their circumstances change. It provides a way to avoid probate, ensuring a smoother transition of assets to beneficiaries. Additionally, it can help in managing the financial affairs of minor children until they reach adulthood.

Steps to Create a Living Trust in Florida

Creating a living trust in Florida involves several key steps:

- Determine your assets: List all properties and financial accounts you wish to include in the trust.

- Choose a trustee: Select a reliable person or institution to manage the trust.

- Draft the trust document: This document outlines the terms of the trust, including how assets will be managed and distributed.

- Fund the trust: Transfer ownership of your assets into the trust by changing titles and designations.

- Review regularly: Periodically assess the trust to ensure it meets your current needs and goals.

Legal Considerations for Living Trusts in Florida

In Florida, a living trust must meet certain legal requirements to be valid. The trust document must be in writing and signed by the grantor. Additionally, the trust should specify the beneficiaries and how the assets will be managed and distributed. It is also important to ensure that the trust complies with Florida laws regarding estate planning and asset protection. Consulting with an attorney who specializes in estate planning can provide valuable guidance in this process.

Key Elements of a Living Trust in Florida

Several essential components define a living trust in Florida:

- Grantor: The individual(s) who create the trust and transfer assets into it.

- Trustee: The person or entity responsible for managing the trust according to its terms.

- Beneficiaries: Individuals or entities designated to receive the trust assets upon the grantor's death.

- Terms of the trust: Specific instructions on how the assets will be managed and distributed.

Common Scenarios for Using a Living Trust in Florida

A living trust is particularly beneficial in various situations, such as:

- Couples with minor children who want to ensure their children are cared for financially.

- Individuals seeking to avoid probate, which can be time-consuming and costly.

- Those with significant assets who wish to maintain privacy regarding their estate plans.

- People with complex family situations, such as blended families, who want to clearly outline asset distribution.

Obtaining and Completing a Living Trust in Florida

Obtaining a living trust in Florida typically involves working with an estate planning attorney or using reputable online services that provide templates and guidance. Once you have the necessary documents, completing the trust involves filling out the trust agreement, signing it in front of a notary, and transferring assets into the trust. It is crucial to ensure that all legal formalities are observed to maintain the trust's validity.

Quick guide on how to complete living trust for husband and wife with minor and or adult children florida

Easily prepare Living Trust For Husband And Wife With Minor And Or Adult Children Florida on any device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can obtain the correct form and securely preserve it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without any hold-ups. Handle Living Trust For Husband And Wife With Minor And Or Adult Children Florida on any platform with airSlate SignNow Android or iOS applications and streamline any document-related process today.

The simplest way to modify and eSign Living Trust For Husband And Wife With Minor And Or Adult Children Florida effortlessly

- Locate Living Trust For Husband And Wife With Minor And Or Adult Children Florida and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight important sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose your preferred method of delivering your form, whether by email, SMS, invitation link, or by downloading it to your computer.

Eliminate the hassle of lost or misplaced documents, laborious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Living Trust For Husband And Wife With Minor And Or Adult Children Florida and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a living trust in Florida, and how does it work?

A living trust in Florida is a legal document that allows you to manage your assets during your lifetime and specify how they should be distributed after your death. It helps avoid probate, maintains privacy, and provides for management of your affairs if you become incapacitated.

-

What are the benefits of creating a living trust in Florida?

Creating a living trust in Florida can provide several benefits, including avoiding probate, reducing estate taxes, and ensuring a smoother transition of assets to beneficiaries. It also allows for greater control over how and when your assets are distributed.

-

How much does it cost to set up a living trust in Florida?

The cost of setting up a living trust in Florida can vary based on the complexity of your estate and whether you choose to use a legal professional or an online service. Generally, the fees can range from a few hundred to a few thousand dollars, depending on your specific needs and the services provided.

-

Can I modify or revoke my living trust in Florida?

Yes, one of the key features of a revocable living trust in Florida is that you can modify or revoke it at any time as your needs and circumstances change. This flexibility allows you to adapt the trust to new financial situations or family dynamics.

-

Who should be the trustee of my living trust in Florida?

In Florida, you can choose yourself as the trustee of your living trust, which allows you to maintain control over your assets. Alternatively, you can appoint a trusted family member, friend, or a professional trustee to manage the trust, ensuring that it is handled according to your wishes.

-

Are living trusts in Florida only for the wealthy?

No, living trusts in Florida are beneficial for individuals of all income levels. They provide indispensable advantages such as avoiding probate and simplifying asset management, making them a valuable estate planning tool for anyone seeking to protect their assets.

-

How does a living trust in Florida integrate with other estate planning documents?

A living trust in Florida can seamlessly integrate with other estate planning documents, such as wills, durable powers of attorney, and health care directives. This comprehensive approach ensures that all aspects of your estate plan work together to reflect your wishes and provide clarity and protection for your beneficiaries.

Get more for Living Trust For Husband And Wife With Minor And Or Adult Children Florida

Find out other Living Trust For Husband And Wife With Minor And Or Adult Children Florida

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now