Letter to Lienholder to Notify of Trust Florida Form

What is the Letter To Lienholder To Notify Of Trust Florida

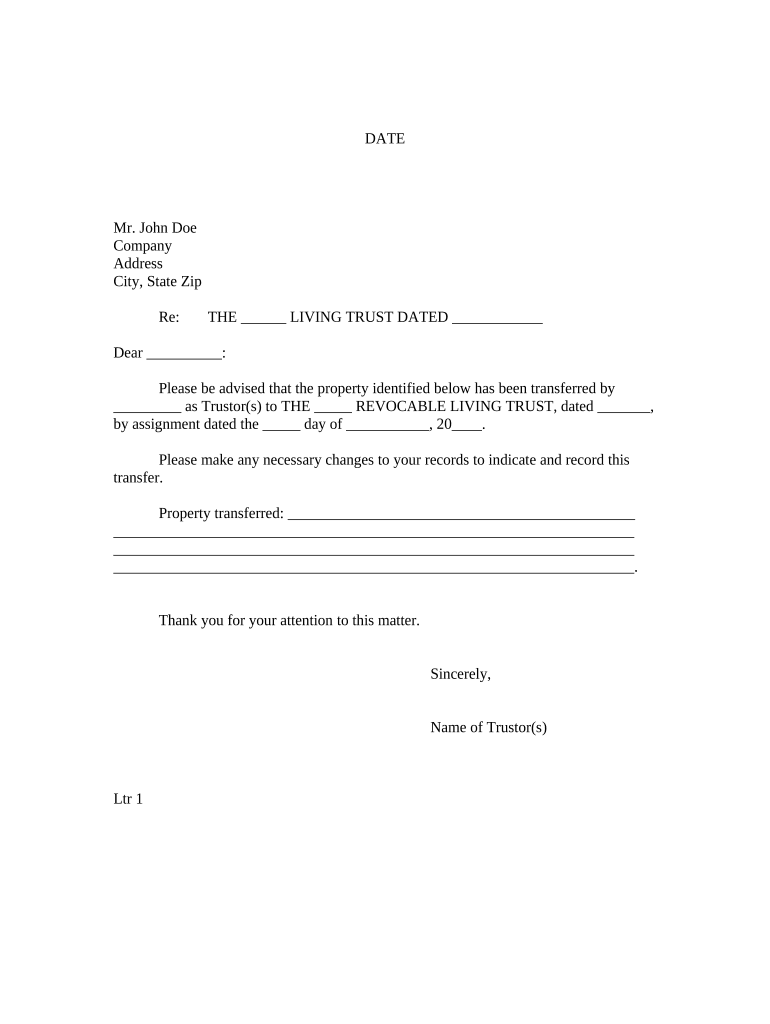

The Letter To Lienholder To Notify Of Trust Florida is a formal document used to inform a lienholder that a property or asset has been transferred into a trust. This letter serves as a notification to the lienholder regarding the change in ownership and management of the asset, ensuring that the lienholder is aware of the trust arrangement. In Florida, this document is crucial for maintaining transparency and compliance with state laws governing trusts and lien agreements.

How to use the Letter To Lienholder To Notify Of Trust Florida

Using the Letter To Lienholder To Notify Of Trust Florida involves several key steps. First, gather all necessary information, including the lienholder's details, trust information, and asset specifics. Next, fill out the letter with accurate and clear information, ensuring it reflects the trust's terms. After completing the letter, send it to the lienholder via certified mail or another secure method to confirm receipt. Keeping a copy for your records is also advisable.

Steps to complete the Letter To Lienholder To Notify Of Trust Florida

Completing the Letter To Lienholder To Notify Of Trust Florida requires careful attention to detail. Follow these steps:

- Identify the lienholder's name and address.

- State the trust's name and date of establishment.

- Provide a description of the asset subject to the lien.

- Clearly indicate the purpose of the letter, notifying the lienholder of the trust.

- Sign the letter, including the date and your contact information.

Legal use of the Letter To Lienholder To Notify Of Trust Florida

The legal use of the Letter To Lienholder To Notify Of Trust Florida is essential for protecting the interests of both the trust and the lienholder. This document ensures that the lienholder is informed about the trust's existence and the asset's status. Proper notification can help prevent potential disputes regarding ownership and lien rights, making it a vital step in trust management.

Key elements of the Letter To Lienholder To Notify Of Trust Florida

Key elements of the Letter To Lienholder To Notify Of Trust Florida include:

- The full name and address of the lienholder.

- The name of the trust and the date it was created.

- A detailed description of the asset involved.

- The purpose of the letter, specifically notifying the lienholder of the trust.

- The signature of the trustee or authorized individual.

State-specific rules for the Letter To Lienholder To Notify Of Trust Florida

In Florida, there are specific rules governing the use of the Letter To Lienholder To Notify Of Trust. It is important to adhere to state laws regarding trust documentation and lien notifications. For instance, the letter must be sent in a manner that provides proof of delivery, such as certified mail. Additionally, the terms of the trust must comply with Florida's trust laws, ensuring that the lienholder's rights are respected and upheld.

Quick guide on how to complete letter to lienholder to notify of trust florida

Effortlessly Complete Letter To Lienholder To Notify Of Trust Florida on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the right forms and securely store them online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents swiftly and without delays. Handle Letter To Lienholder To Notify Of Trust Florida on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to Edit and eSign Letter To Lienholder To Notify Of Trust Florida with Ease

- Locate Letter To Lienholder To Notify Of Trust Florida and select Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow supplies specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all details and click the Done button to save your modifications.

- Choose how you wish to share your form, whether by email, SMS, invite link, or download it to your PC.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate reprinting new documents. airSlate SignNow addresses your document management needs with just a few clicks from any device you prefer. Edit and eSign Letter To Lienholder To Notify Of Trust Florida to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Letter To Lienholder To Notify Of Trust Florida?

A Letter To Lienholder To Notify Of Trust Florida is a formal document that informs a lienholder about a trust arrangement involving a property. This letter is important as it helps clarify ownership and rights over the asset in question, ensuring all parties are notified of the trust's existence.

-

How can airSlate SignNow help me create a Letter To Lienholder To Notify Of Trust Florida?

With airSlate SignNow, you can easily draft a Letter To Lienholder To Notify Of Trust Florida using our user-friendly templates. The platform allows you to customize the letter, ensuring it meets legal requirements while saving time and effort in the document preparation process.

-

Is there a cost associated with sending a Letter To Lienholder To Notify Of Trust Florida using airSlate SignNow?

Yes, airSlate SignNow operates on a subscription model. Pricing is affordable and includes features that enable you to send a Letter To Lienholder To Notify Of Trust Florida efficiently, along with unlimited eSigning capabilities and document management tools.

-

Can I track the status of my Letter To Lienholder To Notify Of Trust Florida when using airSlate SignNow?

Absolutely! airSlate SignNow allows you to track the status of your Letter To Lienholder To Notify Of Trust Florida in real time. You will receive notifications when the document is opened, signed, or completed, providing peace of mind on the process.

-

Are there integrations available with airSlate SignNow for a Letter To Lienholder To Notify Of Trust Florida?

Yes, airSlate SignNow offers various integrations with popular applications and software, making it easy to streamline your workflow. You can easily connect with tools like Google Drive and Dropbox to manage your Letter To Lienholder To Notify Of Trust Florida alongside other important documents.

-

What features does airSlate SignNow provide for eSigning a Letter To Lienholder To Notify Of Trust Florida?

airSlate SignNow provides robust eSigning features for your Letter To Lienholder To Notify Of Trust Florida, including the ability to add secure electronic signatures, date stamps, and personalized messages. These features ensure that your document is not only legally binding but also tailored to your specific needs.

-

How can I ensure my Letter To Lienholder To Notify Of Trust Florida is legally compliant?

To ensure your Letter To Lienholder To Notify Of Trust Florida is legally compliant, airSlate SignNow provides templates designed by legal experts. Additionally, you can consult legal professionals for any specific requirements or compliance issues relevant to your situation.

Get more for Letter To Lienholder To Notify Of Trust Florida

Find out other Letter To Lienholder To Notify Of Trust Florida

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple

- Sign Massachusetts Sports NDA Mobile

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later