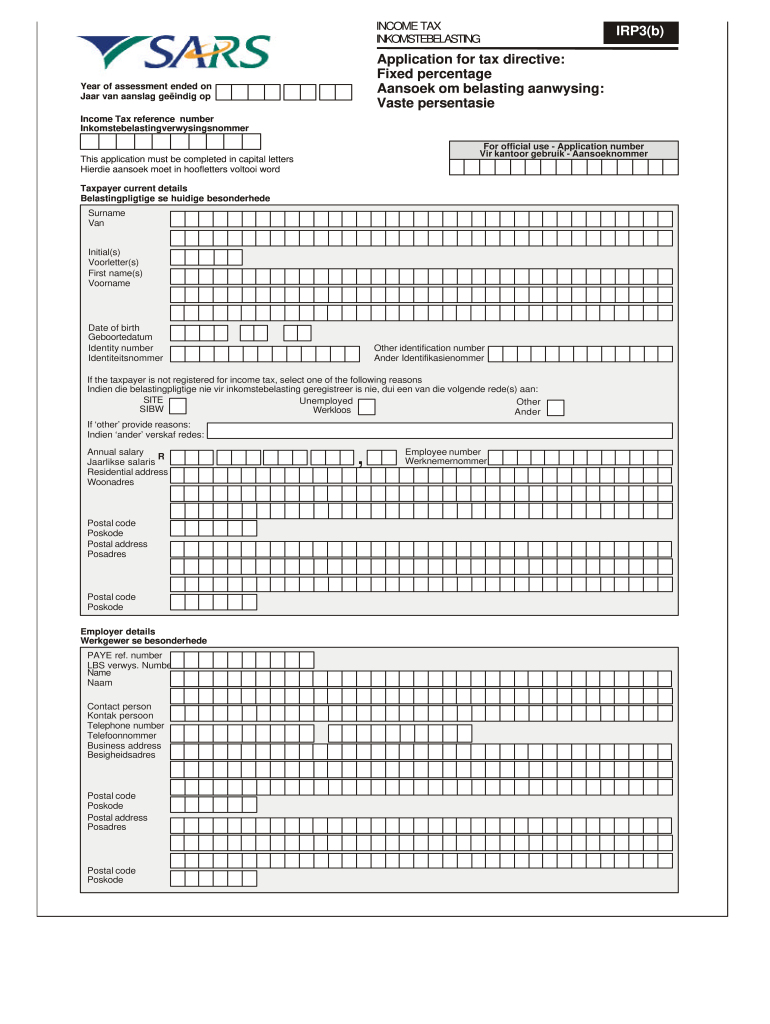

Irp3b Form

What is the Irp3b

The Irp3b form is a tax directive used in the United States, primarily for reporting specific income and tax information. It serves as a formal request to the Internal Revenue Service (IRS) for guidance on how to handle certain tax situations, particularly for individuals who may have complex income scenarios. This form is essential for ensuring compliance with tax regulations and for determining the appropriate withholding tax rates for various types of income.

How to use the Irp3b

Using the Irp3b form involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents that pertain to your income sources. Next, fill out the form with precise information, including your personal details and specifics about the income in question. After completing the form, review it carefully to ensure all information is accurate and complete. Finally, submit the form to the appropriate IRS office or through an electronic filing system, if available.

Steps to complete the Irp3b

Completing the Irp3b form requires careful attention to detail. Follow these steps:

- Collect all relevant financial documents, such as W-2s and 1099s.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide details about your income sources, specifying the type and amount of income.

- Double-check all entries for accuracy to avoid errors that could lead to penalties.

- Sign and date the form before submission.

Legal use of the Irp3b

The legal use of the Irp3b form is crucial for compliance with IRS regulations. It is designed to ensure that taxpayers report their income accurately and request the correct withholding amounts. Failure to use this form properly can result in penalties or audits. It is important to understand the legal implications of the information provided on the form and to ensure that all data is truthful and complete.

Key elements of the Irp3b

Several key elements must be included when filling out the Irp3b form:

- Personal Information: Name, address, and Social Security number.

- Income Details: Types of income being reported, such as wages or investment income.

- Withholding Information: Specific amounts to be withheld based on the income type.

- Signature: A signed declaration certifying the accuracy of the information provided.

Who Issues the Form

The Irp3b form is issued by the Internal Revenue Service (IRS), the federal agency responsible for tax collection and enforcement of tax laws in the United States. The IRS provides the necessary guidelines and updates regarding the use of this form, ensuring that taxpayers have the most current information for compliance.

Quick guide on how to complete irp3b application for tax directive fixed workinfocom

A concise manual on how to prepare your Irp3b

Finding the appropriate template can be a daunting task when you need to submit formal international documents. Even if you possess the necessary form, it may be cumbersome to swiftly complete it according to all the specifications if you rely on printed copies instead of conducting everything digitally. airSlate SignNow is the web-based eSignature software that assists you in overcoming these hurdles. It allows you to retrieve your Irp3b and promptly fill it out and sign it on-site without needing to reprint documents if you make an error.

Here are the actions you must take to prepare your Irp3b using airSlate SignNow:

- Press the Get Form button to instantly add your document to our editor.

- Begin with the first empty field, enter your information, and proceed with the Next tool.

- Complete the empty sections with the Cross and Check tools available in the toolbar.

- Choose the Highlight or Line features to mark the crucial information.

- Click on Image and upload one if your Irp3b necessitates it.

- Utilize the right-side panel to add additional fields for you or others to complete if needed.

- Review your responses and confirm the document by clicking Date, Initials, and Sign.

- Sketch, type, upload your eSignature, or capture it using a camera or QR code.

- Complete editing the form by selecting the Done button and choosing your file-sharing preferences.

When your Irp3b is prepared, you can distribute it however you prefer - send it to your recipients via email, SMS, fax, or even print it directly from the editor. You can also securely keep all your finished documents in your account, organized in folders according to your liking. Don’t waste time on manual document filling; try airSlate SignNow!

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irp3b application for tax directive fixed workinfocom

How to create an eSignature for your Irp3b Application For Tax Directive Fixed Workinfocom online

How to create an eSignature for the Irp3b Application For Tax Directive Fixed Workinfocom in Chrome

How to create an eSignature for putting it on the Irp3b Application For Tax Directive Fixed Workinfocom in Gmail

How to create an eSignature for the Irp3b Application For Tax Directive Fixed Workinfocom straight from your mobile device

How to make an electronic signature for the Irp3b Application For Tax Directive Fixed Workinfocom on iOS

How to generate an electronic signature for the Irp3b Application For Tax Directive Fixed Workinfocom on Android

People also ask

-

What is the irp3b form and why is it important?

The irp3b form is a critical document used in various business transactions to report employee earnings and deductions. Understanding how to accurately complete this form ensures compliance with tax regulations and helps avoid penalties. Utilizing platforms like airSlate SignNow can streamline the eSigning process for the irp3b form.

-

How does airSlate SignNow simplify the completion of the irp3b form?

airSlate SignNow offers a user-friendly interface that allows businesses to complete the irp3b form efficiently. With features like templates and automated workflows, users can easily fill out and eSign necessary documents. This signNowly reduces the time spent on paperwork.

-

What are the pricing options for using airSlate SignNow for the irp3b form?

airSlate SignNow provides flexible pricing plans tailored to different business needs, starting from a basic plan for small teams to advanced options for larger organizations. Each tier of pricing includes access to features that will assist users in managing documents, including the irp3b form. To find the best fit, you can explore their subscription options online.

-

Can multiple users collaborate on the irp3b form in airSlate SignNow?

Yes, airSlate SignNow supports collaborative features that allow multiple users to work on the irp3b form simultaneously. This enhances teamwork by enabling real-time edits and comments. Such collaboration ensures that all necessary information is captured accurately before final submission.

-

What integrations does airSlate SignNow offer for managing the irp3b form?

airSlate SignNow seamlessly integrates with various business tools such as CRM systems, cloud storage, and productivity suites. These integrations improve workflow efficiency by allowing users to access and manage the irp3b form alongside other crucial documents. This connectivity streamlines the document handling process.

-

Is airSlate SignNow compliant with security regulations for handling the irp3b form?

Absolutely, airSlate SignNow prioritizes data security and complies with industry regulations to ensure your irp3b form data is protected. With features like secure encryption and user authentication, businesses can confidently manage sensitive information. This commitment to security fosters trust in the document management process.

-

How can I track the status of the irp3b form sent via airSlate SignNow?

With airSlate SignNow, users can easily track the status of the irp3b form throughout the signing process. Notifications and tracking features keep senders informed about when the document is viewed and signed. This transparency helps businesses maintain effective communication during document transactions.

Get more for Irp3b

- Coasts and seas of the united kingdom jncc adviser to form

- State of west virginia hereinafter referred to as the trustor whether one or form

- As provided in this agreement and the laws of the state of west virginia form

- Or to others for the consequences of the exercise and a dissenting trustee is not form

- Amendment to trustget free legal forms

- Assignment for value received the wvhdf form

- Name or names of person form

- County state of west virginia and described as follows form

Find out other Irp3b

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF

- Can I Sign Michigan Banking PDF

- Help Me With Sign Minnesota Banking Word

- How To Sign Missouri Banking Form

- Help Me With Sign New Jersey Banking PDF

- How Can I Sign New Jersey Banking Document

- Help Me With Sign New Mexico Banking Word