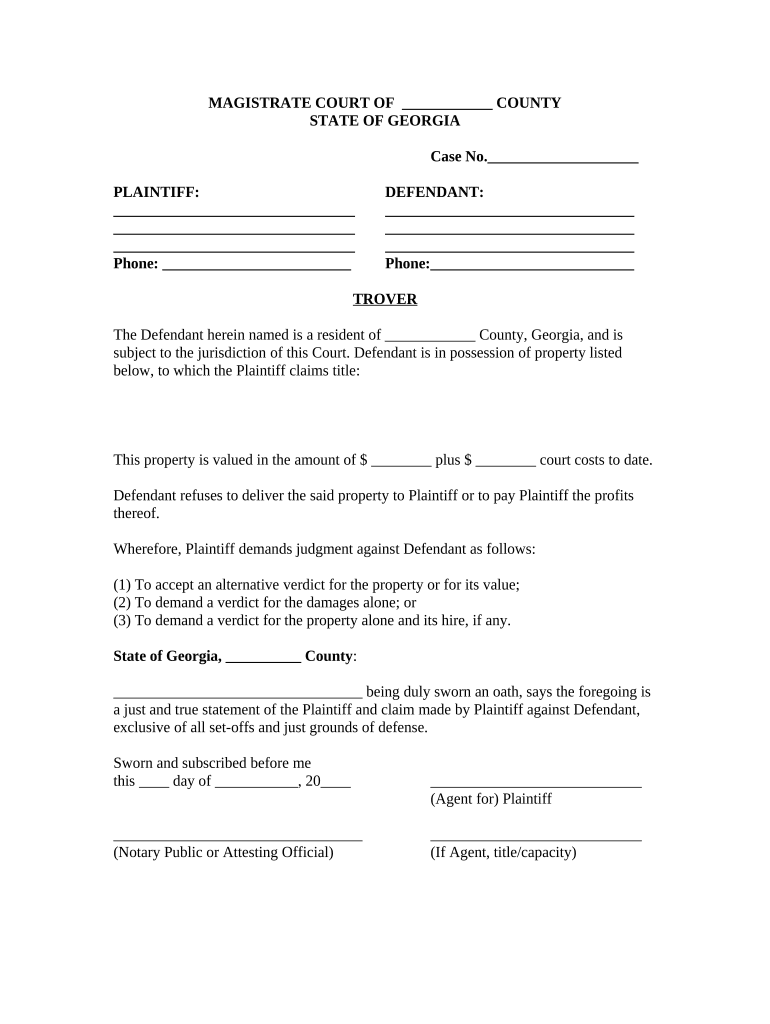

Ga Claim Form

What is the Ga Claim Form

The Ga Claim Form is a specific document used in the state of Georgia for various claims, including those related to insurance, taxes, or other financial matters. This form serves as an official request for compensation or benefits and is essential for individuals seeking to assert their rights under state regulations. Understanding the purpose and requirements of the Ga Claim Form is crucial for ensuring that claims are processed efficiently and effectively.

How to use the Ga Claim Form

Using the Ga Claim Form involves several important steps to ensure that all necessary information is accurately provided. First, download the form from a reliable source, ensuring you have the most current version. Next, fill out the form completely, providing all required details such as personal information, the nature of the claim, and any supporting documentation. After completing the form, review it carefully for accuracy before submitting it through the appropriate channels, whether online, by mail, or in person.

Steps to complete the Ga Claim Form

Completing the Ga Claim Form requires attention to detail. Follow these steps for successful submission:

- Download the latest version of the Ga Claim Form.

- Read the instructions thoroughly to understand the requirements.

- Fill in your personal information, including name, address, and contact details.

- Clearly describe the nature of your claim, providing any necessary context.

- Attach any required supporting documents that validate your claim.

- Review the completed form for accuracy and completeness.

- Submit the form using the recommended method, ensuring you keep a copy for your records.

Legal use of the Ga Claim Form

The Ga Claim Form must be used in accordance with state laws and regulations to ensure its legal validity. This includes adhering to deadlines for submission and providing truthful information. Failure to comply with legal requirements can result in delays or denial of the claim. It is advisable to consult legal resources or professionals if there are uncertainties regarding the form's use or the claims process.

Required Documents

When submitting the Ga Claim Form, certain documents may be required to support your claim. Commonly needed documents include:

- Proof of identity, such as a driver's license or state ID.

- Documentation related to the claim, such as receipts or contracts.

- Any previous correspondence regarding the claim.

- Additional forms that may be specified in the Ga Claim Form instructions.

Gathering these documents ahead of time can streamline the process and help avoid delays.

Form Submission Methods

The Ga Claim Form can typically be submitted through various methods, depending on the specific requirements of the claim. Common submission methods include:

- Online submission through designated state websites.

- Mailing the completed form to the appropriate agency or department.

- In-person delivery at specified locations, such as government offices or service centers.

Choosing the right submission method can impact the processing time, so it is beneficial to consider the options available.

Quick guide on how to complete ga claim form

Complete Ga Claim Form effortlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely archive them online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and efficiently. Manage Ga Claim Form on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and electronically sign Ga Claim Form with ease

- Find Ga Claim Form and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of the documents or obscure sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and carries the same legal standing as a conventional handwritten signature.

- Verify the details and click the Done button to save your edits.

- Select how you wish to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow manages all your document administration needs in just a few clicks from any device you prefer. Modify and electronically sign Ga Claim Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the GA claim print feature in airSlate SignNow?

The GA claim print feature in airSlate SignNow allows users to easily generate and print GA claims. This feature streamlines the process of preparing necessary documents for claims, making it signNowly easier for businesses to manage their paperwork and submissions.

-

How does airSlate SignNow improve the GA claim print process?

AirSlate SignNow enhances the GA claim print process by providing an intuitive interface and robust tools for document management. Users can electronically sign and send documents, reducing the time spent on traditional paperwork and improving overall efficiency.

-

Is there a cost associated with using the GA claim print feature?

Yes, while airSlate SignNow offers various pricing plans, the GA claim print feature is included in these options. Prospective customers can choose a plan that suits their needs, ensuring they get access to powerful tools for managing GA claims effectively.

-

Can I integrate airSlate SignNow with other platforms for GA claim print?

Absolutely! AirSlate SignNow supports integrations with various applications, allowing for seamless operations when handling GA claim print requests. This connectivity helps streamline your workflow and enhances productivity across your business operations.

-

What are the benefits of using airSlate SignNow for GA claim print?

Using airSlate SignNow for GA claim print offers numerous benefits, such as increased accuracy, reduced turnaround time, and easier collaboration among team members. This solution helps eliminate the complexities associated with paper documents and speeds up the claims process.

-

Is the GA claim print feature secure in airSlate SignNow?

Yes, security is a top priority for airSlate SignNow. The GA claim print feature adheres to strict security protocols, including data encryption and secure access controls, ensuring that your sensitive documents remain protected throughout the process.

-

How can I get started with the GA claim print feature in airSlate SignNow?

Getting started with the GA claim print feature in airSlate SignNow is easy. Simply sign up for an account, choose a pricing plan, and you can begin creating, signing, and printing GA claims almost immediately using the user-friendly platform.

Get more for Ga Claim Form

Find out other Ga Claim Form

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form