Assignment of Mortgage by Individual Mortgage Holder Hawaii Form

What is the Assignment Of Mortgage By Individual Mortgage Holder Hawaii

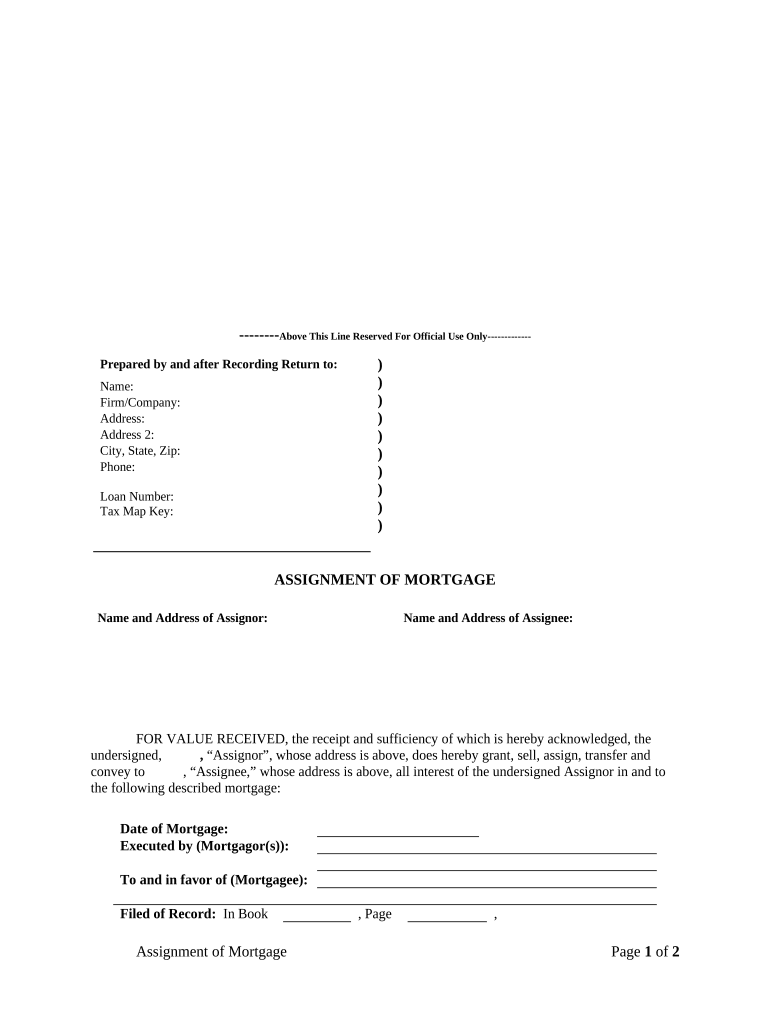

The Assignment of Mortgage by Individual Mortgage Holder in Hawaii is a legal document that facilitates the transfer of a mortgage from one party to another. This process allows the original mortgage holder to assign their rights and obligations under the mortgage agreement to a new party. It is essential for ensuring that the new holder has the authority to collect payments and enforce the terms of the mortgage. This assignment is particularly relevant in real estate transactions, where ownership and financing may change hands frequently.

How to use the Assignment Of Mortgage By Individual Mortgage Holder Hawaii

To effectively use the Assignment of Mortgage by Individual Mortgage Holder in Hawaii, one must complete the form accurately and ensure that all necessary parties are involved. The original mortgage holder must sign the document, and it may require notarization to enhance its legal validity. Once completed, the assignment should be recorded with the appropriate county office to provide public notice of the change in mortgage ownership. This ensures that all parties are aware of the new mortgage holder and their rights.

Steps to complete the Assignment Of Mortgage By Individual Mortgage Holder Hawaii

Completing the Assignment of Mortgage by Individual Mortgage Holder in Hawaii involves several key steps:

- Gather the necessary information, including details of the original mortgage and the new mortgage holder.

- Fill out the form, ensuring that all fields are completed accurately.

- Obtain the original mortgage holder's signature on the document.

- Consider having the document notarized to strengthen its legal standing.

- Submit the completed assignment to the local county recorder’s office for official recording.

Key elements of the Assignment Of Mortgage By Individual Mortgage Holder Hawaii

Key elements of the Assignment of Mortgage by Individual Mortgage Holder in Hawaii include:

- The names and addresses of the original mortgage holder and the new mortgage holder.

- The legal description of the property associated with the mortgage.

- The original mortgage's date and any relevant loan numbers.

- Signatures of the parties involved, along with the date of signing.

- Notarization, if required, to validate the assignment.

Legal use of the Assignment Of Mortgage By Individual Mortgage Holder Hawaii

The legal use of the Assignment of Mortgage by Individual Mortgage Holder in Hawaii is governed by state laws that dictate how mortgages can be assigned. It is crucial to comply with these regulations to ensure that the assignment is enforceable. This includes adhering to any specific requirements for documentation, signatures, and recording the assignment with the local authorities. Failure to follow these legal guidelines can result in disputes over mortgage ownership and payment obligations.

State-specific rules for the Assignment Of Mortgage By Individual Mortgage Holder Hawaii

In Hawaii, the assignment of a mortgage must adhere to specific state laws. This includes the requirement for the assignment to be in writing and signed by the original mortgage holder. Additionally, the assignment must be recorded with the Bureau of Conveyances to be effective against third parties. Understanding these state-specific rules is essential for ensuring that the assignment is legally binding and recognized in the event of any disputes.

Quick guide on how to complete assignment of mortgage by individual mortgage holder hawaii

Prepare Assignment Of Mortgage By Individual Mortgage Holder Hawaii seamlessly on any device

Online document management has become widely embraced by businesses and individuals alike. It serves as an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to generate, modify, and electronically sign your documents swiftly without holdups. Handle Assignment Of Mortgage By Individual Mortgage Holder Hawaii on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and electronically sign Assignment Of Mortgage By Individual Mortgage Holder Hawaii with ease

- Locate Assignment Of Mortgage By Individual Mortgage Holder Hawaii and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or redact sensitive details with tools that airSlate SignNow specifically provides for that purpose.

- Generate your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all information and click on the Done button to save your changes.

- Choose your preferred delivery method for your form, whether it be via email, SMS, invitation link, or downloading it to your computer.

Forget about missing or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you select. Adjust and electronically sign Assignment Of Mortgage By Individual Mortgage Holder Hawaii to ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the process for the Assignment Of Mortgage By Individual Mortgage Holder in Hawaii?

The process for the Assignment Of Mortgage By Individual Mortgage Holder in Hawaii typically involves drafting a formal assignment document, signing it before a notary, and filing it with the appropriate county clerk. Using airSlate SignNow can simplify this process by allowing you to create, send, and eSign documents seamlessly. This ensures that all parties have signed the assignment quickly and securely.

-

What are the costs associated with using airSlate SignNow for the Assignment Of Mortgage By Individual Mortgage Holder in Hawaii?

airSlate SignNow offers a variety of pricing plans to cater to different business needs, allowing you to choose an option that fits your budget. The platform is designed to be cost-effective, especially when handling the Assignment Of Mortgage By Individual Mortgage Holder in Hawaii. By streamlining the document management process, the potential savings on time and resources can be signNow.

-

What features does airSlate SignNow provide for managing the Assignment Of Mortgage By Individual Mortgage Holder in Hawaii?

airSlate SignNow comes packed with features designed to facilitate the Assignment Of Mortgage By Individual Mortgage Holder in Hawaii, including customizable templates, automated workflows, and secure eSigning. These features enable users to easily manage documents, track signing activity, and ensure compliance with state regulations. This functionality enhances efficiency and reduces the likelihood of errors.

-

Are there any integrations available with airSlate SignNow for the Assignment Of Mortgage By Individual Mortgage Holder in Hawaii?

Yes, airSlate SignNow offers various integrations with popular business tools, allowing you to efficiently manage the Assignment Of Mortgage By Individual Mortgage Holder in Hawaii. Whether you use CRM systems, cloud storage, or project management applications, these integrations help streamline your workflow and enhance productivity. This flexibility ensures that your document processes are seamless across different platforms.

-

How does airSlate SignNow ensure the security of the Assignment Of Mortgage By Individual Mortgage Holder in Hawaii?

The security of your documents is paramount at airSlate SignNow. The platform utilizes advanced encryption and secure servers to protect all data related to the Assignment Of Mortgage By Individual Mortgage Holder in Hawaii. Additionally, airSlate SignNow complies with industry standards and regulations, ensuring that your sensitive information remains confidential and secure during the entire signing process.

-

Can I track the status of my Assignment Of Mortgage By Individual Mortgage Holder in Hawaii using airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking features that allow you to monitor the status of your Assignment Of Mortgage By Individual Mortgage Holder in Hawaii. You will receive notifications when documents are viewed, signed, or completed, ensuring that you are always updated on the process. This transparency helps you manage your transactions confidently.

-

Is there customer support available for airSlate SignNow users handling the Assignment Of Mortgage By Individual Mortgage Holder in Hawaii?

Yes, airSlate SignNow offers robust customer support for users who are managing the Assignment Of Mortgage By Individual Mortgage Holder in Hawaii. Whether you need help with setup, document creation, or troubleshooting, their dedicated support team is ready to assist you through chat, email, or phone. This ensures that you have the necessary resources to navigate any challenges that may arise.

Get more for Assignment Of Mortgage By Individual Mortgage Holder Hawaii

- Ultrasound referral form

- Rmv1 pdf form

- Tr11l form

- Mortgage deed format pdf

- Application elbert county fire department ecfire form

- Direct deposit sign up form zimbabwe

- Its turner tournament game fishing club of northern tasmania form

- Harcourts northern midlands 230 marlborough street longford tasmania 7301 ph 03 63912911 fax 03 63912901 email diane form

Find out other Assignment Of Mortgage By Individual Mortgage Holder Hawaii

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement