Blue Cross Blue Shield Por Producer of Record Form Tx

What is the Blue Cross Blue Shield Producer of Record Form in Texas?

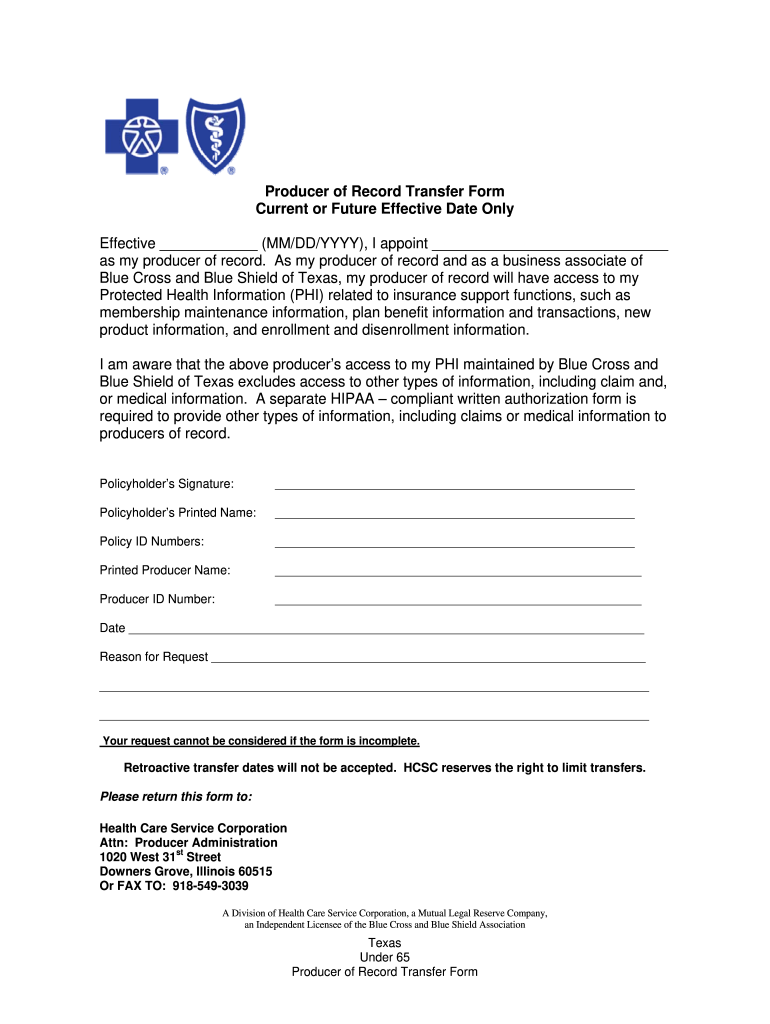

The Blue Cross Blue Shield Producer of Record Form in Texas is a crucial document that designates a specific insurance producer to represent a client in dealings with Blue Cross Blue Shield. This form is essential for ensuring that clients receive the appropriate guidance and support from their chosen producer, particularly when navigating health insurance options under 65. By completing this form, clients can authorize their selected producer to manage their insurance policies, claims, and communications with the insurer on their behalf.

Steps to Complete the Blue Cross Blue Shield Producer of Record Form in Texas

Completing the Blue Cross Blue Shield Producer of Record Form involves several straightforward steps:

- Obtain the form from the Blue Cross Blue Shield website or your insurance producer.

- Fill in your personal information, including your name, address, and contact details.

- Provide the details of the producer you wish to designate, including their name and producer number.

- Sign and date the form to validate your request.

- Submit the completed form to Blue Cross Blue Shield through the designated method (online, mail, or in-person).

Legal Use of the Blue Cross Blue Shield Producer of Record Form in Texas

The legal use of the Blue Cross Blue Shield Producer of Record Form is governed by state insurance regulations. This form must be completed accurately to ensure that it is legally binding. It serves as a formal agreement between the client and the producer, allowing the producer to act on behalf of the client in all matters related to their insurance policies. It is essential to ensure that all information provided is truthful and complete to avoid any legal complications.

Key Elements of the Blue Cross Blue Shield Producer of Record Form in Texas

Several key elements must be included in the Blue Cross Blue Shield Producer of Record Form to ensure its validity:

- Client Information: Full name, address, and contact information.

- Producer Information: Name, producer number, and contact details of the designated producer.

- Authorization Statement: A clear statement indicating the client's consent for the producer to act on their behalf.

- Signature: The client's signature is required to validate the form.

- Date: The date on which the form is signed is also necessary for record-keeping.

How to Obtain the Blue Cross Blue Shield Producer of Record Form in Texas

The Blue Cross Blue Shield Producer of Record Form can be obtained through several channels:

- Visit the official Blue Cross Blue Shield website to download the form directly.

- Contact your insurance producer, who can provide you with the form.

- Request the form through customer service if you prefer assistance.

Eligibility Criteria for the Blue Cross Blue Shield Producer of Record Form in Texas

To be eligible to complete the Blue Cross Blue Shield Producer of Record Form, clients must meet certain criteria:

- Be a current policyholder with Blue Cross Blue Shield.

- Be at least eighteen years of age.

- Provide accurate and truthful information on the form.

Quick guide on how to complete blue cross blue shield por producer of record form tx

Explore the simpler method to manage your Blue Cross Blue Shield Por Producer Of Record Form Tx

The traditional approaches to finalizing and validating documents consume an excessive amount of time in comparison to contemporary document management systems. Previously, you would search for appropriate forms, print them, fill in all the necessary details, and mail them. Now, you can obtain, fill out, and sign your Blue Cross Blue Shield Por Producer Of Record Form Tx all within one browser window using airSlate SignNow. Preparing your Blue Cross Blue Shield Por Producer Of Record Form Tx is more straightforward than it has ever been.

Steps to finalize your Blue Cross Blue Shield Por Producer Of Record Form Tx with airSlate SignNow

- Access the relevant category page and locate your state-specific Blue Cross Blue Shield Por Producer Of Record Form Tx. You may also utilize the search box.

- Verify that you have the correct version of the form by previewing it.

- Hit Obtain form and enter editing mode.

- Fill in your document with the required details using the editing tools.

- Review the information provided and click the Sign button to authorize your form.

- Select the easiest method to create your signature: generate it, draw your signature, or upload an image of it.

- Click FINISHED to apply your modifications.

- Download the document to your device or navigate to Sharing settings to send it electronically.

Efficient online tools such as airSlate SignNow make completing and submitting your forms hassle-free. Give it a try to discover how quickly document management and approval should realistically be. You'll save a signNow amount of time.

Create this form in 5 minutes or less

FAQs

-

How much does it cost for an ACL reconstruction surgery with Blue Cross Blue Shield insurance? What are the total out of pocket costs or breakdown of the medical bill?

Insurance companies negotiate with hospitals and doctors, so actual costs are different all over the country and even within the same state. You need to get the billing company that works with your doctor and surgery center to get you an accurate number. The "bill" that is submitted for your operation will be 2-3 times the actual amount paid, so it is not a useful number. Your share of the bill is determined by your policy and is usually a per cent of the actual amount.

-

My benefits package, from the company that gave me an offer, includes health insurance (Blue Cross Blue Shield) with 90% company-paid premiums for the HMO and 70% company-paid premiums for the PPO. How good of a benefit is that, compared to big recognized firms?

One way to roughly "estimate" whether the company's total compensation (pay plus benefits) is competitive is to find out how much turnover they have. If they are losing people to other bigger companies right and left, it may be because their compensation package is not competitive. You could go on a social media site like LinkedIn and find former employees; they could give you some perspective on this issue. Starting January 1, 2015, health benefit packages will become more similar from one employer to the next. Health reform requires employers with more than 100 employees to offer a plan to 70 percent of its people. In addition, the employer cannot charge an employee more than 9.56% of his/her household income to join the plan (for single coverage). This limit on employee contributions applies to all employees who earn less than 400% of the Federal Poverty Limit. Of course, there will still be some variation in benefit plans between employers. It's one of the many things to consider when you look at a new job. Congrats on getting the offer and good luck with your decision!

-

How do exhibition teams like the Blue Angels time stadium flyovers to sync with the last syllable of S.S.B? Also, from miles out, and at those speeds, how do they co-ordinate their form-ups during airshow performances?

"How do exhibition teams like Blue Angels time stadium flyovers to sync with last syllable of S.S.B? Also, from miles out and at those speeds, how do they co-ordinate their form-ups during airshow performances?"One thing the military dose very well is arrive on time! At air shows the Blue Angels also have a team member on the ground so I guess they may have one in the stadium? The fly over aircraft circle just out of sight a few miles from the fly over point then drop down and flyover at the appointed time! Use to hear the fly over aircraft circling around before the game then see them appear just after the National Anthem.

-

Why should it be so complicated just figuring out how much tax to pay? (record keeping, software, filling out forms . . . many times cost much more than the amount of taxes due) The cost of compliance makes the U.S. uncompetitive and costs jobs and lowers our standard of living.

Taxes can be viewed as having 4 uses (or purposes) in our (and most) governments:Revenue generation (to pay for public services).Fiscal policy control (e.g., If the government wishes to reduce the money supply in order to reduce the risk of inflation, they can raise interest rates, sell fewer bonds, burn money, or raise taxes. In the last case, this represents excess tax revenue over the actual spending needs of the government).Wealth re-distribution. One argument for this is that the earnings of a country can be perceived as belonging to all of its citizens since the we all have a stake in the resources of the country (natural resources, and intangibles such as culture, good citizenship, civic duties). Without some tax policy complexity, the free market alone does not re-distribute wealth according to this "shared" resources concept. However, this steps into the boundary of Purpose # 4...A way to implement Social Policy (and similar government mandated policies, such as environmental policy, health policy, savings and debt policy, etc.). As Government spending can be use to implement policies (e.g., spending money on public health care, environmental cleanup, education, etc.), it is equivalent to provide tax breaks (income deductions or tax credits) for the private sector to act in certain ways -- e.g., spend money on R&D, pay for their own education or health care, avoid spending money on polluting cars by having a higher sales tax on these cars or offering a credit for trade-ins [ref: Cash for Clunkers]).Uses # 1 & 2 are rather straight-forward, and do not require a complex tax code to implement. Flat income and/or consumption (sales) taxes can easily be manipulated up or down overall for these top 2 uses. Furthermore, there is clarity when these uses are invoked. For spending, we publish a budget. For fiscal policy manipulation, the official economic agency (The Fed) publishes their outlook and agenda.Use # 3 is controversial because there is no Constitutional definition for the appropriate level of wealth re-distribution, and the very concept of wealth re-distribution is considered by some to be inappropriate and unconstitutional. Thus, the goal of wealth re-distribution is pretty much hidden in with the actions and policies of Use #4 (social policy manipulation).Use # 4, however, is where the complexity enters the Taxation system. Policy implementation through taxation (or through spending) occurs via legislation. Legislation (law making) is inherently complex and subject to gross manipulation by special interests during formation and amendments. Legislation is subject to interpretation, is prone to errors (leading to loopholes) and both unintentional or intentional (criminal / fraudulent) avoidance.The record keeping and forms referred to in the question are partially due to the basic formula for calculating taxes (i.e., percentage of income, cost of property, amount of purchase for a sales tax, ...). However, it is the complexity (and associated opportunities for exploitation) of taxation legislation for Use # 4 (Social Policy implementation) that naturally leads to complexity in the reporting requirements for the tax system.

Create this form in 5 minutes!

How to create an eSignature for the blue cross blue shield por producer of record form tx

How to make an electronic signature for the Blue Cross Blue Shield Por Producer Of Record Form Tx online

How to create an electronic signature for your Blue Cross Blue Shield Por Producer Of Record Form Tx in Google Chrome

How to make an eSignature for signing the Blue Cross Blue Shield Por Producer Of Record Form Tx in Gmail

How to generate an electronic signature for the Blue Cross Blue Shield Por Producer Of Record Form Tx from your smartphone

How to generate an eSignature for the Blue Cross Blue Shield Por Producer Of Record Form Tx on iOS devices

How to create an electronic signature for the Blue Cross Blue Shield Por Producer Of Record Form Tx on Android OS

People also ask

-

What features does airSlate SignNow offer for Texas businesses?

Texas businesses can understand how airSlate SignNow provides a robust suite of features including eSignature capabilities, document templates, and real-time collaboration. These tools are designed to streamline the signing process and enhance productivity. With a user-friendly interface, Texas understand the value of reducing paperwork and simplifying workflows.

-

How does pricing work for airSlate SignNow in Texas?

Texas understand that airSlate SignNow offers flexible pricing plans tailored to various business needs. There are options for small teams to enterprise-level solutions, ensuring an accessible choice for any budget. This allows Texas businesses to choose a plan that best fits their requirements.

-

Is airSlate SignNow secure for Texas users?

Yes, airSlate SignNow prioritizes security, helping Texas understand that their documents are safe. The platform uses industry-standard encryption and complies with regulations to protect sensitive information. This commitment to security guarantees peace of mind for all users in Texas.

-

Can airSlate SignNow integrate with other software used in Texas?

Texas understand that airSlate SignNow seamlessly integrates with popular applications like Google Drive, Salesforce, and more. These integrations enhance the user experience by allowing businesses to work within their existing systems. Effortless integration means Texas businesses can enjoy a smoother workflow.

-

What are the benefits of using airSlate SignNow for Texas companies?

California companies understand that airSlate SignNow offers numerous benefits, including increased efficiency and reduced turnaround times for document signing. This enables faster decision-making and improves overall productivity. Texas businesses can embrace a modern, paperless environment that drives growth.

-

Is there a trial period available for Texas users of airSlate SignNow?

Texas understand that there is a free trial period available for airSlate SignNow, allowing businesses to explore its features. This trial helps potential users assess how the solution fits their needs without financial commitment. It's an excellent way for Texas businesses to see the software's impact firsthand.

-

How can Texas businesses get support for airSlate SignNow?

Texas users can expect excellent customer support from airSlate SignNow, including online resources and direct assistance when needed. Whether through live chat, email, or phone, assistance is readily available to ensure a smooth user experience. This commitment to support helps Texas understand how to maximize the platform's potential.

Get more for Blue Cross Blue Shield Por Producer Of Record Form Tx

- State of alabama order establishing paternity case number form

- Petition for expungement of records alabama law form

- Front matter the council of state governments form

- In the court of alabama 481195137 form

- Order of expungement alabama law enforcement agency form

- Form c 10f

- Court building b room 120 washington d form

- Asuntos civilestribunales del distrito de columbia dc courts form

Find out other Blue Cross Blue Shield Por Producer Of Record Form Tx

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation