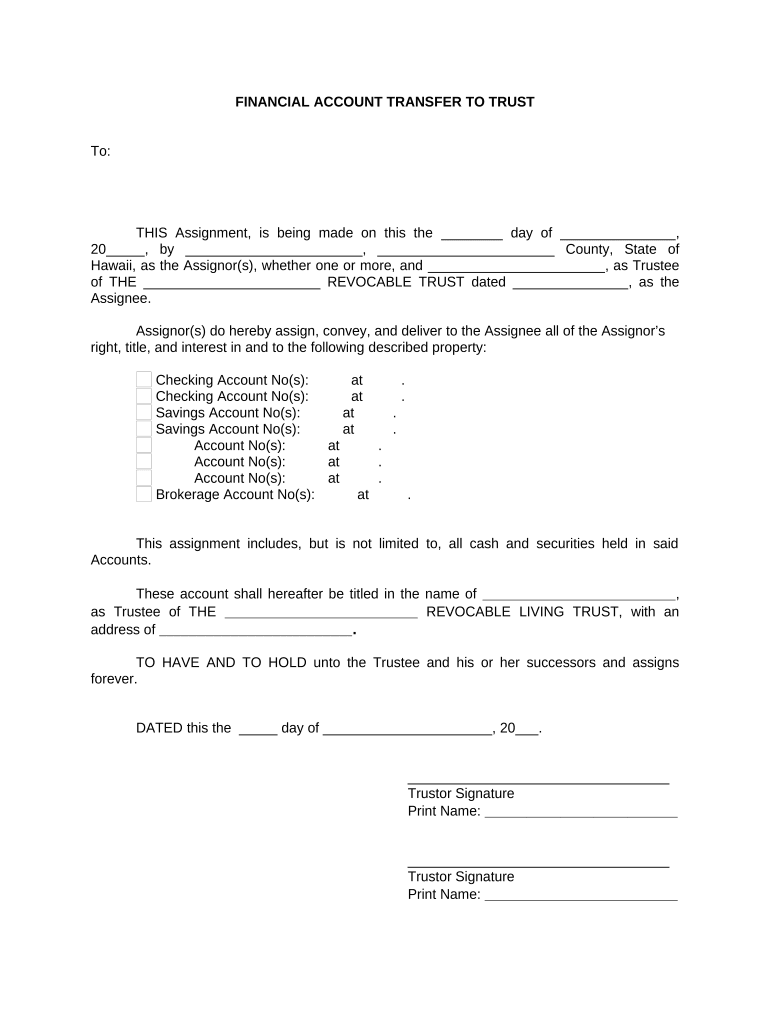

Financial Account Transfer to Living Trust Hawaii Form

What is the Financial Account Transfer To Living Trust Hawaii

The Financial Account Transfer To Living Trust Hawaii is a legal document that enables individuals to transfer their financial accounts into a living trust. This process is essential for estate planning, as it allows for the seamless management and distribution of assets upon the individual's passing. By placing financial accounts within a living trust, individuals can avoid probate, ensuring that their assets are transferred directly to beneficiaries without court intervention. This form is particularly relevant in Hawaii, where specific state laws govern trust management and asset distribution.

Steps to complete the Financial Account Transfer To Living Trust Hawaii

Completing the Financial Account Transfer To Living Trust Hawaii involves several key steps:

- Gather necessary information: Collect details about the financial accounts you wish to transfer, including account numbers and the names of financial institutions.

- Review your living trust document: Ensure that your living trust is properly established and that it includes provisions for the financial accounts being transferred.

- Contact financial institutions: Reach out to your banks or investment firms to inquire about their specific requirements for transferring accounts into a trust.

- Complete the transfer forms: Fill out the necessary forms provided by your financial institutions, ensuring you include the living trust’s name and details.

- Submit the forms: Return the completed forms to the respective financial institutions, either online or in person, as per their submission guidelines.

- Confirm the transfer: Follow up with the institutions to verify that the accounts have been successfully transferred into your living trust.

Legal use of the Financial Account Transfer To Living Trust Hawaii

The legal use of the Financial Account Transfer To Living Trust Hawaii is crucial for ensuring that the transfer of assets complies with state laws. In Hawaii, the law recognizes living trusts as valid legal entities that can hold assets. This means that once financial accounts are transferred into the trust, they are managed according to the terms outlined in the trust document. It is important to ensure that all legal requirements are met during the transfer process to avoid complications in the future.

State-specific rules for the Financial Account Transfer To Living Trust Hawaii

Hawaii has specific regulations governing the establishment and operation of living trusts. Key considerations include:

- Trustee requirements: The trustee must be a competent individual or an institution authorized to act as a trustee in Hawaii.

- Trust document formalities: The trust document must be properly executed, typically requiring signatures from the grantor and witnesses.

- Asset protection laws: Understanding how Hawaii's asset protection laws apply to living trusts can help safeguard your financial accounts.

- Tax implications: Be aware of any state-specific tax considerations that may arise from transferring financial accounts into a living trust.

Required Documents

To complete the Financial Account Transfer To Living Trust Hawaii, several documents are typically required:

- Living trust document: This is the foundational document that outlines the terms and conditions of the trust.

- Identification: A government-issued ID may be needed to verify the identity of the trustee or grantor.

- Transfer forms: Specific forms provided by financial institutions to facilitate the transfer of accounts.

- Proof of ownership: Documentation proving ownership of the financial accounts being transferred.

How to use the Financial Account Transfer To Living Trust Hawaii

Using the Financial Account Transfer To Living Trust Hawaii involves a straightforward process. First, ensure that your living trust is properly established and legally valid. Next, gather all required documents, including your living trust document and any forms needed by your financial institutions. Follow the steps outlined for completing the transfer, ensuring that you provide accurate information and comply with any specific requirements set by your financial institutions. After submitting the necessary paperwork, confirm that the accounts have been successfully transferred into the trust to finalize the process.

Quick guide on how to complete financial account transfer to living trust hawaii

Manage Financial Account Transfer To Living Trust Hawaii effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers a fantastic eco-friendly substitute to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources you need to create, edit, and eSign your documents quickly and without issues. Handle Financial Account Transfer To Living Trust Hawaii on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to edit and eSign Financial Account Transfer To Living Trust Hawaii effortlessly

- Locate Financial Account Transfer To Living Trust Hawaii and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight key sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose your preferred delivery method for your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and eSign Financial Account Transfer To Living Trust Hawaii and guarantee effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the process for Financial Account Transfer To Living Trust Hawaii?

Transferring a financial account to a living trust in Hawaii involves completing specific forms and documents to ensure the assets are properly allocated. Typically, you'll need to create a trust document, title the account in the name of the trust, and notify your financial institution. Engaging with an expert can make the Financial Account Transfer To Living Trust Hawaii process smoother.

-

What are the benefits of Financial Account Transfer To Living Trust Hawaii?

Transferring financial accounts to a living trust in Hawaii offers numerous benefits, such as avoiding probate, ensuring privacy, and enabling more straightforward asset management. It also provides better control over how your assets will be distributed after your passing. The Financial Account Transfer To Living Trust Hawaii can help you maintain peace of mind knowing your assets are protected.

-

Are there any costs associated with Financial Account Transfer To Living Trust Hawaii?

Costs for the Financial Account Transfer To Living Trust Hawaii can vary depending on the complexity of your estate and the fees charged by professionals for their services. Generally, you may incur legal fees for setting up the trust and possible transfer fees from financial institutions. It’s advisable to budget for these potential costs when planning your transfer.

-

How long does the Financial Account Transfer To Living Trust Hawaii take?

The timeline for completing a Financial Account Transfer To Living Trust Hawaii can vary, often taking anywhere from a few weeks to a few months. Factors like the type of accounts, required documentation, and coordination with financial institutions can influence the duration. Staying organized and proactive can help expedite the process.

-

Can I transfer retirement accounts through Financial Account Transfer To Living Trust Hawaii?

Yes, you can transfer retirement accounts to a living trust in Hawaii, but it requires careful consideration of tax implications and regulations. It's essential to consult with a financial advisor to understand the potential consequences of such transfers. Proper planning for the Financial Account Transfer To Living Trust Hawaii can safeguard your retirement funds.

-

What types of financial accounts can be transferred to a living trust in Hawaii?

Various financial accounts can be transferred to a living trust in Hawaii, including bank accounts, investment accounts, and real estate holdings. Ensuring that all relevant assets are included in the Financial Account Transfer To Living Trust Hawaii is crucial for comprehensive estate planning. Make a list of all your accounts to simplify the transfer process.

-

How does using airSlate SignNow simplify the Financial Account Transfer To Living Trust Hawaii?

AirSlate SignNow streamlines the Financial Account Transfer To Living Trust Hawaii by allowing you to easily eSign necessary documents online. With its user-friendly interface and secure platform, you can complete the transfer without needing to schedule in-person meetings. This cost-effective solution enhances efficiency while providing peace of mind.

Get more for Financial Account Transfer To Living Trust Hawaii

Find out other Financial Account Transfer To Living Trust Hawaii

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now