Colorado 5615 Form

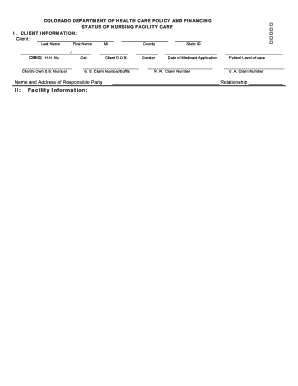

What is the Colorado 5615 Form

The Colorado 5615 form, also known as the Medicaid 5615 form, is a critical document used to determine eligibility for Medicaid services in Colorado. This form is specifically designed to assess an individual's level of care needs, which is essential for receiving appropriate medical assistance. It plays a vital role in the Medicaid application process, ensuring that applicants meet the necessary criteria for support.

How to use the Colorado 5615 Form

Using the Colorado 5615 form involves several key steps. First, applicants must gather all necessary information, including personal details and medical history. The form requires accurate reporting of health conditions and daily living needs. Once completed, it should be submitted to the appropriate Medicaid office for review. Ensuring that all sections are filled out thoroughly can help expedite the approval process.

Steps to complete the Colorado 5615 Form

Completing the Colorado 5615 form involves a systematic approach:

- Gather personal information, including name, address, and Social Security number.

- Document medical history, including diagnoses and treatments.

- Detail daily living activities and any assistance required.

- Review the form for accuracy and completeness.

- Submit the form to the designated Medicaid office, either online or by mail.

Legal use of the Colorado 5615 Form

The Colorado 5615 form is legally binding when completed accurately and submitted according to state guidelines. It adheres to the requirements set forth by Medicaid regulations, ensuring that the information provided is used to assess eligibility for benefits. Proper execution of this form is essential for compliance with state laws governing Medicaid services.

Key elements of the Colorado 5615 Form

Several key elements must be included in the Colorado 5615 form to ensure its effectiveness:

- Personal Information: Full name, address, and contact details.

- Medical History: Comprehensive details about health conditions and treatments.

- Daily Living Needs: Specific information on assistance required for daily activities.

- Signature: The applicant's signature, affirming the accuracy of the information provided.

Eligibility Criteria

Eligibility for the Colorado 5615 form is determined by several factors, including income level, medical needs, and residency status. Applicants must demonstrate that they meet the financial thresholds set by Medicaid guidelines. Additionally, individuals must provide documentation that supports their medical conditions and the need for assistance. Understanding these criteria is crucial for a successful application process.

Quick guide on how to complete colorado 5615 form

Effortlessly Prepare Colorado 5615 Form on Any Device

Managing documents online has become increasingly popular among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the appropriate template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Colorado 5615 Form on any device using the airSlate SignNow applications for Android or iOS and enhance any document-driven process today.

How to Modify and eSign Colorado 5615 Form with Ease

- Find Colorado 5615 Form and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections or redact sensitive details with the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Choose your preferred method for delivering your document, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the risk of lost or misplaced files, tedious form searching, and errors that necessitate printing new document copies. airSlate SignNow addresses all of your document management needs in just a few clicks from any device you choose. Modify and eSign Colorado 5615 Form and ensure exceptional communication at any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the colorado 5615 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 5615 form used for?

The 5615 form is commonly used for electronic signatures on legal documents. Businesses can leverage airSlate SignNow to easily manage, send, and eSign the 5615 form, ensuring compliance and authenticity for important transactions.

-

How does airSlate SignNow simplify the process of using the 5615 form?

airSlate SignNow streamlines the process by providing a user-friendly interface to fill out and send the 5615 form. The platform automates workflows and allows users to track the signing process in real-time, making it more efficient.

-

What are the pricing options for using the 5615 form with airSlate SignNow?

AirSlate SignNow offers flexible pricing plans suitable for businesses of all sizes. Depending on your requirements for using the 5615 form, you can choose from basic to advanced features, ensuring you only pay for what you need.

-

Are there any integrations available for the 5615 form in airSlate SignNow?

Yes, airSlate SignNow supports various integrations that enhance the functionality of the 5615 form. You can easily integrate with popular applications like Google Drive, Salesforce, and Dropbox to streamline your document management process.

-

What security features does airSlate SignNow offer for the 5615 form?

AirSlate SignNow prioritizes data security for the 5615 form by implementing robust encryption and compliance with industry standards. Your documents are safely stored and accessible only to authorized users, ensuring confidentiality and integrity.

-

Can I customize the 5615 form in airSlate SignNow?

Absolutely! With airSlate SignNow, users can easily customize the 5615 form to meet their specific needs. This includes adding fields, logos, and tailoring the design, making it a perfect fit for your brand.

-

Is it easy to send the 5615 form for signatures?

Yes, sending the 5615 form for signatures is straightforward with airSlate SignNow. You can quickly send the form via email or share a link, and recipients can sign electronically from any device, enhancing convenience.

Get more for Colorado 5615 Form

- Yuran food institute of malaysia form

- Share certificate ontario template form

- Portrait commission contract form

- Membership form st thomas knanaya church stthomasknanayachurch

- Gottman love map questionnaire form

- Little caesars fundraiser cards form

- Belize passport application form

- Aer bformb 700 1 aw2 application for financial assistance may 2016 aerhq

Find out other Colorado 5615 Form

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement