Hawaii Estate Form

What is the Hawaii Estate

The Hawaii estate refers to the legal framework governing the distribution of a deceased person's assets in the state of Hawaii. This process ensures that the decedent's wishes are honored and that their estate is settled in accordance with state laws. An estate can include various assets such as real estate, personal property, bank accounts, and investments. Understanding the components of a Hawaii estate is crucial for beneficiaries and executors involved in the estate settlement process.

How to use the Hawaii Estate

Using the Hawaii estate involves navigating the probate process, which is the legal procedure for administering a deceased person's estate. This process typically includes filing the will with the court, notifying beneficiaries, and managing the estate's assets. Executors or personal representatives are responsible for ensuring that debts and taxes are paid before distributing the remaining assets to beneficiaries. It is important to follow all legal requirements to avoid complications during the settlement process.

Steps to complete the Hawaii Estate

Completing the Hawaii estate process involves several key steps:

- File the will with the appropriate probate court.

- Notify all beneficiaries and interested parties of the probate proceedings.

- Inventory the estate's assets and assess their value.

- Pay any outstanding debts, taxes, and expenses associated with the estate.

- Distribute the remaining assets to beneficiaries according to the will or state law.

Each step must be executed carefully to ensure compliance with Hawaii's probate laws and to facilitate a smooth estate settlement.

Legal use of the Hawaii Estate

The legal use of the Hawaii estate is governed by state probate laws, which dictate how estates are managed and distributed. Executors must adhere to these laws to ensure that the estate is settled fairly and legally. This includes filing necessary documents, maintaining accurate records, and communicating with beneficiaries. Failure to comply with legal requirements can lead to disputes or penalties, making it essential for executors to understand their responsibilities.

Required Documents

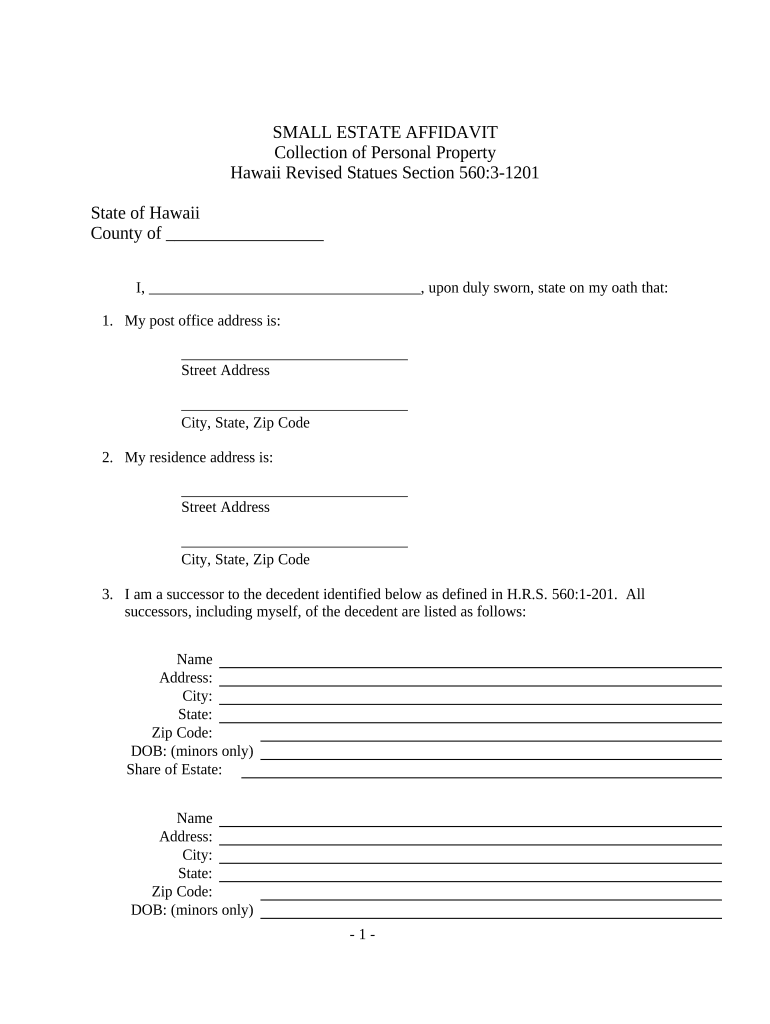

To initiate the probate process for a Hawaii estate, several documents are typically required:

- The original will, if one exists.

- A petition for probate, which requests the court to validate the will.

- A list of the deceased's assets and liabilities.

- Death certificate to confirm the decedent's passing.

- Any relevant financial documents that pertain to the estate.

Having these documents prepared and organized can help streamline the probate process and ensure compliance with legal requirements.

Penalties for Non-Compliance

Non-compliance with Hawaii estate laws can result in various penalties. Executors may face legal repercussions, including personal liability for mismanagement of the estate. Additionally, beneficiaries may contest the probate process, leading to costly legal disputes. It is crucial for executors to understand their duties and follow all legal guidelines to avoid these potential penalties and ensure a smooth estate settlement.

Quick guide on how to complete hawaii estate 497304583

Complete Hawaii Estate effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-conscious substitute for traditional printed and signed paperwork, allowing you to obtain the right form and securely save it online. airSlate SignNow equips you with all the tools you need to create, alter, and eSign your documents swiftly without delays. Handle Hawaii Estate on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Hawaii Estate without hassle

- Obtain Hawaii Estate and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal authority as a conventional wet ink signature.

- Review the information and click on the Done button to save your alterations.

- Select how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new document versions. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Hawaii Estate and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how can it benefit Hawaii small businesses?

airSlate SignNow is a user-friendly platform that enables Hawaii small businesses to send and eSign documents electronically. It streamlines the signing process, allowing for faster transactions which can signNowly improve operational efficiency. With its cost-effective solution, businesses can reduce overhead costs associated with traditional document management.

-

How much does airSlate SignNow cost for Hawaii small businesses?

airSlate SignNow offers flexible pricing plans tailored for Hawaii small businesses. The pricing is competitive, starting at affordable rates that scale with your needs. This ensures that even the smallest enterprises can take advantage of its powerful features without breaking the bank.

-

What features does airSlate SignNow offer that cater specifically to Hawaii small enterprises?

airSlate SignNow includes essential features such as customizable templates, mobile access, and secure cloud storage, perfect for Hawaii small enterprises. The platform also supports various document formats, making it easy for businesses to manage all their paperwork. Its intuitive interface ensures that even those without technical expertise can navigate effortlessly.

-

Can airSlate SignNow integrate with other applications used by Hawaii small businesses?

Yes, airSlate SignNow seamlessly integrates with popular applications like Google Drive, Salesforce, and more, suitable for Hawaii small businesses. This capability allows for a cohesive workflow, as users can manage documents within platforms they already use. These integrations enhance productivity and make document management more efficient.

-

Is airSlate SignNow secure for managing sensitive documents for Hawaii small businesses?

Absolutely, airSlate SignNow employs robust security measures including encryption and compliance with industry standards to ensure sensitive documents are safe for Hawaii small businesses. This level of security gives users peace of mind when handling confidential information. You can trust that your documents are protected from unauthorized access.

-

How does airSlate SignNow enhance collaboration for Hawaii small teams?

airSlate SignNow enhances collaboration among Hawaii small teams through features like real-time document sharing and eSigning. Team members can access and modify documents simultaneously, reducing delays in approvals. This collaborative approach fosters teamwork and speeds up decision-making processes.

-

What support options are available for Hawaii small businesses using airSlate SignNow?

airSlate SignNow provides comprehensive support for Hawaii small businesses, including live chat, email support, and a detailed knowledge base. This ensures that users have the resources they need to resolve any issues quickly. The support team is well-equipped to assist with common queries related to the platform's features.

Get more for Hawaii Estate

- Horse grooming tools worksheets form

- Aarto 14 form download 218900703

- City of plano termination torque forms building

- Ohio dnr form

- Mahindra 4530 owners manual form

- Terminacin de la dependencia por adopcin judicial council forms

- Speed amp agility training for high school athletes st teamunify form

- St anthony parish baptism godparent affirmation st anthony form

Find out other Hawaii Estate

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now