Hawaii Unsecured Installment Payment Promissory Note for Fixed Rate Hawaii Form

What is the Hawaii Unsecured Installment Payment Promissory Note For Fixed Rate Hawaii

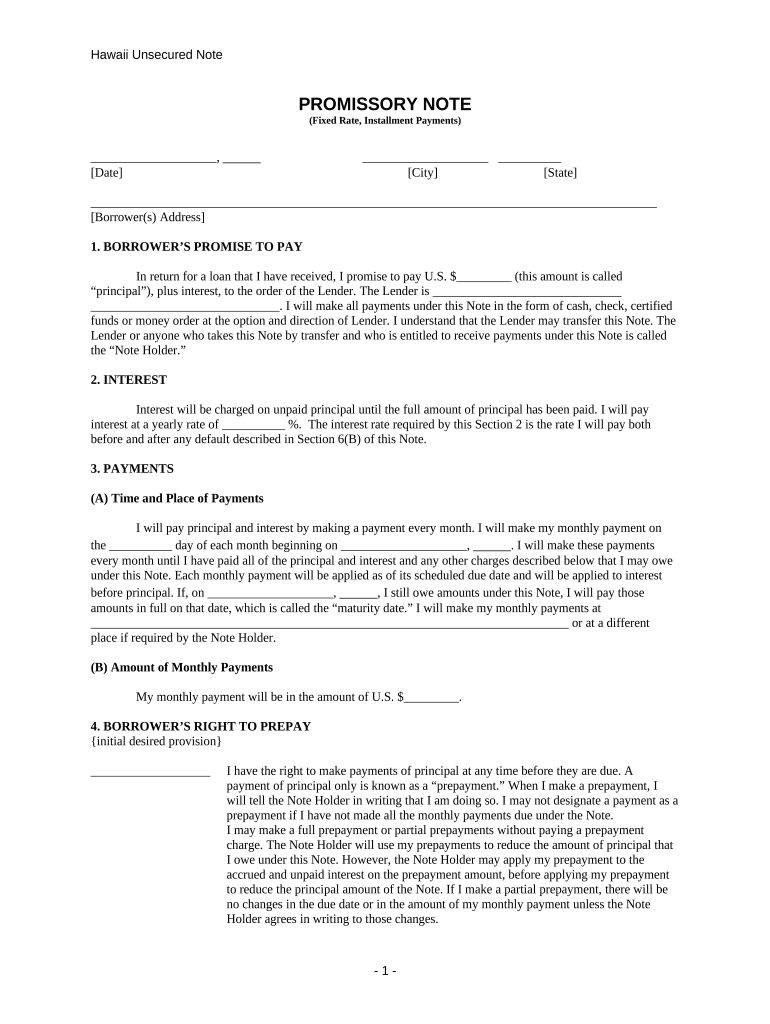

The Hawaii Unsecured Installment Payment Promissory Note for Fixed Rate Hawaii is a legal document used to outline the terms of a loan agreement between a lender and a borrower. This note specifies the repayment schedule, interest rate, and other essential details regarding the loan. Unlike secured notes, this type of promissory note does not require collateral, making it crucial for borrowers to understand their obligations and the potential risks involved. It serves as a binding agreement that can be enforced in a court of law if necessary.

How to use the Hawaii Unsecured Installment Payment Promissory Note For Fixed Rate Hawaii

To effectively use the Hawaii Unsecured Installment Payment Promissory Note for Fixed Rate Hawaii, both parties must first agree on the loan terms. This includes determining the loan amount, interest rate, and repayment schedule. Once the terms are finalized, the borrower should fill out the note, ensuring all necessary information is accurate. After completing the document, both the lender and borrower should sign it, ideally in the presence of a witness or notary, to enhance its legal standing. Digital signing options are available, which can streamline this process while maintaining compliance with legal standards.

Steps to complete the Hawaii Unsecured Installment Payment Promissory Note For Fixed Rate Hawaii

Completing the Hawaii Unsecured Installment Payment Promissory Note for Fixed Rate Hawaii involves several key steps:

- Gather Information: Collect all necessary details, including the loan amount, interest rate, and repayment terms.

- Fill Out the Document: Accurately input the agreed-upon terms into the promissory note template.

- Review the Terms: Both parties should carefully review the document to ensure all information is correct and mutually agreed upon.

- Sign the Note: Both the lender and borrower must sign the document, either physically or digitally, to make it legally binding.

- Store the Document Securely: Keep a copy of the signed note in a safe place for future reference and to ensure compliance with the terms.

Key elements of the Hawaii Unsecured Installment Payment Promissory Note For Fixed Rate Hawaii

Several key elements must be included in the Hawaii Unsecured Installment Payment Promissory Note for Fixed Rate Hawaii to ensure clarity and enforceability:

- Loan Amount: The total amount borrowed must be clearly stated.

- Interest Rate: The fixed interest rate applicable to the loan should be specified.

- Repayment Schedule: Details on how and when payments will be made, including due dates and payment amounts.

- Late Fees: Any penalties for late payments should be outlined to avoid future disputes.

- Signatures: Both parties' signatures are essential for the document's validity.

Legal use of the Hawaii Unsecured Installment Payment Promissory Note For Fixed Rate Hawaii

The legal use of the Hawaii Unsecured Installment Payment Promissory Note for Fixed Rate Hawaii is governed by state laws. This document is recognized as a valid form of debt acknowledgment and can be enforced in court if either party fails to adhere to the terms. It is essential for both lenders and borrowers to understand their rights and responsibilities under this agreement. Additionally, ensuring that the document complies with the requirements set forth by the Uniform Commercial Code (UCC) can further solidify its legal standing.

State-specific rules for the Hawaii Unsecured Installment Payment Promissory Note For Fixed Rate Hawaii

In Hawaii, specific rules govern the use of unsecured installment payment promissory notes. These rules include requirements for interest rates, which must comply with state usury laws, and stipulations regarding the enforceability of the note. It is crucial for both parties to be aware of these regulations to avoid legal complications. Additionally, any modifications to the agreement must be documented in writing and signed by both parties to maintain the note's validity.

Quick guide on how to complete hawaii unsecured installment payment promissory note for fixed rate hawaii

Effortlessly Prepare Hawaii Unsecured Installment Payment Promissory Note For Fixed Rate Hawaii on Any Device

The management of online documents has gained signNow traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to obtain the necessary forms and securely store them online. airSlate SignNow provides all the tools required to swiftly create, modify, and electronically sign your documents without any delays. Manage Hawaii Unsecured Installment Payment Promissory Note For Fixed Rate Hawaii on any device using the airSlate SignNow apps for Android or iOS and enhance your document-related processes today.

The Easiest Way to Edit and Electronically Sign Hawaii Unsecured Installment Payment Promissory Note For Fixed Rate Hawaii

- Find Hawaii Unsecured Installment Payment Promissory Note For Fixed Rate Hawaii and select Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any chosen device. Modify and electronically sign Hawaii Unsecured Installment Payment Promissory Note For Fixed Rate Hawaii to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Hawaii Unsecured Installment Payment Promissory Note For Fixed Rate Hawaii?

A Hawaii Unsecured Installment Payment Promissory Note For Fixed Rate Hawaii is a legal document that outlines the borrower's commitment to repay a loan in fixed installments over a specified period. This type of promissory note does not require collateral, making it accessible for borrowers seeking unsecured financing options in Hawaii.

-

How can I create a Hawaii Unsecured Installment Payment Promissory Note For Fixed Rate Hawaii?

You can easily create a Hawaii Unsecured Installment Payment Promissory Note For Fixed Rate Hawaii using airSlate SignNow's user-friendly document templates. Simply fill in the necessary details, such as loan amount, payment schedule, and parties involved, and generate your promissory note for eSigning.

-

What are the benefits of using a Hawaii Unsecured Installment Payment Promissory Note For Fixed Rate Hawaii?

Using a Hawaii Unsecured Installment Payment Promissory Note For Fixed Rate Hawaii provides several benefits, including clear terms of repayment and protection for both parties involved in the transaction. It also establishes a formal record of the loan agreement, which can help prevent future disputes.

-

Are there any fees associated with the Hawaii Unsecured Installment Payment Promissory Note For Fixed Rate Hawaii?

While the cost of generating a Hawaii Unsecured Installment Payment Promissory Note For Fixed Rate Hawaii can vary based on the service you use, airSlate SignNow offers competitive pricing with no hidden fees. Our packages provide an economical solution for creating and managing your documents.

-

Can I customize my Hawaii Unsecured Installment Payment Promissory Note For Fixed Rate Hawaii?

Absolutely! airSlate SignNow allows you to fully customize your Hawaii Unsecured Installment Payment Promissory Note For Fixed Rate Hawaii according to your specific needs. You can adjust terms, add personalized clauses, and tailor the document format to suit your preferences.

-

Is it legal to use a Hawaii Unsecured Installment Payment Promissory Note For Fixed Rate Hawaii?

Yes, a Hawaii Unsecured Installment Payment Promissory Note For Fixed Rate Hawaii is a legally binding document recognized in Hawaii. As long as it fulfills all state requirements and is properly executed with signatures, it is enforceable in a court of law.

-

What integrations does airSlate SignNow offer for managing my Hawaii Unsecured Installment Payment Promissory Note For Fixed Rate Hawaii?

airSlate SignNow seamlessly integrates with various applications such as Google Drive, Dropbox, and CRMs, allowing you to manage your Hawaii Unsecured Installment Payment Promissory Note For Fixed Rate Hawaii efficiently. This streamlines your document management process and improves overall productivity.

Get more for Hawaii Unsecured Installment Payment Promissory Note For Fixed Rate Hawaii

- Purchase money security interest form

- Boy scout behavior contract form

- Teen budget worksheet form

- Physiotherapy discharge summary template form

- Events yu gi oh arc v official card game asia yugioh card form

- Straight bill of lading short form jj keller

- Passfail designation form boston university

- Statement of citizenship alienage and immigration status form

Find out other Hawaii Unsecured Installment Payment Promissory Note For Fixed Rate Hawaii

- How Can I eSignature Texas Stock Certificate

- Help Me With eSign Florida New employee checklist

- How To eSign Illinois Rental application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract