Satisfaction, Release or Cancellation of Mortgage by Individual Hawaii Form

What is the Satisfaction, Release Or Cancellation Of Mortgage By Individual Hawaii

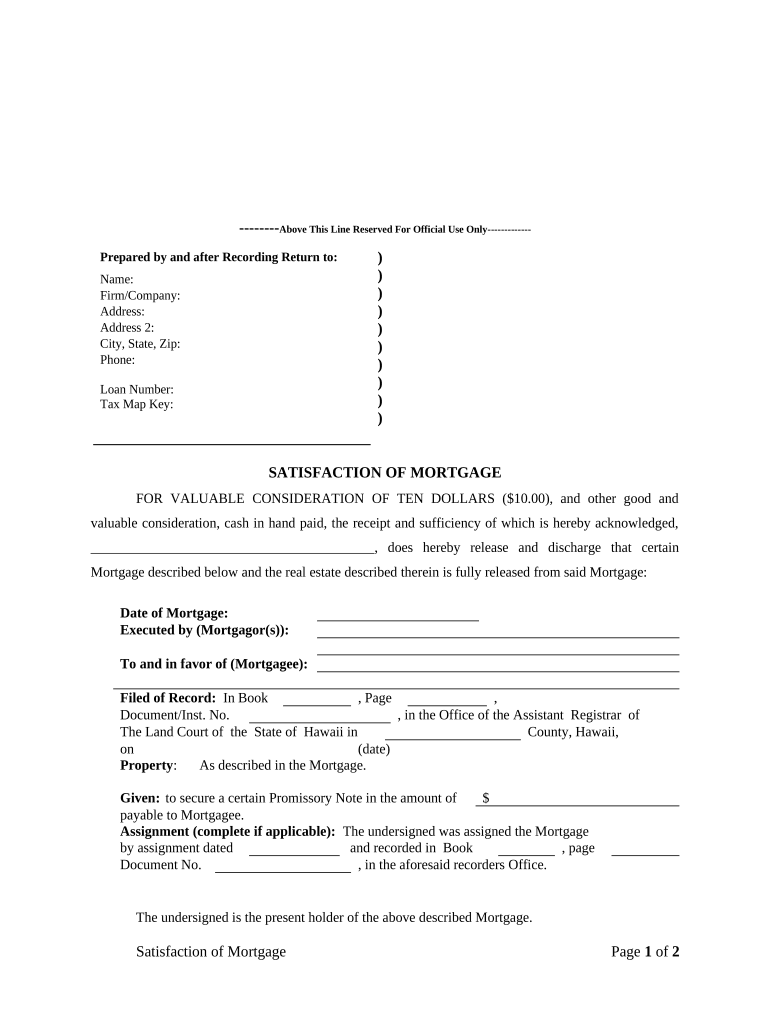

The Satisfaction, Release or Cancellation of Mortgage by Individual in Hawaii is a legal document that signifies the completion of a mortgage agreement. When a borrower pays off their mortgage, this form is used to formally release the lender's claim on the property. It serves as proof that the mortgage obligation has been fulfilled, allowing the borrower to clear the title of the property. This document is crucial for homeowners who wish to sell or refinance their property, as it ensures that there are no outstanding liens against it.

Steps to Complete the Satisfaction, Release Or Cancellation Of Mortgage By Individual Hawaii

Completing the Satisfaction, Release or Cancellation of Mortgage by Individual in Hawaii involves several important steps:

- Gather necessary information, including the mortgage account number, property details, and borrower information.

- Obtain the appropriate form from a reliable source or create one using digital tools.

- Fill out the form accurately, ensuring all required fields are completed.

- Sign the document using a legally recognized method, such as an electronic signature, to ensure compliance.

- Submit the completed form to the appropriate county office for recording.

How to Use the Satisfaction, Release Or Cancellation Of Mortgage By Individual Hawaii

Using the Satisfaction, Release or Cancellation of Mortgage by Individual in Hawaii is straightforward. Once the mortgage is paid off, the borrower should fill out the form to initiate the release process. This document must be submitted to the local county recorder's office, where it will be officially recorded. By doing so, the borrower ensures that the mortgage is removed from public records, allowing for clear ownership of the property. Utilizing digital tools can simplify this process, making it easier to fill out and submit the form securely.

Legal Use of the Satisfaction, Release Or Cancellation Of Mortgage By Individual Hawaii

This form is legally binding when executed correctly. To ensure its validity, it must meet specific requirements, such as being signed by the borrower and notarized if necessary. The document must also comply with Hawaii state laws regarding mortgage releases. By adhering to these legal stipulations, the Satisfaction, Release or Cancellation of Mortgage by Individual serves as a reliable means of confirming that the mortgage has been satisfied, protecting the borrower's rights and interests.

Key Elements of the Satisfaction, Release Or Cancellation Of Mortgage By Individual Hawaii

Key elements of the Satisfaction, Release or Cancellation of Mortgage by Individual in Hawaii include:

- The names and addresses of the borrower and lender.

- The mortgage account number and property description.

- A statement confirming that the mortgage has been paid in full.

- Signatures of the borrower and any required witnesses or notaries.

- The date of completion and submission to the county recorder's office.

State-Specific Rules for the Satisfaction, Release Or Cancellation Of Mortgage By Individual Hawaii

In Hawaii, specific rules govern the use of the Satisfaction, Release or Cancellation of Mortgage. These include requirements for notarization, the need for accurate property descriptions, and adherence to local recording laws. It is essential for borrowers to familiarize themselves with these regulations to ensure the document is valid and enforceable. Additionally, understanding local procedures for filing can help streamline the process and avoid delays.

Quick guide on how to complete satisfaction release or cancellation of mortgage by individual hawaii

Complete Satisfaction, Release Or Cancellation Of Mortgage By Individual Hawaii effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed forms, allowing you to obtain the necessary document and securely save it online. airSlate SignNow equips you with all the necessary tools to create, alter, and eSign your documents quickly and without delays. Manage Satisfaction, Release Or Cancellation Of Mortgage By Individual Hawaii on any device with the airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

The simplest method to modify and eSign Satisfaction, Release Or Cancellation Of Mortgage By Individual Hawaii with ease

- Locate Satisfaction, Release Or Cancellation Of Mortgage By Individual Hawaii and then click Get Form to commence.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure confidential information using tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and then click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Disregard lost or misplaced documents, the hassle of searching for forms, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Satisfaction, Release Or Cancellation Of Mortgage By Individual Hawaii and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the process for Satisfaction, Release Or Cancellation Of Mortgage By Individual Hawaii?

The process begins with the borrower requesting the satisfaction or release of the mortgage from the lender. Once approved, the lender will prepare and file the necessary documents to officially release the mortgage. Using airSlate SignNow can streamline this process, allowing for easy electronic signatures and quicker completion times.

-

How does airSlate SignNow facilitate Satisfaction, Release Or Cancellation Of Mortgage By Individual Hawaii?

airSlate SignNow simplifies the process by enabling users to send documents for eSignature quickly. This allows individuals in Hawaii to efficiently manage the satisfaction, release, or cancellation of their mortgage with minimal hassle. The platform’s user-friendly interface ensures that all parties can navigate the process easily.

-

Are there any costs associated with using airSlate SignNow for mortgage release in Hawaii?

Yes, airSlate SignNow offers flexible pricing plans tailored to fit various needs, including options for individual users. By subscribing to an appropriate plan, customers can access features that make the Satisfaction, Release Or Cancellation Of Mortgage By Individual Hawaii process seamless. The investment is often outweighed by the time saved and the convenience offered.

-

What features does airSlate SignNow provide for document management?

airSlate SignNow offers features such as customizable templates, real-time tracking, and secure eSigning, which are crucial for the Satisfaction, Release Or Cancellation Of Mortgage By Individual Hawaii. These features enable users to manage their documents efficiently, ensuring that nothing is overlooked during the process.

-

Can I integrate airSlate SignNow with other tools for my mortgage processing needs?

Absolutely! airSlate SignNow provides integrations with various productivity tools, enhancing your workflow. This is particularly beneficial for users involved in the Satisfaction, Release Or Cancellation Of Mortgage By Individual Hawaii, as it allows for more efficient document handling across different platforms.

-

Is airSlate SignNow compliant with the legal requirements for mortgage releases in Hawaii?

Yes, airSlate SignNow complies with legal standards required for electronic signatures in Hawaii. This means that when completing the Satisfaction, Release Or Cancellation Of Mortgage By Individual Hawaii, you can have confidence that your documents are legally binding and secure.

-

What are the benefits of using airSlate SignNow for mortgage release documentation?

The main benefits include time savings, ease of use, and enhanced security. By utilizing airSlate SignNow for the Satisfaction, Release Or Cancellation Of Mortgage By Individual Hawaii, borrowers can complete their processes quickly, allowing for faster transitions to new opportunities.

Get more for Satisfaction, Release Or Cancellation Of Mortgage By Individual Hawaii

- Similarity in right triangles answer key form

- Hap prior authorization form pdf

- Ussf game report form

- Peoples bank fixed deposit application form

- Scim spinal cord independence measure version iii form

- Modelo de denuncia por acoso form

- Take your child to work day letter from employer template form

- Download an employment application xpress non emergency form

Find out other Satisfaction, Release Or Cancellation Of Mortgage By Individual Hawaii

- How To eSign Vermont Digital contracts

- eSign Vermont Digital contracts Now

- eSign Vermont Digital contracts Later

- How Can I eSign New Jersey Contract of employment

- eSignature Kansas Travel Agency Agreement Now

- How Can I eSign Texas Contract of employment

- eSignature Tennessee Travel Agency Agreement Mobile

- eSignature Oregon Amendment to an LLC Operating Agreement Free

- Can I eSign Hawaii Managed services contract template

- How Do I eSign Iowa Managed services contract template

- Can I eSignature Wyoming Amendment to an LLC Operating Agreement

- eSign Massachusetts Personal loan contract template Simple

- How Do I eSign Massachusetts Personal loan contract template

- How To eSign Mississippi Personal loan contract template

- How Do I eSign Oklahoma Personal loan contract template

- eSign Oklahoma Managed services contract template Easy

- Can I eSign South Carolina Real estate contracts

- eSign Texas Renter's contract Mobile

- How Do I eSign Texas Renter's contract

- eSign Hawaii Sales contract template Myself