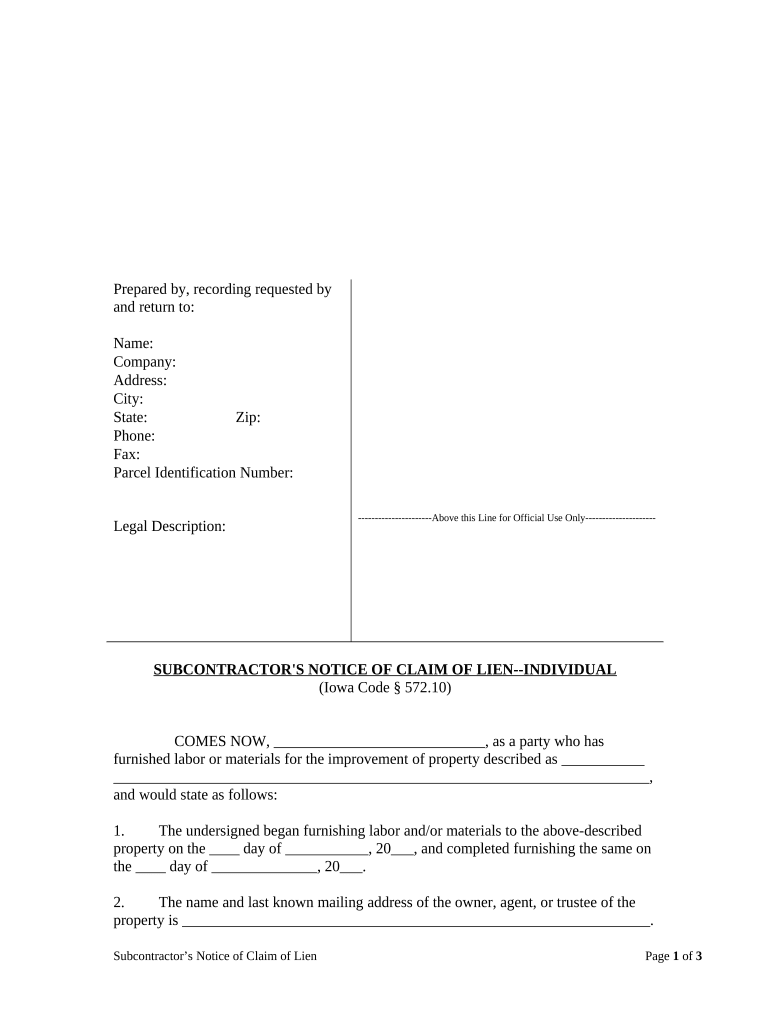

Ia Lien Form

What is the Ia Lien

The Ia Lien is a legal document used primarily in the United States to establish a claim against a property. It serves as a notice to the property owner and potential buyers that there is an outstanding obligation, such as unpaid debts or taxes, associated with the property. This form is crucial for creditors seeking to secure their interests and ensure that they have a legal claim should the property be sold or refinanced.

How to Use the Ia Lien

Using the Ia Lien involves several steps to ensure it is properly filed and recognized. First, you must complete the form accurately, providing all necessary details about the property and the debt. Once completed, the form should be filed with the appropriate local government office, typically the county recorder or clerk’s office. It is essential to keep a copy for your records and to notify the property owner of the lien to maintain transparency and legal standing.

Steps to Complete the Ia Lien

Completing the Ia Lien requires careful attention to detail. Follow these steps:

- Gather all necessary information, including the property address, owner details, and specifics about the debt.

- Fill out the form, ensuring all fields are completed accurately.

- Review the form for any errors or omissions.

- Sign and date the form as required.

- File the completed form with the local government office.

- Notify the property owner of the lien.

Legal Use of the Ia Lien

The Ia Lien is legally binding once filed with the appropriate authority. It provides a formal mechanism for creditors to assert their rights over a property. To be enforceable, the lien must comply with local laws regarding notification and filing procedures. Understanding these legal requirements is essential for both creditors and property owners to avoid disputes and ensure compliance with state regulations.

Key Elements of the Ia Lien

Several key elements must be included in the Ia Lien to ensure its validity:

- Identification of the debtor and the property.

- A clear description of the debt or obligation.

- The date the debt was incurred.

- The signature of the creditor or authorized representative.

- Filing information, including the date of filing and the recording office.

Examples of Using the Ia Lien

The Ia Lien can be utilized in various scenarios, such as:

- A contractor filing a lien for unpaid work on a property.

- A lender asserting a claim on a property due to unpaid mortgage payments.

- A tax authority placing a lien for unpaid property taxes.

These examples illustrate the Ia Lien's role in protecting creditors' rights and ensuring that obligations are met.

Quick guide on how to complete ia lien

Effortlessly Prepare Ia Lien on Any Device

Digital document management has gained signNow traction among companies and individuals alike. It serves as an excellent environmentally-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly and without interruptions. Handle Ia Lien across any platform using airSlate SignNow's Android or iOS applications and improve any document-based workflow today.

How to Alter and eSign Ia Lien with Ease

- Find Ia Lien and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Select important sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the information, then click the Done button to save your changes.

- Decide how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your preferred device. Modify and eSign Ia Lien while ensuring excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is ia lien and how does airSlate SignNow support it?

ia lien refers to a legal claim against an asset. With airSlate SignNow, users can efficiently create, send, and eSign document templates that include ia lien details, ensuring compliance and accuracy in legal matters.

-

How does the pricing for airSlate SignNow work for managing ia lien documents?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. By utilizing airSlate SignNow for ia lien documents, users can manage costs effectively while ensuring secure and efficient document handling.

-

What features does airSlate SignNow provide for managing ia lien documentation?

Features for managing ia lien documentation in airSlate SignNow include customizable templates, automated workflows, and secure eSignature capabilities. These help streamline the process, reduce errors, and save time.

-

Can airSlate SignNow integrate with other software for handling ia lien documents?

Yes, airSlate SignNow integrates seamlessly with various third-party applications, making it easy to manage ia lien documents within your existing workflow. This enhances productivity and data management efficiency.

-

What are the benefits of using airSlate SignNow for ia lien processing?

Using airSlate SignNow for ia lien processing offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform enables quick eSigning, which speeds up transactions and approvals.

-

Is airSlate SignNow secure for handling sensitive ia lien documents?

Absolutely, airSlate SignNow employs robust security measures, including encryption and secure data storage, to protect sensitive ia lien documents. Users can trust that their information is safeguarded at all times.

-

How can airSlate SignNow improve the workflow for managing ia lien documents?

airSlate SignNow enhances workflow for ia lien documents by automating repetitive tasks and providing real-time tracking of document status. This leads to improved collaboration and faster turnaround times.

Get more for Ia Lien

Find out other Ia Lien

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF