Non Foreign Affidavit under IRC 1445 Iowa Form

What is the Non Foreign Affidavit Under IRC 1445 Iowa

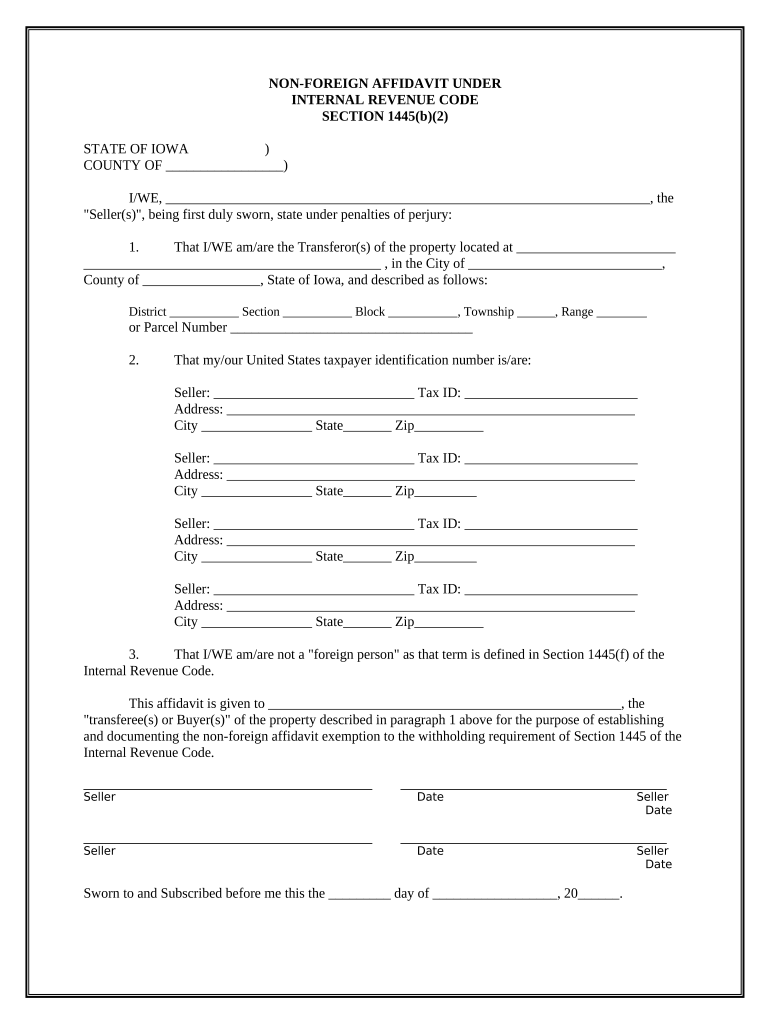

The Non Foreign Affidavit Under IRC 1445 Iowa is a legal document utilized primarily in real estate transactions. It certifies that the seller is not a foreign person as defined by the Internal Revenue Code (IRC) Section 1445. This affidavit is crucial for buyers as it helps them avoid withholding taxes that would apply if the seller were a foreign entity. By signing this affidavit, sellers affirm their status, thereby facilitating smoother property transfers and compliance with federal tax regulations.

How to use the Non Foreign Affidavit Under IRC 1445 Iowa

Using the Non Foreign Affidavit Under IRC 1445 Iowa involves several steps. First, the seller must fill out the affidavit accurately, providing necessary personal information and confirming their non-foreign status. This document is typically presented during the closing of a real estate transaction. Buyers should ensure they receive this affidavit from the seller to comply with tax obligations. Once completed, the affidavit should be signed in the presence of a notary public to ensure its legal validity.

Steps to complete the Non Foreign Affidavit Under IRC 1445 Iowa

Completing the Non Foreign Affidavit Under IRC 1445 Iowa involves the following steps:

- Gather required information, including the seller's name, address, and taxpayer identification number.

- Fill out the affidavit, ensuring all details are accurate and complete.

- Sign the document in the presence of a notary public to validate the affidavit.

- Provide the completed affidavit to the buyer or their representative during the closing process.

Key elements of the Non Foreign Affidavit Under IRC 1445 Iowa

The Non Foreign Affidavit Under IRC 1445 Iowa contains several key elements that are essential for its effectiveness:

- Seller's Information: Full name and address of the seller.

- Taxpayer Identification Number: Required for tax identification purposes.

- Certification Statement: A declaration confirming the seller is not a foreign person.

- Signature and Notarization: The seller's signature must be notarized to ensure authenticity.

Legal use of the Non Foreign Affidavit Under IRC 1445 Iowa

The legal use of the Non Foreign Affidavit Under IRC 1445 Iowa is primarily to comply with federal tax regulations. By providing this affidavit, sellers protect buyers from potential withholding taxes that apply to foreign sellers. It serves as a safeguard for both parties, ensuring that the transaction adheres to the legal requirements set forth by the IRS. Failure to provide this affidavit can result in tax complications for the buyer, making it a critical component of real estate transactions.

Filing Deadlines / Important Dates

While the Non Foreign Affidavit Under IRC 1445 Iowa does not have specific filing deadlines like tax returns, it is essential to present it during the closing of a real estate transaction. Buyers and sellers should ensure that the affidavit is completed and notarized before the closing date to avoid any delays in the transaction process. It is advisable to check with local regulations or legal counsel for any additional timelines that may apply.

Quick guide on how to complete non foreign affidavit under irc 1445 iowa

Complete Non Foreign Affidavit Under IRC 1445 Iowa seamlessly across any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without any setbacks. Manage Non Foreign Affidavit Under IRC 1445 Iowa on any device with airSlate SignNow Android or iOS applications and streamline any document-oriented procedure today.

The easiest way to modify and eSign Non Foreign Affidavit Under IRC 1445 Iowa effortlessly

- Locate Non Foreign Affidavit Under IRC 1445 Iowa and click on Get Form to initiate the process.

- Use the tools we provide to complete your form.

- Emphasize important sections of the documents or black out confidential information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to deliver your form, either by email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Non Foreign Affidavit Under IRC 1445 Iowa and ensure exceptional communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Non Foreign Affidavit Under IRC 1445 in Iowa?

A Non Foreign Affidavit Under IRC 1445 in Iowa is a legal document used to signNow that a seller of real property is not a foreign person, thereby ensuring that withholding tax is not applicable. This affidavit is essential for buyers and sellers to comply with federal regulations during the real estate transaction process.

-

Why is a Non Foreign Affidavit Under IRC 1445 important in real estate transactions?

Having a Non Foreign Affidavit Under IRC 1445 in Iowa is crucial as it protects both the buyer and the seller from potential tax liabilities. It confirms the seller's tax status and helps facilitate smoother transactions without unexpected withholding issues during the sale process.

-

How can airSlate SignNow assist in the process of obtaining a Non Foreign Affidavit Under IRC 1445 in Iowa?

airSlate SignNow simplifies the process of obtaining a Non Foreign Affidavit Under IRC 1445 in Iowa by allowing users to create, sign, and send documents electronically. Our platform provides templates and guidance to ensure the affidavit meets all necessary legal requirements, streamlining your workflow.

-

What features does airSlate SignNow offer for handling Non Foreign Affidavit Under IRC 1445 in Iowa?

airSlate SignNow offers features that include document templates, electronic signatures, secure storage, and customizable workflows specifically tailored for the Non Foreign Affidavit Under IRC 1445 in Iowa. These tools enhance efficiency and reduce the time spent on paperwork during real estate transactions.

-

Is airSlate SignNow a cost-effective solution for processing Non Foreign Affidavit Under IRC 1445 in Iowa?

Yes, airSlate SignNow offers a cost-effective solution for processing a Non Foreign Affidavit Under IRC 1445 in Iowa. Our pricing plans are designed to fit the needs of businesses of all sizes, ensuring access to essential features without breaking your budget.

-

Can I integrate airSlate SignNow with other tools for managing Non Foreign Affidavit Under IRC 1445 in Iowa?

Absolutely! airSlate SignNow supports integrations with various applications, enhancing the management of your Non Foreign Affidavit Under IRC 1445 in Iowa. By connecting to tools you already use, you can streamline your document workflow and increase productivity.

-

What benefits do I gain by using airSlate SignNow for my Non Foreign Affidavit Under IRC 1445 in Iowa?

Using airSlate SignNow for your Non Foreign Affidavit Under IRC 1445 in Iowa provides numerous benefits, including increased efficiency, reduced processing time, and enhanced security for your documents. Our platform empowers you to focus on important business decisions rather than paperwork.

Get more for Non Foreign Affidavit Under IRC 1445 Iowa

- Cyber security sop pdf form

- Dubai offer letter pdf form

- Maine home inspection checklist form

- Pg1 peri operative record v8 hospital forms

- Bomb threat checklist 474099350 form

- Fem application form

- Hub24 invest application form 30 september hu

- Pricing and internet ordering agreement waxie sanitary supply form

Find out other Non Foreign Affidavit Under IRC 1445 Iowa

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement