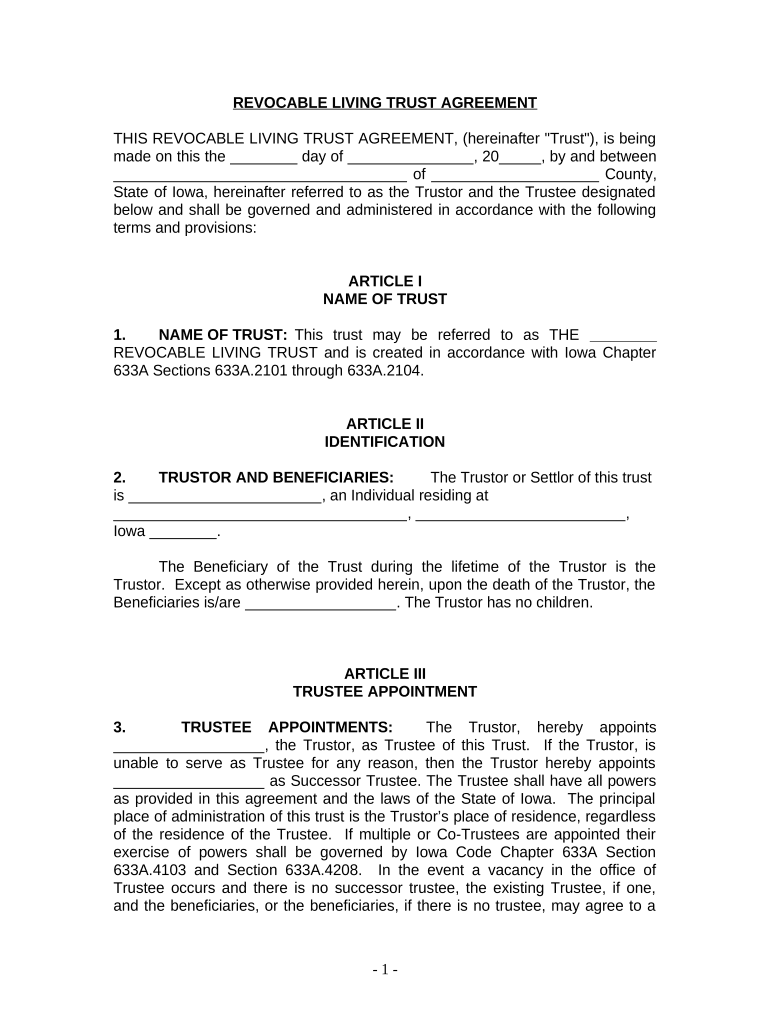

Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children Iowa Form

What is the Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children Iowa

A living trust for an individual who is single, divorced, or a widow or widower with no children in Iowa is a legal arrangement that allows a person to manage their assets during their lifetime and specify how those assets should be distributed after their death. This type of trust is particularly beneficial for individuals without children, as it provides a clear plan for asset distribution, ensuring that their wishes are honored. It can help avoid the lengthy probate process, maintain privacy, and provide flexibility in managing assets.

Steps to Complete the Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children Iowa

Completing a living trust in Iowa involves several key steps:

- Determine your assets: List all assets you wish to include in the trust, such as real estate, bank accounts, and investments.

- Select a trustee: Choose a reliable person or institution to manage the trust. This can be yourself or another trusted individual.

- Draft the trust document: Create a legal document outlining the terms of the trust, including how assets will be managed and distributed.

- Sign the document: Execute the trust document according to Iowa state laws, which may require witnesses or notarization.

- Fund the trust: Transfer ownership of your assets into the trust to ensure they are managed according to your wishes.

Legal Use of the Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children Iowa

The legal use of a living trust in Iowa is recognized as a valid estate planning tool. It allows individuals to dictate how their assets should be handled during their lifetime and after death. This trust can be particularly useful for avoiding probate, which can be time-consuming and costly. It also provides a mechanism for managing assets in case of incapacity, ensuring that your financial affairs are handled according to your preferences.

State-Specific Rules for the Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children Iowa

Iowa has specific regulations governing living trusts. The trust must be created in writing and signed by the grantor. It is essential to ensure that the trust complies with Iowa law to be considered valid. Additionally, the trust should clearly outline the distribution of assets and the responsibilities of the trustee. Understanding these state-specific rules can help avoid potential legal challenges and ensure that the trust operates as intended.

Key Elements of the Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children Iowa

Key elements of a living trust in Iowa include:

- Grantor: The individual creating the trust, who retains control over the assets.

- Trustee: The person or entity responsible for managing the trust assets.

- Beneficiaries: Individuals or organizations designated to receive assets from the trust upon the grantor's death.

- Trust document: The legal document that outlines the terms and conditions of the trust.

How to Use the Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children Iowa

Using a living trust in Iowa involves managing your assets according to the terms set forth in the trust document. As the grantor, you can continue to use and control your assets during your lifetime. Upon your death, the trustee will distribute the assets to the beneficiaries as specified in the trust. This process is generally quicker and less complicated than probate, allowing for a smoother transition of assets to your chosen beneficiaries.

Quick guide on how to complete living trust for individual who is single divorced or widow or widower with no children iowa

Complete Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children Iowa effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly replacement for conventional printed and signed documents, enabling you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without delays. Manage Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children Iowa on any device via airSlate SignNow Android or iOS applications and streamline any document-related operation today.

The easiest way to modify and eSign Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children Iowa without hassle

- Find Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children Iowa and click Get Form to commence.

- Utilize the tools we offer to finish your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, cumbersome form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children Iowa and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust for Individuals Who Are Single, Divorced, or Widowed Without Children in Iowa?

A Living Trust for Individuals Who Are Single, Divorced, or Widowed Without Children in Iowa is a legal document that allows you to manage your assets during your lifetime and specify how they will be distributed after your death, without the need for probate. This is particularly beneficial for those who do not have children, as it can help streamline the transfer of assets.

-

How much does it cost to establish a Living Trust for individuals who are single, divorced, or widowed with no children in Iowa?

The cost of creating a Living Trust for Individuals Who Are Single, Divorced, or Widowed With No Children in Iowa can vary, typically ranging from a few hundred to a few thousand dollars depending on complexity. It's advisable to consult with an estate planning attorney to receive a tailored quote based on your specific needs.

-

What are the key benefits of using a Living Trust for Individuals Who Are Single, Divorced, or Widowed With No Children in Iowa?

Key benefits include avoiding probate, maintaining privacy regarding your assets, and having greater control over the distribution of your estate. Additionally, a Living Trust can expedite asset distribution to your chosen beneficiaries, which is particularly beneficial for those without children.

-

Can I amend my Living Trust for individuals who are single, divorced, or widowed without children in Iowa?

Yes, a Living Trust for Individuals Who Are Single, Divorced, or Widowed With No Children in Iowa is revocable, meaning you can amend it as your circumstances change. This flexibility allows you to update your beneficiaries or modify asset management strategies as needed.

-

What assets can be included in a Living Trust for individuals who are single, divorced, or widowed without children in Iowa?

You can include various assets in a Living Trust for Individuals Who Are Single, Divorced, or Widowed With No Children in Iowa, such as real estate, bank accounts, investments, and personal property. Properly funding your trust with these assets ensures they are managed and distributed according to your wishes.

-

How does a Living Trust affect estate tax for individuals who are single, divorced, or widowed with no children in Iowa?

A Living Trust does not directly impact your estate tax liabilities; however, it can help minimize probate costs and provide flexibility in the distribution of your estate. Consulting with a tax advisor or estate planner can help you understand any potential tax implications specific to your situation.

-

Is it necessary to hire a lawyer to create a Living Trust for individuals who are single, divorced, or widowed without children in Iowa?

While it's not strictly necessary, hiring a lawyer is highly recommended when creating a Living Trust for Individuals Who Are Single, Divorced, or Widowed With No Children in Iowa. A legal professional can ensure that your trust complies with Iowa laws and accurately reflects your wishes.

Get more for Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children Iowa

- Trent and dove register form

- Downloadable word resident policies addendum form 17 0

- Mol es 001e t1 form

- Referral for nycha fill online printable form

- Pdf editor online persian form

- Proxy authorization drr aktiengesellschaft form

- Oklahoma farm lease agreement oces okstate form

- If you wish to pay by direct debit please fill in the form

Find out other Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children Iowa

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile