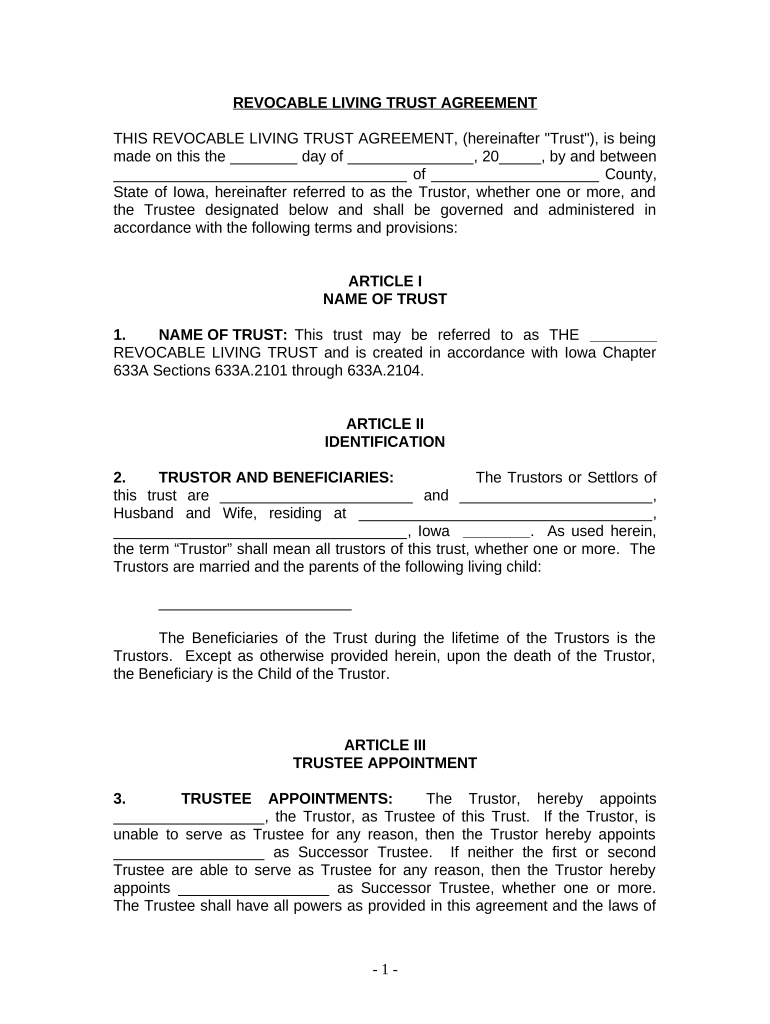

Living Trust for Husband and Wife with One Child Iowa Form

What is the Living Trust For Husband And Wife With One Child Iowa

A living trust for husband and wife with one child in Iowa is a legal arrangement that allows couples to manage and distribute their assets during their lifetime and after death. This type of trust can help avoid probate, ensuring that the surviving spouse and child receive their inheritance without the delays and costs associated with court proceedings. The trust can hold various assets, including real estate, bank accounts, and investments, providing a flexible way to manage family wealth.

Key Elements of the Living Trust For Husband And Wife With One Child Iowa

Several key elements define a living trust for husband and wife with one child in Iowa:

- Trustees: Typically, both spouses act as co-trustees, allowing them to manage the trust assets together.

- Beneficiaries: The primary beneficiaries are usually the spouse and child, with provisions for alternate beneficiaries if necessary.

- Asset Management: The trust outlines how assets are to be managed during the couple's lifetime and specifies distribution upon death.

- Revocability: Most living trusts are revocable, meaning the couple can modify or dissolve the trust as their circumstances change.

Steps to Complete the Living Trust For Husband And Wife With One Child Iowa

Completing a living trust for husband and wife with one child in Iowa involves several steps:

- Gather Information: Collect details about all assets, including property, bank accounts, and investments.

- Choose a Trustee: Decide whether both spouses will serve as co-trustees or designate another trusted individual.

- Draft the Trust Document: Create a trust document that outlines the terms, including asset distribution and management instructions.

- Sign the Document: Both spouses must sign the trust document in front of a notary public to ensure its legal validity.

- Transfer Assets: Fund the trust by transferring ownership of assets into the trust's name.

Legal Use of the Living Trust For Husband And Wife With One Child Iowa

The legal use of a living trust for husband and wife with one child in Iowa is significant for estate planning. It provides a clear framework for asset distribution, minimizing potential disputes among heirs. The trust remains effective during the couple's lifetime and can be used to manage assets if one spouse becomes incapacitated. Additionally, it can help in tax planning and protecting assets from creditors, ensuring that the family's financial legacy is preserved.

State-Specific Rules for the Living Trust For Husband And Wife With One Child Iowa

Iowa has specific regulations governing living trusts. These include:

- Witness Requirements: The trust document must be signed by the grantors in the presence of a notary public.

- Asset Transfer: Properly transferring assets into the trust is essential for it to be effective; failure to do so may result in those assets being subject to probate.

- Tax Implications: Couples should consult with a tax professional to understand the tax implications of their living trust, especially regarding estate taxes.

How to Obtain the Living Trust For Husband And Wife With One Child Iowa

Obtaining a living trust for husband and wife with one child in Iowa can be accomplished through several methods:

- Legal Assistance: Many couples choose to work with an estate planning attorney who specializes in trusts to ensure compliance with state laws.

- Online Resources: Various online platforms offer templates and guidance for creating a living trust, although these may not be tailored to specific needs.

- Financial Institutions: Some banks and financial advisors provide trust services and can assist in setting up a living trust.

Quick guide on how to complete living trust for husband and wife with one child iowa

Complete Living Trust For Husband And Wife With One Child Iowa with ease on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to obtain the necessary form and securely preserve it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents swiftly without any hold-ups. Handle Living Trust For Husband And Wife With One Child Iowa on any device with airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Living Trust For Husband And Wife With One Child Iowa seamlessly

- Obtain Living Trust For Husband And Wife With One Child Iowa and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred delivery method for your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any chosen device. Alter and eSign Living Trust For Husband And Wife With One Child Iowa and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust For Husband And Wife With One Child in Iowa?

A Living Trust For Husband And Wife With One Child in Iowa is a legal document that allows couples to manage their assets during their lifetime and specify how those assets should be distributed upon their death. It can help in avoiding probate, ensuring a smoother transfer of assets to your child.

-

How much does it cost to create a Living Trust For Husband And Wife With One Child in Iowa?

The cost of creating a Living Trust For Husband And Wife With One Child in Iowa can vary depending on the complexity of your assets and the fees charged by legal professionals or online services. Generally, you can expect to spend anywhere from $1,000 to $3,000, but using airSlate SignNow can offer you a more cost-effective solution.

-

What are the benefits of establishing a Living Trust For Husband And Wife With One Child in Iowa?

The benefits of a Living Trust For Husband And Wife With One Child in Iowa include avoiding probate, maintaining privacy, and providing greater control over asset management and distribution. Additionally, it can simplify the process for your child, as they won't have to navigate probate court.

-

Can I modify my Living Trust For Husband And Wife With One Child in Iowa?

Yes, you can modify your Living Trust For Husband And Wife With One Child in Iowa at any time as long as you are competent. This flexibility allows you to adjust the terms of the trust based on changes in your family situation or financial status.

-

Are there any tax implications with a Living Trust For Husband And Wife With One Child in Iowa?

Generally, a Living Trust For Husband And Wife With One Child in Iowa does not have direct tax implications, as the assets are still considered part of your estate. It's advisable to consult a tax professional to understand any potential tax considerations or benefits for your specific situation.

-

How does airSlate SignNow facilitate the creation of a Living Trust For Husband And Wife With One Child in Iowa?

airSlate SignNow simplifies the creation of a Living Trust For Husband And Wife With One Child in Iowa by offering user-friendly templates and an eSigning platform that ensures your documents are securely signed and stored. This allows you to efficiently manage and finalize your trust without the hassle of traditional methods.

-

What assets can be included in a Living Trust For Husband And Wife With One Child in Iowa?

You can include various assets in your Living Trust For Husband And Wife With One Child in Iowa, such as real estate, bank accounts, investments, and personal property. This flexibility allows you to ensure that all your assets are managed according to your wishes.

Get more for Living Trust For Husband And Wife With One Child Iowa

- Sba form 793

- Laparoscopic cholecystectomy operative note sample form

- Nurturing parenting workbook pdf form

- If something should happen pdf form

- Reisepass antragsformular

- Health alaska govdphvitalstatsalaska marriage certificate request form

- Mental capacity assessment form 788517409

- Design and access statement template form

Find out other Living Trust For Husband And Wife With One Child Iowa

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment

- eSign Georgia Lease Amendment Free

- eSign Arizona Notice of Intent to Vacate Easy

- eSign Louisiana Notice of Rent Increase Mobile

- eSign Washington Notice of Rent Increase Computer

- How To eSign Florida Notice to Quit

- How To eSign Hawaii Notice to Quit

- eSign Montana Pet Addendum to Lease Agreement Online

- How To eSign Florida Tenant Removal

- How To eSign Hawaii Tenant Removal

- eSign Hawaii Tenant Removal Simple

- eSign Arkansas Vacation Rental Short Term Lease Agreement Easy