Iowa Unsecured Installment Payment Promissory Note for Fixed Rate Iowa Form

What is the Iowa Unsecured Installment Payment Promissory Note For Fixed Rate Iowa

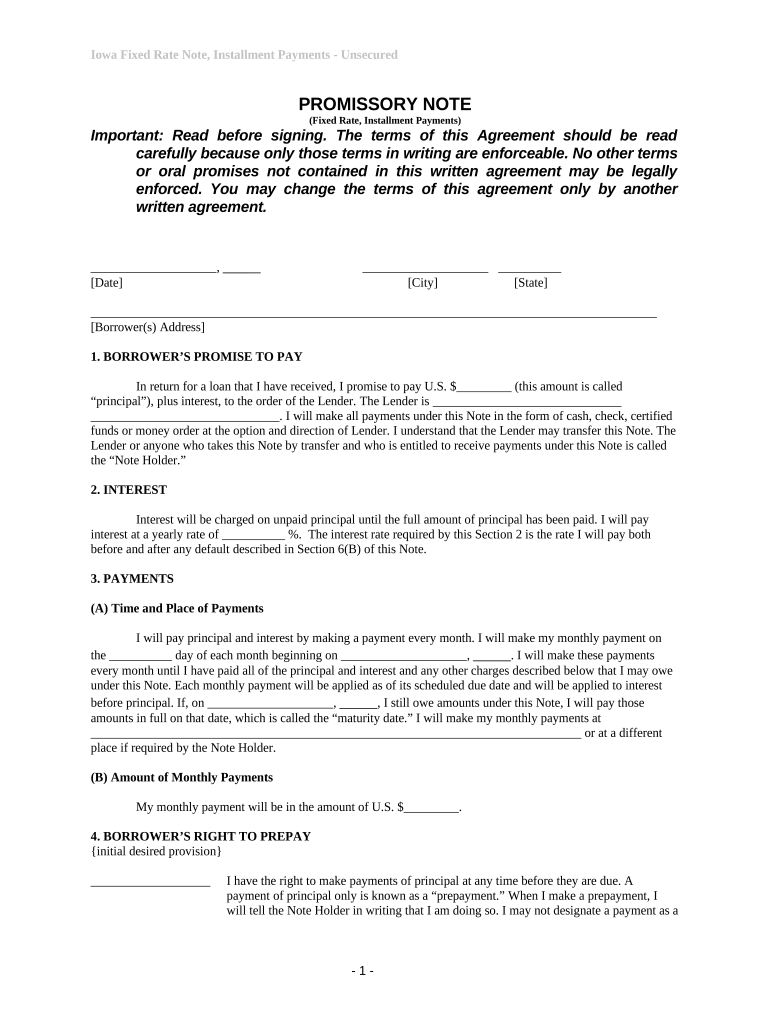

The Iowa Unsecured Installment Payment Promissory Note for Fixed Rate Iowa is a legal document that outlines the terms of a loan agreement where the borrower promises to repay the lender in fixed installments over a specified period. This type of promissory note is unsecured, meaning it is not backed by collateral. It is commonly used in personal loans, business loans, or any situation where a lender provides funds without requiring security. The document includes essential details such as the loan amount, interest rate, payment schedule, and consequences for defaulting on payments.

How to use the Iowa Unsecured Installment Payment Promissory Note For Fixed Rate Iowa

Using the Iowa Unsecured Installment Payment Promissory Note for Fixed Rate Iowa involves several straightforward steps. First, both parties should review the terms of the loan agreement to ensure mutual understanding. Next, the borrower fills out the note with accurate information, including their name, address, and the loan details. After completing the document, both the borrower and lender must sign it to make it legally binding. It is advisable to retain copies for personal records and ensure that both parties have access to the signed document for future reference.

Key elements of the Iowa Unsecured Installment Payment Promissory Note For Fixed Rate Iowa

Several key elements must be included in the Iowa Unsecured Installment Payment Promissory Note for Fixed Rate Iowa to ensure its validity. These elements include:

- Loan amount: The total amount being borrowed.

- Interest rate: The fixed rate at which interest will accrue on the loan.

- Payment schedule: Details on how often payments are due, such as monthly or bi-weekly.

- Due dates: Specific dates when each installment must be paid.

- Consequences of default: Information on what happens if the borrower fails to make payments.

- Signatures: Signatures of both the borrower and lender to validate the agreement.

Steps to complete the Iowa Unsecured Installment Payment Promissory Note For Fixed Rate Iowa

Completing the Iowa Unsecured Installment Payment Promissory Note for Fixed Rate Iowa involves a series of clear steps:

- Gather necessary information, including personal details and loan specifics.

- Fill out the promissory note with accurate data, ensuring all fields are completed.

- Review the document with the lender to confirm all terms are correct.

- Both parties should sign the document in the presence of a witness, if required.

- Make copies of the signed note for both the borrower and lender.

Legal use of the Iowa Unsecured Installment Payment Promissory Note For Fixed Rate Iowa

The legal use of the Iowa Unsecured Installment Payment Promissory Note for Fixed Rate Iowa is critical for protecting both the lender and borrower. This document serves as a formal agreement that can be enforced in a court of law if necessary. It is essential to comply with Iowa state laws regarding loan agreements, ensuring that the terms are clear and unambiguous. By using this promissory note, both parties can have peace of mind knowing that their rights and obligations are documented and legally recognized.

State-specific rules for the Iowa Unsecured Installment Payment Promissory Note For Fixed Rate Iowa

When using the Iowa Unsecured Installment Payment Promissory Note for Fixed Rate Iowa, it is important to be aware of state-specific rules that may affect the document's validity. Iowa law requires that all loan agreements be clear and include specific terms to be enforceable. Additionally, interest rates must comply with state usury laws, which limit the maximum allowable interest rates on loans. Understanding these regulations helps ensure that the promissory note is legally sound and protects both parties involved.

Quick guide on how to complete iowa unsecured installment payment promissory note for fixed rate iowa

Complete Iowa Unsecured Installment Payment Promissory Note For Fixed Rate Iowa seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the required form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Manage Iowa Unsecured Installment Payment Promissory Note For Fixed Rate Iowa on any platform with airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

How to modify and eSign Iowa Unsecured Installment Payment Promissory Note For Fixed Rate Iowa effortlessly

- Obtain Iowa Unsecured Installment Payment Promissory Note For Fixed Rate Iowa and click on Get Form to initiate.

- Utilize the tools we offer to fill out your form.

- Mark important sections of the documents or conceal sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and eSign Iowa Unsecured Installment Payment Promissory Note For Fixed Rate Iowa and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Iowa Unsecured Installment Payment Promissory Note For Fixed Rate Iowa?

An Iowa Unsecured Installment Payment Promissory Note For Fixed Rate Iowa is a legal document that outlines a borrower's promise to pay back a fixed amount in installments over a specified period. This type of promissory note is unsecured, meaning it does not require collateral. It's particularly useful for servicing loans with fixed interest rates.

-

How can I create an Iowa Unsecured Installment Payment Promissory Note For Fixed Rate Iowa using airSlate SignNow?

Creating an Iowa Unsecured Installment Payment Promissory Note For Fixed Rate Iowa with airSlate SignNow is straightforward. Simply use our templates to customize your note according to your specific needs. You can easily input the terms, sign it digitally, and send it for eSignature, streamlining the entire process.

-

What are the benefits of using airSlate SignNow for my Iowa Unsecured Installment Payment Promissory Note For Fixed Rate Iowa?

Using airSlate SignNow for your Iowa Unsecured Installment Payment Promissory Note For Fixed Rate Iowa offers various benefits, such as ease of use, secure digital signing, and quicker turnaround times. Additionally, our platform helps ensure that your documents are legally binding and compliant with Iowa's laws. This enhances your overall efficiency in handling important documentation.

-

What is the pricing for creating an Iowa Unsecured Installment Payment Promissory Note For Fixed Rate Iowa on airSlate SignNow?

The pricing for using airSlate SignNow to create an Iowa Unsecured Installment Payment Promissory Note For Fixed Rate Iowa is competitive, with various plans tailored to meet different business needs. You can explore our subscription models to find one that offers the features you require. The cost-effective solution helps businesses save on time and resources.

-

Are there any features that specifically enhance the Iowa Unsecured Installment Payment Promissory Note For Fixed Rate Iowa?

Yes, airSlate SignNow offers features that enhance your Iowa Unsecured Installment Payment Promissory Note For Fixed Rate Iowa, including customizable templates, automated reminders, and detailed audit trails. These features improve tracking of the notarization process, ensuring accountability and transparency throughout the transaction.

-

Can I integrate airSlate SignNow with other tools for managing my Iowa Unsecured Installment Payment Promissory Note For Fixed Rate Iowa?

Absolutely! airSlate SignNow supports integrations with various popular tools and platforms, allowing you to manage your Iowa Unsecured Installment Payment Promissory Note For Fixed Rate Iowa seamlessly. Integrating with your CRM, accounting software, or email platforms enhances your workflow and keeps everything organized.

-

Is it legally binding to use airSlate SignNow for my Iowa Unsecured Installment Payment Promissory Note For Fixed Rate Iowa?

Yes, documents created and signed using airSlate SignNow for your Iowa Unsecured Installment Payment Promissory Note For Fixed Rate Iowa are legally binding. We comply with the electronic signature laws, ensuring that your rights are protected and that your agreements are enforceable in court. Always ensure you meet specific legal requirements for your state.

Get more for Iowa Unsecured Installment Payment Promissory Note For Fixed Rate Iowa

Find out other Iowa Unsecured Installment Payment Promissory Note For Fixed Rate Iowa

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement