Quitclaim Deed from Corporation to Corporation Idaho Form

What is the Quitclaim Deed From Corporation To Corporation Idaho

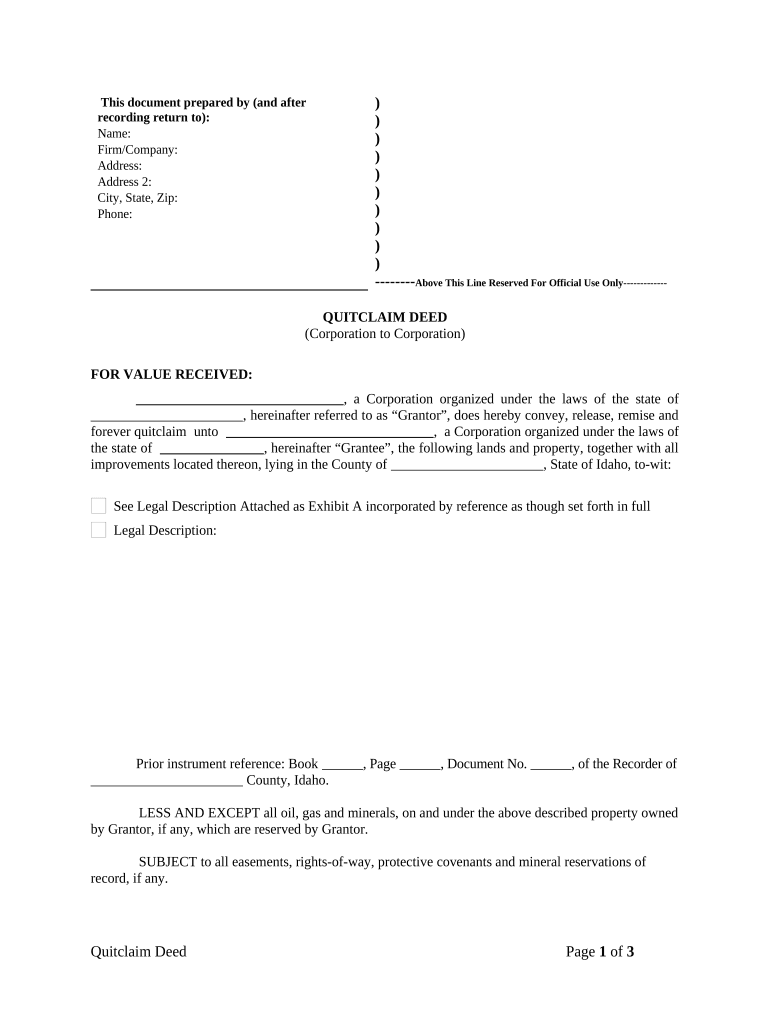

A quitclaim deed from corporation to corporation in Idaho is a legal document that allows one corporation to transfer its interest in a property to another corporation without making any warranties about the title. This type of deed is often used in business transactions where the parties are familiar with each other and trust that the property title is clear. Unlike warranty deeds, quitclaim deeds do not guarantee that the grantor has clear title to the property, making them a quicker and simpler option for transferring ownership.

Key Elements of the Quitclaim Deed From Corporation To Corporation Idaho

The key elements of a quitclaim deed from corporation to corporation in Idaho include:

- Parties Involved: The names and addresses of both the transferring corporation (grantor) and the receiving corporation (grantee).

- Description of the Property: A clear legal description of the property being transferred, including its location and boundaries.

- Consideration: The amount of money or value exchanged for the property, which may be nominal in some cases.

- Execution: Signatures of authorized representatives from both corporations, along with the date of execution.

- Notarization: The quitclaim deed must be notarized to be legally binding.

Steps to Complete the Quitclaim Deed From Corporation To Corporation Idaho

Completing a quitclaim deed from corporation to corporation in Idaho involves several steps:

- Gather necessary information, including the names of both corporations and the legal description of the property.

- Draft the quitclaim deed, ensuring all required elements are included.

- Have the deed signed by authorized representatives of both corporations.

- Obtain notarization for the signatures on the deed.

- File the completed quitclaim deed with the appropriate county recorder’s office to make the transfer public.

Legal Use of the Quitclaim Deed From Corporation To Corporation Idaho

The legal use of a quitclaim deed from corporation to corporation in Idaho is primarily to facilitate the transfer of property ownership between businesses. This type of deed is particularly useful in situations such as mergers, acquisitions, or when one corporation is transferring property to another as part of a business restructuring. It is essential to ensure that the deed complies with Idaho state laws to avoid any legal complications.

State-Specific Rules for the Quitclaim Deed From Corporation To Corporation Idaho

In Idaho, specific rules govern the execution and filing of quitclaim deeds. These include:

- The deed must be signed by an authorized officer of the corporation.

- Notarization is required to validate the signatures.

- The deed must be recorded with the county recorder’s office where the property is located to be effective against third parties.

- Idaho law does not require a quitclaim deed to include a warranty of title, which differentiates it from other types of deeds.

How to Obtain the Quitclaim Deed From Corporation To Corporation Idaho

To obtain a quitclaim deed from corporation to corporation in Idaho, businesses can follow these steps:

- Visit the Idaho Secretary of State’s website or the local county recorder’s office to access the necessary forms.

- Download or request a blank quitclaim deed form suitable for corporate use.

- Fill out the form with accurate information regarding both corporations and the property.

- Ensure the completed form is signed and notarized before filing.

- Submit the quitclaim deed to the appropriate county office for recording.

Quick guide on how to complete quitclaim deed from corporation to corporation idaho

Prepare Quitclaim Deed From Corporation To Corporation Idaho effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without delays. Handle Quitclaim Deed From Corporation To Corporation Idaho on any platform using airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to modify and eSign Quitclaim Deed From Corporation To Corporation Idaho with ease

- Locate Quitclaim Deed From Corporation To Corporation Idaho and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Modify and eSign Quitclaim Deed From Corporation To Corporation Idaho and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Quitclaim Deed From Corporation To Corporation in Idaho?

A Quitclaim Deed From Corporation To Corporation in Idaho is a legal document that transfers ownership of property from one corporation to another without any guarantee or warranty. This type of deed is often used in business transactions to quickly transfer assets between corporate entities. Understanding its implications is crucial for ensuring that properties are transferred smoothly.

-

How do I prepare a Quitclaim Deed From Corporation To Corporation in Idaho?

To prepare a Quitclaim Deed From Corporation To Corporation in Idaho, you will need to obtain a standard form that complies with state laws. Fill in the necessary details, including the names of both corporations and a detailed description of the property. Consulting with a legal professional may also be beneficial to ensure that all legal requirements are met.

-

What are the benefits of using airSlate SignNow for my Quitclaim Deed From Corporation To Corporation in Idaho?

Using airSlate SignNow to manage your Quitclaim Deed From Corporation To Corporation in Idaho offers signNow advantages. Our platform simplifies the eSigning process, allowing you to quickly send documents and receive signatures securely. Additionally, it helps maintain compliance with legal standards while providing an efficient digital workflow.

-

Is there a cost associated with executing a Quitclaim Deed From Corporation To Corporation in Idaho through airSlate SignNow?

Yes, while the costs for a Quitclaim Deed From Corporation To Corporation in Idaho can vary depending on your specific needs, airSlate SignNow provides cost-effective plans for businesses. We offer various subscription options that ensure you pay only for what you use. Detailed pricing information is available on our website, allowing you to choose the best package.

-

Can I integrate airSlate SignNow with other software for my Quitclaim Deed From Corporation To Corporation in Idaho?

Absolutely! airSlate SignNow offers seamless integration with numerous business applications, enabling you to streamline your processes. Whether you're using CRM systems or document management software, you can easily connect them to enhance your workflow for handling a Quitclaim Deed From Corporation To Corporation in Idaho.

-

How secure is my data when using airSlate SignNow for a Quitclaim Deed From Corporation To Corporation in Idaho?

Security is a top priority at airSlate SignNow. When you use our platform for your Quitclaim Deed From Corporation To Corporation in Idaho, your data is encrypted and stored securely. We implement industry-standard security protocols to protect your information and ensure compliance with relevant data protection regulations.

-

What should I consider before filing a Quitclaim Deed From Corporation To Corporation in Idaho?

Before filing a Quitclaim Deed From Corporation To Corporation in Idaho, consider the legal implications and potential tax consequences. It's essential to ensure that all disputes regarding property rights are resolved prior to execution. Consulting with legal professionals can help clarify these matters and avoid issues post-filing.

Get more for Quitclaim Deed From Corporation To Corporation Idaho

Find out other Quitclaim Deed From Corporation To Corporation Idaho

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy