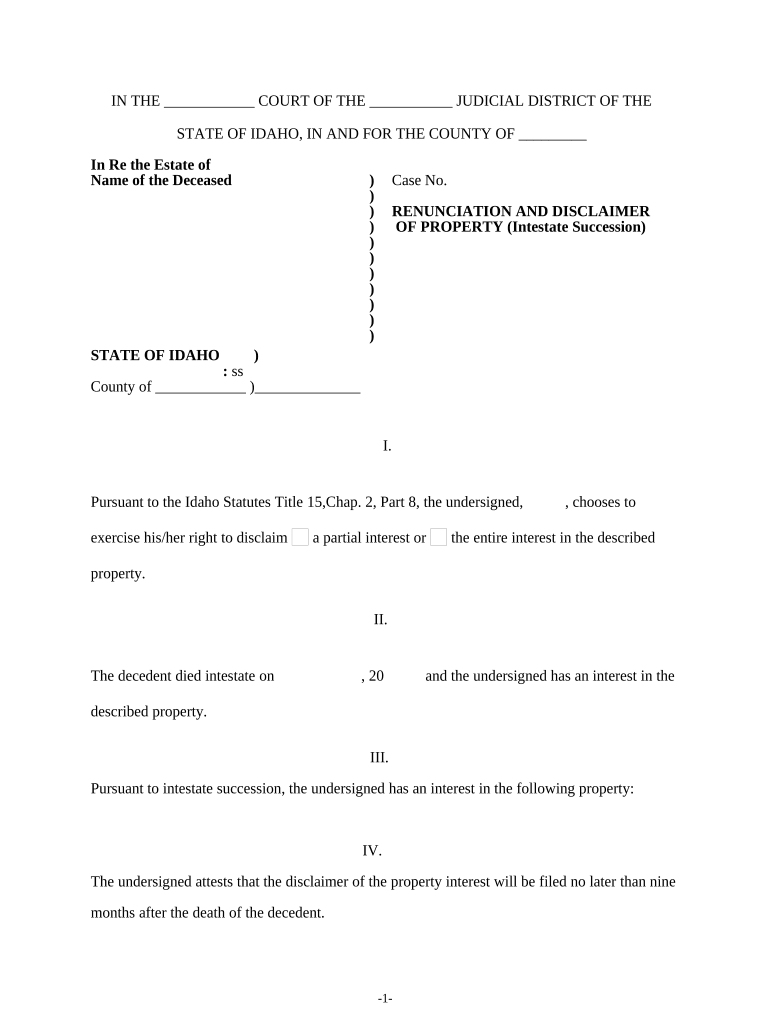

Idaho Intestate Succession Form

What is the Idaho Intestate Succession

The Idaho intestate succession process determines how a deceased person's assets are distributed when they die without a valid will. Under Idaho law, the distribution of property follows a specific hierarchy, prioritizing family members. This ensures that the deceased's estate is handled fairly and according to state regulations. The intestate succession law outlines the shares of spouses, children, parents, and siblings, among others, depending on the surviving relatives.

Steps to complete the Idaho Intestate Succession

Completing the Idaho intestate succession process involves several key steps. First, it is essential to gather all relevant documents, including any existing financial records and property titles. Next, identify the heirs according to Idaho law, which dictates the order of inheritance. After determining the rightful heirs, an application may need to be filed with the local probate court to initiate the legal process. Finally, the estate must be settled, which includes paying any debts and distributing assets to the heirs.

Legal use of the Idaho Intestate Succession

The legal framework surrounding the Idaho intestate succession ensures that the distribution of assets adheres to state laws. This framework is crucial for maintaining fairness and order in the probate process. It is important to understand that the intestate succession laws apply only when there is no valid will. If a will exists, its terms take precedence over intestate laws. Legal representation may be beneficial in navigating the complexities of probate court and ensuring compliance with all legal requirements.

Key elements of the Idaho Intestate Succession

Several key elements define the Idaho intestate succession process. These include the hierarchy of heirs, which specifies who inherits first, such as spouses and children. Additionally, the process includes the determination of community property versus separate property, as Idaho is a community property state. Understanding these elements is vital for anyone involved in the intestate succession process, ensuring that all legal obligations are met and that the distribution of assets aligns with state laws.

Required Documents

To initiate the Idaho intestate succession process, specific documents are required. These typically include the death certificate of the deceased, identification of the heirs, and any relevant financial documents or property titles. If there are disputes among heirs, additional documentation may be necessary to resolve these issues. Having all required documents prepared and organized can help streamline the probate process and facilitate a smoother resolution.

Form Submission Methods (Online / Mail / In-Person)

Submitting the necessary forms for the Idaho intestate succession can be done through various methods. Individuals may choose to file documents online, where available, or submit them via mail or in person at the local probate court. Each method has its own requirements and processing times, so it is essential to select the most appropriate option based on individual circumstances. Ensuring that all forms are correctly completed and submitted can help avoid delays in the probate process.

Eligibility Criteria

Eligibility for intestate succession in Idaho is determined by the relationship between the deceased and the potential heirs. Generally, spouses and children have the highest priority, followed by parents, siblings, and more distant relatives. If no eligible heirs exist, the estate may escheat to the state. Understanding these criteria is crucial for anyone involved in the intestate succession process, as it directly impacts who will inherit the deceased's assets.

Quick guide on how to complete idaho intestate succession

Complete Idaho Intestate Succession seamlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Manage Idaho Intestate Succession on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Idaho Intestate Succession with ease

- Locate Idaho Intestate Succession and then click Get Form to initiate.

- Utilize the tools we provide to finalize your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to preserve your changes.

- Choose how you would like to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form retrieval, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Edit and eSign Idaho Intestate Succession and guarantee exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Idaho succession and how does it relate to document signing?

Idaho succession refers to the legal process of transferring property after a person passes away. Using airSlate SignNow, businesses can streamline the documentation involved in Idaho succession by easily sending and eSigning essential forms and contracts, ensuring a smooth transition.

-

How does airSlate SignNow facilitate Idaho succession documentation?

airSlate SignNow simplifies the process of Idaho succession by providing electronic signatures and customizable templates for necessary documents. This allows users to quickly prepare, send, and sign estate planning forms, thus reducing delays and enhancing efficiency.

-

What are the pricing options for using airSlate SignNow for Idaho succession documents?

airSlate SignNow offers several pricing plans to meet varying needs for managing Idaho succession documents. Each plan provides access to features like document templates, eSigning, and integration capabilities, ensuring that users can choose an option that fits their budget and requirements.

-

Can I integrate airSlate SignNow with other platforms for Idaho succession management?

Yes, airSlate SignNow supports integrations with various platforms that can aid in Idaho succession management, including CRM and document management systems. This allows for a seamless flow of information and enhances collaboration among stakeholders.

-

What features does airSlate SignNow offer that are beneficial for Idaho succession processes?

airSlate SignNow provides features such as customizable templates, multi-party signing, and secure storage, which are particularly beneficial for Idaho succession processes. These tools help ensure compliance and accuracy while making the document management process more efficient.

-

How secure is my information when using airSlate SignNow for Idaho succession?

When using airSlate SignNow for Idaho succession, your information is protected with advanced security measures like encryption and multi-factor authentication. This ensures that sensitive estate documents remain confidential and secure throughout the signing process.

-

Is airSlate SignNow user-friendly for those handling Idaho succession paperwork?

Absolutely! airSlate SignNow is designed with a user-friendly interface that makes handling Idaho succession paperwork straightforward for all users. Whether you're tech-savvy or not, the platform allows for easy navigation and quick document management.

Get more for Idaho Intestate Succession

Find out other Idaho Intestate Succession

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online