Non Foreign Affidavit under IRC 1445 Idaho Form

What is the Non Foreign Affidavit Under IRC 1445 Idaho

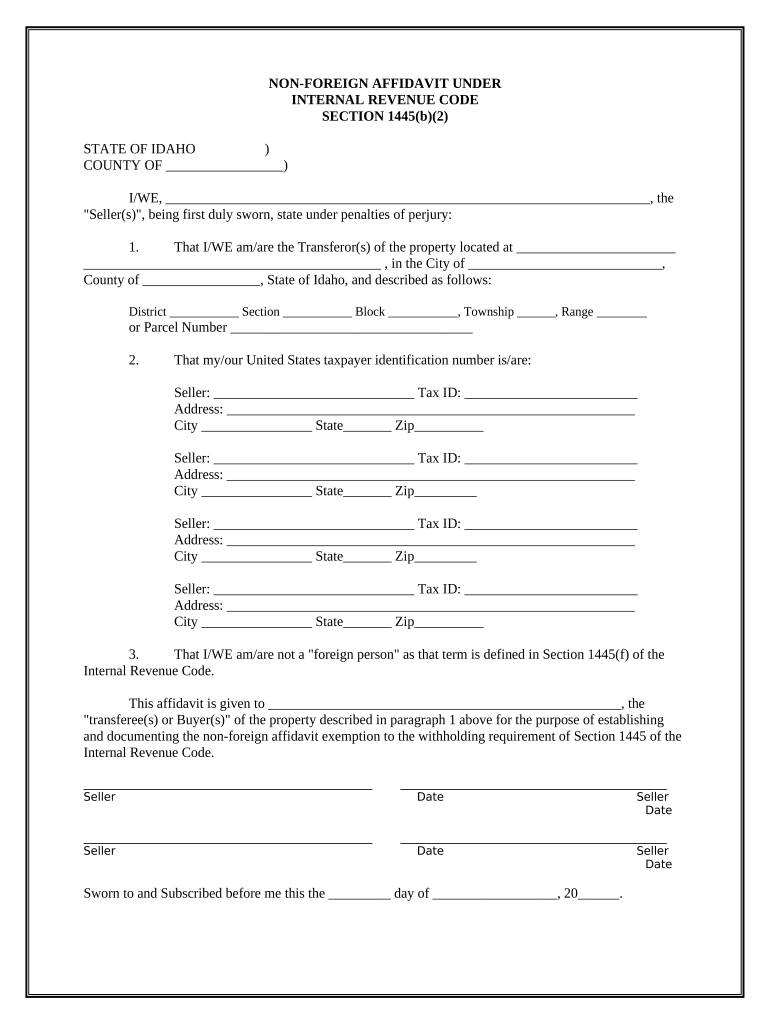

The Non Foreign Affidavit Under IRC 1445 is a legal document used in Idaho to certify that a seller of real property is not a foreign person as defined by the Internal Revenue Code (IRC) Section 1445. This affidavit is crucial for buyers and sellers to avoid withholding taxes on the sale of property. By providing this affidavit, the seller confirms their status as a U.S. person, thereby ensuring compliance with federal tax regulations. This document plays a significant role in real estate transactions, protecting both parties from potential tax liabilities.

How to use the Non Foreign Affidavit Under IRC 1445 Idaho

To effectively use the Non Foreign Affidavit Under IRC 1445 in Idaho, the seller must complete the form accurately and provide it to the buyer at the time of the property transaction. The buyer should retain this affidavit for their records to confirm the seller's status. It is essential for the seller to ensure that all information provided is truthful and complete, as inaccuracies could lead to legal complications or tax penalties. Utilizing digital tools can streamline this process, making it easier to fill out and sign the affidavit securely.

Steps to complete the Non Foreign Affidavit Under IRC 1445 Idaho

Completing the Non Foreign Affidavit Under IRC 1445 involves several key steps:

- Gather necessary information, including the seller's name, address, and taxpayer identification number.

- Fill out the affidavit form, ensuring all details are accurate and complete.

- Sign and date the affidavit, confirming the truthfulness of the information provided.

- Provide the completed affidavit to the buyer as part of the property transaction documentation.

- Keep a copy of the signed affidavit for your records.

Legal use of the Non Foreign Affidavit Under IRC 1445 Idaho

The legal use of the Non Foreign Affidavit Under IRC 1445 in Idaho is to certify that the seller is not a foreign entity, thereby exempting the buyer from withholding taxes on the sale. This affidavit must be executed properly to be legally binding. It is advisable for both parties to consult with legal professionals to ensure compliance with all applicable laws and regulations. Proper execution of this affidavit protects the buyer from potential tax liabilities and ensures a smooth transaction process.

Key elements of the Non Foreign Affidavit Under IRC 1445 Idaho

Key elements of the Non Foreign Affidavit Under IRC 1445 include:

- The seller's full legal name and address.

- The seller's taxpayer identification number (TIN).

- A declaration confirming the seller's status as a U.S. person.

- The date of the transaction.

- The signatures of the seller and any witnesses, if required.

Eligibility Criteria

To be eligible to complete the Non Foreign Affidavit Under IRC 1445, the seller must be a U.S. citizen or a resident alien. This includes individuals, corporations, partnerships, and other entities that meet the definition of a U.S. person under the IRC. Sellers who do not meet these criteria must be aware of the withholding tax requirements and may need to seek alternative documentation or legal advice to comply with tax obligations.

Quick guide on how to complete non foreign affidavit under irc 1445 idaho

Complete Non Foreign Affidavit Under IRC 1445 Idaho effortlessly on any device

Digital document management has become widely accepted among businesses and individuals. It serves as a fantastic environmentally friendly alternative to traditional printed and signed papers, as you can locate the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents rapidly without delays. Manage Non Foreign Affidavit Under IRC 1445 Idaho on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Non Foreign Affidavit Under IRC 1445 Idaho with ease

- Obtain Non Foreign Affidavit Under IRC 1445 Idaho and click Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with features that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes moments and holds the same legal validity as a conventional ink signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, exhausting form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Alter and eSign Non Foreign Affidavit Under IRC 1445 Idaho while ensuring excellent communication at every stage of the form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Non Foreign Affidavit Under IRC 1445 Idaho?

A Non Foreign Affidavit Under IRC 1445 Idaho is a document that certifies the seller of certain real property is not a foreign person, thus exempting buyers from withholding tax. This affidavit is crucial for compliance with U.S. tax regulations. Utilizing airSlate SignNow can streamline the process of creating and executing this affidavit efficiently.

-

How can airSlate SignNow help with the Non Foreign Affidavit Under IRC 1445 Idaho?

airSlate SignNow provides an easy-to-use platform for drafting and electronically signing the Non Foreign Affidavit Under IRC 1445 Idaho. By leveraging our software, users can ensure their documents meet legal standards while saving time and minimizing errors. The integration of templates allows for quick assembly tailored to Idaho's requirements.

-

What are the pricing options for airSlate SignNow when dealing with Non Foreign Affidavit Under IRC 1445 Idaho?

airSlate SignNow offers various pricing plans that cater to different needs, starting with a free trial to familiarize yourself with its features. Plans typically include additional functionalities such as advanced document management and integrations, which are beneficial for handling a Non Foreign Affidavit Under IRC 1445 Idaho. Check our website for the most current pricing details.

-

Is airSlate SignNow compliant with legal standards for Non Foreign Affidavit Under IRC 1445 Idaho?

Yes, airSlate SignNow is designed to comply with legal requirements and standards for documents, including the Non Foreign Affidavit Under IRC 1445 Idaho. Our templates are regularly updated to reflect current legislation, ensuring that your affidavits are valid and enforceable. You can trust our platform for legal document processing.

-

Can I integrate airSlate SignNow with other software for processing Non Foreign Affidavit Under IRC 1445 Idaho?

Absolutely! airSlate SignNow offers integrations with various tools and platforms that enhance your document processing experience. Whether you're using CRM systems or document management software, integrating with airSlate SignNow can simplify the generation and signing of the Non Foreign Affidavit Under IRC 1445 Idaho.

-

What are the benefits of using airSlate SignNow for the Non Foreign Affidavit Under IRC 1445 Idaho?

Using airSlate SignNow allows for quick and easy execution of the Non Foreign Affidavit Under IRC 1445 Idaho with secure electronic signatures. The platform's user-friendly interface and robust features can improve efficiency, reduce the turnaround time on documents, and enhance collaboration among parties involved in the real estate transaction.

-

How secure is airSlate SignNow when handling Non Foreign Affidavit Under IRC 1445 Idaho?

Security is a top priority at airSlate SignNow. We implement advanced encryption technologies and adhere to strict data protection regulations to ensure that your Non Foreign Affidavit Under IRC 1445 Idaho is handled securely. You can confidently eSign and store your documents knowing they are protected.

Get more for Non Foreign Affidavit Under IRC 1445 Idaho

Find out other Non Foreign Affidavit Under IRC 1445 Idaho

- Sign Minnesota Employee Appraisal Form Online

- How To Sign Alabama Employee Satisfaction Survey

- Sign Colorado Employee Satisfaction Survey Easy

- Sign North Carolina Employee Compliance Survey Safe

- Can I Sign Oklahoma Employee Satisfaction Survey

- How Do I Sign Florida Self-Evaluation

- How Do I Sign Idaho Disclosure Notice

- Sign Illinois Drug Testing Consent Agreement Online

- Sign Louisiana Applicant Appraisal Form Evaluation Free

- Sign Maine Applicant Appraisal Form Questions Secure

- Sign Wisconsin Applicant Appraisal Form Questions Easy

- Sign Alabama Deed of Indemnity Template Later

- Sign Alabama Articles of Incorporation Template Secure

- Can I Sign Nevada Articles of Incorporation Template

- Sign New Mexico Articles of Incorporation Template Safe

- Sign Ohio Articles of Incorporation Template Simple

- Can I Sign New Jersey Retainer Agreement Template

- Sign West Virginia Retainer Agreement Template Myself

- Sign Montana Car Lease Agreement Template Fast

- Can I Sign Illinois Attorney Approval