Gew Ta Rv 1 Form

What is the Gew Ta Rv 1

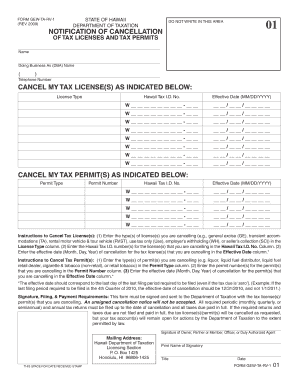

The Gew Ta Rv 1 is a specific form used in various administrative and legal processes. It serves as a crucial document for individuals and businesses, often required for compliance with state and federal regulations. Understanding the purpose and requirements of the Gew Ta Rv 1 is essential for ensuring its proper use in various applications.

How to use the Gew Ta Rv 1

Using the Gew Ta Rv 1 involves several steps to ensure that all necessary information is accurately provided. First, gather all relevant personal or business information required for the form. Next, fill out the form carefully, ensuring that all fields are completed to avoid delays. Once the form is filled, it may need to be signed and submitted according to the specific guidelines set forth by the issuing authority.

Steps to complete the Gew Ta Rv 1

Completing the Gew Ta Rv 1 requires attention to detail. Follow these steps:

- Review the form to understand all required sections.

- Gather necessary documents that may be needed for reference.

- Fill in your information accurately, ensuring there are no errors.

- Sign the form where indicated, ensuring that your signature meets legal requirements.

- Submit the form according to the specified method, whether online, by mail, or in person.

Legal use of the Gew Ta Rv 1

The Gew Ta Rv 1 is legally binding when completed correctly and submitted in accordance with applicable laws. It is essential to comply with all legal stipulations to ensure that the form is recognized by relevant authorities. This includes understanding the specific regulations that govern the use of the form in your state or jurisdiction.

Required Documents

To successfully complete the Gew Ta Rv 1, certain documents may be required. These documents can vary depending on the purpose of the form but typically include:

- Identification documents, such as a driver's license or passport.

- Supporting documentation relevant to the information provided on the form.

- Any previous forms related to the Gew Ta Rv 1, if applicable.

Who Issues the Form

The Gew Ta Rv 1 is typically issued by governmental agencies or specific regulatory bodies. It is important to identify the correct issuing authority to ensure that the form is valid and accepted. This may include state departments, federal agencies, or local government offices, depending on the context in which the form is used.

Quick guide on how to complete gew ta rv 1

Effortlessly Complete Gew Ta Rv 1 on Any Device

The management of documents online has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to conventional printed and signed documents, allowing you to locate the right form and store it securely online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and electronically sign your documents without any hassles. Manage Gew Ta Rv 1 on any device using the airSlate SignNow applications for Android or iOS, and enhance any document-based process today.

How to Modify and Electronically Sign Gew Ta Rv 1 with Ease

- Find Gew Ta Rv 1 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form—via email, SMS, invite link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious document searching, or errors that require reprinting new copies. airSlate SignNow handles all your document management requirements in just a few clicks from any device of your choice. Modify and electronically sign Gew Ta Rv 1 to ensure exceptional communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the gew ta rv 1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is gew ta rv 1 and how does it relate to airSlate SignNow?

Gew ta rv 1 refers to an essential feature that enhances the user experience with airSlate SignNow. This feature helps streamline the document signing process, making it more efficient and easier for businesses to manage. With gew ta rv 1, users can quickly send and eSign documents, ensuring a smoother workflow.

-

What are the pricing options for using gew ta rv 1 on airSlate SignNow?

airSlate SignNow offers competitive pricing plans that include access to gew ta rv 1 features. Pricing varies based on the level of service required, and businesses can choose from monthly or annual subscriptions. This flexibility allows companies of all sizes to benefit from the cost-effective solutions provided by gew ta rv 1.

-

What features does gew ta rv 1 include within airSlate SignNow?

The gew ta rv 1 feature includes tools for secure electronic signatures, document templates, and automated workflows. These features help businesses save time and reduce errors in the signing process. Utilizing gew ta rv 1 ensures that your document management is both efficient and user-friendly.

-

How can gew ta rv 1 benefit my business?

By integrating gew ta rv 1 into your operations, your business can enhance productivity and reduce turnaround time for document approvals. This feature helps eliminate the hassle of paper-based signing, allowing for faster completion of important agreements. Overall, gew ta rv 1 supports better collaboration and communication within teams.

-

Is gew ta rv 1 compatible with other tools and applications?

Yes, gew ta rv 1 is designed to integrate smoothly with various applications, including CRM and cloud storage solutions. This compatibility allows users to streamline their document workflows further and ensures that eSigning can take place seamlessly within existing systems. The integration with gew ta rv 1 enhances the overall utility of airSlate SignNow for businesses.

-

What security measures are in place for gew ta rv 1 documents?

airSlate SignNow prioritizes the security of documents signed using gew ta rv 1. The platform employs advanced encryption and compliance measures to safeguard sensitive information. Businesses can trust that their documents are secure and that they meet industry standards for electronic signatures.

-

Can I customize my experience with gew ta rv 1 on airSlate SignNow?

Absolutely! airSlate SignNow allows for customization of templates and workflows through gew ta rv 1. Users can tailor their eSigning and document management processes according to their specific business needs, providing greater flexibility and efficiency in their operations.

Get more for Gew Ta Rv 1

- Warranty deed form mn

- Subcontractors notice to owner corporation or llc minnesota form

- Quitclaim deed from individual to two individuals in joint tenancy minnesota form

- Minnesota subcontractor form

- Quitclaim deed by two individuals to husband and wife minnesota form

- Warranty deed from two individuals to husband and wife minnesota form

- Minnesota corporation company form

- Mn response form

Find out other Gew Ta Rv 1

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe